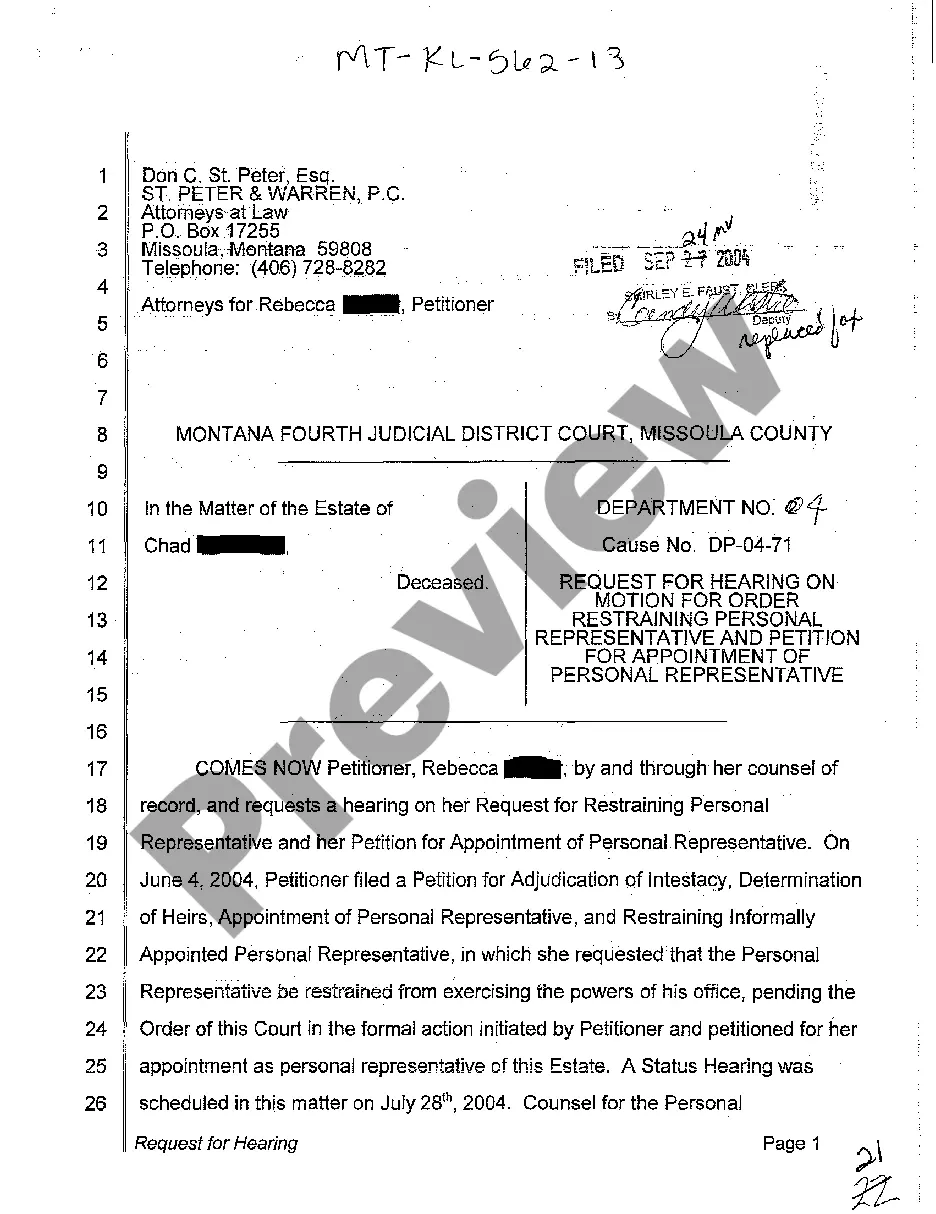

Montana Request for Hearing on Motion for Order Restraining Personal Representative and Petition for Appointment of Personal Representative

Description

How to fill out Montana Request For Hearing On Motion For Order Restraining Personal Representative And Petition For Appointment Of Personal Representative?

