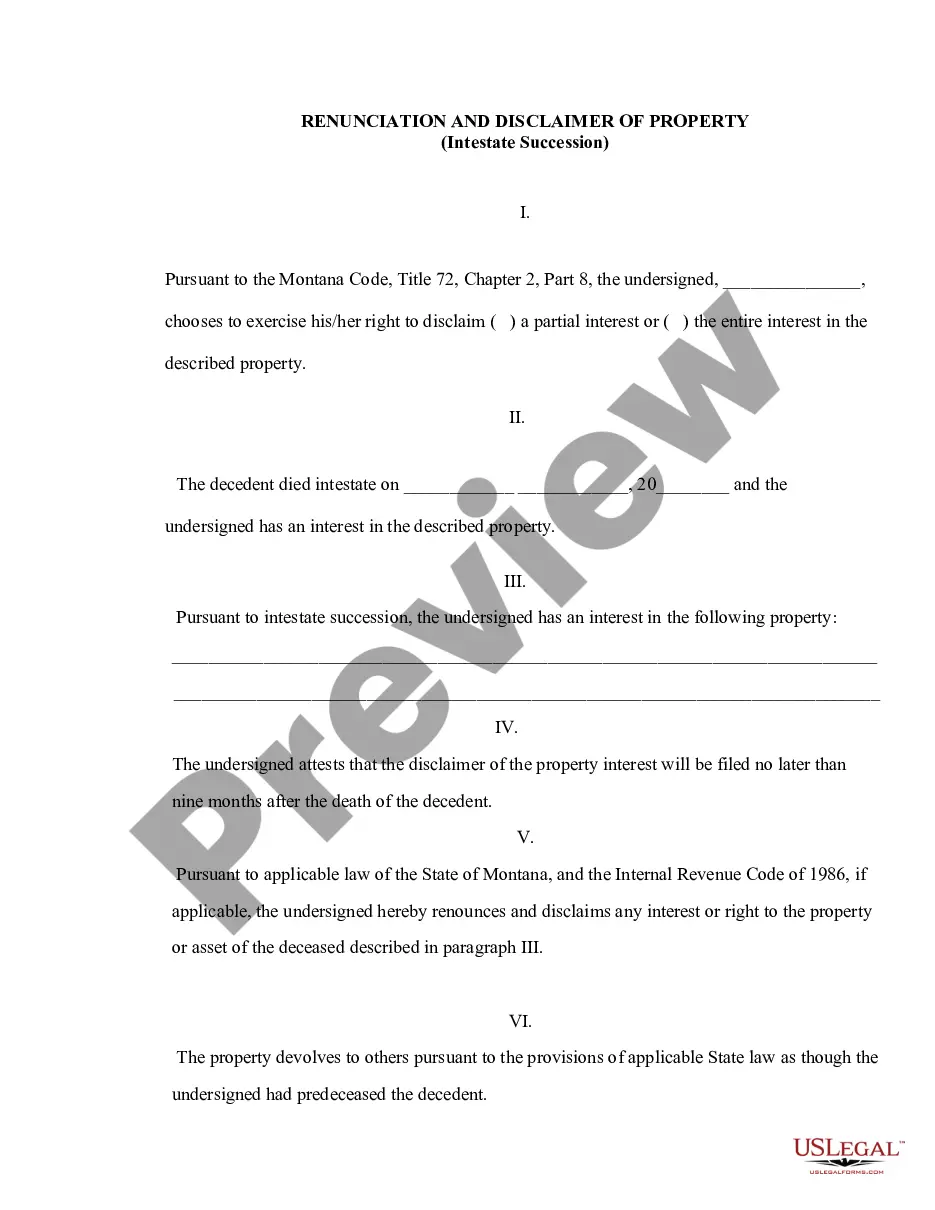

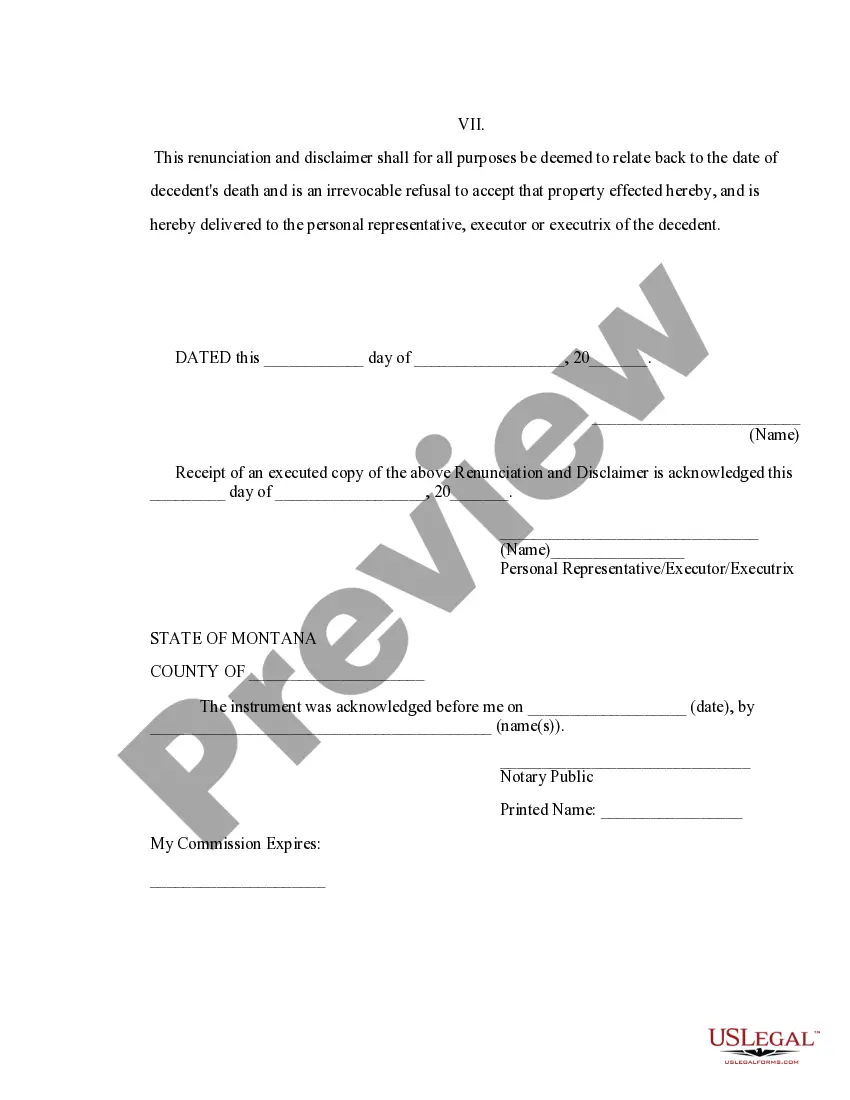

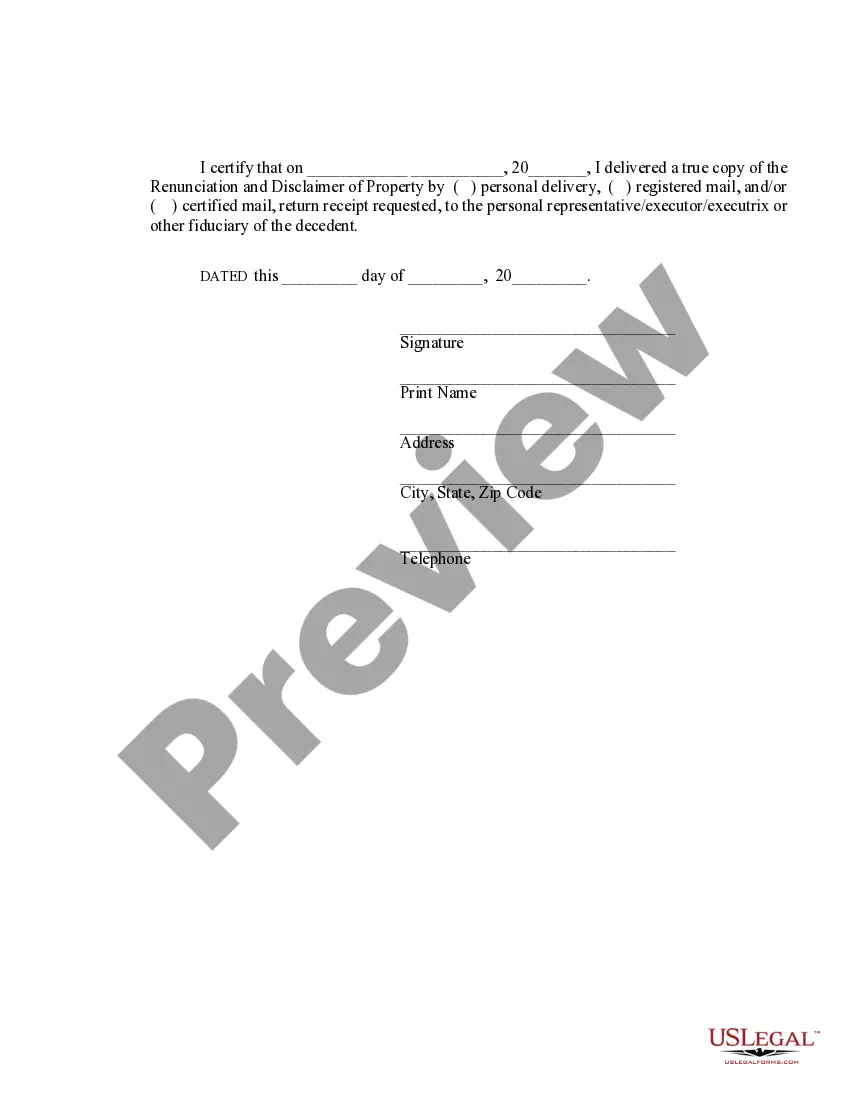

This form is a Renunciation and Disclaimer of Property acquired by the beneficiary through intestate succession. This form is for a beneficiary who dies intestate (without a will) and gains an interest in the property but, pursuant to the Montana Code, Title 72, Chapter 2, Part 8, decides to disclaim a portion of or the entire interest in the property. The disclaimer will relate back to the death of