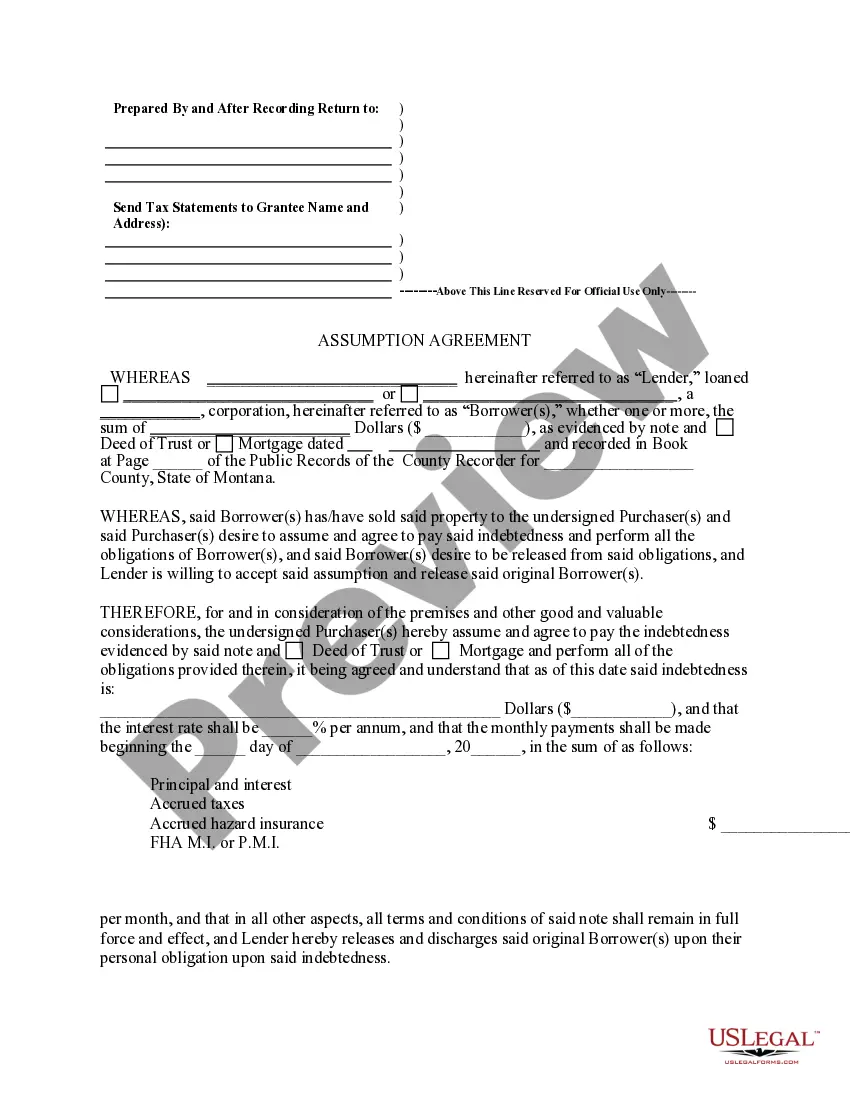

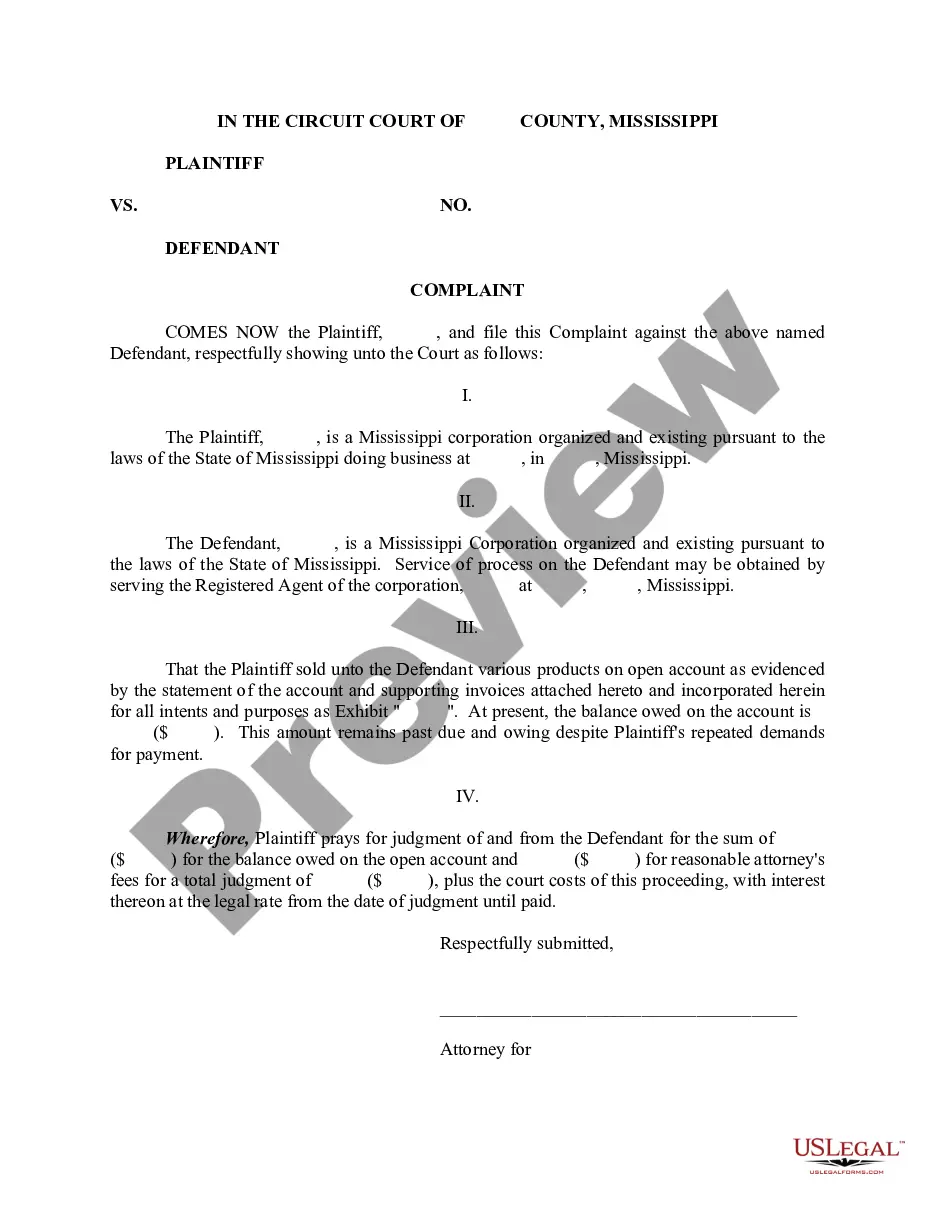

This Assumption Agreement of Deed of Trust and Release of Original Mortgagors form is for the lender, mortgagees and new purchasers to sign whereby the new purchasers of the property assume and agree to pay the debt to the lender, and the lender releases the original mortgagors from any future liability on the loan.

Montana Assumption Agreement of Deed of Trust and Release of Original Mortgagors

Description

How to fill out Montana Assumption Agreement Of Deed Of Trust And Release Of Original Mortgagors?

