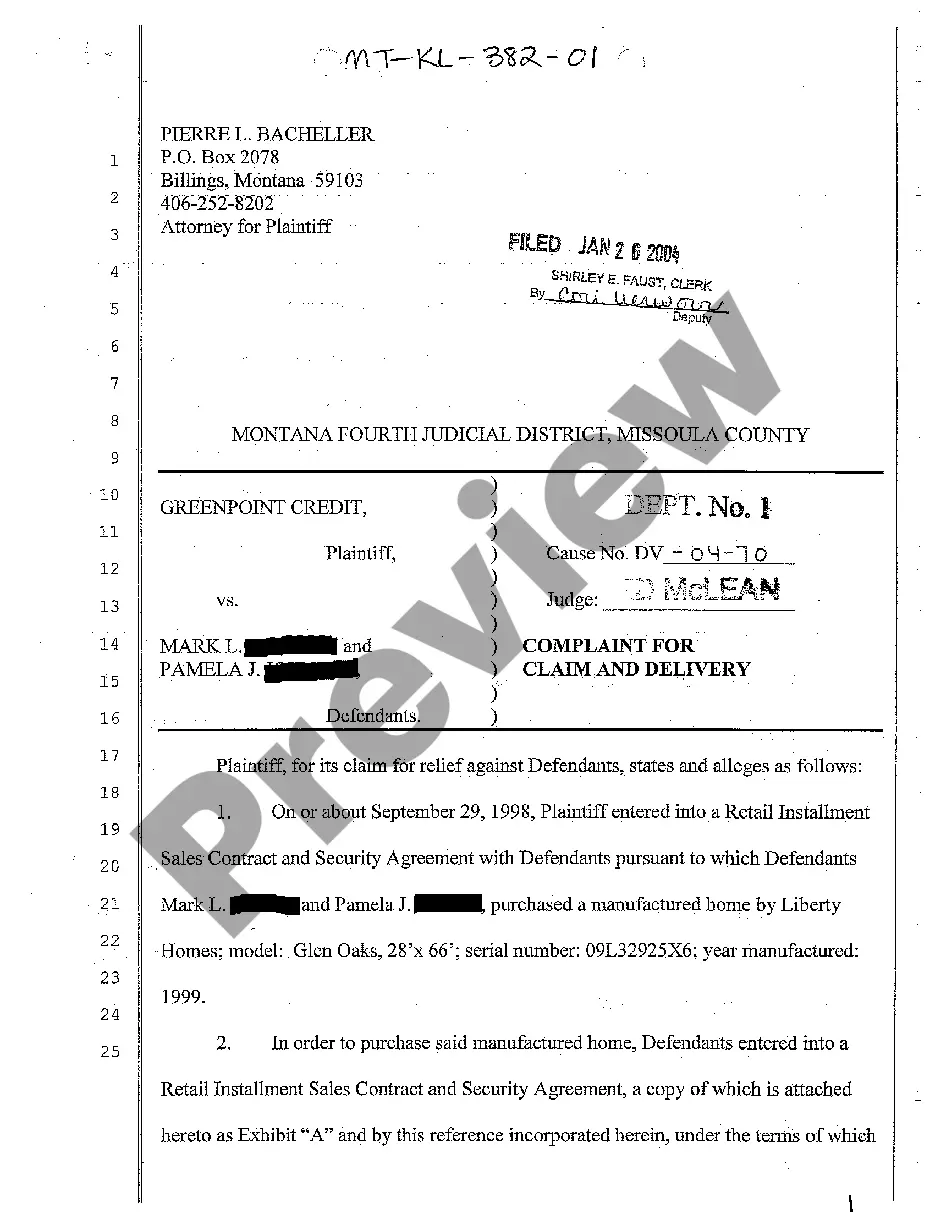

Montana Complaint for Repossession of Mobile Home Due to Defendant's Defaulted Payments

Description

How to fill out Montana Complaint For Repossession Of Mobile Home Due To Defendant's Defaulted Payments?

Get a printable Montana Complaint for Repossession of Mobile Home Due to Defendant's Defaulted Payments in just several clicks in the most extensive catalogue of legal e-documents. Find, download and print out professionally drafted and certified samples on the US Legal Forms website. US Legal Forms continues to be the #1 supplier of affordable legal and tax forms for US citizens and residents online since 1997.

Users who have already a subscription, must log in directly into their US Legal Forms account, down load the Montana Complaint for Repossession of Mobile Home Due to Defendant's Defaulted Payments and find it stored in the My Forms tab. Users who don’t have a subscription are required to follow the steps listed below:

- Make certain your form meets your state’s requirements.

- If provided, read the form’s description to learn more.

- If available, review the shape to see more content.

- As soon as you are sure the form suits you, click Buy Now.

- Create a personal account.

- Pick a plan.

- Pay through PayPal or visa or mastercard.

