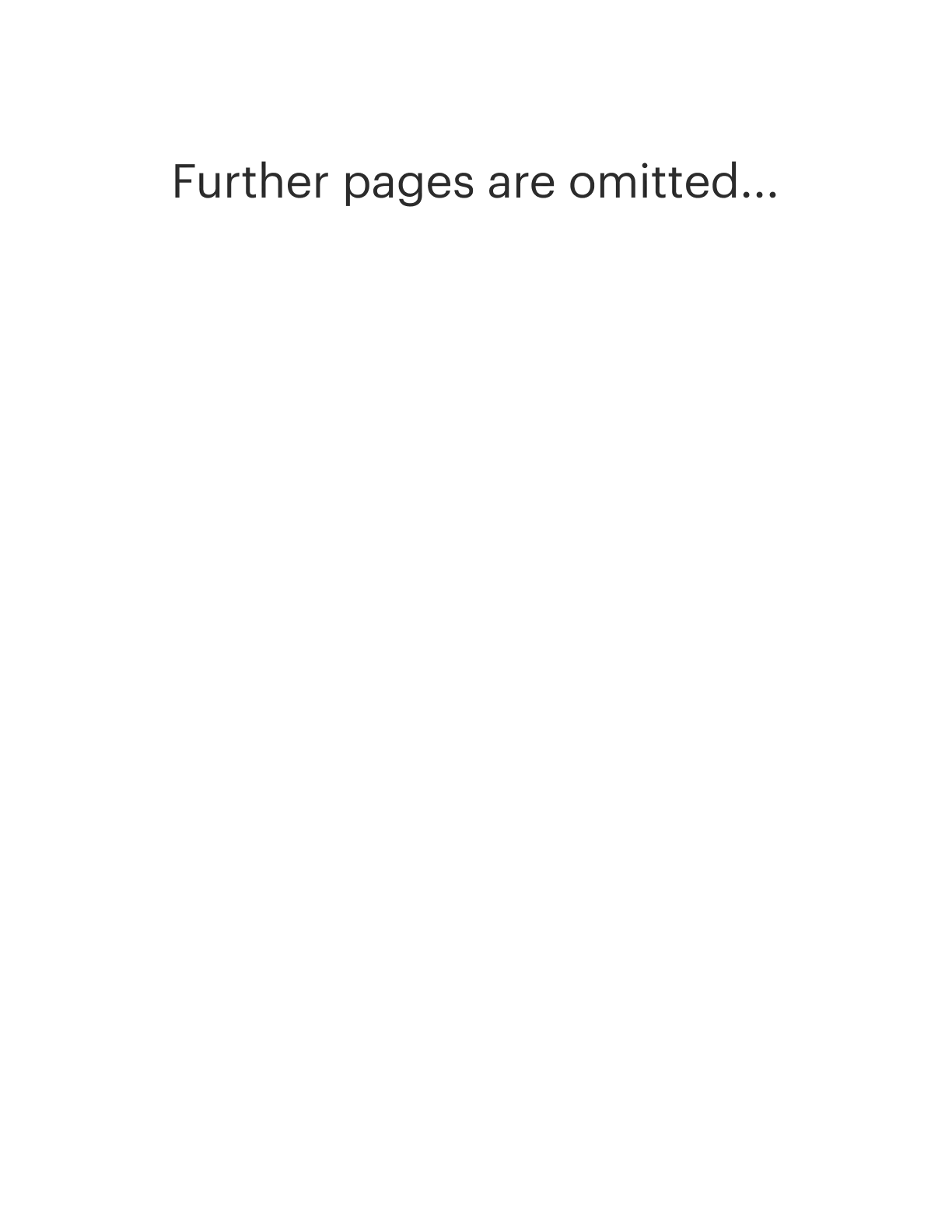

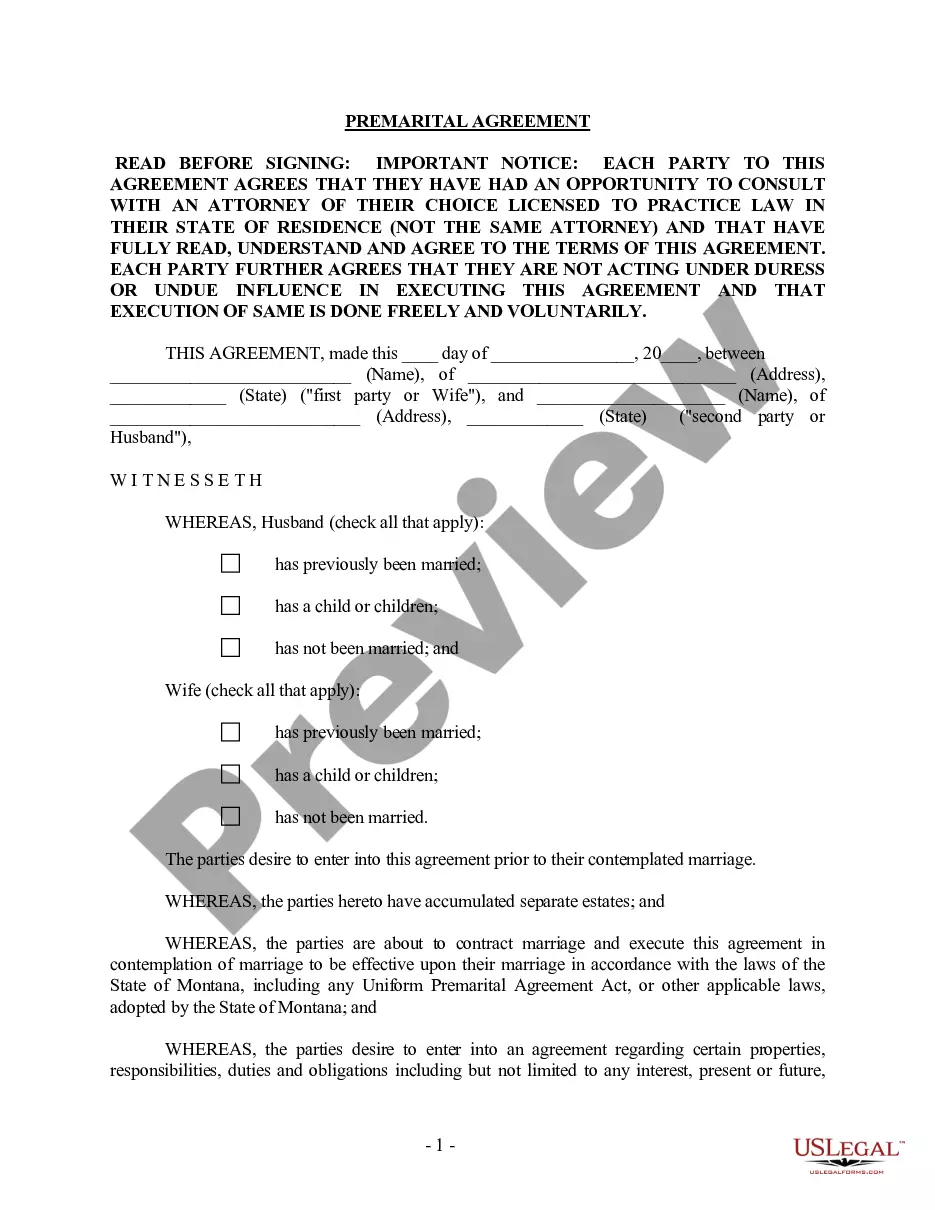

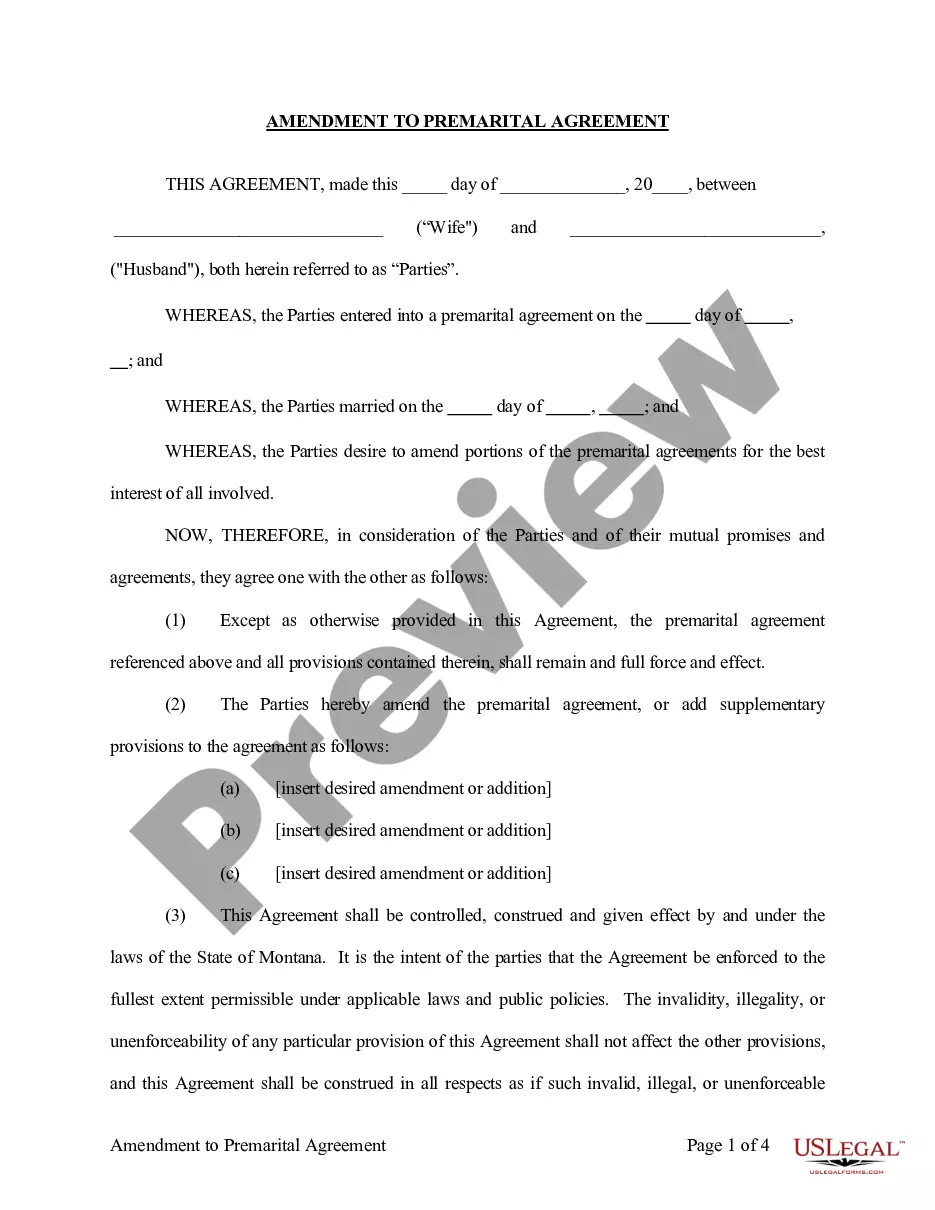

This Prenuptial Premarital Agreement with Financial Statements form package contains a premarital agreement and financial statements for your state. The agreement can be used by persons who have been previously married, or by persons who have never been married. It includes provisions regarding the contemplated marriage, assets and debts disclosure and property rights after the marriage. The agreement describes the rights, duties and obligations of prospective parties during and upon termination of marriage through death or divorce. These contracts are often used by individuals who want to ensure the proper and organized disposition of their assets in the event of death or divorce. Among the benefits that prenuptial agreements provide are avoidance of costly litigation, protection of family and/or business assets, protection against creditors and assurance that the marital property will be disposed of properly.

Montana Prenuptial Premarital Agreement - Uniform Premarital Agreement Act - with Financial Statements

Description

How to fill out Montana Prenuptial Premarital Agreement - Uniform Premarital Agreement Act - With Financial Statements?

Get a printable Montana Prenuptial Premarital Agreement - Uniform Premarital Agreement Act - with Financial Statements within just several mouse clicks from the most comprehensive catalogue of legal e-files. Find, download and print out professionally drafted and certified samples on the US Legal Forms website. US Legal Forms has been the Top provider of affordable legal and tax forms for US citizens and residents on-line starting from 1997.

Users who already have a subscription, need to log in in to their US Legal Forms account, get the Montana Prenuptial Premarital Agreement - Uniform Premarital Agreement Act - with Financial Statements see it stored in the My Forms tab. Customers who do not have a subscription must follow the tips listed below:

- Make certain your template meets your state’s requirements.

- If available, look through form’s description to find out more.