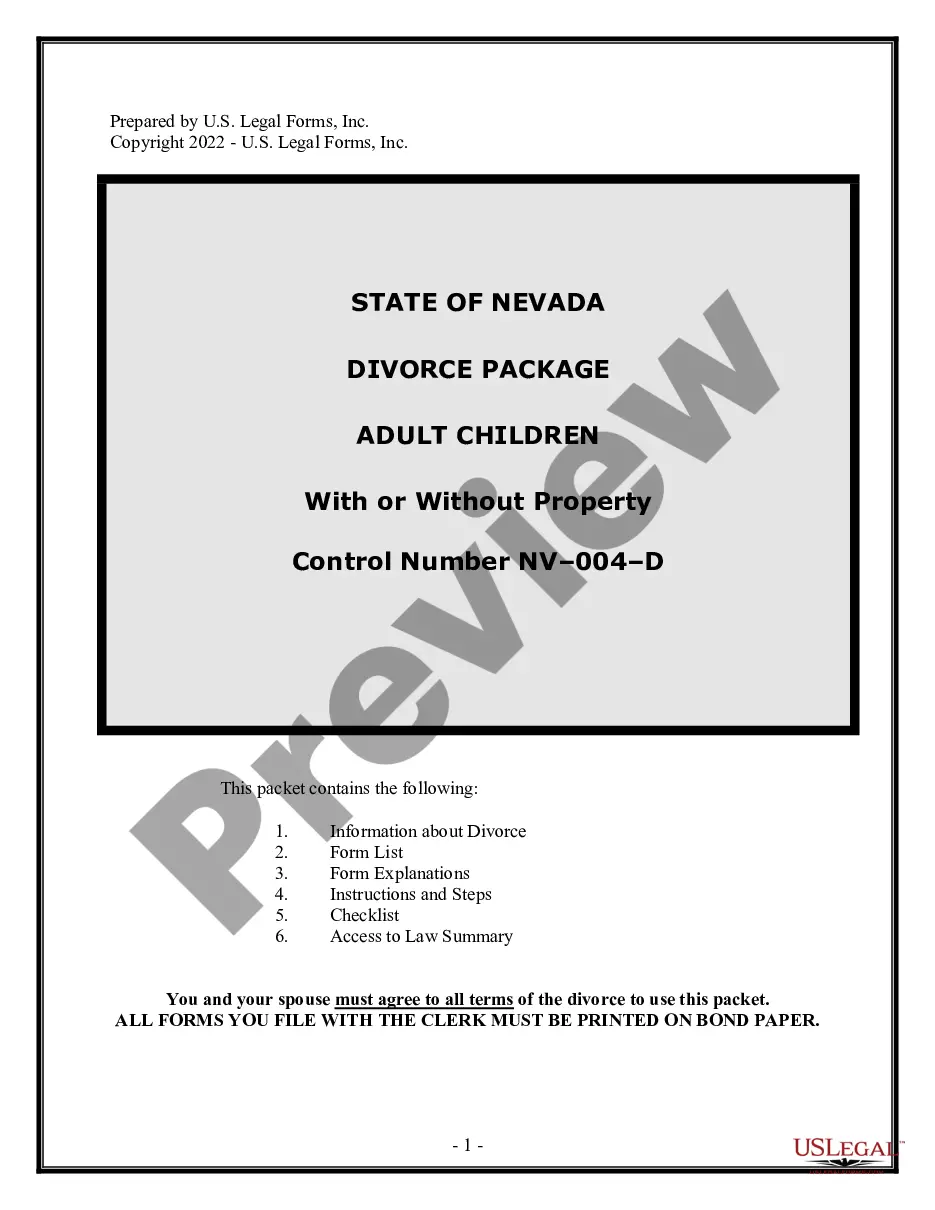

Obtain a printable Montana Assumption Agreement of Deed of Trust and Release of Original Mortgagors in just several clicks from the most extensive catalogue of legal e-files. Find, download and print professionally drafted and certified samples on the US Legal Forms website. US Legal Forms has been the #1 provider of reasonably priced legal and tax forms for US citizens and residents online since 1997.

Customers who have a subscription, need to log in directly into their US Legal Forms account, down load the Montana Assumption Agreement of Deed of Trust and Release of Original Mortgagors see it saved in the My Forms tab. Users who don’t have a subscription must follow the steps below:

- Make sure your form meets your state’s requirements.

- If available, read the form’s description to find out more.

- If offered, review the shape to view more content.

- Once you are confident the template is right for you, click on Buy Now.

- Create a personal account.

- Pick a plan.

- Pay through PayPal or visa or mastercard.

- Download the template in Word or PDF format.

As soon as you have downloaded your Montana Assumption Agreement of Deed of Trust and Release of Original Mortgagors, it is possible to fill it out in any web-based editor or print it out and complete it manually. Use US Legal Forms to to access 85,000 professionally-drafted, state-specific forms.

Form popularity

FAQ

The following states may use either Mortgage Agreements or Deed of Trusts: Colorado, Idaho, Illinois, Iowa, Maryland, Montana, Nebraska, Oklahoma, Oregon, Tennessee, Texas, Utah, Wyoming, Washington, and West Virginia.

Whether you have a deed of trust or a mortgage, they both serve to assure that a loan is repaid, either to a lender or an individual person. A mortgage only involves two parties the borrower and the lender. A deed of trust adds an additional party, a trustee, who holds the home's title until the loan is repaid.

Name of the trust. Address of the trust. Objects of the trust (Charitable or Religious) One settlor of the trust. Two trustees of the trust (minimum)

Can I make a declaration of trust myself? Some owners are put off using solicitors duke to the deed of trust cost. Individuals can write out their own, and use someone else as a witness. However, this may have errors or not be a legally binding document.

Some owners are put off using solicitors duke to the deed of trust cost. Individuals can write out their own, and use someone else as a witness. However, this may have errors or not be a legally binding document. The investment of getting a deed of trust when buying a property is often worth it in the long term.

Based on information compiled by the National Consumer Law Center (NCLC), at least 10 states can be generally classified as non-recourse for residential mortgages: Alaska, Arizona, California, Hawaii, Minnesota, Montana, North Dakota, Oklahoma, Oregon, and Washington.

Yes, there are key differences between the two. With a deed, you transfer the ownership of the property to one party. In contrast, a deed of trust does not mean the holder owns the property. In an arrangement involving a deed of trust, the borrower signs a contract with the lender with details regarding the loan.

The lender is the person or legal entity providing the loan to the borrower. The trustee is a neutral third-party who holds the legal title to a property until the borrower pays off the loan in full. They're called a trustee because they hold the property in trust for the lender.

Deed: This is the document that proves ownership of a property. It transfers ownership of the property to the grantee, also known as the buyer.Mortgage: This is the document that gives the lender a security interest in the property until the Note is paid in full.