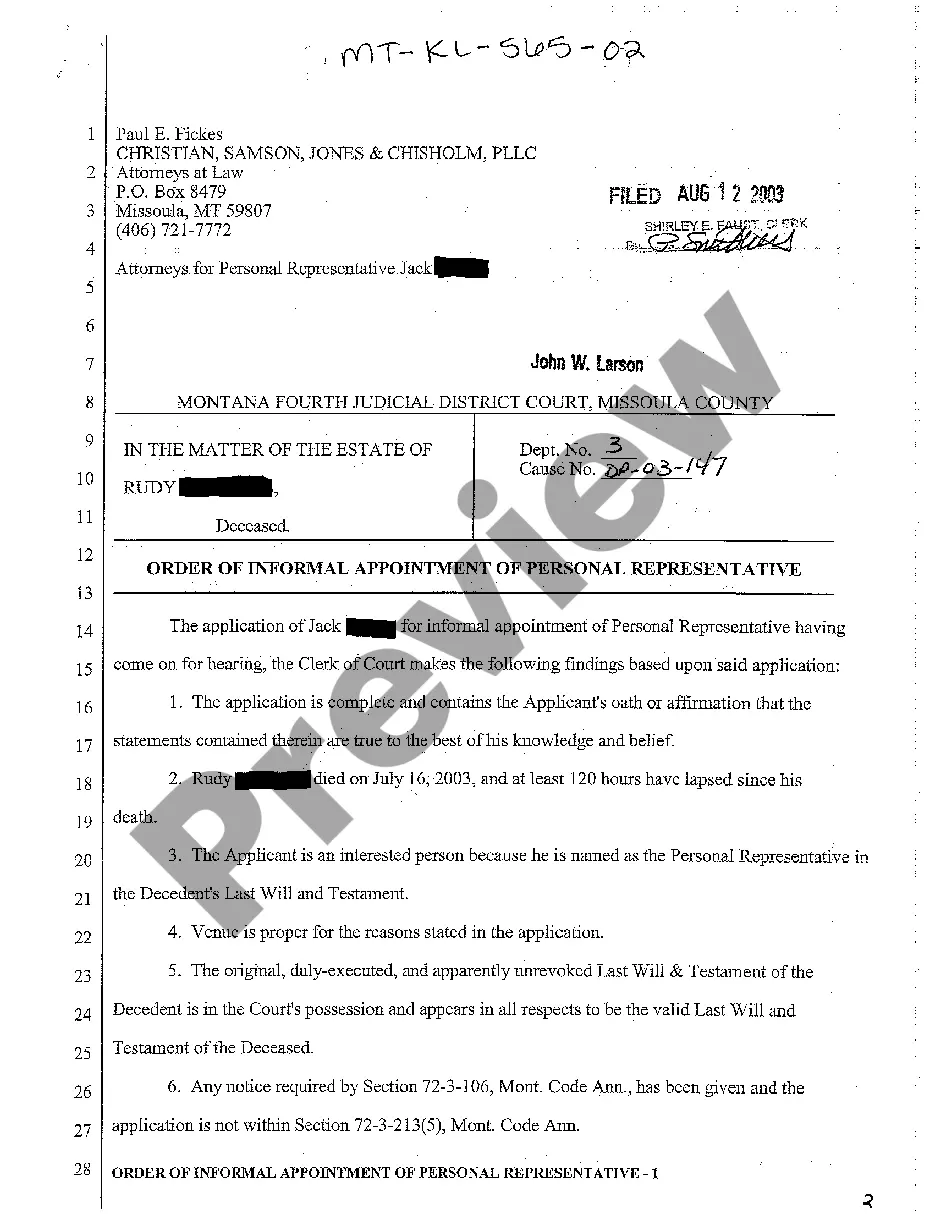

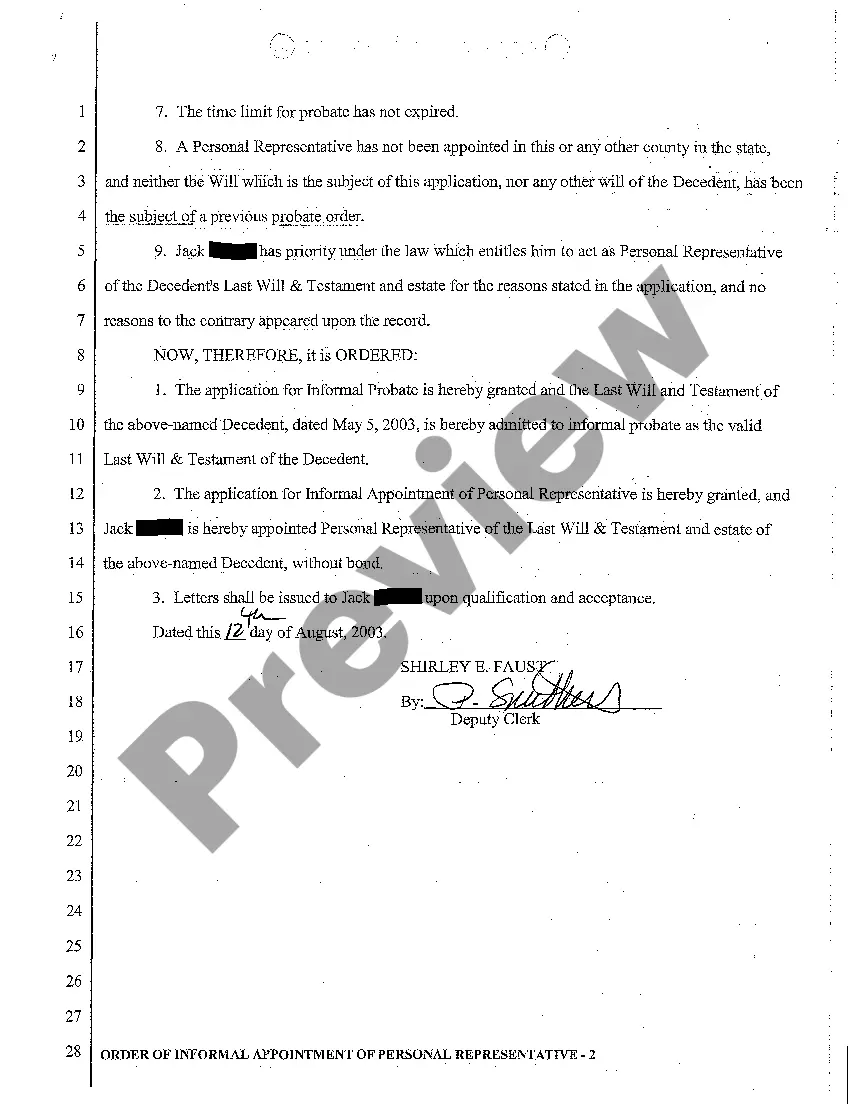

Montana Order of Informal Appointment of Personal Representative

Description

How to fill out Montana Order Of Informal Appointment Of Personal Representative?

Obtain a printable Montana Order of Informal Appointment of Personal Representative within several clicks from the most comprehensive library of legal e-documents. Find, download and print out professionally drafted and certified samples on the US Legal Forms website. US Legal Forms has been the #1 supplier of affordable legal and tax templates for US citizens and residents online since 1997.

Users who have already a subscription, need to log in in to their US Legal Forms account, down load the Montana Order of Informal Appointment of Personal Representative see it stored in the My Forms tab. Customers who do not have a subscription must follow the tips listed below:

- Make sure your template meets your state’s requirements.

- If available, read the form’s description to find out more.

- If accessible, preview the shape to view more content.

- Once you’re sure the template is right for you, simply click Buy Now.

- Create a personal account.

- Choose a plan.

- through PayPal or bank card.

- Download the template in Word or PDF format.

Once you have downloaded your Montana Order of Informal Appointment of Personal Representative, you can fill it out in any web-based editor or print it out and complete it by hand. Use US Legal Forms to get access to 85,000 professionally-drafted, state-specific forms.

Form popularity

FAQ

Personal Representatives is the collective name for either Executors or Administrators. Personal Representatives of someone who made a valid Will are called Executors. If someone dies without a Will (intestate) then the people in charge of their estate are called Adminstrators.

A personal representative must be 18 or more years of age. A Montana personal representative need not be a resident of the same county or state as the deceased. For example, he or she may be a resident of Glendive and serve as a personal representative in Helena.

