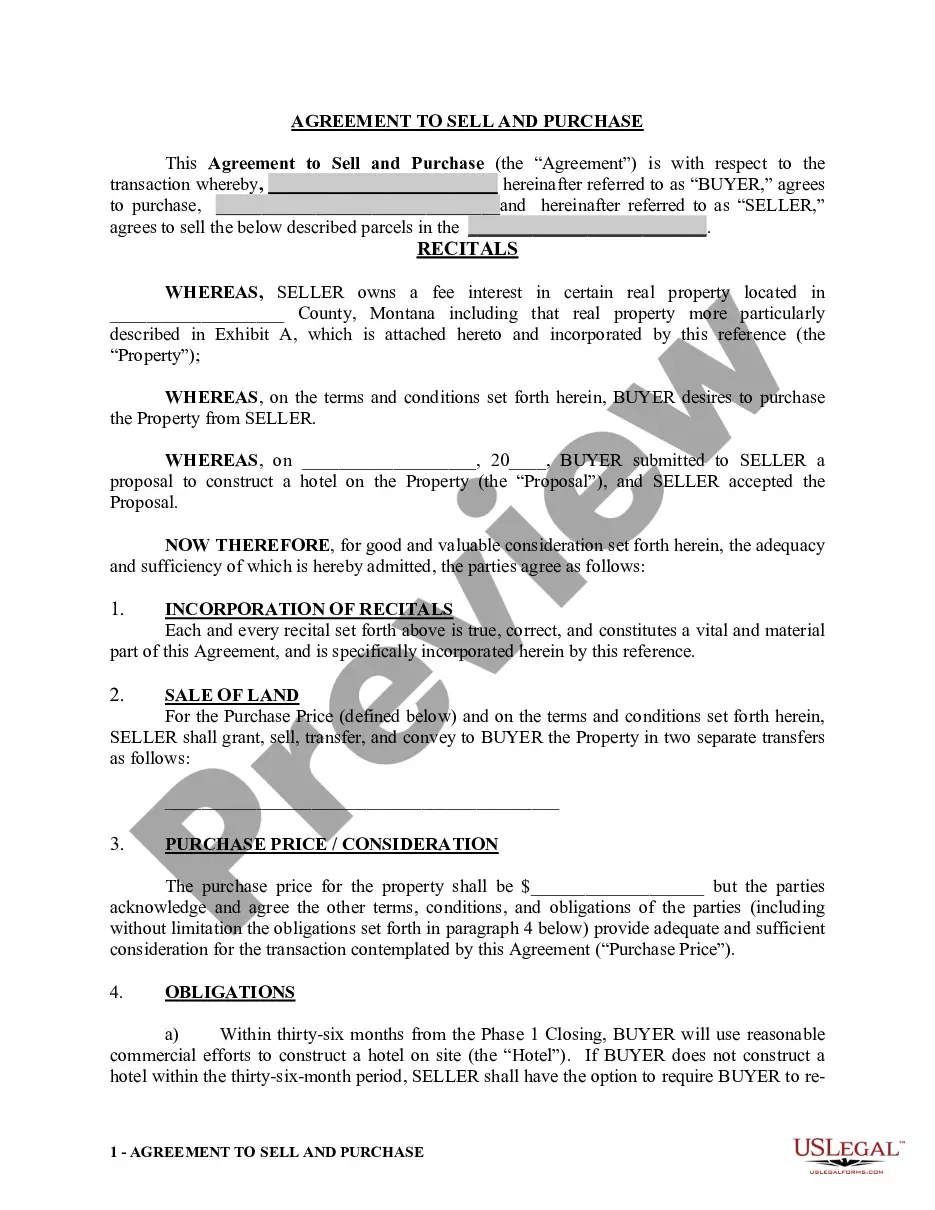

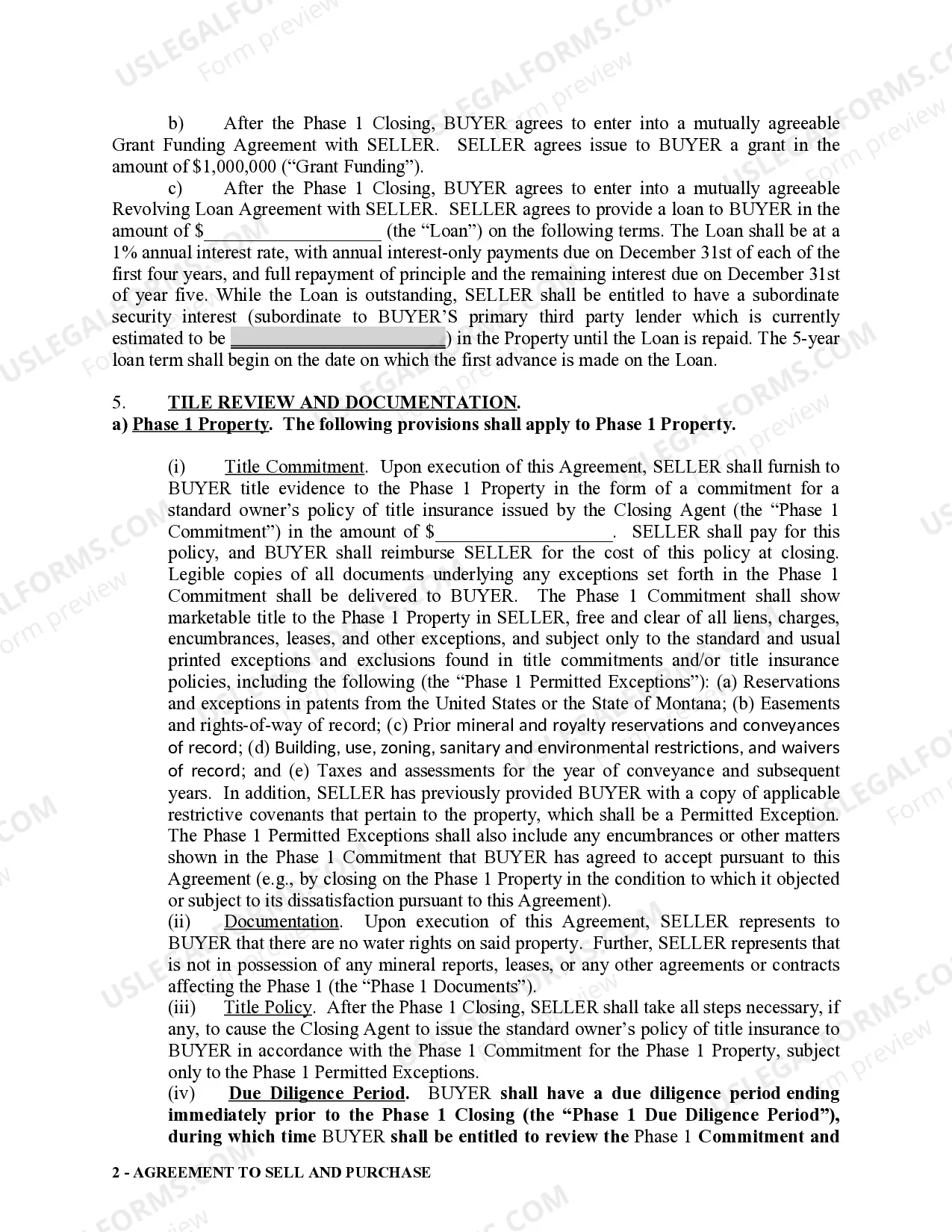

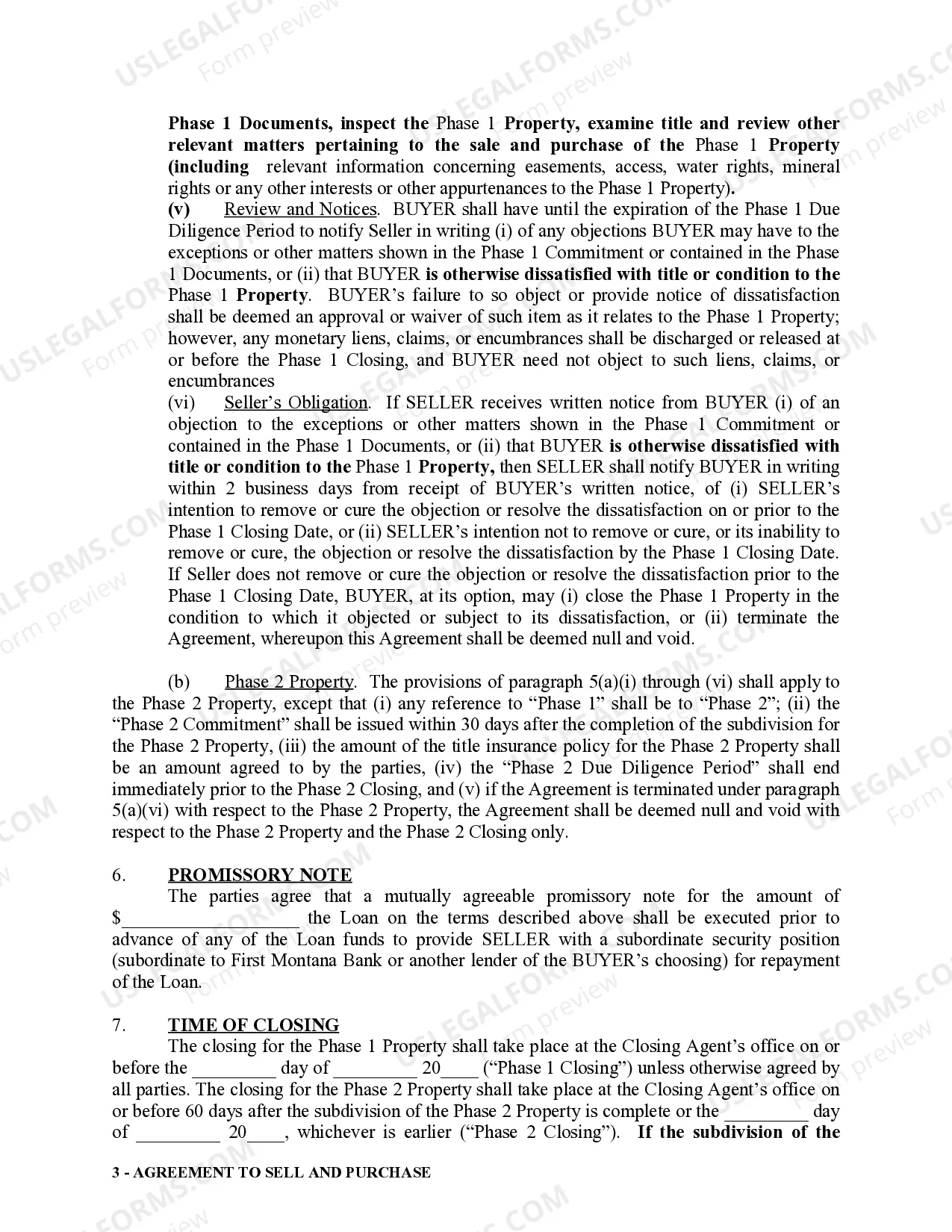

The Montana Agreement to Sell and Purchase Land for Development and Re acquisition Option is a contract between two or more parties in which one party (the seller) agrees to sell land to another party (the buyer) for the purpose of developing it. The agreement typically outlines the purchase price, terms of the sale, and any conditions associated with the sale. It may also include a reacquisition option, which allows the buyer to buy back the land at a predetermined price should the development fail. The Montana Agreement to Sell and Purchase Land for Development and Re acquisition Option can take on several forms, including a standard sale agreement, a lease-purchase agreement, or a land installment contract. The standard sale agreement is the most common, as it outlines the purchase price, terms of the sale, and any conditions associated with the sale. The lease-purchase agreement allows the buyer to lease the land and pay a monthly fee until the full purchase price is paid. The land installment contract allows the buyer to pay a down payment and then make monthly payments until the full purchase price is paid. No matter the form, all Montana Agreement to Sell and Purchase Land for Development and Re acquisition Option documents must be in writing and signed by all parties involved. The agreement will be legally binding upon all parties and will be enforced by the courts should any disputes arise.

Montana Agreement to Sell and Purchase Land for Development and Reacquisition Option

Description

How to fill out Montana Agreement To Sell And Purchase Land For Development And Reacquisition Option?

