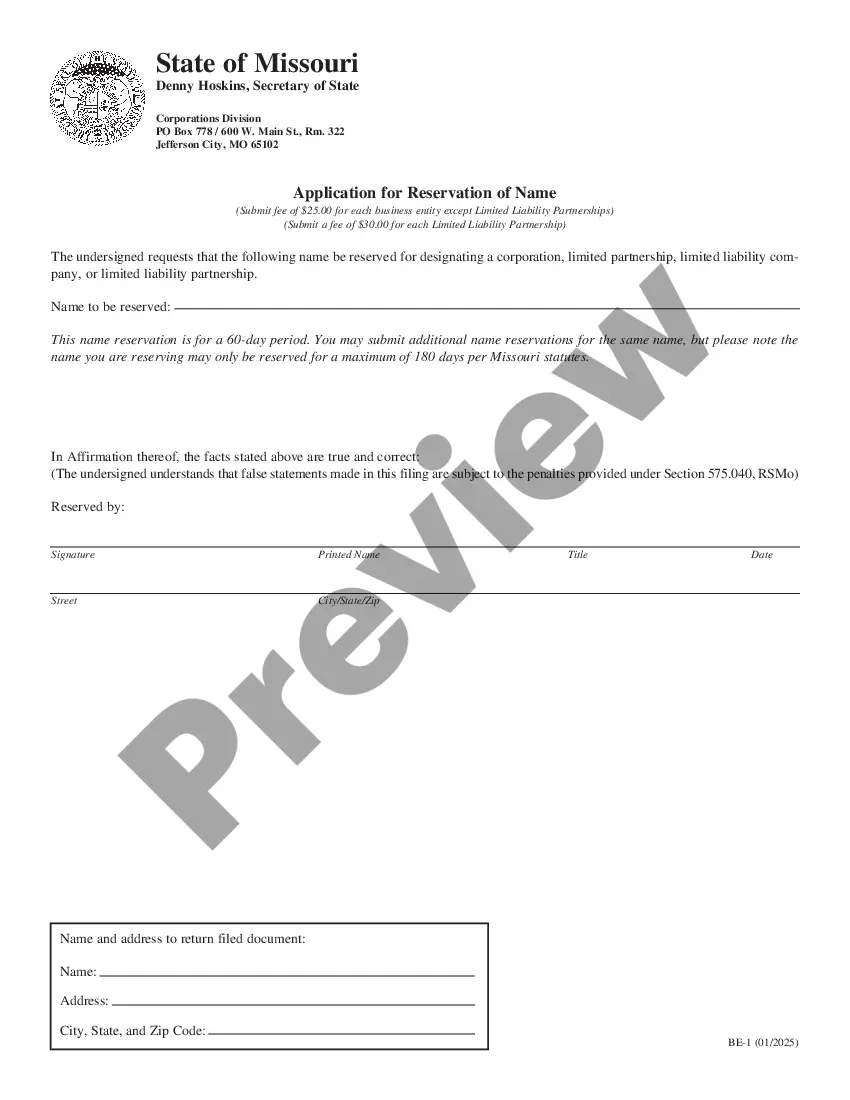

Final Declaration of Disclosure of Assets, Debts, Income and Expenses (Joint Divorce): This is an official form from the Montana State Court, which complies with all applicable laws and statutes. USLF amends and updates the forms as is required by Montana statutes and law.

Montana Final Declaration of Disclosure of Assets, Debts, Income and Expenses

Description

How to fill out Montana Final Declaration Of Disclosure Of Assets, Debts, Income And Expenses?

Get a printable Montana Final Declaration of Disclosure of Assets, Debts, Income and Expenses in only several mouse clicks from the most extensive library of legal e-forms. Find, download and print professionally drafted and certified samples on the US Legal Forms website. US Legal Forms is the Top provider of affordable legal and tax templates for US citizens and residents on-line since 1997.

Users who already have a subscription, must log in directly into their US Legal Forms account, download the Montana Final Declaration of Disclosure of Assets, Debts, Income and Expenses see it stored in the My Forms tab. Customers who don’t have a subscription must follow the tips listed below:

- Make sure your form meets your state’s requirements.

- If available, look through form’s description to learn more.

- If readily available, preview the shape to find out more content.

- Once you’re sure the template suits you, just click Buy Now.

- Create a personal account.

- Choose a plan.

- Pay through PayPal or visa or mastercard.

- Download the template in Word or PDF format.

As soon as you have downloaded your Montana Final Declaration of Disclosure of Assets, Debts, Income and Expenses, you may fill it out in any web-based editor or print it out and complete it manually. Use US Legal Forms to to access 85,000 professionally-drafted, state-specific documents.

Form popularity

FAQ

As discussed in the previous blog post, Preliminary Disclosures are required for all. divorces in California. Preliminary Disclosures are a set of forms and documents that each party in a divorce must give to the other in writing providing information regarding all assets, debts, income and expenses.

No, you don't have to file the FL-150. You do, however, have to serve it (along with the FL-140 Declaration of disclosure and FL-142 Schedule of Assets and Debts) on your spouse.

A declaration is a written statement submitted to a court in which the writer swears 'under penalty of perjury' that the contents are true. Declarations are normally used in place of live testimony when the court is asked to rule on a motion.

Form FL-142 is also known as the Schedule of Assets and Debts, and it's not as difficult to complete as the Income and Expense Declaration.FL-142 is your opportunity to disclose everything that you own and everything that you owe, and you must provide documentation attached with it.

The Declarations of Disclosure are financial disclosures that each party to a divorce case must provide to the other side, and they consist of an Income & Expense Declaration as well as a Schedule of Assets and Debts. Those documents are exactly like they sound, they list out all income, expenses, assets and debts.

Your previous years' tax return. Pay stubs for the past two months and the last pay stub for the previous year. Your credit card statements for the year. A copy or information about your bills for the year.