the decedent and will serve as an irrevocable renunciation of the property. The form also contains a state specific acknowledgment and a certificate to verify delivery.

- US Legal Forms

-

Montana Renunciation and Disclaimer of Property received by Intestate...

Montana Intestate Succession

Description

Related forms

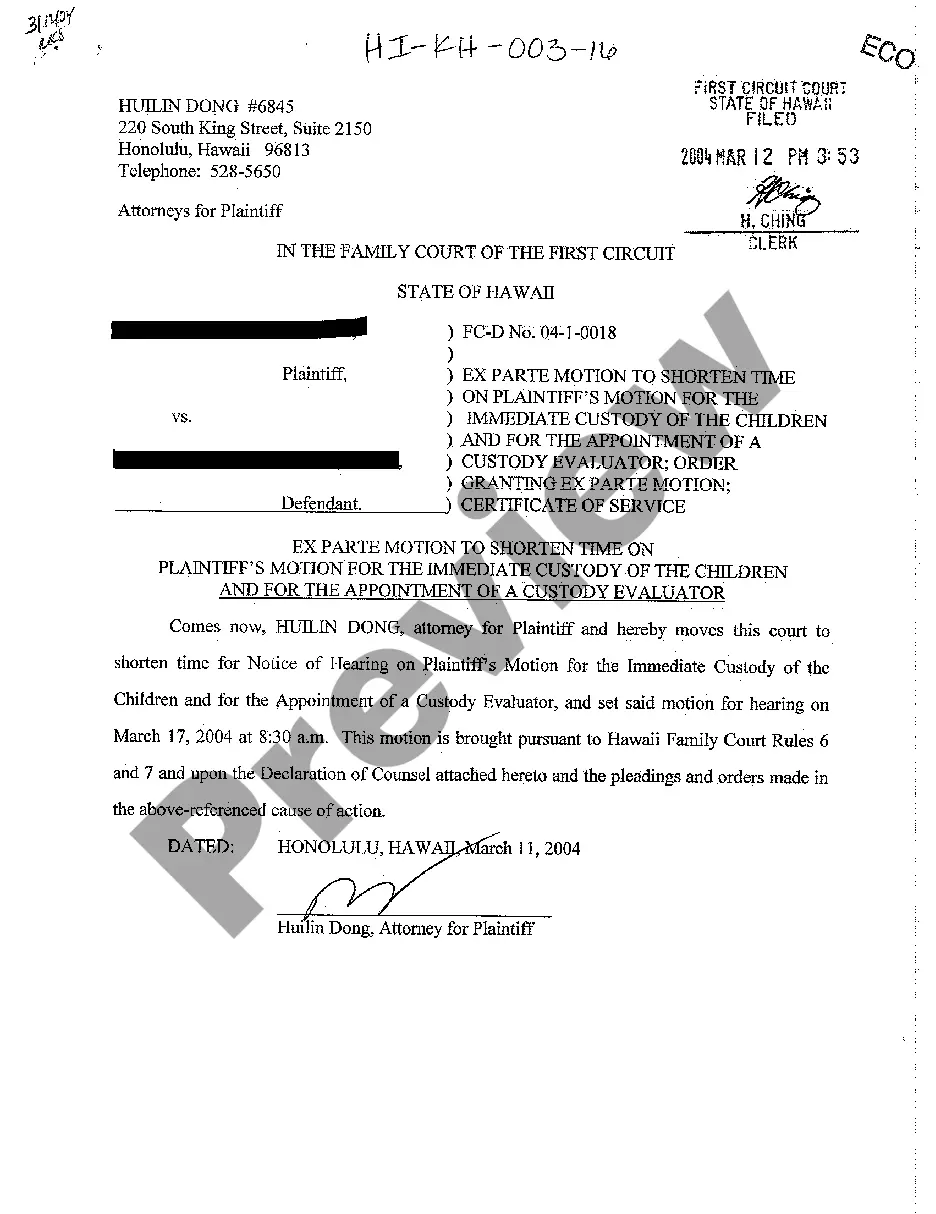

View A16 Ex Parte Motion to Shorten Time on Plaintiff's Motion for Immediate Custody of Children and for Appointment of Custody Evaluator - Order Granting Motion

