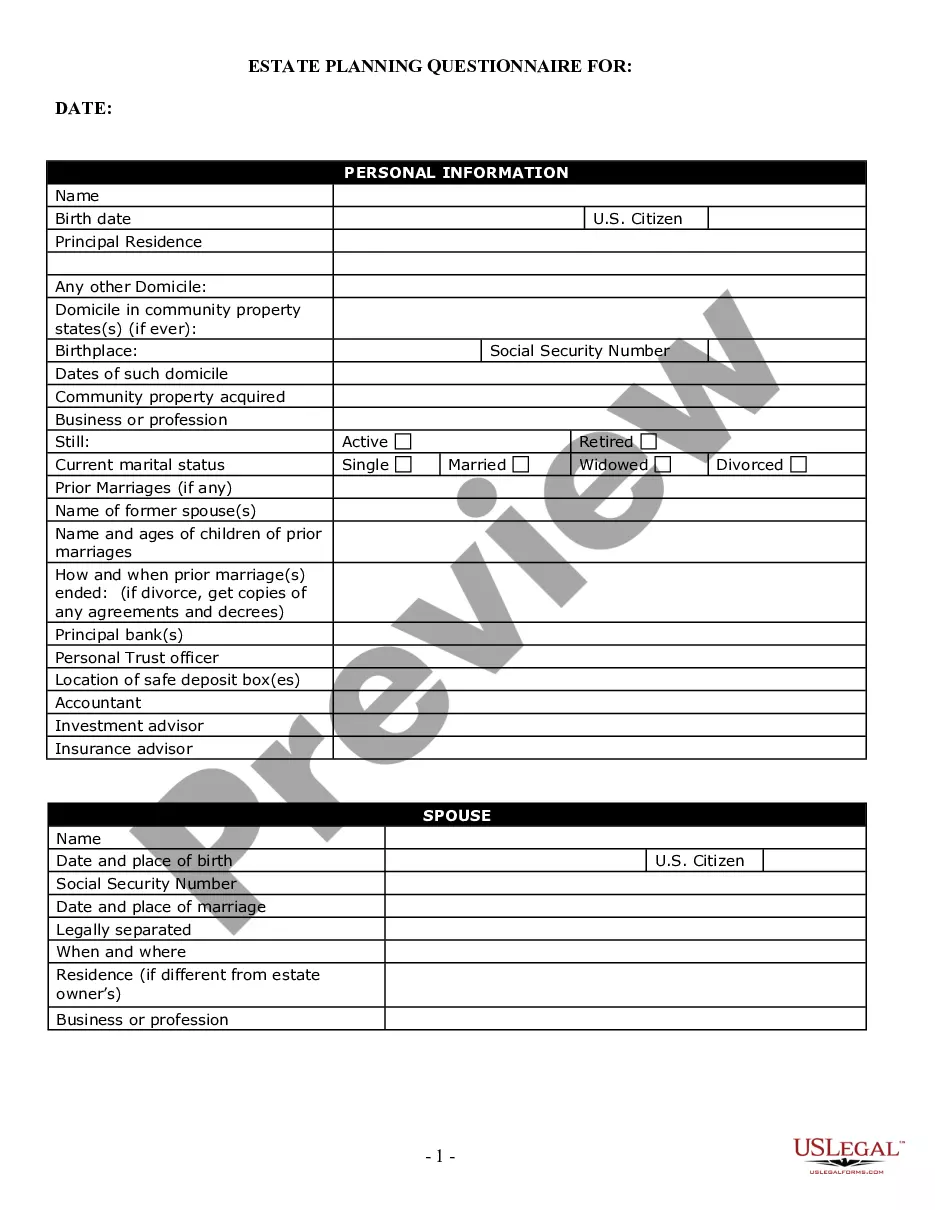

Mississippi Estate Planning Questionnaire and Worksheets

Description

How to fill out Mississippi Estate Planning Questionnaire And Worksheets?

Obtain a printable Mississippi Estate Planning Questionnaire and Worksheets in just several clicks from the most extensive catalogue of legal e-forms. Find, download and print professionally drafted and certified samples on the US Legal Forms website. US Legal Forms is the #1 provider of reasonably priced legal and tax forms for US citizens and residents online starting from 1997.