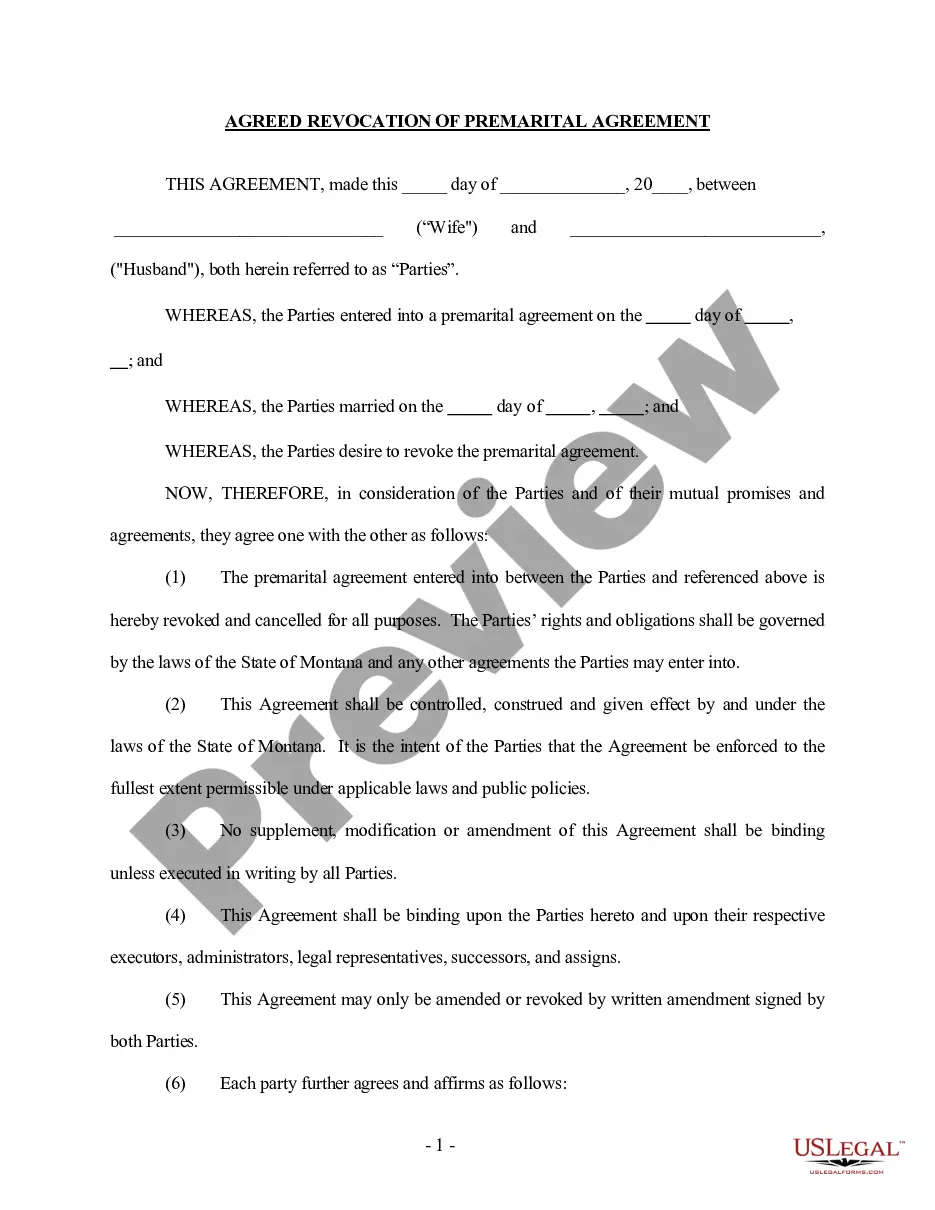

- If readily available, preview the form to view more content.

- As soon as you’re confident the form meets your requirements, click on Buy Now.

- Create a personal account.

- Pick a plan.

- via PayPal or credit card.

- Download the form in Word or PDF format.

When you’ve downloaded your Montana Prenuptial Premarital Agreement - Uniform Premarital Agreement Act - with Financial Statements, you can fill it out in any web-based editor or print it out and complete it by hand. Use US Legal Forms to to access 85,000 professionally-drafted, state-specific forms.

Form popularity

FAQ

The average cost of a prenup ranges from about $1,200 for low-cost, simple agreements to $10,000 for more complicated situations.

A prenuptial agreement can protect your funds and assets that you hold prior to entering into the marriage.Oftentimes, having a prenuptial agreement helps to ease the tension and conflict within a divorce process. It often helps protect prior children if you were to die without a will.

Prenuptial agreements, if drawn up and executed correctly, are legally binding and are usually upheld in court. One recent, high-profile case, however, has shown that prenups are not always ironclad.

More and more couples are opting for prenups when they get married, and for good reason. Debt, alimony, and assets divided up beforehand can save a lot of stress in the case of divorce. A prenup can also help you go into marriage with a little less stress on your shoulders.

Rather, "it's when there are unequal amounts coming in from the marriage." In other words, if one member of the couple has a much higher income or significantly more assets than the other, it's worth considering a prenup. "When one person has way more than the other, that's where it gets a little dicey," says Holeman.

2. Prenups make you think less of your spouse. And at their root, prenups show a lack of commitment to the marriage and a lack of faith in the partnership.Ironically, the marriage becomes more concerned with money after a prenup than it would have been without the prenup.

Prenups aren't just for the rich or famous more millennials are signing them before getting married, and you probably should too.Prenups set expectations for a division of assets and finances in the event of divorce. They may not be romantic to bring up, but most couples will benefit from having one.

The legal advice website Avvo.com suggests that you'll likely pay $600 to $800 for an attorney to draft a prenup. You can certainly pay much more. Generally, the more money you have to protect, and the more complicated your and your beloved's finances are, the more you will spend on a prenup.

In the event of divorce, a prenup can protect a spouse from being liable for any debt the other spouse brought into the marriage.A prenup can also protect any income or assets you earn during the marriage, as well as unearned income from a bequest or a trust distribution.