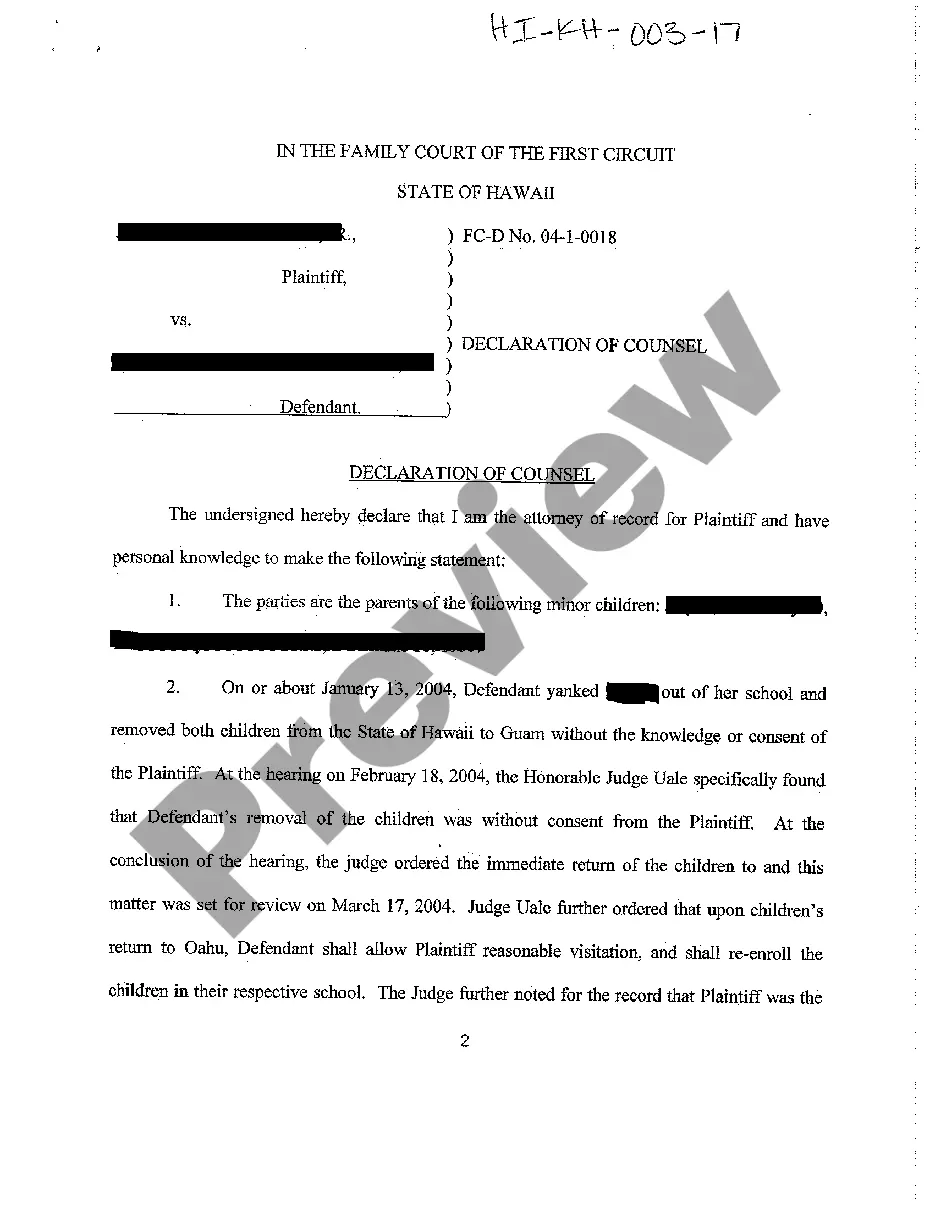

View A17 Declaration of Counsel

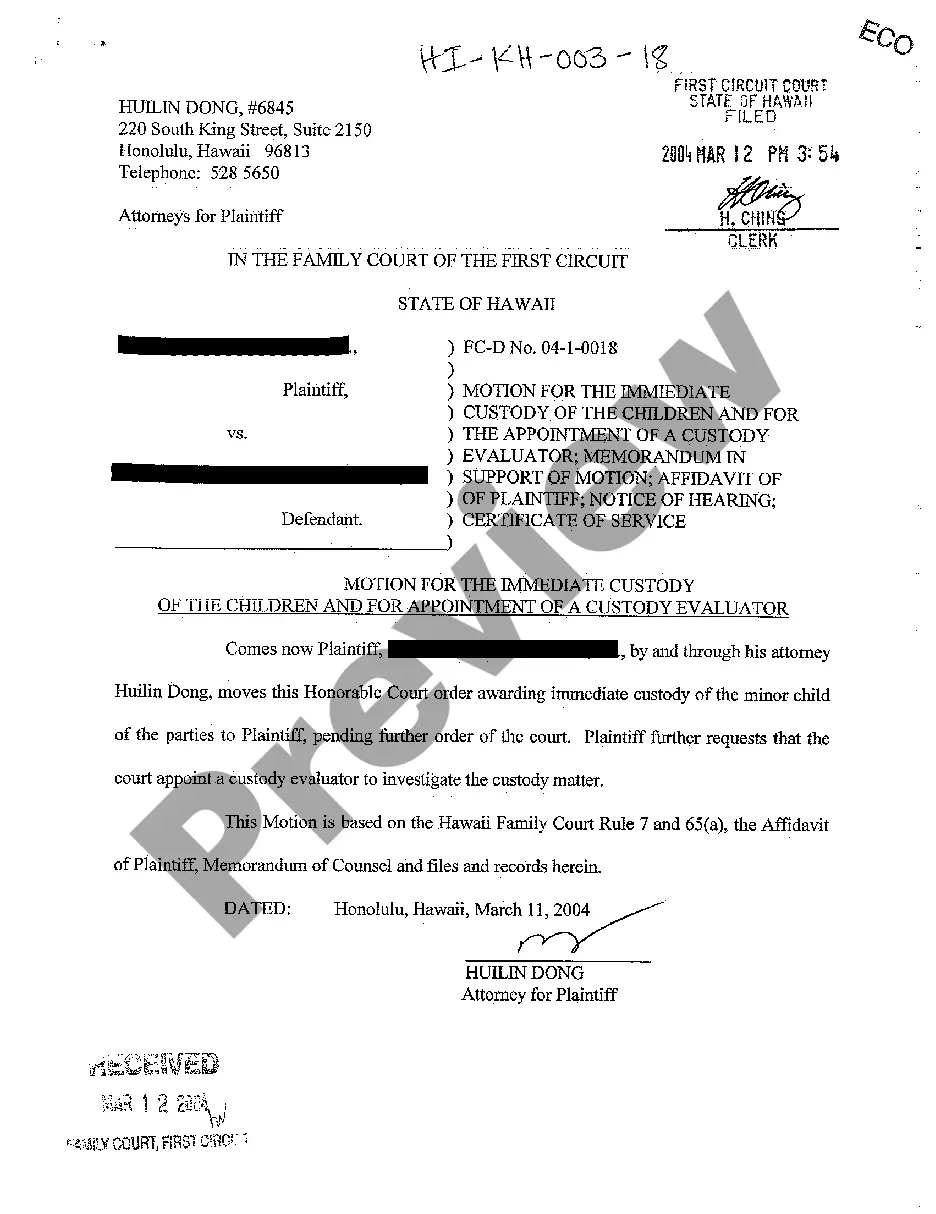

View A18 Motion for Immediate Custody of Children and for Appointment of Custody Evaluator - Memorandum in Support of Motion

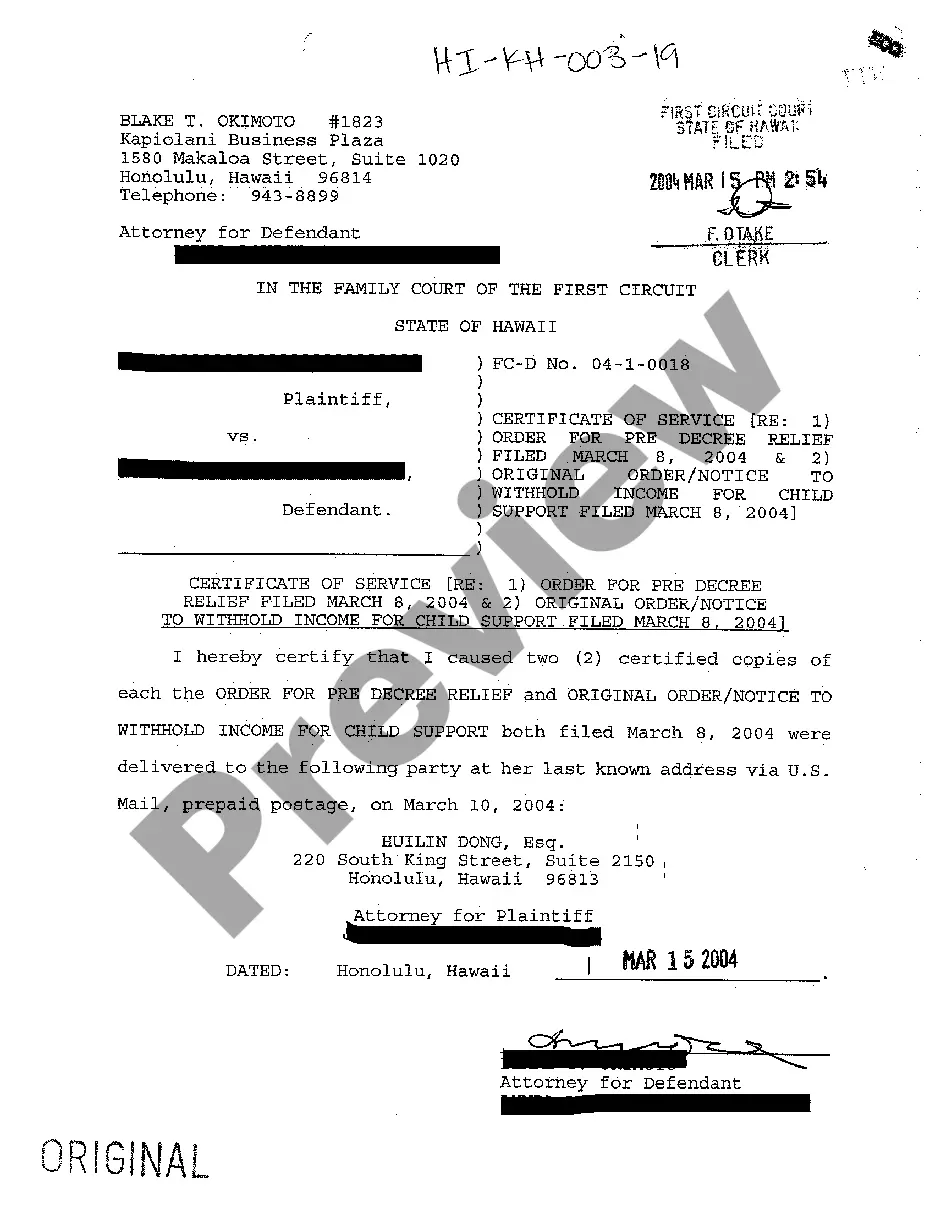

View A19 Certificate of Service Order for Pre-Decree Relief, Original Order - Notice