Customers who have already a subscription, must log in directly into their US Legal Forms account, down load the Mississippi Estate Planning Questionnaire and Worksheets see it saved in the My Forms tab. Users who don’t have a subscription must follow the tips listed below:

- Ensure your template meets your state’s requirements.

- If provided, read the form’s description to learn more.

- If offered, review the form to view more content.

- Once you’re sure the form is right for you, just click Buy Now.

- Create a personal account.

- Pick a plan.

- Pay through PayPal or credit card.

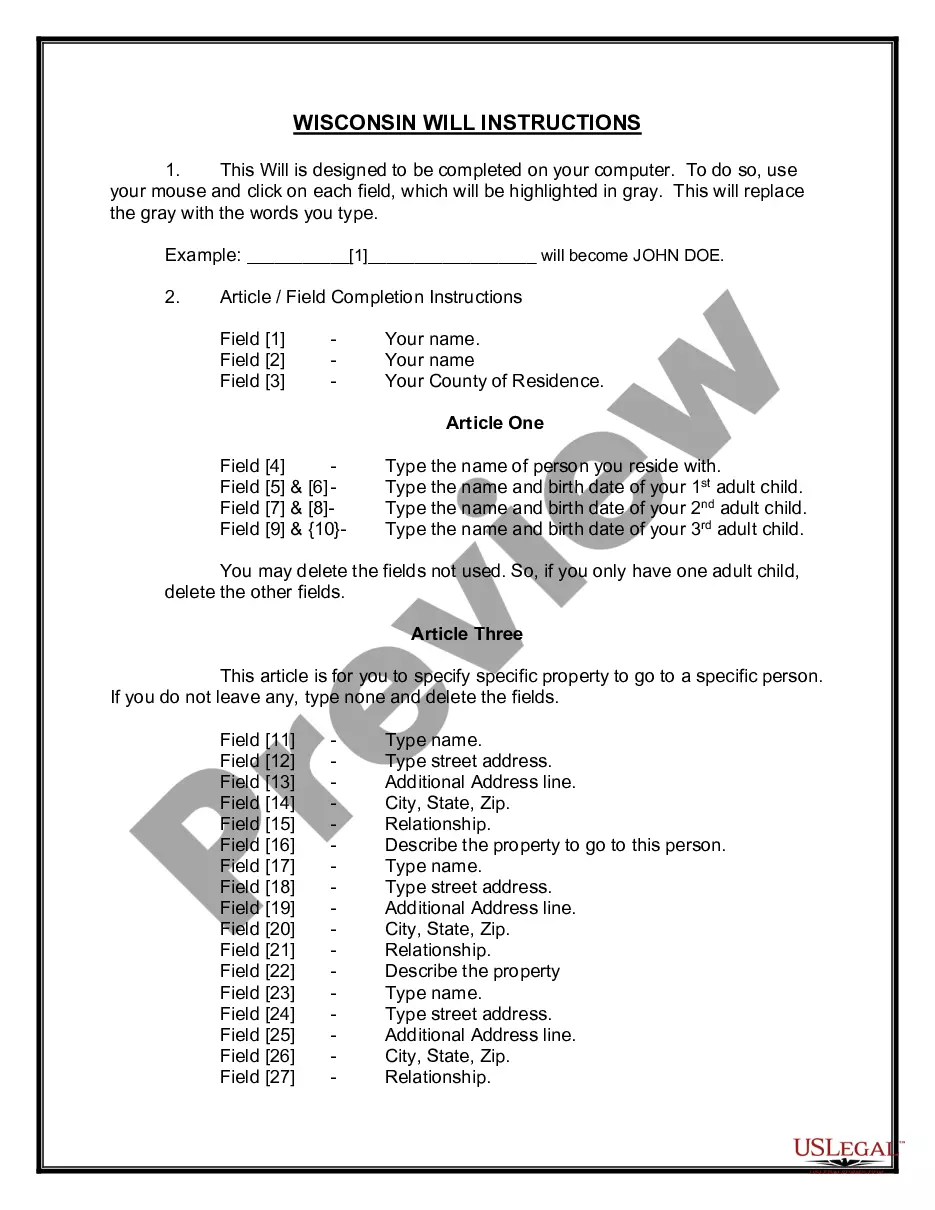

- Download the form in Word or PDF format.

