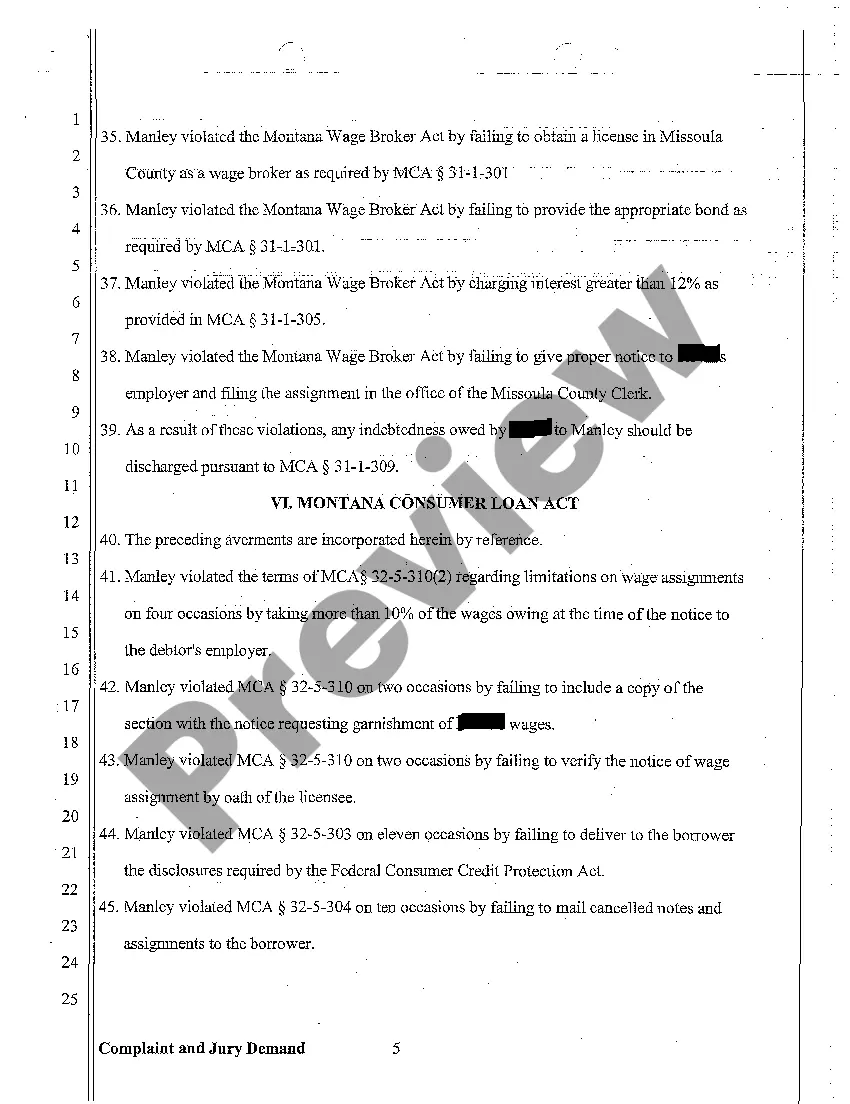

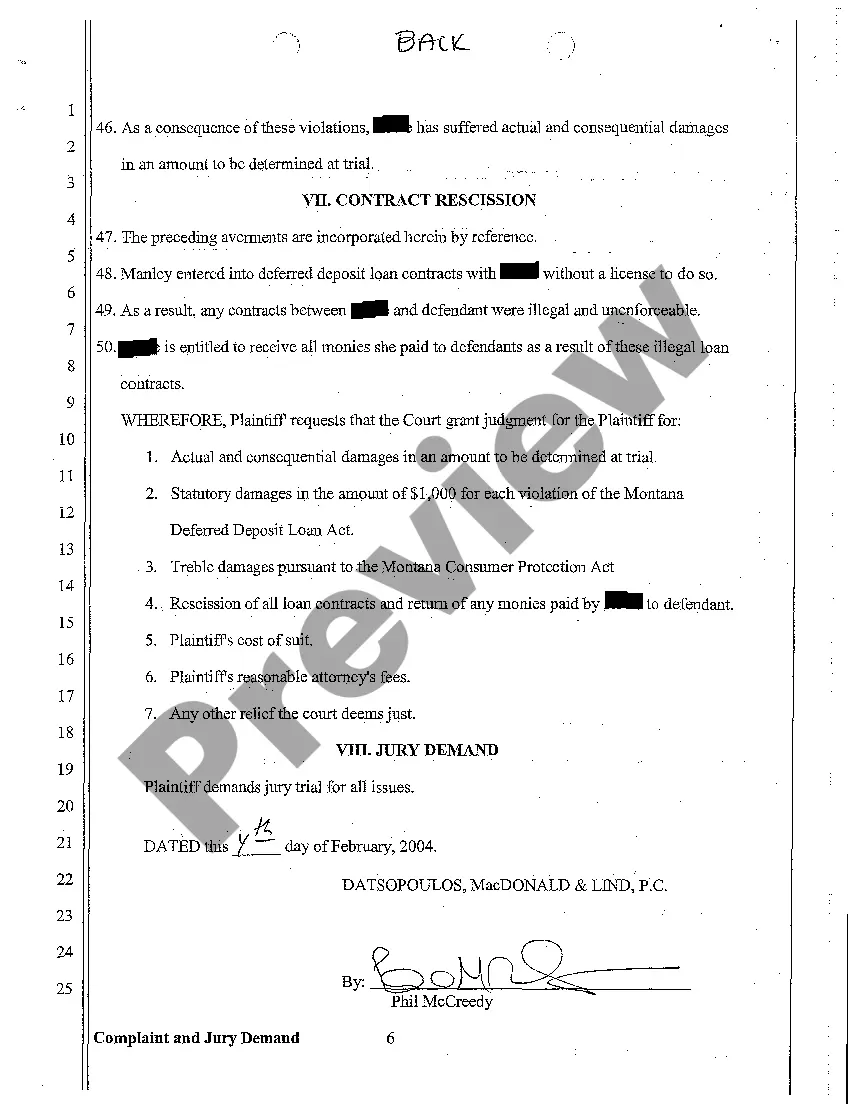

Montana Complaint for Penalty Fines Against Licensed Consumer Loan Business Making Deferred Deposit Loans Without License

Description

How to fill out Montana Complaint For Penalty Fines Against Licensed Consumer Loan Business Making Deferred Deposit Loans Without License?

Obtain a printable Montana Complaint for Penalty Fines Against Licensed Consumer Loan Business Making Deferred Deposit Loans Without License in just several clicks in the most comprehensive library of legal e-documents. Find, download and print out professionally drafted and certified samples on the US Legal Forms website. US Legal Forms continues to be the #1 supplier of reasonably priced legal and tax forms for US citizens and residents online starting from 1997.

Users who have a subscription, need to log in in to their US Legal Forms account, download the Montana Complaint for Penalty Fines Against Licensed Consumer Loan Business Making Deferred Deposit Loans Without License see it stored in the My Forms tab. Customers who don’t have a subscription must follow the steps listed below:

- Make sure your template meets your state’s requirements.

- If available, look through form’s description to learn more.

- If offered, review the form to discover more content.

- As soon as you are sure the template is right for you, click Buy Now.

- Create a personal account.

- Choose a plan.

- Pay via PayPal or bank card.

- Download the form in Word or PDF format.

As soon as you have downloaded your Montana Complaint for Penalty Fines Against Licensed Consumer Loan Business Making Deferred Deposit Loans Without License, you can fill it out in any online editor or print it out and complete it manually. Use US Legal Forms to get access to 85,000 professionally-drafted, state-specific forms.

Form popularity

FAQ