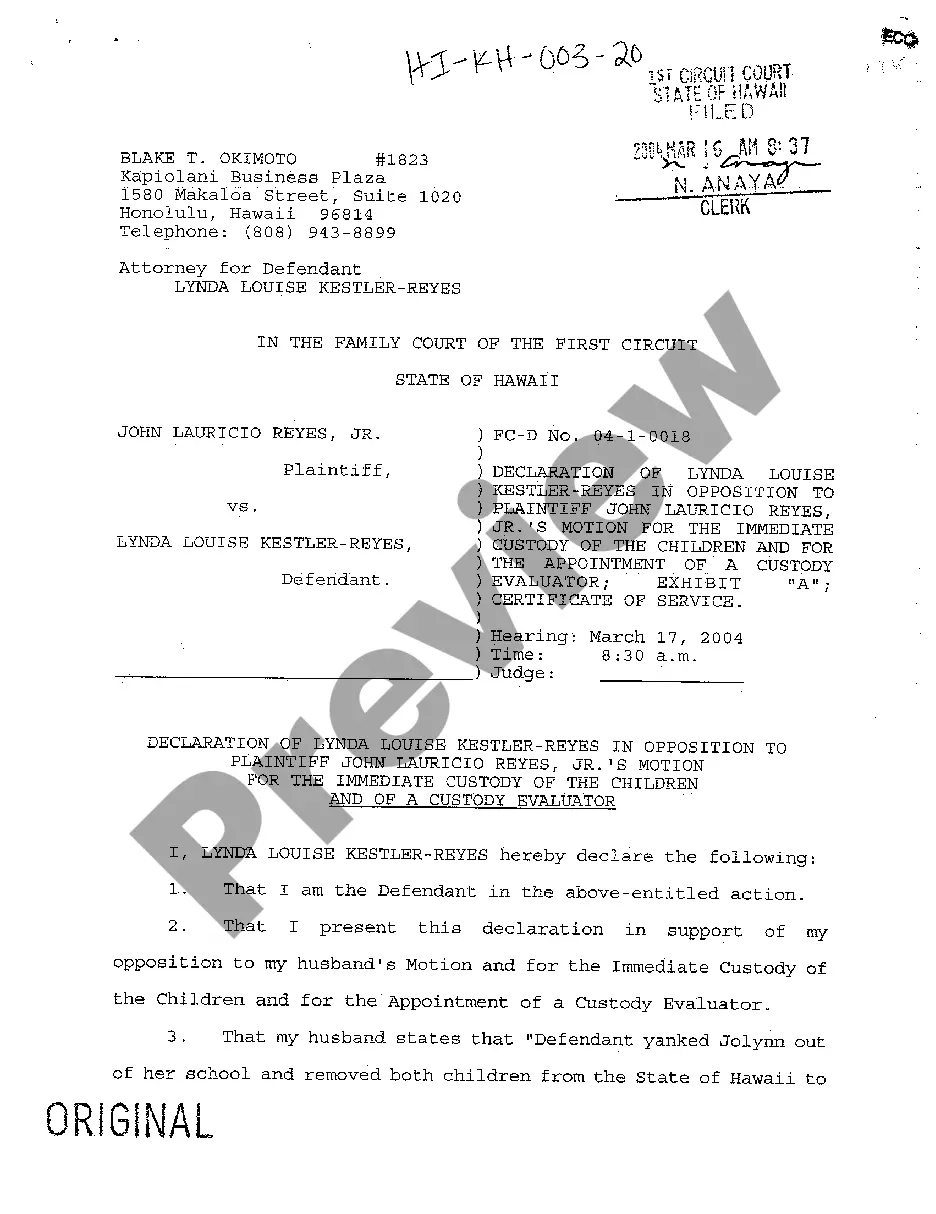

View A20 Declaration of Defendant in Opposition to Motion for the Immediate Custody of Children and for Appointment of Custody Evaluator

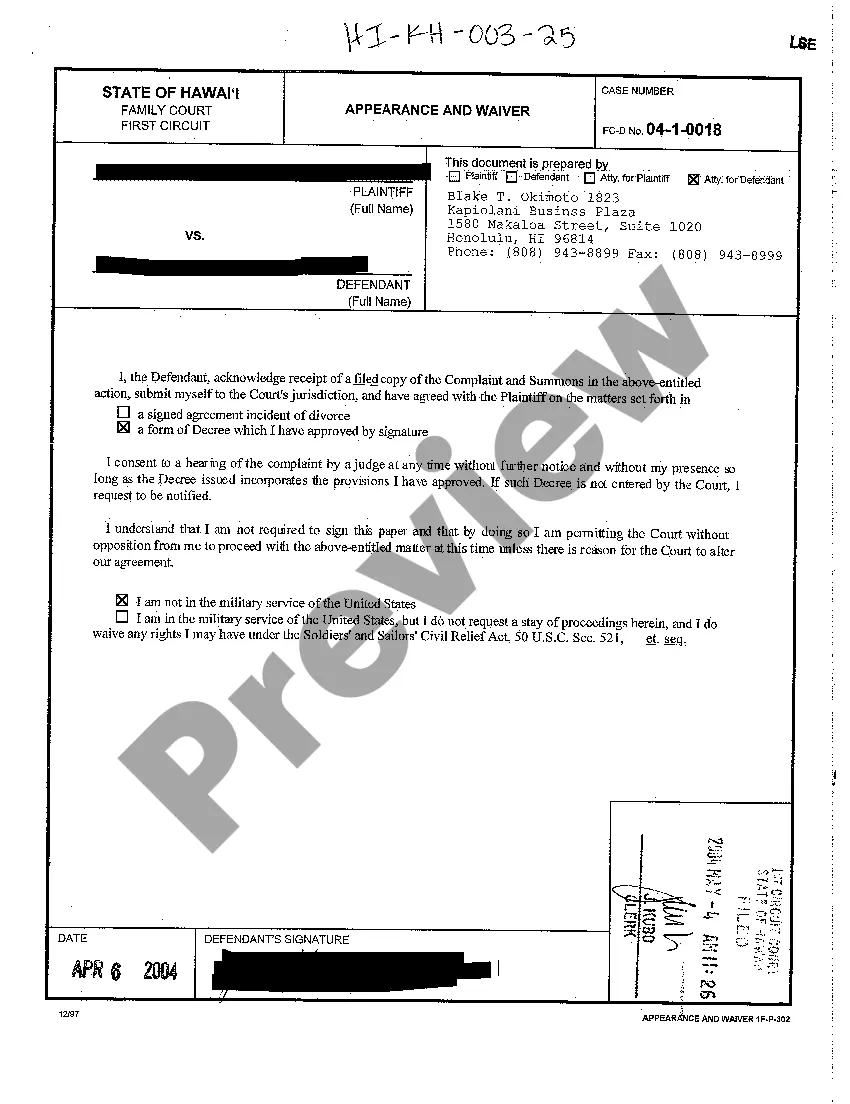

View A25 Appearance and Waiver

How to fill out Montana Renunciation And Disclaimer Of Property Received By Intestate Succession?

Get a printable Montana Renunciation and Disclaimer of Property received by Intestate Succession in just several clicks in the most extensive catalogue of legal e-documents. Find, download and print professionally drafted and certified samples on the US Legal Forms website. US Legal Forms is the #1 provider of affordable legal and tax templates for US citizens and residents online starting from 1997.

Users who already have a subscription, need to log in in to their US Legal Forms account, download the Montana Renunciation and Disclaimer of Property received by Intestate Succession see it saved in the My Forms tab. Customers who do not have a subscription must follow the tips listed below:

- Make sure your template meets your state’s requirements.

- If available, look through form’s description to learn more.

- If accessible, preview the shape to view more content.

- When you’re sure the template suits you, simply click Buy Now.

- Create a personal account.

- Select a plan.

- Pay out through PayPal or bank card.

- Download the template in Word or PDF format.

As soon as you’ve downloaded your Montana Renunciation and Disclaimer of Property received by Intestate Succession, you may fill it out in any web-based editor or print it out and complete it by hand. Use US Legal Forms to to access 85,000 professionally-drafted, state-specific forms.

Form Rating

Form popularity

FAQ

4. Siblings If the person who died had no living spouse, civil partner, children or parents, then their siblings are their next of kin.

Children - if there is no surviving married or civil partnerIf there is no surviving partner, the children of a person who has died without leaving a will inherit the whole estate. This applies however much the estate is worth. If there are two or more children, the estate will be divided equally between them.

If one dies, the other partner will automatically inherit the whole of the money. Property and money that the surviving partner inherits does not count as part of the estate of the person who has died when it is being valued for the intestacy rules.

In Montana, you can make a living trust to avoid probate for virtually any asset you ownreal estate, bank accounts, vehicles, and so on. You need to create a trust document (it's similar to a will), naming someone to take over as trustee after your death (called a successor trustee).

Many married couples own most of their assets jointly with the right of survivorship. When one spouse dies, the surviving spouse automatically receives complete ownership of the property. This distribution cannot be changed by Will.

