The Mississippi Last Will and Testament with Special Needs Trust Distribution is a legal document that outlines the distribution of assets and property of the testator (person who makes the will) upon their death. This type of will is specifically designed to provide financial support for individuals who have special needs, such as mental or physical disabilities, without disqualifying them from government assistance. It allows the testator to provide for their dependents in the event of their death, while also protecting their assets from being used to pay for medical and other expenses associated with their disability. There are two types of Mississippi Last Will and Testament with Special Needs Trust Distribution: revocable and irrevocable trusts. In a revocable trust, the testator has the ability to modify the terms of the trust and can opt to revoke it at any time. An irrevocable trust, on the other hand, is not modifiable and cannot be revoked. Both forms of trusts allow the testator to specify how their assets will be distributed upon their death. The Mississippi Last Will and Testament with Special Needs Trust Distribution is an important document for those who have dependents with special needs and want to ensure their financial security upon their death. It is important to consult with an experienced estate planning attorney to ensure that the trust is properly set up and executed.

Mississippi Last Will and Testament with Special Needs Trust Distribution

Description

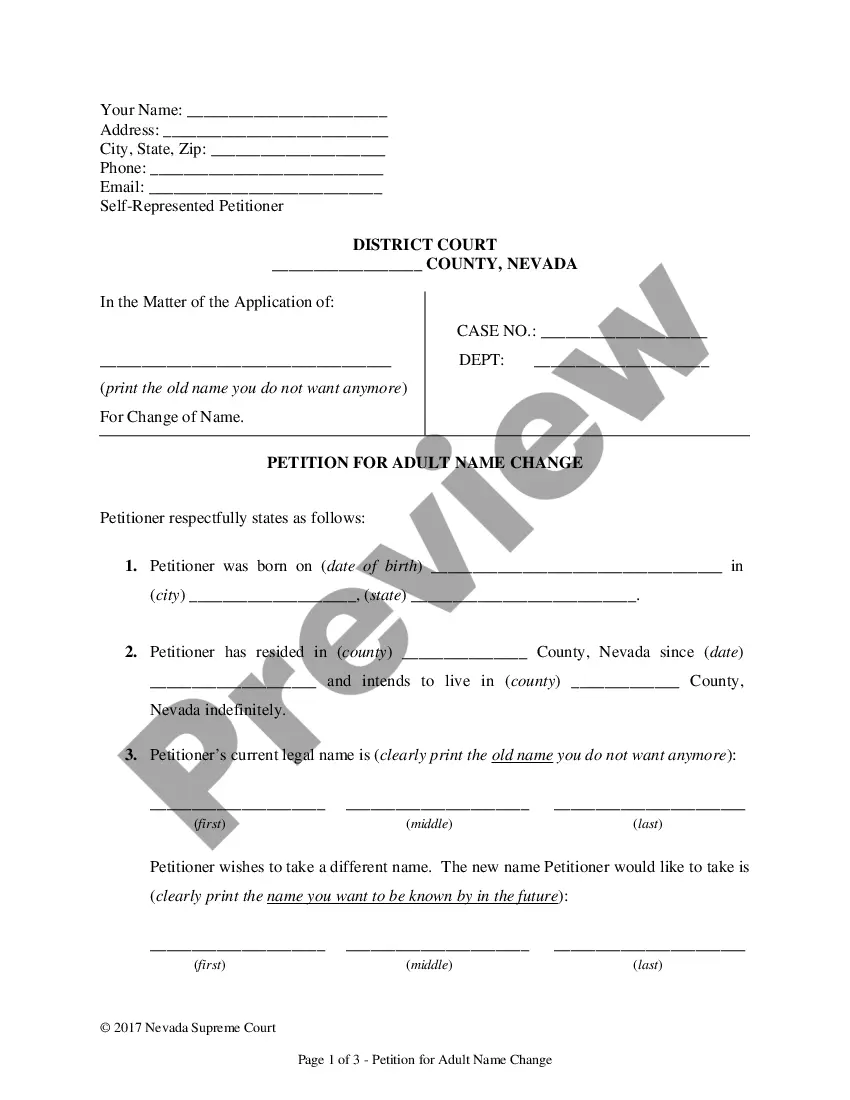

How to fill out Mississippi Last Will And Testament With Special Needs Trust Distribution?

Working with legal paperwork requires attention, accuracy, and using well-drafted blanks. US Legal Forms has been helping people nationwide do just that for 25 years, so when you pick your Mississippi Last Will and Testament with Special Needs Trust Distribution template from our library, you can be sure it complies with federal and state regulations.

Working with our service is easy and fast. To obtain the required paperwork, all you’ll need is an account with a valid subscription. Here’s a quick guideline for you to obtain your Mississippi Last Will and Testament with Special Needs Trust Distribution within minutes:

- Remember to attentively check the form content and its correspondence with general and legal requirements by previewing it or reading its description.

- Search for another formal blank if the previously opened one doesn’t suit your situation or state regulations (the tab for that is on the top page corner).

- Log in to your account and download the Mississippi Last Will and Testament with Special Needs Trust Distribution in the format you need. If it’s your first experience with our service, click Buy now to continue.

- Register for an account, decide on your subscription plan, and pay with your credit card or PayPal account.

- Decide in what format you want to obtain your form and click Download. Print the blank or add it to a professional PDF editor to submit it paper-free.

All documents are created for multi-usage, like the Mississippi Last Will and Testament with Special Needs Trust Distribution you see on this page. If you need them one more time, you can fill them out without re-payment - simply open the My Forms tab in your profile and complete your document any time you need it. Try US Legal Forms and accomplish your business and personal paperwork rapidly and in full legal compliance!

Form popularity

FAQ

A Trust that does not require distribution of all its income by the terms of the trust agreement is called a ?Complex? Trust, and is allowed an exemption of $100. A ?Qualified Disability Trust? or ?QDT? is allowed the same exemption as an individual under IRS Code §642(b)(2)(C).

A Special Disability Trust can be set up while the parents are alive, or specific instructions can be laid out in their Wills. The legislation requires that the Special Disability Trust is set up by a trust deed or Will, using a Model Special Disability Trust (prescribed by social security rules).

The trust beneficiary is the party for whose benefit the trustee holds the title to the trust property.

A Trust can protect a disabled person who could otherwise be vulnerable to financial abuse or exploitation from others. The Trust offers a means of managing money or other assets for a disabled person, which is invaluable if they are unable to do this themselves.

A Special Needs Trust (SNT) allows for a disabled person to maintain his or her eligibility for public assistance benefits, despite having assets that would otherwise make the person ineligible for those benefits. There are two types of SNTs: First Party and Third Party funded.

A trust containing the assets of an individual under age 65 who is disabled (as defined by the SSI program) and which is established for the sole benefit of the disabled individual by a parent, grandparent, legal guardian of the individual, or a court is often referred to as a Special Needs Trust.

Pooled special needs trust These types of funds ? also called community trusts ? are usually administered by nonprofit organizations. Pooled special needs trusts gather funds from multiple families, as well as other donors and community members, and use that money to serve each family.

Funds held in a properly drafted special needs trust (SNT) will not affect a Supplemental Security Income (SSI) or Medicaid recipient's benefits. However, funds disbursed in a manner that violates SSI or Medicaid rules can impact these benefits.