When you’ve downloaded your Mississippi Estate Planning Questionnaire and Worksheets, you are able to fill it out in any web-based editor or print it out and complete it manually. Use US Legal Forms to get access to 85,000 professionally-drafted, state-specific documents.

Form popularity

FAQ

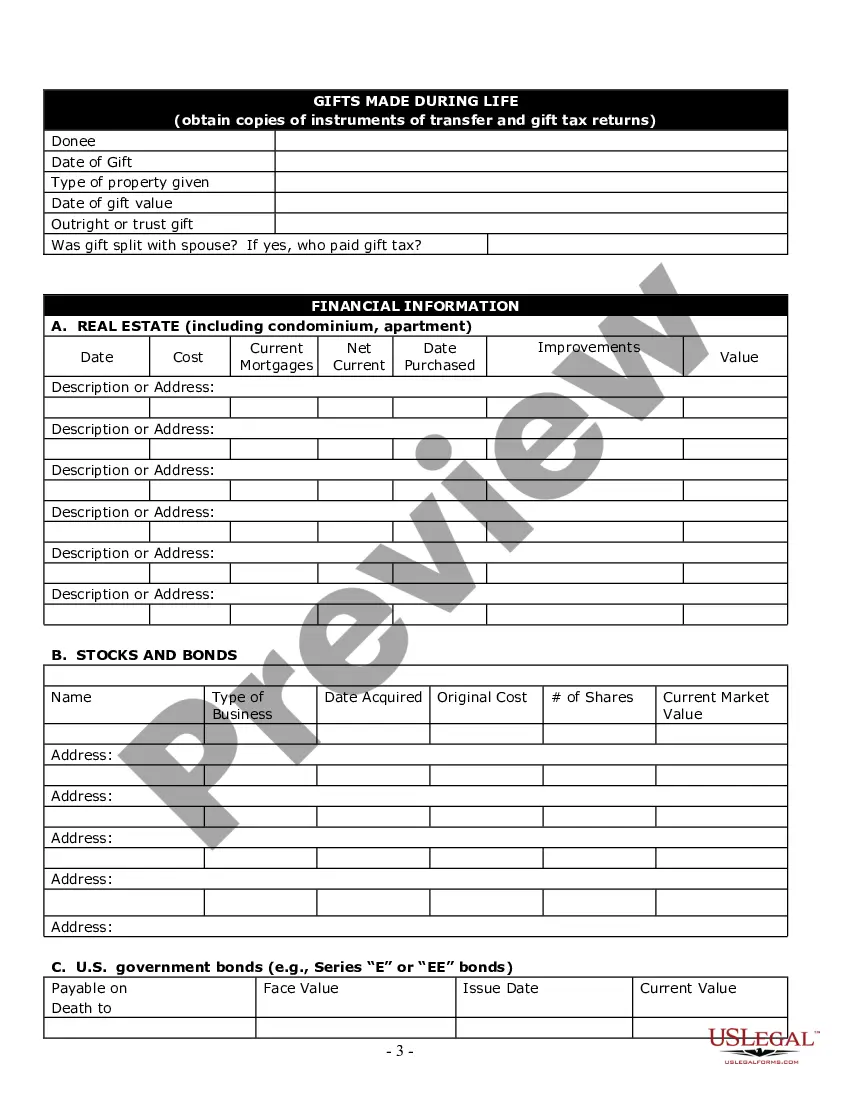

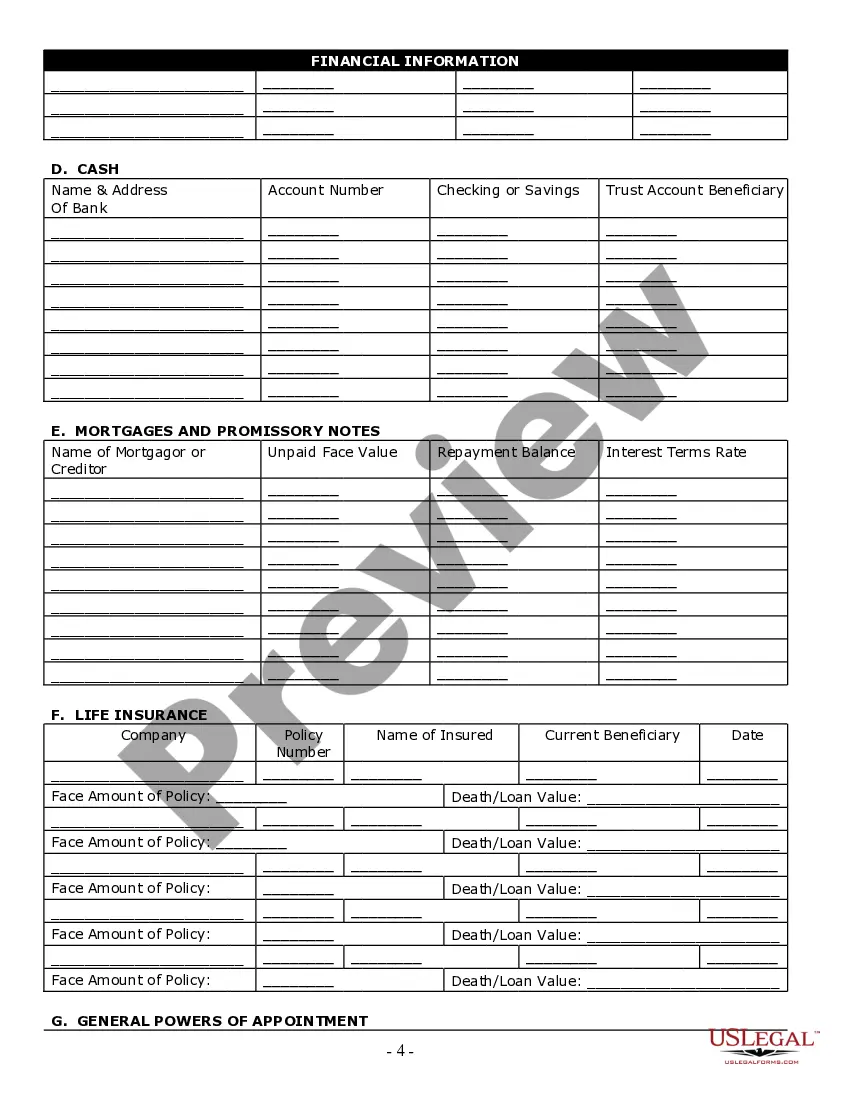