If you are unmarried and die without a valid will and last testament in Montana, then your entire estate goes to any surviving children in equal shares, or grandchildren if you don't have any surviving children. If you die intestate unmarried and with no children, then by law, your parents inherit your entire estate.

Who Inherits When There's No Will? Intestate succession laws determine how to distribute assets among them when no will is in place. This varies between states. Generally, a spouse receives most of the assets and property, followed by children, parents, grandparents, and other blood relatives of the deceased.

Under Montana statute, where as estate is valued at less than $50,000, an interested party may, thirty (30) days after the death of the decedent, issue a small estate affidavit to to demand payment on any debts owed to the decedent.

The laws are different in every state, but if you're married and die without a will, your estate will probably go to your spouse if you both own it.If he passes away without a will, the law says his surviving spouse will inherit the first $50,000 of his personal assets (not any shared assets) plus half the balance.

Trusted and secure by over 3 million people of the world’s leading companies

-

No results found.

-

Montana

-

Alabama

-

Alaska

-

Arizona

-

Arkansas

-

California

-

Colorado

-

Connecticut

-

Delaware

-

District of Columbia

-

Florida

-

Hawaii

-

Illinois

-

Indiana

-

Iowa

-

Kansas

-

Kentucky

-

Maine

-

Maryland

-

Massachusetts

-

Michigan

-

Minnesota

-

Missouri

-

Nebraska

-

Nevada

-

New Hampshire

-

New Jersey

-

New Mexico

-

New York

-

North Carolina

-

North Dakota

-

Oklahoma

-

Oregon

-

Pennsylvania

-

Rhode Island

-

South Dakota

-

Texas

-

Utah

-

Vermont

-

Washington

-

West Virginia

-

Wisconsin

Disclaimer of Property Interest-Montana

Title 72 ESTATES, TRUSTS, AND FIDUCIARY RELATIONSHIPS

CHAPTER 2 UPC -- INTESTACY, WILLS, AND DONATIVE TRANSFERS

Part 8 General Provisions Concerning Probate and Nonprobate Transfers

Disclaimer of property interests.

(1) (a) A person or the representative of a person to whom

an interest in or with respect to property or an interest in the property

devolves by whatever means may disclaim it in whole or in part by delivering

or filing a written disclaimer under this section.

(b) The right to disclaim exists notwithstanding:

(i) any limitation on the interest of the disclaimant in

the nature of a spendthrift provision or similar restriction; or

(ii) any restriction or limitation on the right to disclaim contained

in the governing instrument.

(c) For purposes of this subsection (1), the "representative of a person"

includes a personal representative of a decedent; a conservator of a disabled

person; a guardian of a minor or incapacitated person; a guardian ad litem

of a minor, an incapacitated person, an unborn person, an unascertained

person, or a person whose identity or address is unknown; and an agent

acting on behalf of the person within the authority of a power of attorney.

The representative of a person may rely on a general family benefit accruing

to the living members of the represented person's family as a basis for

making a disclaimer.

(2) The following rules govern the time when a disclaimer must be filed

or delivered:

(a) If the property or interest has devolved to the disclaimant

under a testamentary instrument or by the laws of intestacy, the disclaimer

must be filed, if of a present interest, not later than 9 months after

the death of the deceased owner or deceased donee of a power of appointment

and, if of a future interest, not later than 9 months after the event determining

that the taker of the property or interest is finally ascertained and the

taker's interest is indefeasibly vested. The disclaimer must be filed in

the court of the county in which proceedings for the administration of

the estate of the deceased owner or deceased donee of the power have been

commenced. A copy of the disclaimer must be delivered in person or mailed

by certified mail, return receipt requested, to any personal representative

or other fiduciary of the decedent or donee of the power.

(b) If a property or interest has devolved to the disclaimant under

a nontestamentary instrument or contract, the disclaimer must be delivered

or filed, if of a present interest, not later than 9 months after the effective

date of the nontestamentary instrument or contract and, if of a future

interest, not later than 9 months after the event determining that the

taker of the property or interest is finally ascertained and the taker's

interest is indefeasibly vested. If the person entitled to disclaim does

not know of the existence of the interest, the disclaimer must be delivered

or filed not later than 9 months after the person learns of the existence

of the interest. The effective date of a revocable instrument or contract

is the date on which the maker no longer has power to revoke it or to transfer

to the maker or another the entire legal and equitable ownership of the

interest. The disclaimer or a copy of the disclaimer must be delivered

in person or mailed by certified mail, return receipt requested, to the

person who has legal title to or possession of the interest disclaimed.

(c) A surviving joint tenant may disclaim as a separate interest

any property or interest in property devolving to the surviving joint tenant

by right of survivorship within 9 months after the death of the deceased

joint owner, regardless of whether the surviving joint tenant contributed

to the purchase of jointly held property or benefited from the jointly

held property prior to the other joint tenant's death.

(d) If real property or an interest in the property is disclaimed,

a copy of the disclaimer may be recorded in the office of the clerk and

recorder of the county in which the property or interest disclaimed is

located.

(3) The disclaimer must:

(a) describe the property or interest disclaimed;

(b) declare the disclaimer and extent of the disclaimer; and

(c) be signed by the disclaimant.

(4) The following are the effects of a disclaimer:

(a) If property or an interest in property devolves to

a disclaimant under a testamentary instrument, under a power of appointment

exercised by a testamentary instrument, or under the laws of intestacy

and the decedent has not provided for another disposition of that interest,

should it be disclaimed, or of disclaimed or failed interests in general,

the disclaimed interest devolves as if the disclaimant had predeceased

the decedent, but if by law or under the testamentary instrument the descendants

of the disclaimant would share in the disclaimed interest by representation

or otherwise were the disclaimant to predecease the decedent, then the

disclaimed interest passes by representation, or passes as directed by

the governing instrument, to the descendants of the disclaimant who survive

the decedent. A future interest that takes effect in possession or enjoyment

after the termination of the estate or interest disclaimed takes effect

as if the disclaimant had predeceased the decedent. A disclaimer relates

back for all purposes to the date of the death of the decedent.

(b) If property or an interest in property devolves to a disclaimant

under a nontestamentary instrument or contract and the instrument or contract

does not provide for another disposition of that interest, should it be

disclaimed, or of disclaimed or failed interests in general, the disclaimed

interest devolves as if the disclaimant had predeceased the effective date

of the instrument or contract, but if by law or under the nontestamentary

instrument or contract the descendants of the disclaimant would share in

the disclaimed interest by representation or otherwise were the disclaimant

to predecease the effective date of the instrument, then the disclaimed

interest passes by representation, or passes as directed by the governing

instrument, to the descendants of the disclaimant who survive the effective

date of the instrument. A disclaimer relates back for all purposes to that

date. A future interest that takes effect in possession or enjoyment at

or after the termination of the disclaimed interest takes effect as if

the disclaimant had died before the effective date of the instrument or

contract that transferred the disclaimed interest.

(c) The disclaimer or the written waiver of the right to disclaim

is binding upon the disclaimant or person waiving and on all persons claiming

through or under either of them.

(5) The right to disclaim property or an interest in the property is

barred by:

(a) an assignment, conveyance, encumbrance, pledge, or

transfer of the property or interest or a contract therefor;

(b) a written waiver of the right to disclaim;

(c) an acceptance of the property or interest or benefit under it;

or

(d) a sale of the property or interest under judicial sale made

before the disclaimer is made.

(6) This section does not abridge the right of a person to waive, release,

disclaim, or renounce property or an interest in property under any other

statute.

(7) An interest in property that exists on October 1, 1993, as to

which, if a present interest, the time for filing a disclaimer under this

section has not expired or, if a future interest, the interest has not

become indefeasibly vested or the taker finally ascertained may be disclaimed

within 9 months after October 1, 1993.

History: En. 91A-2-801 by Sec. 1, Ch. 365, L. 1974; R.C.M. 1947, 91A-2-801; amd. Sec. 1, Ch. 52, L. 1981; amd. Sec. 1, Ch. 511, L. 1983; amd. Sec. 5, Ch. 494, L. 1993; Sec. 72-2-101, MCA 1991; redes. 72-2-811 by Code Commissioner, 1993; amd. Sec. 20, Ch. 592, L. 1995; amd. Sec. 4, Ch. 290, L. 1999.

Official Comments: Purpose and Scope of Revisions.

This section brings into the Code the Uniform Disclaimer of Property Interests Act, replacing the prior incorporation of the Uniform Disclaimer of Transfers by Will, Intestacy or Appointment Act. The reason for incorporating the broader Act is that the scope of Article II [Title 72, chapter 2] has now been expanded to cover dispositive provisions not contained in wills.

Explanation of Revisions.