Generally speaking, a Personal Representative is responsible for opening the estate, collecting the assets of the estate, protecting the estate property, preparing an inventory of the property, paying various estate expenses, valid claims (including debts and taxes) against the estate, representing the estate in claims

A personal representative is appointed by a judge to oversee the administration of a probate estate.When a personal representative is nominated to the position in a will, he's commonly called the executor of the estate.

Under Montana statute, where as estate is valued at less than $50,000, an interested party may, thirty (30) days after the death of the decedent, issue a small estate affidavit to to demand payment on any debts owed to the decedent.

You can legally prepare your own will, it can even be handwritten. This type of will is known as a "holographic will." In Montana, your handwritten will must be signed by you. Your signature must also be located on any material provisions, and no witnesses will need to be present for the signing of your will.

Under California Probate Code, the executor typically receives 4% on the first $100,000, 3% on the next $100,000 and 2% on the next $800,000, says William Sweeney, a California-based probate attorney. For an estate worth $600,000 the fee works out at approximately $15,000.

No. The person must be appointed by the probate court as the personal representative and letters issued for the appointment as personal representative to be effective. California Probate Code §8400(a).To learn about the duties of a personal representative in California probate, click here.

That person (it could be one or more individuals, a bank or trust company, or both) who acts for, or stands in the shoes of, the deceased is generally called the personal representative. If the decedent dies testate that is, with a Will an Executor is appointed as the personal representative.