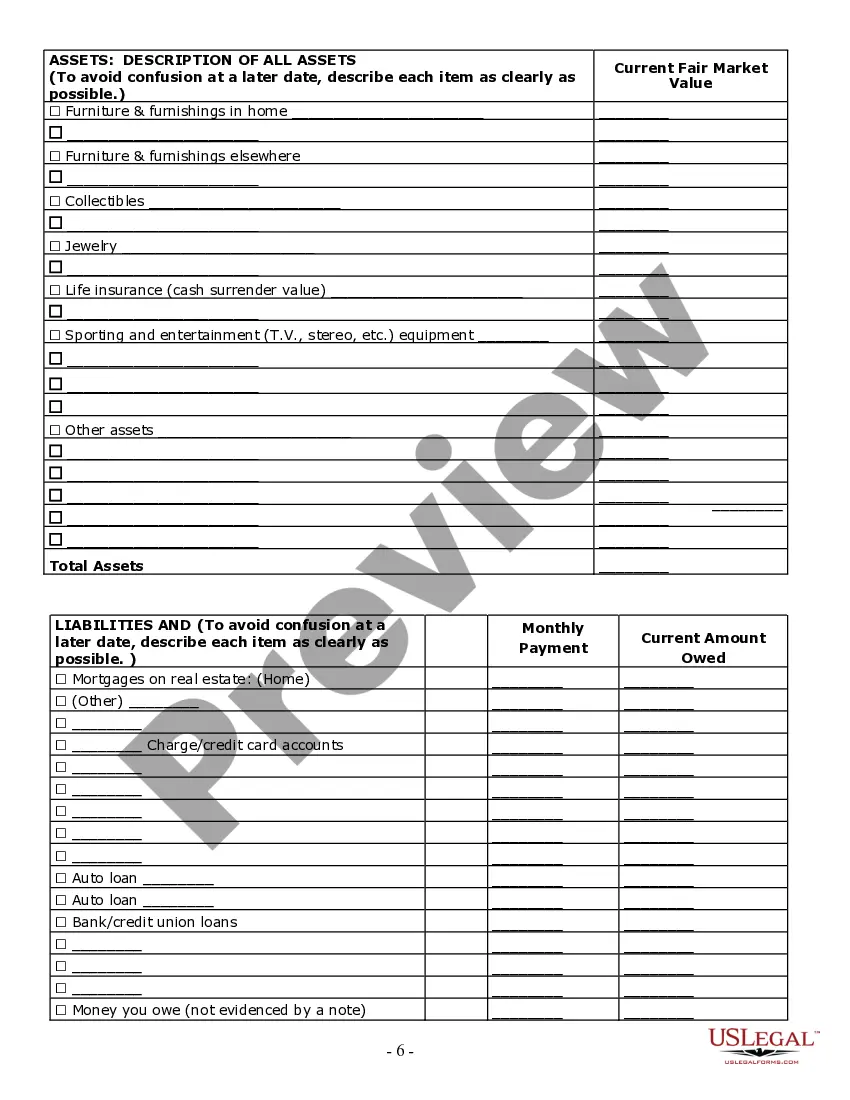

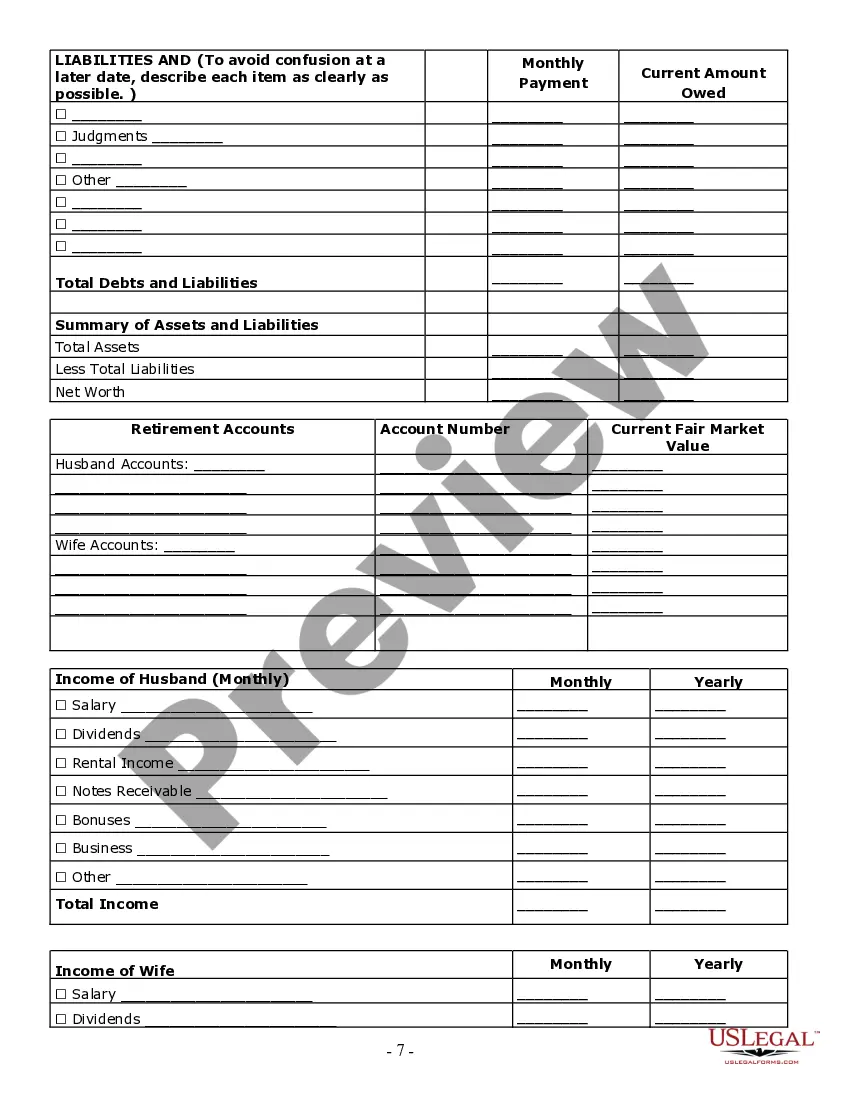

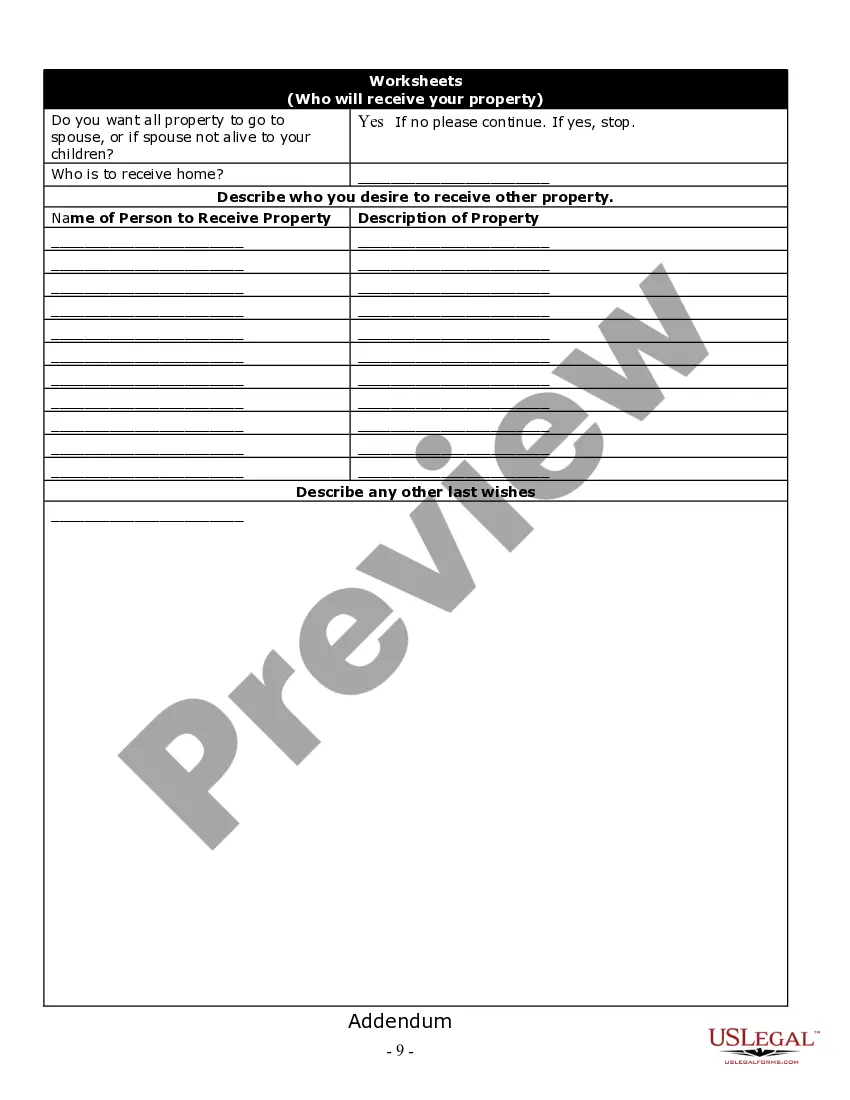

Itemize Your Inventory. Follow with Non-Physical Assets. Assemble a List of Debts. Make a Memberships List. Make Copies of Your Lists. Review Your Retirement Accounts. Update Your Insurance. Assign Transfer on Death Designations.