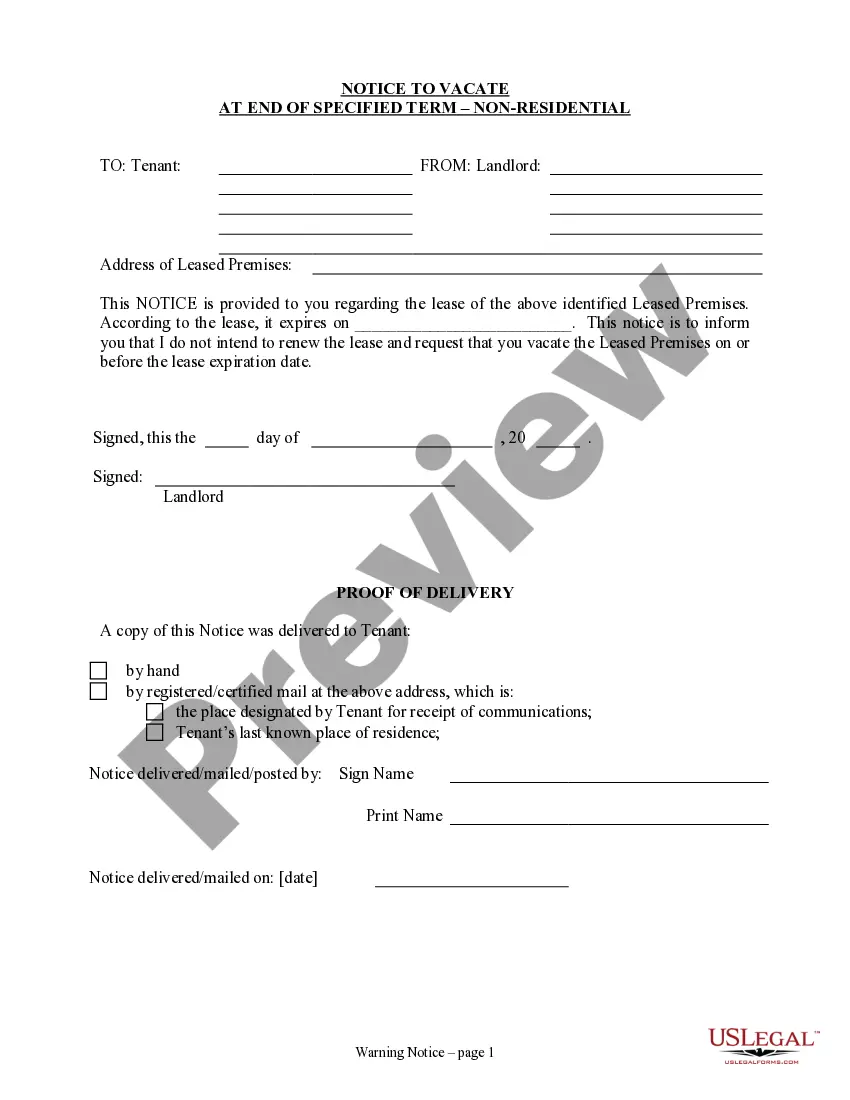

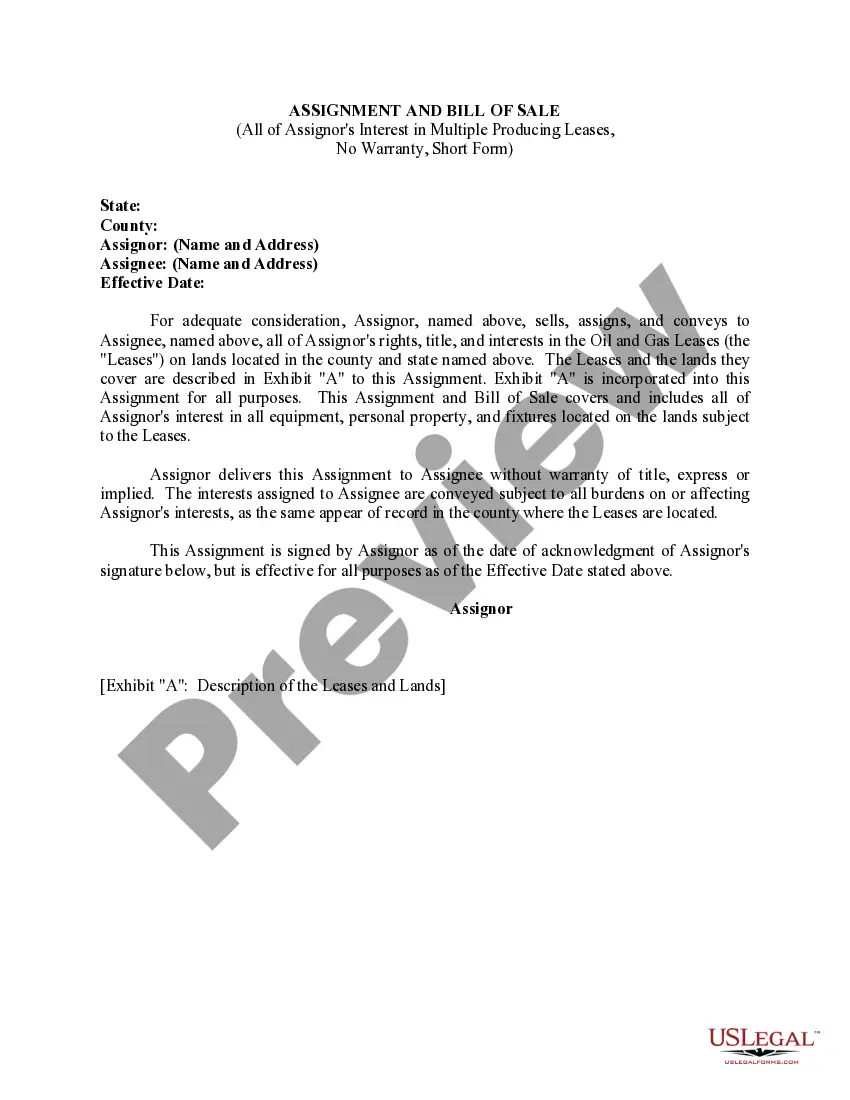

Get a printable Montana Request for Hearing on Motion for Order Restraining Personal Representative and Petition for Appointment of Personal Representative within several clicks from the most comprehensive catalogue of legal e-documents. Find, download and print out professionally drafted and certified samples on the US Legal Forms website. US Legal Forms has been the Top supplier of affordable legal and tax forms for US citizens and residents on-line starting from 1997.

Customers who have already a subscription, need to log in directly into their US Legal Forms account, down load the Montana Request for Hearing on Motion for Order Restraining Personal Representative and Petition for Appointment of Personal Representative see it stored in the My Forms tab. Users who don’t have a subscription are required to follow the steps listed below:

- Make sure your template meets your state’s requirements.

- If available, read the form’s description to find out more.

- If offered, preview the shape to discover more content.

- When you’re sure the form fits your needs, just click Buy Now.

- Create a personal account.

- Select a plan.

- Pay via PayPal or visa or mastercard.

- Download the form in Word or PDF format.

When you have downloaded your Montana Request for Hearing on Motion for Order Restraining Personal Representative and Petition for Appointment of Personal Representative, it is possible to fill it out in any online editor or print it out and complete it by hand. Use US Legal Forms to get access to 85,000 professionally-drafted, state-specific documents.

Form popularity

FAQ

Yes he can sue on behalf of the estate.

-712 provides that if the exercise of power concerning the estate is improper, the personal representative is liable to interested persons for damage or loss resulting from breach of fiduciary duty to the same extent as a trustee of an express trust. This means that if you are an interested party and you have

