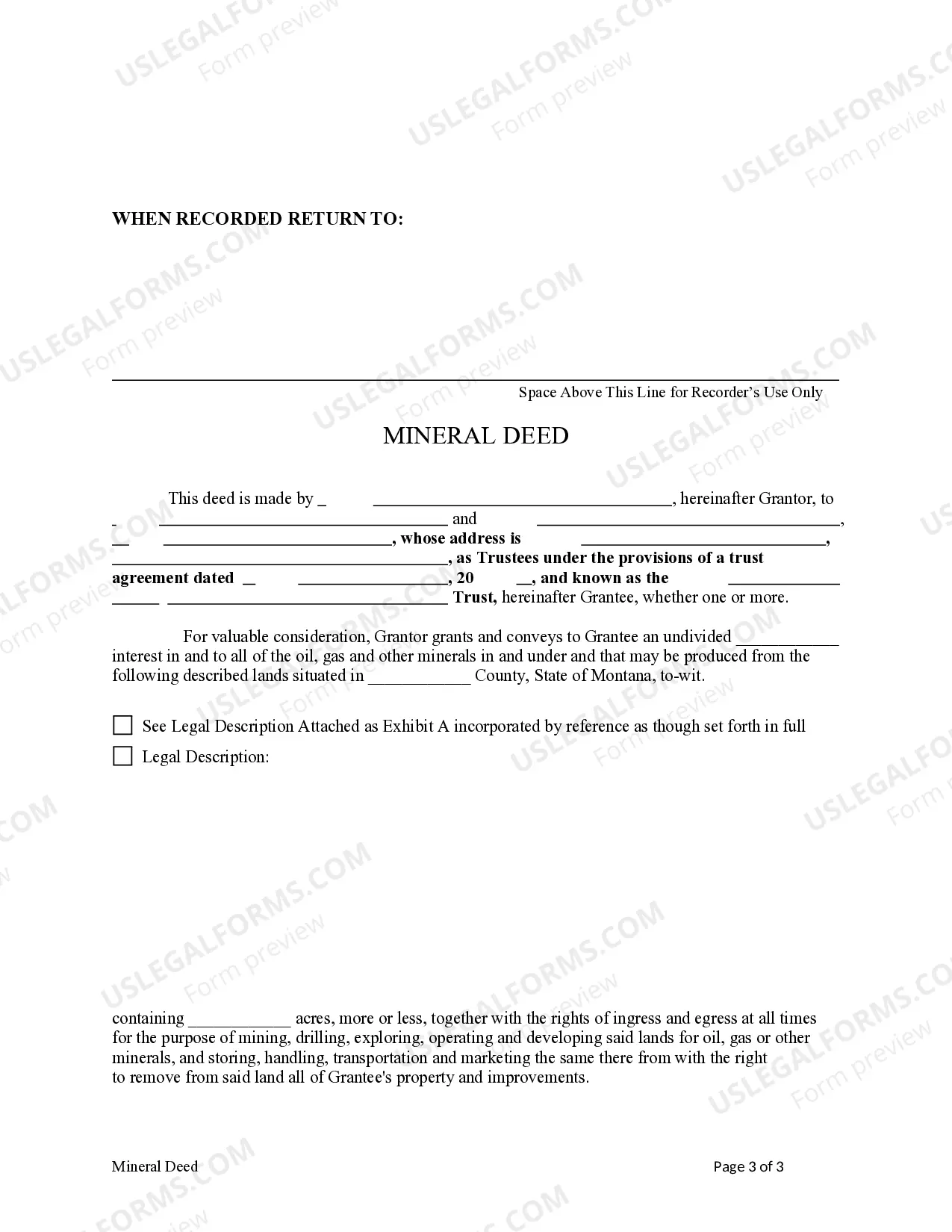

This form is a Mineral Deed for the State of Montana. Grantor conveys and warrants the described property interest to the Grantees as Trustees of a Trust. This deed complies with all state statutory laws.

Montana Mineral Deed - Individual to Trustees of Trust

Description Mineral Trust Montana

How to fill out Montana Trustees Trust?

Get a printable Montana Mineral Deed - Individual to Trustees of Trust within just several clicks in the most complete catalogue of legal e-documents. Find, download and print professionally drafted and certified samples on the US Legal Forms website. US Legal Forms continues to be the #1 supplier of affordable legal and tax templates for US citizens and residents online since 1997.

Users who have a subscription, need to log in directly into their US Legal Forms account, get the Montana Mineral Deed - Individual to Trustees of Trust and find it saved in the My Forms tab. Users who don’t have a subscription must follow the tips listed below:

- Make certain your template meets your state’s requirements.

- If available, look through form’s description to learn more.

- If offered, preview the shape to view more content.

- Once you are sure the form meets your requirements, simply click Buy Now.

- Create a personal account.

- Select a plan.

- via PayPal or visa or mastercard.

- Download the template in Word or PDF format.

Once you have downloaded your Montana Mineral Deed - Individual to Trustees of Trust, it is possible to fill it out in any web-based editor or print it out and complete it manually. Use US Legal Forms to get access to 85,000 professionally-drafted, state-specific files.

Mineral Trust Form popularity

Trust Grantor Form Other Form Names

Trustees Trust FAQ

Determine the Current Title and Vesting to Your Property. Prepare a Deed. Be Aware of Your Lender and Title Insurance. Prepare a Preliminary Change of Ownership Report. Execute Your Deed. Record Your Deed. Wait for the Deed to be Returned. Keep the Property in the Trust.

The advantages of placing your house in a trust include avoiding probate court, saving on estate taxes and possibly protecting your home from certain creditors. Disadvantages include the cost of creating the trust and the paperwork.

Transferring Real Property to a Trust You can transfer your home (or any real property) to the trust with a deed, a document that transfers ownership to the trust. A quitclaim deed is the most common and simplest method (and one you can do yourself).

A trustee deedsometimes called a deed of trust or a trust deedis a legal document created when someone purchases real estate in a trust deed state, such as California (check your local laws to see what is required in your state). A trust deed is used in place of a mortgage.

Party information: names and addresses of the trustor(s), trustee(s), beneficiary(ies), and guarantor(s) (if applicable) Property details: full address of the property and its legal description (which can be obtained from the County Recorder's Office)

As of 2019, attorney fees can range from $1,000 to $2,500 to set up a trust, depending upon the complexity of the document and where you live. You can also hire an online service provider to set up your trust. As of 2019, you can expect to pay about $300 for an online trust.

To move assets into a revocable trust you must put them into the trust's name and file or record this information. Change the property's title on any real estate you own, and file the change with the recorder in the county where the property is located.

Some owners are put off using solicitors duke to the deed of trust cost. Individuals can write out their own, and use someone else as a witness. However, this may have errors or not be a legally binding document. The investment of getting a deed of trust when buying a property is often worth it in the long term.

When you're ready to transfer trust real estate to the beneficiary who is named in the trust document to receive it, you'll need to prepare, sign, and record a deed. That's the document that transfers title to the property from you, the trustee, to the new owner.