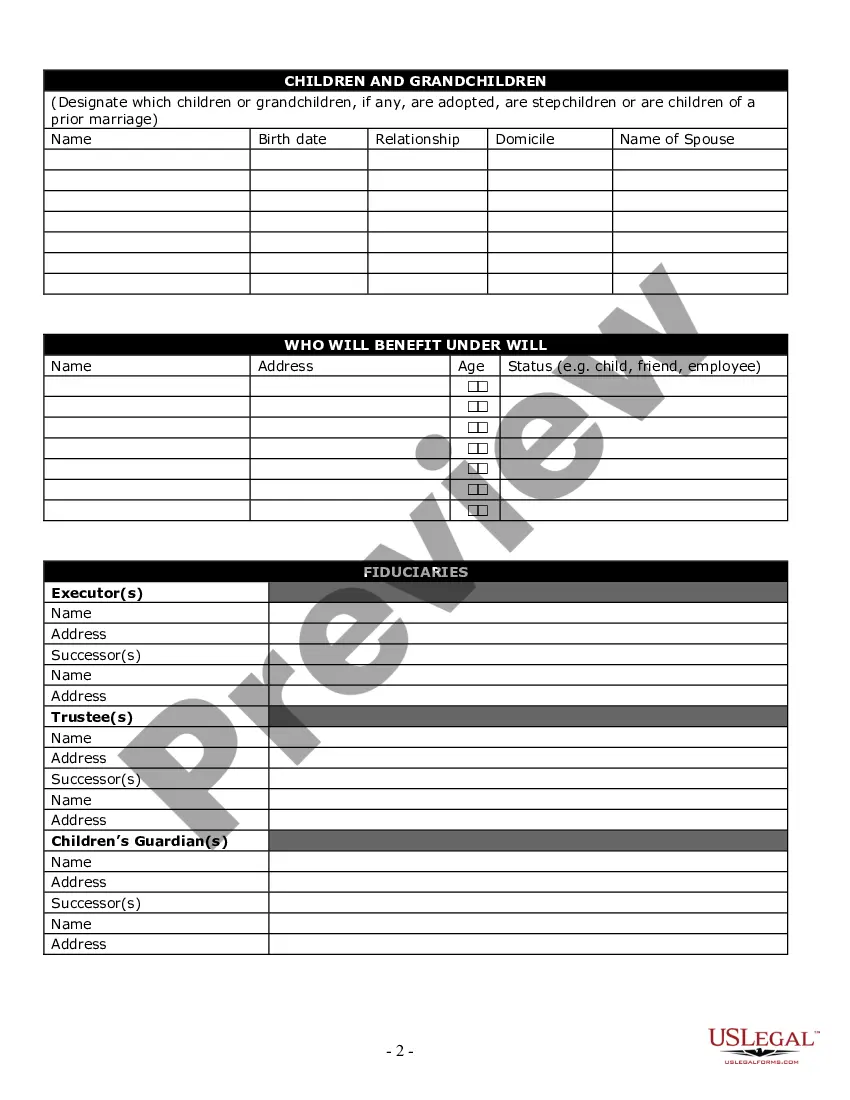

There are four main elements of an estate plan; these include a will, a living will and healthcare power of attorney, a financial power of attorney, and a trust.

Lay out Your Assets & Think About Final Wishes. Consider Your Digital Assets. Gather Documents Needed for Will Preparation. Choose Your Executor & Beneficiaries. Nominate Guardians. Sign Your Will. Store Your Will. Update or Amend Your Will.

A Last Will and Testament. When it comes to estate planning, having a last will and testament is likely the first thing that will come to mind. A Document Granting Power of Attorney. An Advance Medical Directive. Revocable Living Trust.

A will may be a relatively simple document that sets forth your wishes regarding the distribution of property; it may also include instructions regarding the care of minor children. An estate plan goes much further than a will.

What Property Can Go in a Living Trust? Who Should Be My Trustee? Does a Living Trust Avoid Estate and Probate Taxes? What Are the Benefits of a Living Trust? What Are the Drawbacks of a Living Trust? Do I Still Need a Power of Attorney?

Will/trust. Durable power of attorney. Beneficiary designations. Letter of intent. Healthcare power of attorney. Guardianship designations.

Will/trust. Durable power of attorney. Beneficiary designations. Letter of intent. Healthcare power of attorney. Guardianship designations.

Bank accounts. Brokerage or investment accounts. Retirement accounts and pension plans. A life insurance policy.