- Download the template in Word or PDF format.

Once you have downloaded your Montana Complaint for Repossession of Mobile Home Due to Defendant's Defaulted Payments, you are able to fill it out in any web-based editor or print it out and complete it by hand. Use US Legal Forms to to access 85,000 professionally-drafted, state-specific documents.

Form popularity

FAQ

You can pay off the difference of the mortgage right away if you have the cash on hand. You could also take out a loan for less money with a lower interest rate than the mortgage. Another option you have is to short sale your mobile home.

A repossession takes seven years to come off your credit report. That seven-year countdown starts from the date of the first missed payment that led to the repossession. When you finance a vehicle, the lender owns it until it is completely paid off.

If the lender can't prove that your debt is accurate, fair or substantiated , then the credit bureaus can remove the repossession from your credit reports. Your window to negotiate with your lender may be short or already closed if they've already repossessed your asset.

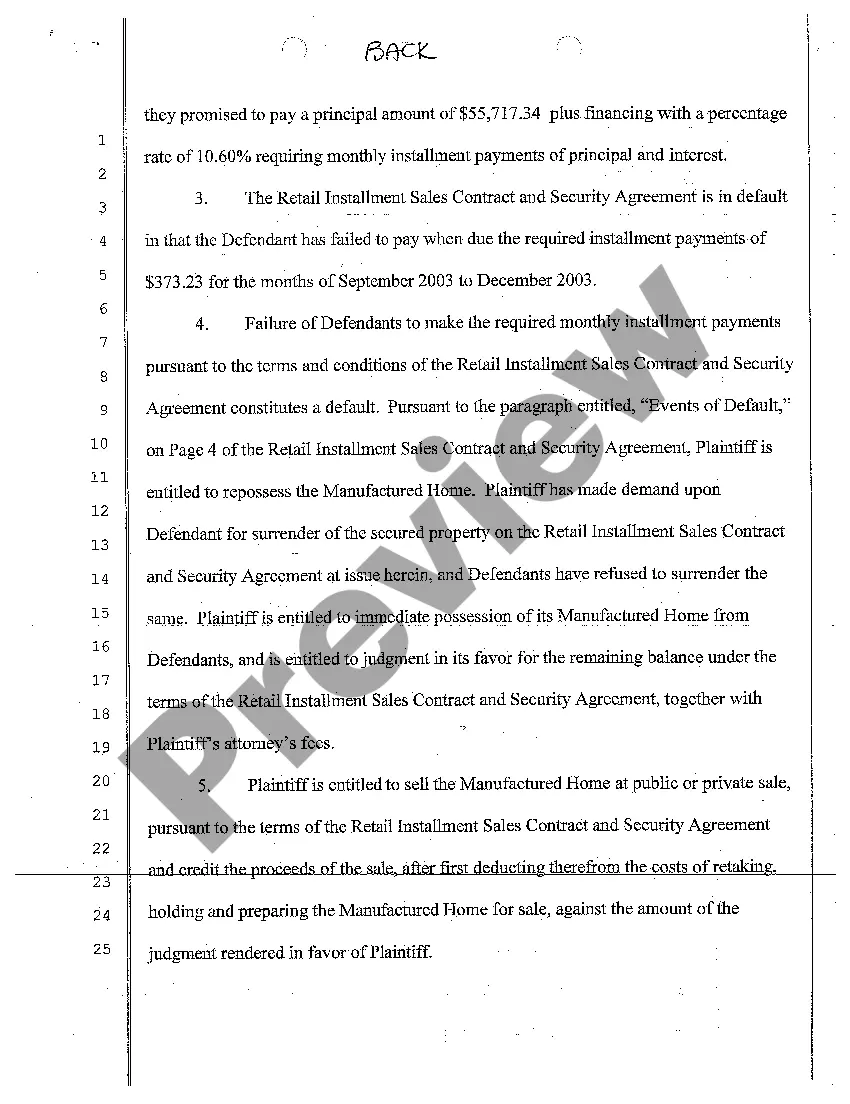

What Happens if the Manufactured Homeowner Defaults on the Loan? If the borrower defaults on loan payments for a manufactured home, the creditor can repossess or foreclose the home.Generally, if the home is personal property, the creditor repossesses the home.

Your repossession and any late payments and collections that went with it will be automatically deleted after seven years. At that point, they will no longer affect your credit score.

A disadvantage of buying a mobile home is that its value will depreciate quickly. Like a new car, once a mobile home leaves the factory, it quickly drops in value. Stick built homes, on the other hand, normally appreciate in value over time because the stick built home owner almost always owns the underlying land.

Voluntary repossession. In a voluntary repossession, the homeowner voluntarily surrenders the home to the lender. If a manufactured home is wrapped up with the land as collateral for the loan, the lender will likely forecloseeven if the manufactured home is still classified as personal property.