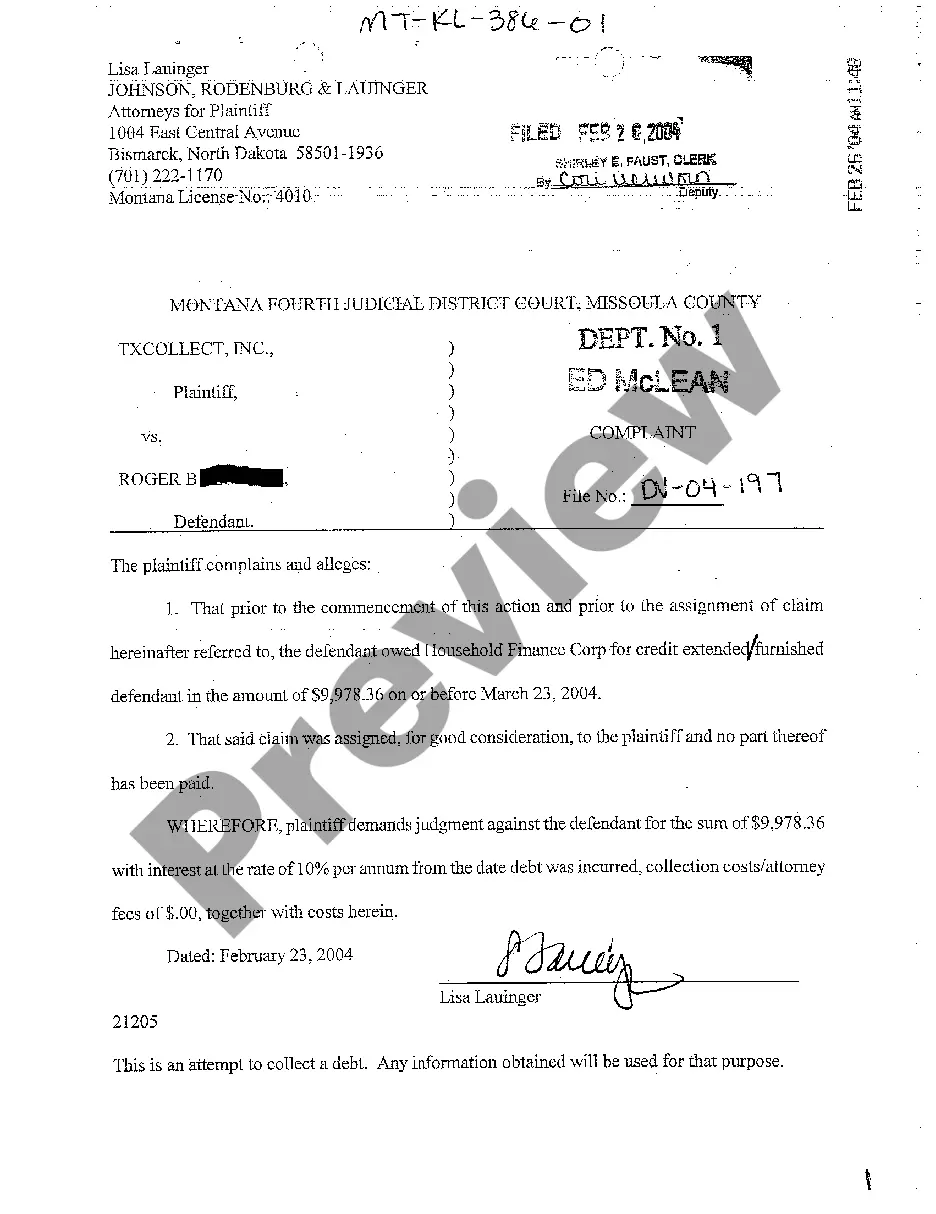

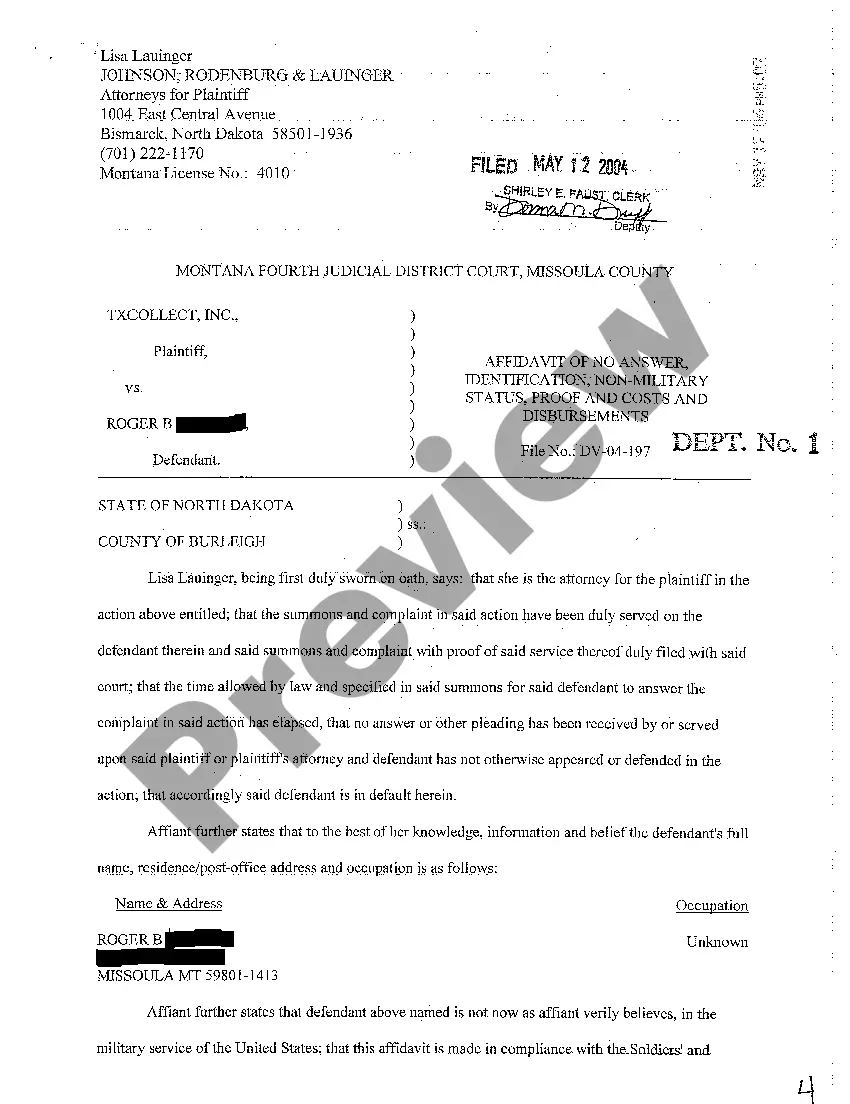

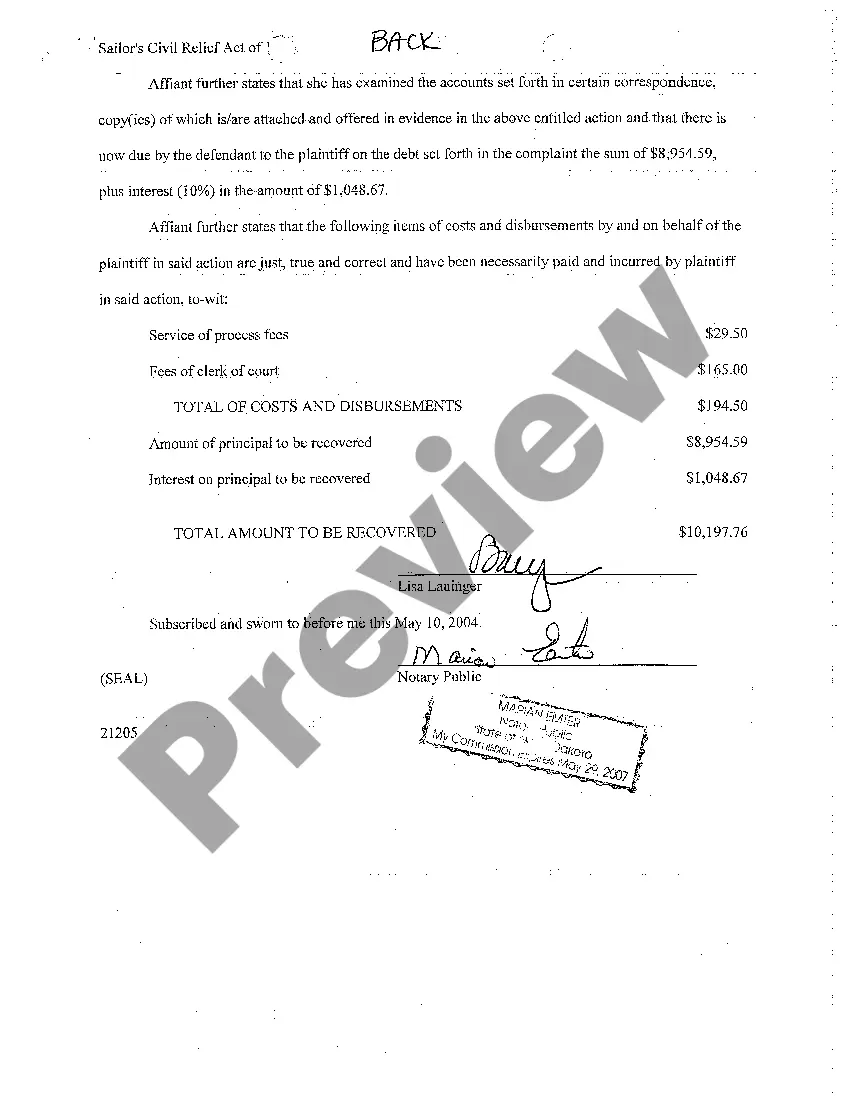

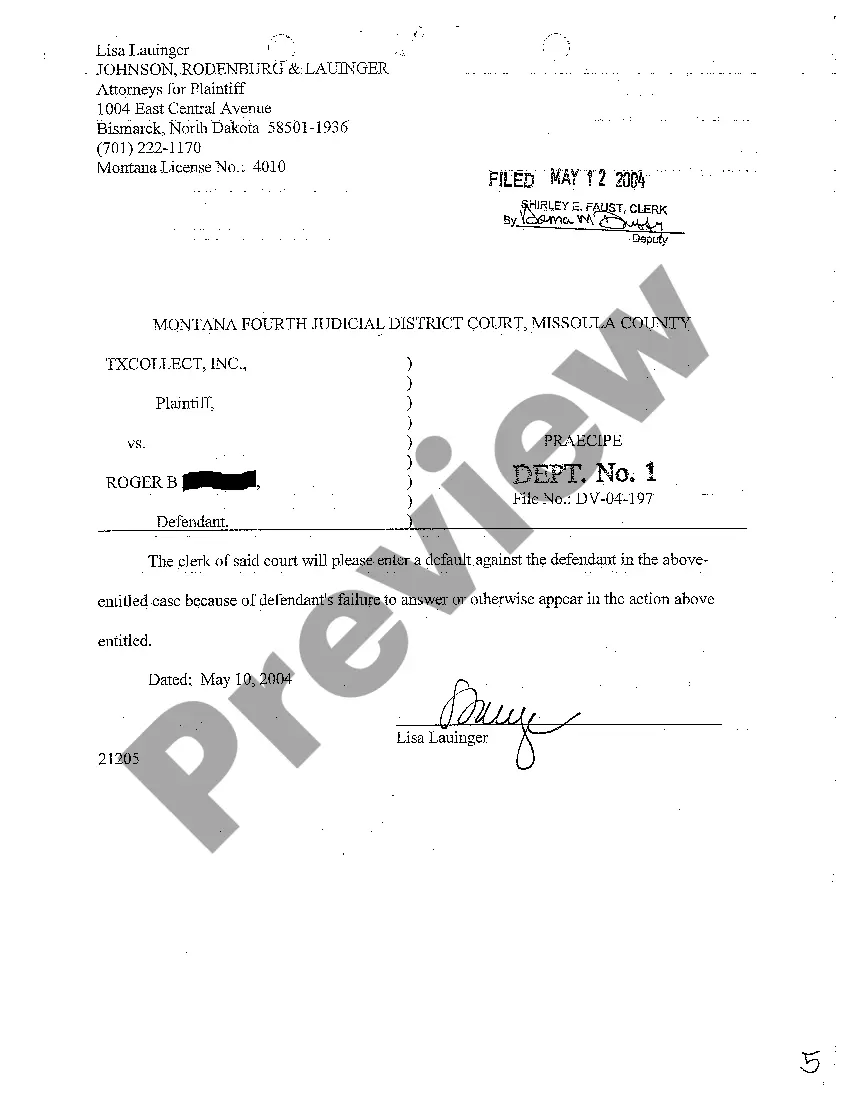

Montana Complaint for Debt Collection Due to Default in Payments of Credit Extension

Description

How to fill out Montana Complaint For Debt Collection Due To Default In Payments Of Credit Extension?

Get a printable Montana Complaint for Debt Collection Due to Default in Payments of Credit Extension in only several mouse clicks in the most complete library of legal e-forms. Find, download and print out professionally drafted and certified samples on the US Legal Forms website. US Legal Forms is the #1 supplier of affordable legal and tax templates for US citizens and residents on-line since 1997.

Users who already have a subscription, need to log in straight into their US Legal Forms account, get the Montana Complaint for Debt Collection Due to Default in Payments of Credit Extension see it stored in the My Forms tab. Users who never have a subscription must follow the steps below:

- Make sure your form meets your state’s requirements.

- If provided, look through form’s description to find out more.

- If accessible, review the shape to see more content.

- As soon as you’re sure the template meets your requirements, simply click Buy Now.

- Create a personal account.

- Select a plan.

- Pay via PayPal or bank card.

- Download the template in Word or PDF format.

As soon as you’ve downloaded your Montana Complaint for Debt Collection Due to Default in Payments of Credit Extension, you may fill it out in any online editor or print it out and complete it manually. Use US Legal Forms to get access to 85,000 professionally-drafted, state-specific documents.

Form popularity

FAQ

By federal law, a late payment cannot be reported to the credit reporting bureaus until it is at least 30 days past due. An overlooked bill won't hurt your credit as long as you pay before the 30-day mark, although you may have to pay a late fee.

Verify the age. Confirm the age of sold-off debt. Get all three of your credit reports. Send letters to the credit bureaus. Send a letter to the reporting creditor. Get special attention. Contact the regulators. Talk to an attorney.

A: Yes. A collection agency can report to the credit bureaus even if you're making payments. Once your debt is transferred from the original creditor to the collection agency, the debt gets a new tradeline on your credit report that's under the control of the collection agency.

Debt that is past the statute of limitations. If this is the case, then you can either call or write them a letter detailing your state's statute of limitations and demand that they remove the information from your credit reports and cease all collection activity.

If you pay the collection agency directly, the debt is removed from your credit report in six years from the date of payment. If you don't pay, it purges six years from the last activity date, but you may be at risk for wage garnishment.

In Montana, the statute of limitations on written contracts, obligations, or liabilities is 8 years. Verbal contracts, accounts, or promises have a statute of limitation of 5 years. As for verbal obligations or liabilities that are not contracts, these have a statute of limitation of 3 years.

Agreeing to pay: If you acknowledge that the debt is yours and agree to pay, the statute of limitations on your debt will start over. Making a charge: If you have old credit card or revolving debt and you make a charge to your account, the clock on your old debt will restart.

Only the original creditor can report you as 30, 60, 90 or even 120 days late.The collection agency should be limited to reporting information such as: Date the collection account was opened. The original amount owed along with the current balance and whether the account has been paid or unpaid.

When debt is time-barred, you can't be sued for payment but the debt doesn't go away. You may ignore it, but debt collectors and your credit reports won't. Most delinquent debts can remain on your credit reports for up to seven and a half years.