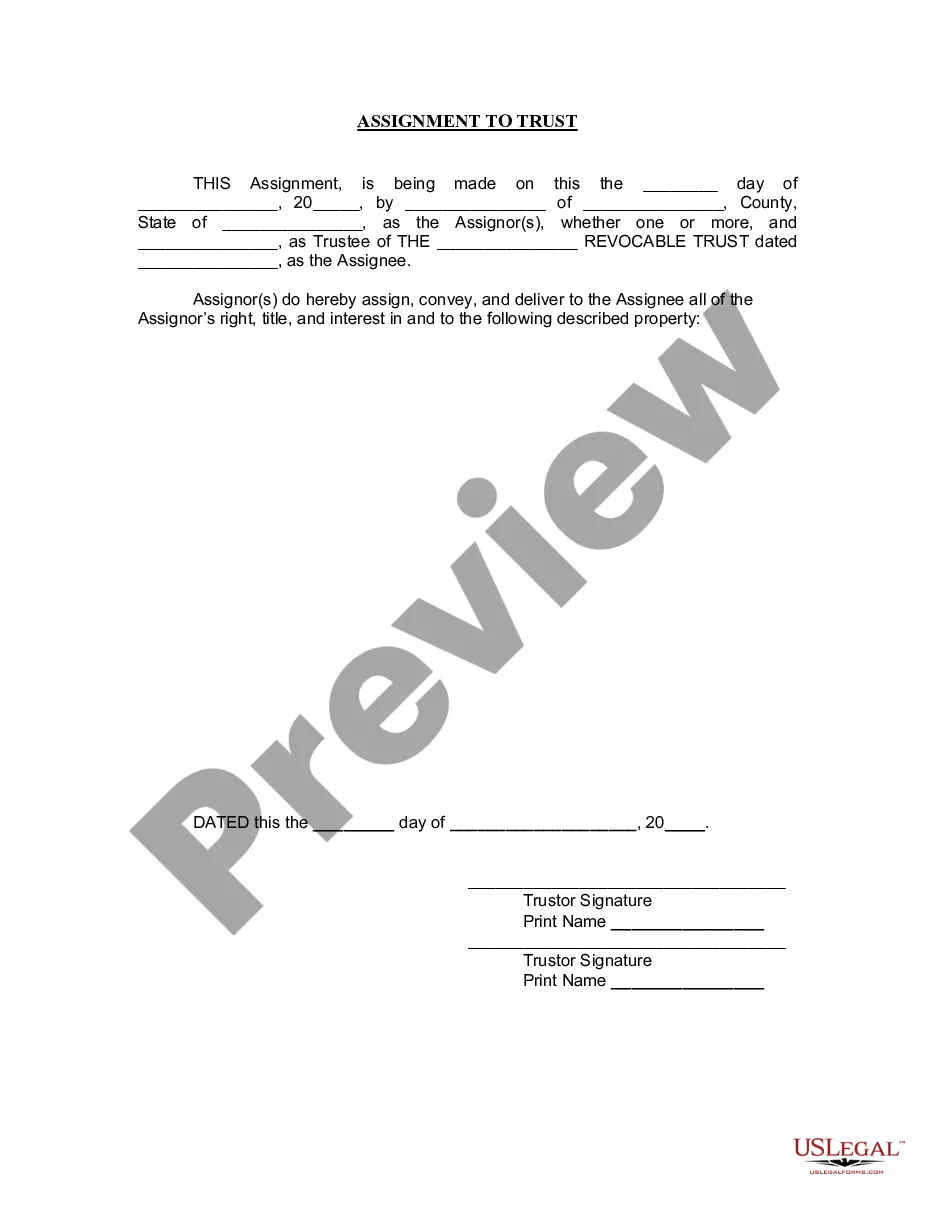

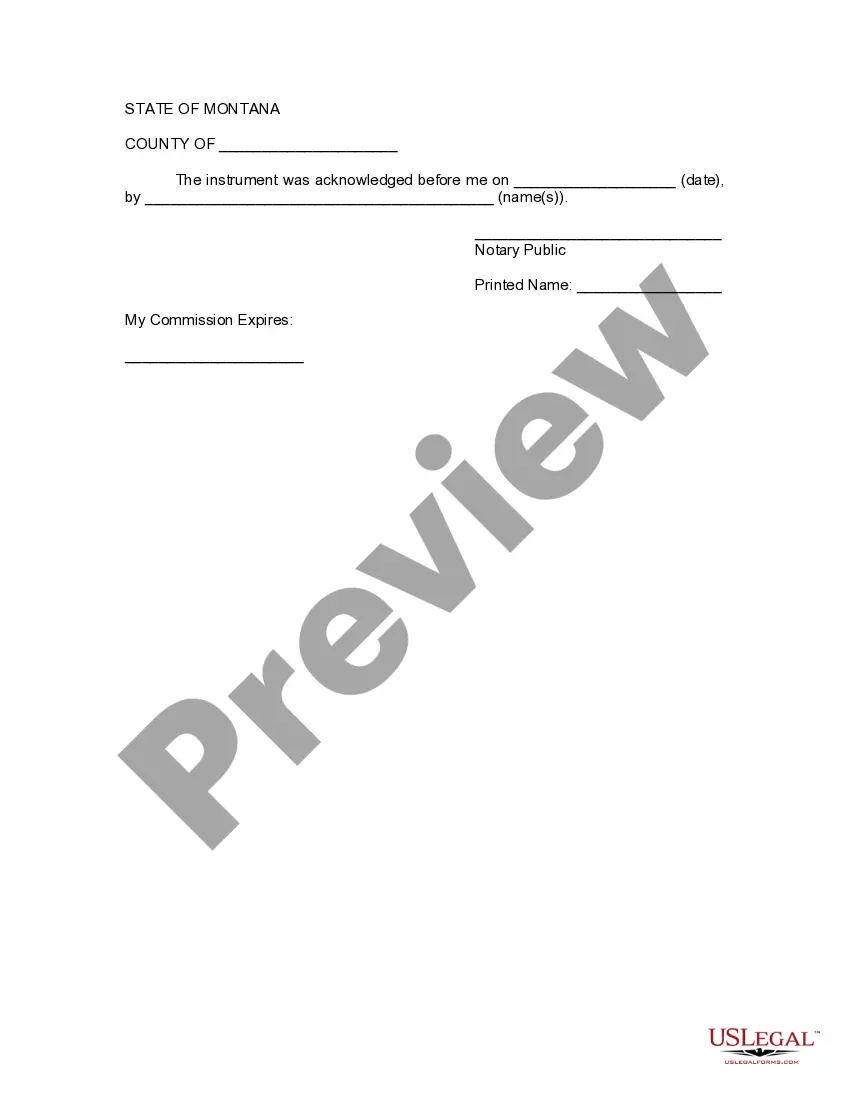

This Assignment to Trust form is used to assign all right, title and interest in specific property to a Living Trust. A living trust is a trust established during a person's lifetime in which a person's assets and property are placed within the trust, usually for the purpose of estate planning. This form must be signed by the Assignor before a notary public.

Montana Assignment to Living Trust

Description

How to fill out Montana Assignment To Living Trust?

Get a printable Montana Assignment to Living Trust in just several mouse clicks in the most complete catalogue of legal e-documents. Find, download and print out professionally drafted and certified samples on the US Legal Forms website. US Legal Forms continues to be the #1 provider of reasonably priced legal and tax templates for US citizens and residents on-line starting from 1997.

Users who already have a subscription, need to log in directly into their US Legal Forms account, download the Montana Assignment to Living Trust and find it saved in the My Forms tab. Customers who do not have a subscription must follow the steps listed below:

- Ensure your template meets your state’s requirements.

- If available, look through form’s description to learn more.

- If accessible, preview the form to discover more content.

- Once you’re sure the template meets your requirements, click Buy Now.

- Create a personal account.

- Select a plan.

- Pay through PayPal or credit card.

- Download the form in Word or PDF format.

As soon as you have downloaded your Montana Assignment to Living Trust, you are able to fill it out in any online editor or print it out and complete it manually. Use US Legal Forms to to access 85,000 professionally-drafted, state-specific documents.

Form popularity

FAQ

A revocable living trust isn't subject to the same kind of rules as a will; it should be valid in any state, no matter where you signed it.If you acquire real estate in your new state, you'll probably want to hold it in the trust, so that it doesn't have to go through probate at your death.