They are intended to help consumers get some quick cash to hold them over until their next paycheck, hence the name payday loan. Payday loans are also called cash advance loans, deferred deposit loans, post-dated check loans, or check advance loans.

The states of Connecticut, Maryland, Massachusetts, Pennsylvania, Vermont, and West Virginia never authorized payday loans. The District of Columbia repealed its payday law. Small loans secured by access to the borrower's bank account are authorized in three states at lower than typical rates.

A payday loan default can lead to bank overdraft fees, collections calls, damage to your credit scores, a day in court and garnishment of your paycheck.If you can't repay a payday loan, you could settle the debt for less than you owe or file for bankruptcy if your debts are overwhelming.

(a) Deferred deposit loan includes any arrangement in which a person accepts a check dated on the date it was written and agrees to hold it for a period of days prior to deposit or presentment, or accepts a check dated subsequent to the date it was written, and agrees to hold the check for deposit until the date

Payday lending is legal in Oklahoma. The loan can be given for the term from 60 days to 365 days.

If you don't repay your loan, the payday lender or a debt collector generally can sue you to collect. If they win, or if you do not dispute the lawsuit or claim, the court will enter an order or judgment against you. The order or judgment will state the amount of money you owe.

Pay off the loan with a new, less-expensive loan. Pay off the loan with savings. Arrange an extended repayment program with your current lender. Temporarily increase your available cash to eliminate the debt.

Deferred deposit means a transaction in which a check casher refrains from depositing a personal check written by a customer until a date after the transaction date, pursuant to a written agreement. "