Only three revisions of the Uniform Disclaimer of Property Interests Act are adopted at this time, though the Joint Editorial Board believes that this and the other Uniform Disclaimer Acts are in need of revision in other respects.

Subsection (a) [72-2-811(1)]. Subsection (a) [72-2-811(1)] is revised in two respects. First, the right to disclaim is extended to a decedent through his or her personal representative. The Uniform Disclaimer of Property Interests Act does not authorize disclaimers on behalf of a deceased person. Second, the sentence authorizing a disclaimer despite a limitation or restriction in the governing instrument is clarified to leave no doubt that an explicit restriction or limitation on the right to disclaim in the governing instrument is ineffective.

Subsection (d) [72-2-811(4)]. The third revision clarifies the effect of a disclaimer. The Uniform Disclaimer of Property Interests Act states that "it" shall devolve "as if the disclaimant had predeceased the decedent." Literally interpreted, the word "it" refers to "the disclaimed interest," not to the estate as a whole. (One of the changes above is to make this point unmistakable by replacing "it" with "the disclaimed interest.")

Unfortunately, even though the word "it" refers to the disclaimed interest, not to the estate as a whole, there is still a plausible interpretation of the phrase "the disclaimed interest devolves as if the disclaimant had predeceased the decedent" that does not produce the desired result. The desired result is to prevent an heir, for example, from using a disclaimer to effect a change in the division of an intestate's estate. To illustrate this point, consider the following example:

Under these facts, G's intestate estate is divided into two equal parts: A takes half and B's child, Z, takes the other half. Suppose, however, that A files a disclaimer. The desired effect of that disclaimer is to prevent A from affecting the basic division of G's intestate estate by this maneuver. If, however, the disclaimer statute merely provides that the "disclaimed interest" devolves as though the disclaimant (A) had predeceased the decedent, then A's one half interest would not pass only to X and Y, but to X, Y, and Z. To prevent this possible interpretation of that language, the "but if" phrase is added to (d)(1) [72-2-811(4)(a)] and (d)(2) [72-2-811(4)(b)]. This added phrase explicitly provides that A's disclaimed interest passes to A's descendants, if A left any descendants.

Time Allowed for Filing Disclaimer.

It should be noted that there may be a discrepancy between the time allowed for filing a disclaimer under this section (and under the freestanding Uniform Acts) and the time allowed for filing a qualified disclaimer under the Internal Revenue Code § 2518. Lawyers are cautioned to check both the state and federal disclaimer statutes before advising clients, especially with respect to disclaimers of future interests.

Compiler's Comments:

1999 Amendment: Chapter 290 in (2)(c) near beginning after "devolving to the" inserted "surviving" and inserted "within 9 months after the death of the deceased joint owner, regardless of whether the surviving joint tenant contributed to the purchase of jointly held property or benefited from the jointly held property prior to the other joint tenant's death" and at end deleted sentence that read: "A surviving joint tenant may disclaim the entire interest in any property or interest in the property that is the subject of a joint tenancy devolving to the joint tenant if the joint tenancy was created by act of a deceased joint tenant, the survivor did not join in creating the joint tenancy, and the survivor has not accepted a benefit under it." Amendment effective April 9, 1999.

1995 Amendment: Chapter 592 in first sentence of (4)(a) and (4)(b) substituted "share in the disclaimed interest by representation or otherwise" for "take the disclaimant's share by representation" and near end of both sentences, after "representation", inserted "or passes as directed by the governing instrument"; and made minor changes in style.

1993 Amendment: Chapter 494 substituted current text concerning disclaimer of property interests for former text that read:

"(1) A person or his personal representative or the representative

of an incapacitated or protected person who is an heir, devisee, person

succeeding to a renounced interest, donee, appointee, grantee, recipient,

or beneficiary under a trust or other nontestamentary instrument or under

a power of appointment exercised by a testamentary or nontestamentary instrument,

surviving joint owner or surviving joint tenant, or beneficiary or owner

of an insurance contract or any incident of ownership therein may renounce,

in whole or in part, the right of succession to any property or interest

therein, including a future interest, by filing a written renunciation

under this section. The instrument shall:

(a) describe the property or interest renounced;

(b) be signed by the person renouncing; and

(c) declare the renunciation and the extent thereof.

(2) The court may direct or permit a trustee under a testamentary or

nontestamentary instrument to renounce, modify, amend, or otherwise deviate

from any restriction on or power of administration, management, or allocation

of benefit upon finding that such restriction on the exercise of the power

may defeat or impair the accomplishment of the purposes of the trust, whether

by the imposition of tax, the allocation of beneficial interest inconsistent

with such purposes, or by other reason. Such authority shall be exercised,

after hearing and upon notice to all known persons beneficially interested

in such trust, in the manner directed by the court.

(3) The instrument of renunciation must be received by the transferor

of the interest, his legal representative, the personal representative

of a deceased transferor, the trustee of any trust in which the interest

being renounced exists, or the holder of the legal title to the property

to which the interest relates. To be effective for purposes of determining

inheritance and estate taxes, the instrument must be received not later

than the date which is 9 months after the later of the date on which the

transfer creating the interest in a person is made or the date on which

the person attains 18 years of age. If the circumstances that establish

the right of a person to renounce an interest arise as a result of the

death of an individual, the instrument must also be filed in the court

of the county where proceedings concerning the decedent's estate are pending

or where they would be pending if commenced. If real property or an interest

therein is renounced, a copy of the renunciation may be recorded in the

office of the county clerk and recorder of the county in which the real

estate is situated. No person entitled to a copy of the instrument is liable

for any proper distribution or disposition made without actual notice of

the renunciation, and no person making a proper distribution or disposition

in reliance upon the renunciation is liable for any such distribution or

disposition in the absence of actual notice that an action has been instituted

contesting the validity of the renunciation.

(4) Unless the transferor of the interest has otherwise provided,

the property or interest renounced devolves as though the person renouncing

had predeceased the decedent or, if the appointment was exercised by a

testamentary instrument, as though the person renouncing had predeceased

the donee of the power. A future interest that takes effect in possession

or enjoyment after the termination of the estate or interest renounced

takes effect as though the person renouncing had predeceased the decedent

or the donee of the power. A renunciation relates back for all purposes

to the date of the death of the decedent or the donee of the power.

(5) (a) The right to renounce property or an interest therein

is barred by:

(i) an assignment, conveyance, encumbrance, pledge, or

transfer of property or interest, or a contract therefor;

(ii) a written waiver of the right to renounce;

(iii) an acceptance of the property or interest or benefit thereunder;

or

(iv) a sale of the property or interest under judicial sale made

before the renunciation is effected.

(b) The right to renounce exists notwithstanding any limitation on

the interest of the person renouncing in the nature of a spendthrift provision

or similar restriction.

(c) A renunciation or a written waiver of the right to renounce

is binding upon the person renouncing or person waiving and all persons

claiming through or under him.

(6) This section does not abridge the right of a person to waive, release,

disclaim, or renounce property or an interest therein under any other statute.

(7) Within 30 days of receipt of a written instrument of renunciation

by the transferor of the interest, the renouncer, his legal representative,

the personal representative of the decedent, the trustee of any trust in

which the interest being renounced exists, or the holder of the legal title

to the property to which the interest relates, as the case may be, shall

attempt to notify in writing those persons who are known or ascertainable

with reasonable diligence who are recipients or potential recipients of

the renounced interest of the renunciation and the interest or potential

interest such recipient will receive as a result of the renunciation.

(8) Any interest in property which exists on July 1, 1983, may be

renounced after October 1, 1983, as provided in this section. An interest

that has arisen prior to July 1, 1983, in any person other than the person

renouncing is not destroyed or diminished by any action of the person renouncing

taken under this section."

Saving Clause: Section 136, Ch. 494, L. 1993, was a saving clause.

1983 Amendment: In (1), after "renounced interest" substituted "donee, appointee, grantee, recipient, or beneficiary under a . . . ownership therein" (see 1983 Session Law for complete text) for "beneficiary under a testamentary instrument, or appointee under a power of appointment exercised by a testamentary instrument"; deleted former (2), which read:

"(a) An instrument renouncing a present interest shall

be filed within 9 months after the death of the decedent or the donee of

the power.

(b) An instrument renouncing a future interest may be filed not

later than 9 months after the event determining that the taker of the property

or interest is finally ascertained and his interest is indefeasibly vested.

