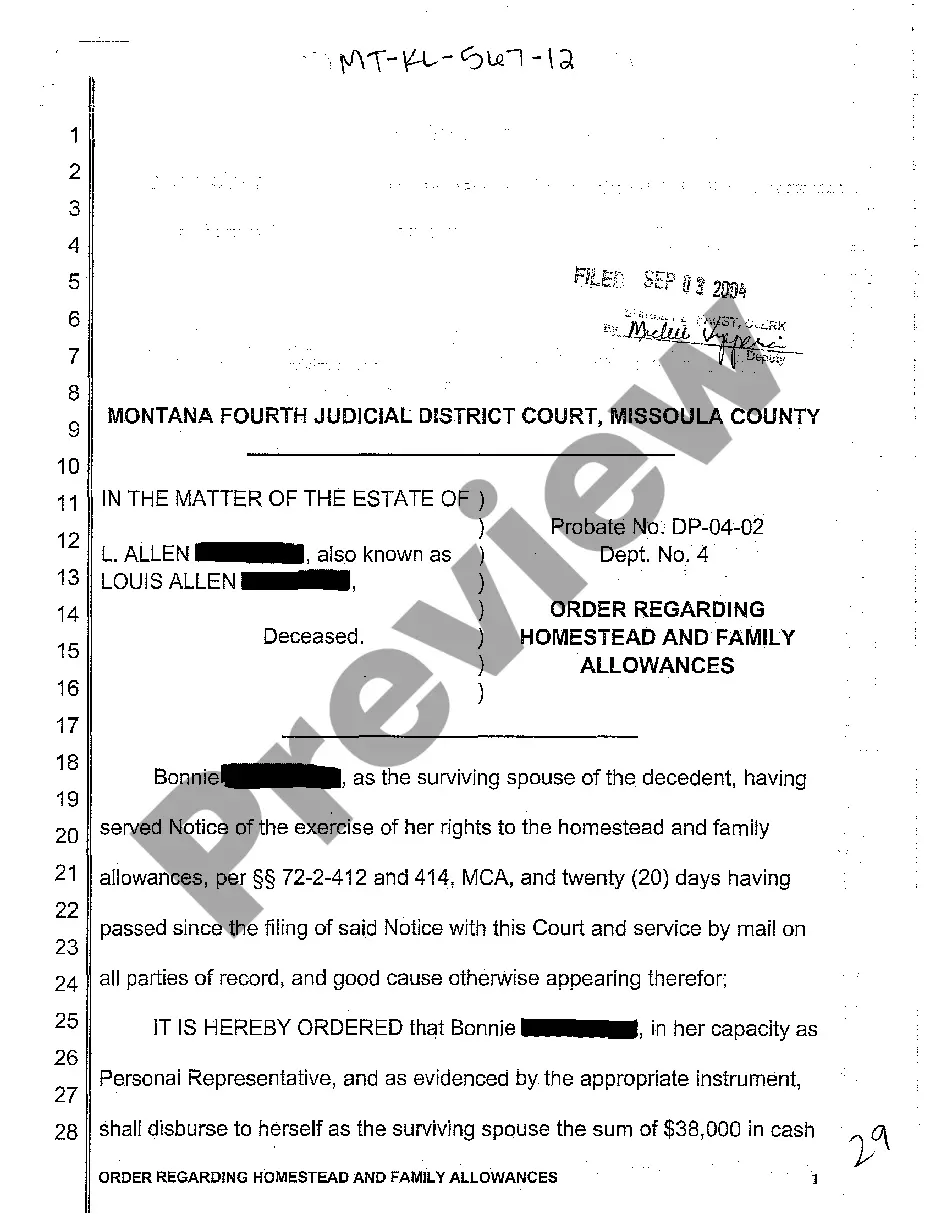

Montana Order Regarding Homestead and Family Allowances

Description

How to fill out Montana Order Regarding Homestead And Family Allowances?

Obtain a printable Montana Order Regarding Homestead and Family Allowances in just several clicks in the most complete library of legal e-files. Find, download and print professionally drafted and certified samples on the US Legal Forms website. US Legal Forms continues to be the Top supplier of affordable legal and tax forms for US citizens and residents online since 1997.

Customers who already have a subscription, must log in straight into their US Legal Forms account, download the Montana Order Regarding Homestead and Family Allowances see it saved in the My Forms tab. Users who don’t have a subscription are required to follow the tips below:

- Make sure your template meets your state’s requirements.

- If available, read the form’s description to learn more.

- If readily available, review the shape to view more content.

- When you are sure the form is right for you, simply click Buy Now.

- Create a personal account.

- Pick a plan.

- Pay out through PayPal or visa or mastercard.

- Download the form in Word or PDF format.

When you have downloaded your Montana Order Regarding Homestead and Family Allowances, it is possible to fill it out in any online editor or print it out and complete it by hand. Use US Legal Forms to get access to 85,000 professionally-drafted, state-specific documents.

Form popularity

FAQ

In Montana, you can make a living trust to avoid probate for virtually any asset you ownreal estate, bank accounts, vehicles, and so on. You need to create a trust document (it's similar to a will), naming someone to take over as trustee after your death (called a successor trustee).

If you are unmarried and die without a valid will and last testament in Montana, then your entire estate goes to any surviving children in equal shares, or grandchildren if you don't have any surviving children. If you die intestate unmarried and with no children, then by law, your parents inherit your entire estate.

If the total value of all the assets you leave behind is less than a certain amount, the people who inherit your personal property -- that's anything except real estate -- may be able to skip probate entirely. The exact amount depends on state law, and varies hugely.

The exempt property allowance under MCL 700.2404 sets aside $10,000 (adjusted for inflation annually under MCL 700.1210, making the current allowance $15,000) for the dece- dent's spouse or children even if they are excluded under the will.

Life insurance or 401(k) accounts where a beneficiary was named. Assets under a Living Trust. Funds, securities, or US savings bonds that are registered on transfer on death (TOD) or payable on death (POD) forms. Funds held in a pension plan.

Small estate administration is a simplified court procedure that is an alternative to the longer probate process. It is available when the person who dies did not own that much in assets. There is often a limit to the value of the property, such as $25,000 or $100,000.

Under Montana statute, where as estate is valued at less than $50,000, an interested party may, thirty (30) days after the death of the decedent, issue a small estate affidavit to to demand payment on any debts owed to the decedent.