US Legal Forms is the most straightforward and cost-effective way to locate suitable legal templates. It’s the most extensive online library of business and personal legal paperwork drafted and checked by attorneys. Here, you can find printable and fillable templates that comply with federal and local laws - just like your Montana Agreement to Sell and Purchase Land for Development and Reacquisition Option.

Getting your template takes just a few simple steps. Users that already have an account with a valid subscription only need to log in to the website and download the form on their device. Afterwards, they can find it in their profile in the My Forms tab.

And here’s how you can get a professionally drafted Montana Agreement to Sell and Purchase Land for Development and Reacquisition Option if you are using US Legal Forms for the first time:

- Read the form description or preview the document to ensure you’ve found the one meeting your requirements, or locate another one using the search tab above.

- Click Buy now when you’re sure of its compatibility with all the requirements, and select the subscription plan you like most.

- Create an account with our service, sign in, and pay for your subscription using PayPal or you credit card.

- Select the preferred file format for your Montana Agreement to Sell and Purchase Land for Development and Reacquisition Option and download it on your device with the appropriate button.

After you save a template, you can reaccess it whenever you want - just find it in your profile, re-download it for printing and manual completion or upload it to an online editor to fill it out and sign more effectively.

Benefit from US Legal Forms, your reliable assistant in obtaining the required formal documentation. Give it a try!

Form popularity

FAQ