(c) The renunciation must be filed in the court of the county in

which proceedings have been commenced for the administration of the estate

of the deceased owner or deceased donee of the power or, if they have not

been commenced, in which they could be commenced. A copy of the renunciation

shall be delivered in person or mailed by registered or certified mail

to any personal representative or other fiduciary of the decedent or donee

of the power. If real property or an interest therein is renounced, a copy

of the renunciation may be recorded in the office of the county clerk of

the county in which the real estate is situated."; inserted (2) allowing

trustee renunciation; inserted (3) relating to receipt of instrument of

renunciation and date of renunciation; in (4) near beginning of first sentence

substituted "transferor of the interest" for "decedent or donee of the

power"; deleted former (6), which read: "An interest in property which

exists on July 1, 1975, as to which, if a present interest, the time for

filing a renunciation under the Uniform Probate Code has not expired, or

if a future interest, the interest has not become indefeasibly vested or

the taker finally ascertained, may be renounced within 9 months after July

1, 1975."; inserted (7) concerning notice of renunciation; and inserted

(8) concerning renunciation of interest in property arising prior to and

existing on July 1, 1983.

Title 72, Chap. 2, Par 8, §72-2-811.

Disclaimer of Property Interest-Montana

Title 72 ESTATES, TRUSTS, AND FIDUCIARY RELATIONSHIPS

CHAPTER 2 UPC -- INTESTACY, WILLS, AND DONATIVE TRANSFERS

Part 8 General Provisions Concerning Probate and Nonprobate Transfers

Disclaimer of property interests.

(1) (a) A person or the representative of a person to whom

an interest in or with respect to property or an interest in the property

devolves by whatever means may disclaim it in whole or in part by delivering

or filing a written disclaimer under this section.

(b) The right to disclaim exists notwithstanding:

(i) any limitation on the interest of the disclaimant in

the nature of a spendthrift provision or similar restriction; or

(ii) any restriction or limitation on the right to disclaim contained

in the governing instrument.

(c) For purposes of this subsection (1), the "representative of a person"

includes a personal representative of a decedent; a conservator of a disabled

person; a guardian of a minor or incapacitated person; a guardian ad litem

of a minor, an incapacitated person, an unborn person, an unascertained

person, or a person whose identity or address is unknown; and an agent

acting on behalf of the person within the authority of a power of attorney.

The representative of a person may rely on a general family benefit accruing

to the living members of the represented person's family as a basis for

making a disclaimer.

(2) The following rules govern the time when a disclaimer must be filed

or delivered:

(a) If the property or interest has devolved to the disclaimant

under a testamentary instrument or by the laws of intestacy, the disclaimer

must be filed, if of a present interest, not later than 9 months after

the death of the deceased owner or deceased donee of a power of appointment

and, if of a future interest, not later than 9 months after the event determining

that the taker of the property or interest is finally ascertained and the

taker's interest is indefeasibly vested. The disclaimer must be filed in

the court of the county in which proceedings for the administration of

the estate of the deceased owner or deceased donee of the power have been

commenced. A copy of the disclaimer must be delivered in person or mailed

by certified mail, return receipt requested, to any personal representative

or other fiduciary of the decedent or donee of the power.

(b) If a property or interest has devolved to the disclaimant under

a nontestamentary instrument or contract, the disclaimer must be delivered

or filed, if of a present interest, not later than 9 months after the effective

date of the nontestamentary instrument or contract and, if of a future

interest, not later than 9 months after the event determining that the

taker of the property or interest is finally ascertained and the taker's

interest is indefeasibly vested. If the person entitled to disclaim does

not know of the existence of the interest, the disclaimer must be delivered

or filed not later than 9 months after the person learns of the existence

of the interest. The effective date of a revocable instrument or contract

is the date on which the maker no longer has power to revoke it or to transfer

to the maker or another the entire legal and equitable ownership of the

interest. The disclaimer or a copy of the disclaimer must be delivered

in person or mailed by certified mail, return receipt requested, to the

person who has legal title to or possession of the interest disclaimed.

(c) A surviving joint tenant may disclaim as a separate interest

any property or interest in property devolving to the surviving joint tenant

by right of survivorship within 9 months after the death of the deceased

joint owner, regardless of whether the surviving joint tenant contributed

to the purchase of jointly held property or benefited from the jointly

held property prior to the other joint tenant's death.

(d) If real property or an interest in the property is disclaimed,

a copy of the disclaimer may be recorded in the office of the clerk and

recorder of the county in which the property or interest disclaimed is

located.

(3) The disclaimer must:

(a) describe the property or interest disclaimed;

(b) declare the disclaimer and extent of the disclaimer; and

(c) be signed by the disclaimant.

(4) The following are the effects of a disclaimer:

(a) If property or an interest in property devolves to

a disclaimant under a testamentary instrument, under a power of appointment

exercised by a testamentary instrument, or under the laws of intestacy

and the decedent has not provided for another disposition of that interest,

should it be disclaimed, or of disclaimed or failed interests in general,

the disclaimed interest devolves as if the disclaimant had predeceased

the decedent, but if by law or under the testamentary instrument the descendants

of the disclaimant would share in the disclaimed interest by representation

or otherwise were the disclaimant to predecease the decedent, then the

disclaimed interest passes by representation, or passes as directed by

the governing instrument, to the descendants of the disclaimant who survive

the decedent. A future interest that takes effect in possession or enjoyment

after the termination of the estate or interest disclaimed takes effect

as if the disclaimant had predeceased the decedent. A disclaimer relates

back for all purposes to the date of the death of the decedent.

(b) If property or an interest in property devolves to a disclaimant

under a nontestamentary instrument or contract and the instrument or contract

does not provide for another disposition of that interest, should it be

disclaimed, or of disclaimed or failed interests in general, the disclaimed

interest devolves as if the disclaimant had predeceased the effective date

of the instrument or contract, but if by law or under the nontestamentary

instrument or contract the descendants of the disclaimant would share in

the disclaimed interest by representation or otherwise were the disclaimant

to predecease the effective date of the instrument, then the disclaimed

interest passes by representation, or passes as directed by the governing

instrument, to the descendants of the disclaimant who survive the effective

date of the instrument. A disclaimer relates back for all purposes to that

date. A future interest that takes effect in possession or enjoyment at

or after the termination of the disclaimed interest takes effect as if

the disclaimant had died before the effective date of the instrument or

contract that transferred the disclaimed interest.

(c) The disclaimer or the written waiver of the right to disclaim

is binding upon the disclaimant or person waiving and on all persons claiming

through or under either of them.

(5) The right to disclaim property or an interest in the property is

barred by:

(a) an assignment, conveyance, encumbrance, pledge, or

transfer of the property or interest or a contract therefor;

(b) a written waiver of the right to disclaim;

(c) an acceptance of the property or interest or benefit under it;

or

(d) a sale of the property or interest under judicial sale made

before the disclaimer is made.

(6) This section does not abridge the right of a person to waive, release,

disclaim, or renounce property or an interest in property under any other

statute.

(7) An interest in property that exists on October 1, 1993, as to

which, if a present interest, the time for filing a disclaimer under this

section has not expired or, if a future interest, the interest has not

become indefeasibly vested or the taker finally ascertained may be disclaimed

within 9 months after October 1, 1993.

History: En. 91A-2-801 by Sec. 1, Ch. 365, L. 1974; R.C.M. 1947, 91A-2-801; amd. Sec. 1, Ch. 52, L. 1981; amd. Sec. 1, Ch. 511, L. 1983; amd. Sec. 5, Ch. 494, L. 1993; Sec. 72-2-101, MCA 1991; redes. 72-2-811 by Code Commissioner, 1993; amd. Sec. 20, Ch. 592, L. 1995; amd. Sec. 4, Ch. 290, L. 1999.

Official Comments: Purpose and Scope of Revisions.

This section brings into the Code the Uniform Disclaimer of Property Interests Act, replacing the prior incorporation of the Uniform Disclaimer of Transfers by Will, Intestacy or Appointment Act. The reason for incorporating the broader Act is that the scope of Article II [Title 72, chapter 2] has now been expanded to cover dispositive provisions not contained in wills.

Explanation of Revisions.

Only three revisions of the Uniform Disclaimer of Property Interests Act are adopted at this time, though the Joint Editorial Board believes that this and the other Uniform Disclaimer Acts are in need of revision in other respects.

Subsection (a) [72-2-811(1)]. Subsection (a) [72-2-811(1)] is revised in two respects. First, the right to disclaim is extended to a decedent through his or her personal representative. The Uniform Disclaimer of Property Interests Act does not authorize disclaimers on behalf of a deceased person. Second, the sentence authorizing a disclaimer despite a limitation or restriction in the governing instrument is clarified to leave no doubt that an explicit restriction or limitation on the right to disclaim in the governing instrument is ineffective.

Subsection (d) [72-2-811(4)]. The third revision clarifies the effect of a disclaimer. The Uniform Disclaimer of Property Interests Act states that "it" shall devolve "as if the disclaimant had predeceased the decedent." Literally interpreted, the word "it" refers to "the disclaimed interest," not to the estate as a whole. (One of the changes above is to make this point unmistakable by replacing "it" with "the disclaimed interest.")

