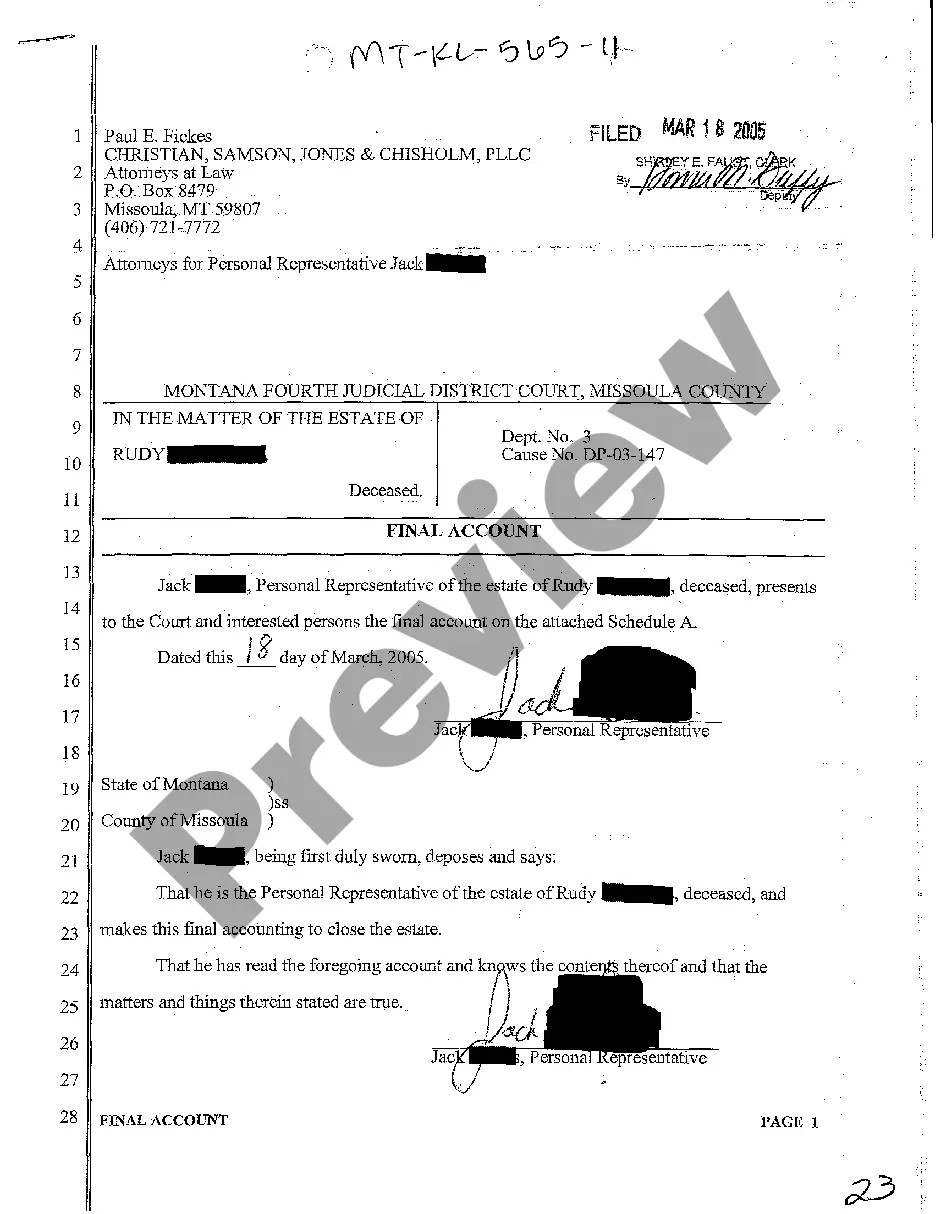

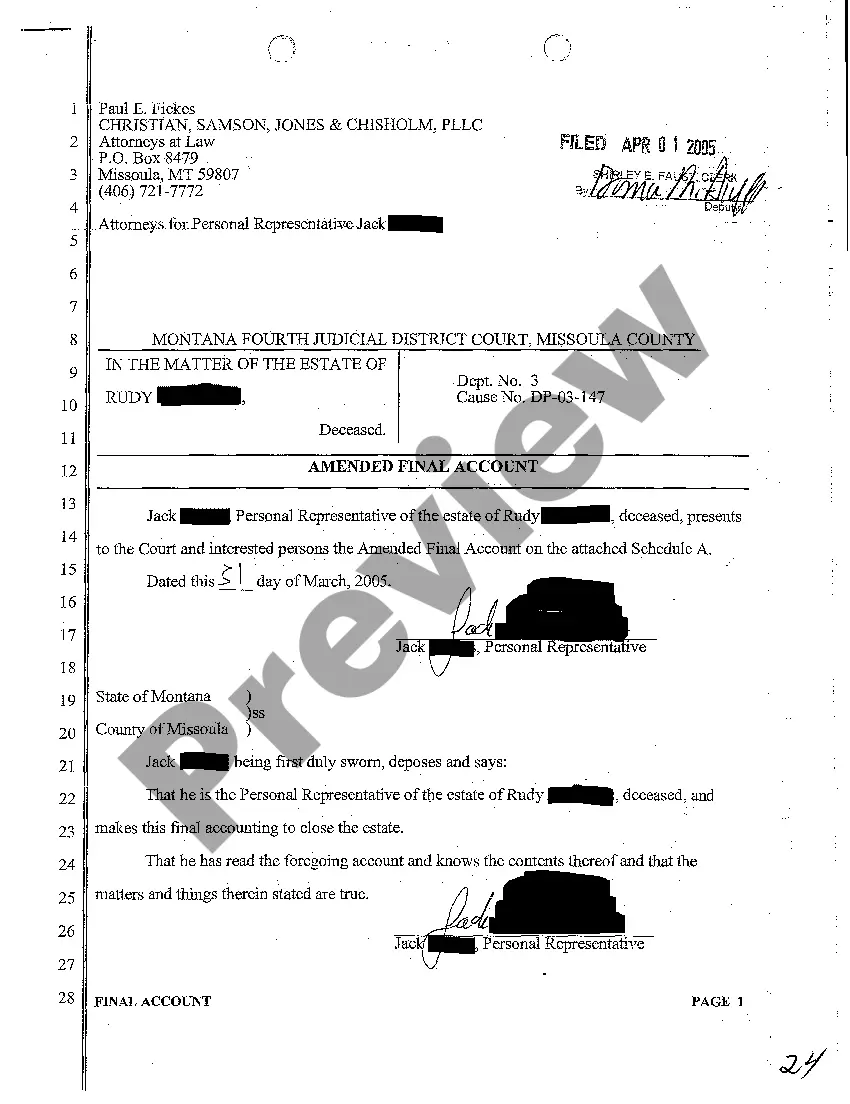

Montana Final Account

Description

How to fill out Montana Final Account?

Get a printable Montana Final Account in just several clicks in the most comprehensive library of legal e-documents. Find, download and print professionally drafted and certified samples on the US Legal Forms website. US Legal Forms continues to be the #1 provider of reasonably priced legal and tax templates for US citizens and residents on-line starting from 1997.

Customers who have a subscription, need to log in into their US Legal Forms account, down load the Montana Final Account and find it stored in the My Forms tab. Customers who never have a subscription are required to follow the tips below:

- Make sure your template meets your state’s requirements.

- If available, read the form’s description to learn more.

- If accessible, review the shape to see more content.

- Once you’re confident the template meets your requirements, click on Buy Now.

- Create a personal account.

- Select a plan.

- through PayPal or visa or mastercard.

- Download the form in Word or PDF format.

As soon as you have downloaded your Montana Final Account, you may fill it out in any online editor or print it out and complete it manually. Use US Legal Forms to get access to 85,000 professionally-drafted, state-specific forms.

Form popularity

FAQ

The will of a decedent must be filed with the Clerk of Court so the personal representative may proceed with the administration of the estate. Montana has both formal (court-directed) and informal probate as well as a simplified probate process for small estates.

In Montana, you can make a living trust to avoid probate for virtually any asset you ownreal estate, bank accounts, vehicles, and so on. You need to create a trust document (it's similar to a will), naming someone to take over as trustee after your death (called a successor trustee).

You can legally prepare your own will, it can even be handwritten. This type of will is known as a "holographic will." In Montana, your handwritten will must be signed by you. Your signature must also be located on any material provisions, and no witnesses will need to be present for the signing of your will.

Yes, a person can make his or her own will, but it must be in the testator's own handwriting. This type of will is called a holographic will. Such a will is valid if the signature and the material provisions are in the handwriting of the testator.

If you are unmarried and die without a valid will and last testament in Montana, then your entire estate goes to any surviving children in equal shares, or grandchildren if you don't have any surviving children. If you die intestate unmarried and with no children, then by law, your parents inherit your entire estate.