Minnesota statute limits interest rates to 6 percent in general, and 8 percent for written contracts.

Since an agreement for deed is an agreement that the seller makes to the buyer to transfer the property once a specified amount of money has been received, it is considered a mortgage under Florida Law.

Con: It takes time Writing up an agreement takes more time than verbally agreeing. It can lead to delays as well as confusion. Legal terms may not be clearly understood by both parties. A written contract takes more time and sometimes limits flexibility, but it also makes agreements easier to enforce.

A Contract for Deed is used as owner financing for the purchase of real property. The Seller retains title to the property until an agreed amount is paid. After the agreed amount is paid, the Seller conveys the property to Buyer.

The contract must be signed by all involved parties. A contract must be signed by both parties involved in the purchase and sale of a property to be legally enforceable. All parties signing must be of legal age and must enter into the contract voluntarily, not by force, to be enforceable.

A major drawback of a contract for deed for buyers is that the seller retains the legal title to the property until the payment plan is completed. On one hand, this means that they're responsible for things like property taxes. On the other hand, the buyer lacks security and rights to their home.

1% of the sales price. Thus, for a home with a sales price of $300,000, a $300 option fee is generally an acceptable amount for a 7 day option period.

A Contract for Deed is a way to buy a house that doesn't involve a bank. The seller finances the property for the buyer. The buyer moves in when the contract is signed. The buyer pays the seller monthly payments that go towards payment for the home.