Unfortunately, even though the word "it" refers to the disclaimed interest, not to the estate as a whole, there is still a plausible interpretation of the phrase "the disclaimed interest devolves as if the disclaimant had predeceased the decedent" that does not produce the desired result. The desired result is to prevent an heir, for example, from using a disclaimer to effect a change in the division of an intestate's estate. To illustrate this point, consider the following example:

Under these facts, G's intestate estate is divided into two equal parts: A takes half and B's child, Z, takes the other half. Suppose, however, that A files a disclaimer. The desired effect of that disclaimer is to prevent A from affecting the basic division of G's intestate estate by this maneuver. If, however, the disclaimer statute merely provides that the "disclaimed interest" devolves as though the disclaimant (A) had predeceased the decedent, then A's one half interest would not pass only to X and Y, but to X, Y, and Z. To prevent this possible interpretation of that language, the "but if" phrase is added to (d)(1) [72-2-811(4)(a)] and (d)(2) [72-2-811(4)(b)]. This added phrase explicitly provides that A's disclaimed interest passes to A's descendants, if A left any descendants.

Time Allowed for Filing Disclaimer.

It should be noted that there may be a discrepancy between the time allowed for filing a disclaimer under this section (and under the freestanding Uniform Acts) and the time allowed for filing a qualified disclaimer under the Internal Revenue Code § 2518. Lawyers are cautioned to check both the state and federal disclaimer statutes before advising clients, especially with respect to disclaimers of future interests.

Compiler's Comments:

1999 Amendment: Chapter 290 in (2)(c) near beginning after "devolving to the" inserted "surviving" and inserted "within 9 months after the death of the deceased joint owner, regardless of whether the surviving joint tenant contributed to the purchase of jointly held property or benefited from the jointly held property prior to the other joint tenant's death" and at end deleted sentence that read: "A surviving joint tenant may disclaim the entire interest in any property or interest in the property that is the subject of a joint tenancy devolving to the joint tenant if the joint tenancy was created by act of a deceased joint tenant, the survivor did not join in creating the joint tenancy, and the survivor has not accepted a benefit under it." Amendment effective April 9, 1999.

1995 Amendment: Chapter 592 in first sentence of (4)(a) and (4)(b) substituted "share in the disclaimed interest by representation or otherwise" for "take the disclaimant's share by representation" and near end of both sentences, after "representation", inserted "or passes as directed by the governing instrument"; and made minor changes in style.

1993 Amendment: Chapter 494 substituted current text concerning disclaimer of property interests for former text that read:

"(1) A person or his personal representative or the representative

of an incapacitated or protected person who is an heir, devisee, person

succeeding to a renounced interest, donee, appointee, grantee, recipient,

or beneficiary under a trust or other nontestamentary instrument or under

a power of appointment exercised by a testamentary or nontestamentary instrument,

surviving joint owner or surviving joint tenant, or beneficiary or owner

of an insurance contract or any incident of ownership therein may renounce,

in whole or in part, the right of succession to any property or interest

therein, including a future interest, by filing a written renunciation

under this section. The instrument shall:

(a) describe the property or interest renounced;

(b) be signed by the person renouncing; and

(c) declare the renunciation and the extent thereof.

(2) The court may direct or permit a trustee under a testamentary or

nontestamentary instrument to renounce, modify, amend, or otherwise deviate

from any restriction on or power of administration, management, or allocation

of benefit upon finding that such restriction on the exercise of the power

may defeat or impair the accomplishment of the purposes of the trust, whether

by the imposition of tax, the allocation of beneficial interest inconsistent

with such purposes, or by other reason. Such authority shall be exercised,

after hearing and upon notice to all known persons beneficially interested

in such trust, in the manner directed by the court.

(3) The instrument of renunciation must be received by the transferor

of the interest, his legal representative, the personal representative

of a deceased transferor, the trustee of any trust in which the interest

being renounced exists, or the holder of the legal title to the property

to which the interest relates. To be effective for purposes of determining

inheritance and estate taxes, the instrument must be received not later

than the date which is 9 months after the later of the date on which the

transfer creating the interest in a person is made or the date on which

the person attains 18 years of age. If the circumstances that establish

the right of a person to renounce an interest arise as a result of the

death of an individual, the instrument must also be filed in the court

of the county where proceedings concerning the decedent's estate are pending

or where they would be pending if commenced. If real property or an interest

therein is renounced, a copy of the renunciation may be recorded in the

office of the county clerk and recorder of the county in which the real

estate is situated. No person entitled to a copy of the instrument is liable

for any proper distribution or disposition made without actual notice of

the renunciation, and no person making a proper distribution or disposition

in reliance upon the renunciation is liable for any such distribution or

disposition in the absence of actual notice that an action has been instituted

contesting the validity of the renunciation.

(4) Unless the transferor of the interest has otherwise provided,

the property or interest renounced devolves as though the person renouncing

had predeceased the decedent or, if the appointment was exercised by a

testamentary instrument, as though the person renouncing had predeceased

the donee of the power. A future interest that takes effect in possession

or enjoyment after the termination of the estate or interest renounced

takes effect as though the person renouncing had predeceased the decedent

or the donee of the power. A renunciation relates back for all purposes

to the date of the death of the decedent or the donee of the power.

(5) (a) The right to renounce property or an interest therein

is barred by:

(i) an assignment, conveyance, encumbrance, pledge, or

transfer of property or interest, or a contract therefor;

(ii) a written waiver of the right to renounce;

(iii) an acceptance of the property or interest or benefit thereunder;

or

(iv) a sale of the property or interest under judicial sale made

before the renunciation is effected.

(b) The right to renounce exists notwithstanding any limitation on

the interest of the person renouncing in the nature of a spendthrift provision

or similar restriction.

(c) A renunciation or a written waiver of the right to renounce

is binding upon the person renouncing or person waiving and all persons

claiming through or under him.

(6) This section does not abridge the right of a person to waive, release,

disclaim, or renounce property or an interest therein under any other statute.

(7) Within 30 days of receipt of a written instrument of renunciation

by the transferor of the interest, the renouncer, his legal representative,

the personal representative of the decedent, the trustee of any trust in

which the interest being renounced exists, or the holder of the legal title

to the property to which the interest relates, as the case may be, shall

attempt to notify in writing those persons who are known or ascertainable

with reasonable diligence who are recipients or potential recipients of

the renounced interest of the renunciation and the interest or potential

interest such recipient will receive as a result of the renunciation.

(8) Any interest in property which exists on July 1, 1983, may be

renounced after October 1, 1983, as provided in this section. An interest

that has arisen prior to July 1, 1983, in any person other than the person

renouncing is not destroyed or diminished by any action of the person renouncing

taken under this section."

Saving Clause: Section 136, Ch. 494, L. 1993, was a saving clause.

1983 Amendment: In (1), after "renounced interest" substituted "donee, appointee, grantee, recipient, or beneficiary under a . . . ownership therein" (see 1983 Session Law for complete text) for "beneficiary under a testamentary instrument, or appointee under a power of appointment exercised by a testamentary instrument"; deleted former (2), which read:

"(a) An instrument renouncing a present interest shall

be filed within 9 months after the death of the decedent or the donee of

the power.

(b) An instrument renouncing a future interest may be filed not

later than 9 months after the event determining that the taker of the property

or interest is finally ascertained and his interest is indefeasibly vested.

(c) The renunciation must be filed in the court of the county in

which proceedings have been commenced for the administration of the estate

of the deceased owner or deceased donee of the power or, if they have not

been commenced, in which they could be commenced. A copy of the renunciation

shall be delivered in person or mailed by registered or certified mail

to any personal representative or other fiduciary of the decedent or donee

of the power. If real property or an interest therein is renounced, a copy

of the renunciation may be recorded in the office of the county clerk of

the county in which the real estate is situated."; inserted (2) allowing

trustee renunciation; inserted (3) relating to receipt of instrument of

renunciation and date of renunciation; in (4) near beginning of first sentence

substituted "transferor of the interest" for "decedent or donee of the

power"; deleted former (6), which read: "An interest in property which

exists on July 1, 1975, as to which, if a present interest, the time for

filing a renunciation under the Uniform Probate Code has not expired, or

if a future interest, the interest has not become indefeasibly vested or

the taker finally ascertained, may be renounced within 9 months after July

1, 1975."; inserted (7) concerning notice of renunciation; and inserted

(8) concerning renunciation of interest in property arising prior to and

existing on July 1, 1983.

Title 72, Chap. 2, Par 8, §72-2-811.