Trusts created during your lifetime, known as living trusts, do not go into the public record after you die. With rare exceptions, trusts remain private regardless of whether you have an irrevocable or revocable trust at the time of your death.

Houses and other real estate (even if they're mortgaged) stock, bond, and other security accounts held by brokerages (but think about naming a TOD beneficiary instead) small business interests (stock in a closely held corporation, partnership interests, or limited liability company shares)

No. Trust does not need to be filed in California. Trusts are private documents and usually there are compelling reasons not to file the trust.

Trusts aren't recorded anywhere, so you can't go to the County Recorder's office in the courthouse to ask to see a copy of the trust. However, if real estate is involved, the trust may be recorded in the local office of the county clerk.

Trusts Are Not Public Record. Most states require a last will and testament to be filed with the appropriate state court when the person dies. When this happens, the will becomes a public record for anyone to read. However, trusts aren't recorded.

Pick a type of living trust. If you're married, you'll first need to decide whether you want a single or joint trust. Take stock of your property. Choose a trustee. Draw up the trust document. Sign the trust. Transfer your property to the trust.

To transfer assets such as investments, bank accounts, or stock to your real living trust, you will need to contact the institution and complete a form. You will likely need to provide a certificate of trust as well. You may want to keep your personal checking and savings account out of the trust for ease of use.

Qualified retirement accounts 401ks, IRAs, 403(b)s, qualified annuities. Health saving accounts (HSAs) Medical saving accounts (MSAs) Uniform Transfers to Minors (UTMAs) Uniform Gifts to Minors (UGMAs) Life insurance. Motor vehicles.