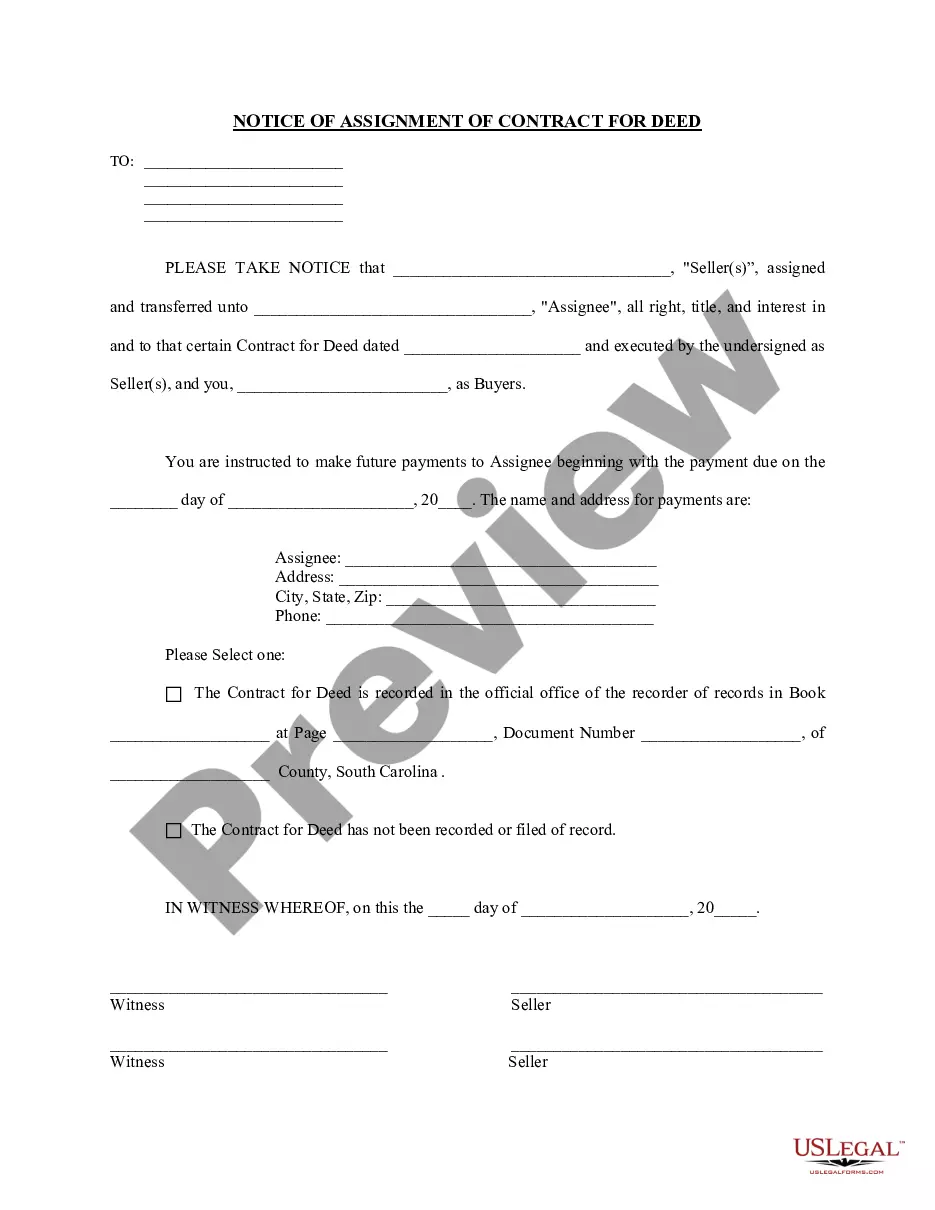

The process of removing a personal representative begins with filing a petition or removal. An heir or interested party must file the petition with the probate court and serve a copy of the petition on the personal representative. The probate court schedules a hearing date and time to hear the matter.

Under California Probate Code, the executor typically receives 4% on the first $100,000, 3% on the next $100,000 and 2% on the next $800,000, says William Sweeney, a California-based probate attorney. For an estate worth $600,000 the fee works out at approximately $15,000.

No. The person must be appointed by the probate court as the personal representative and letters issued for the appointment as personal representative to be effective. California Probate Code §8400(a).To learn about the duties of a personal representative in California probate, click here.

If a deceased specifically names a person or institution to act for him or her in his or her will, and if the will is accepted as valid, the named personal representative is known as the executor (male) or executrix (female).Corporate entities (banks and trust companies) are also called executors.

A personal representative in California is entitled to compensation for ordinary services provided to the estate. California Probate Code § 10800. These fees are also called statutory fees, because they are provided by statute.

As the Personal Representative, you are responsible for doing the following: 2022 Collecting and inventorying the assets of the estate; 2022 Managing the assets of the estate during the probate process; 2022 Paying the bills of the estate. Making distribution to the heirs or beneficiaries of the estate.

You can do this by simply signing your name and putting your title of executor of the estate afterward. One example of an acceptable signature would be Signed by Jane Doe, Executor of the Estate of John Doe, Deceased. Of course, many institutions may not simply take your word that you are the executor of the estate.