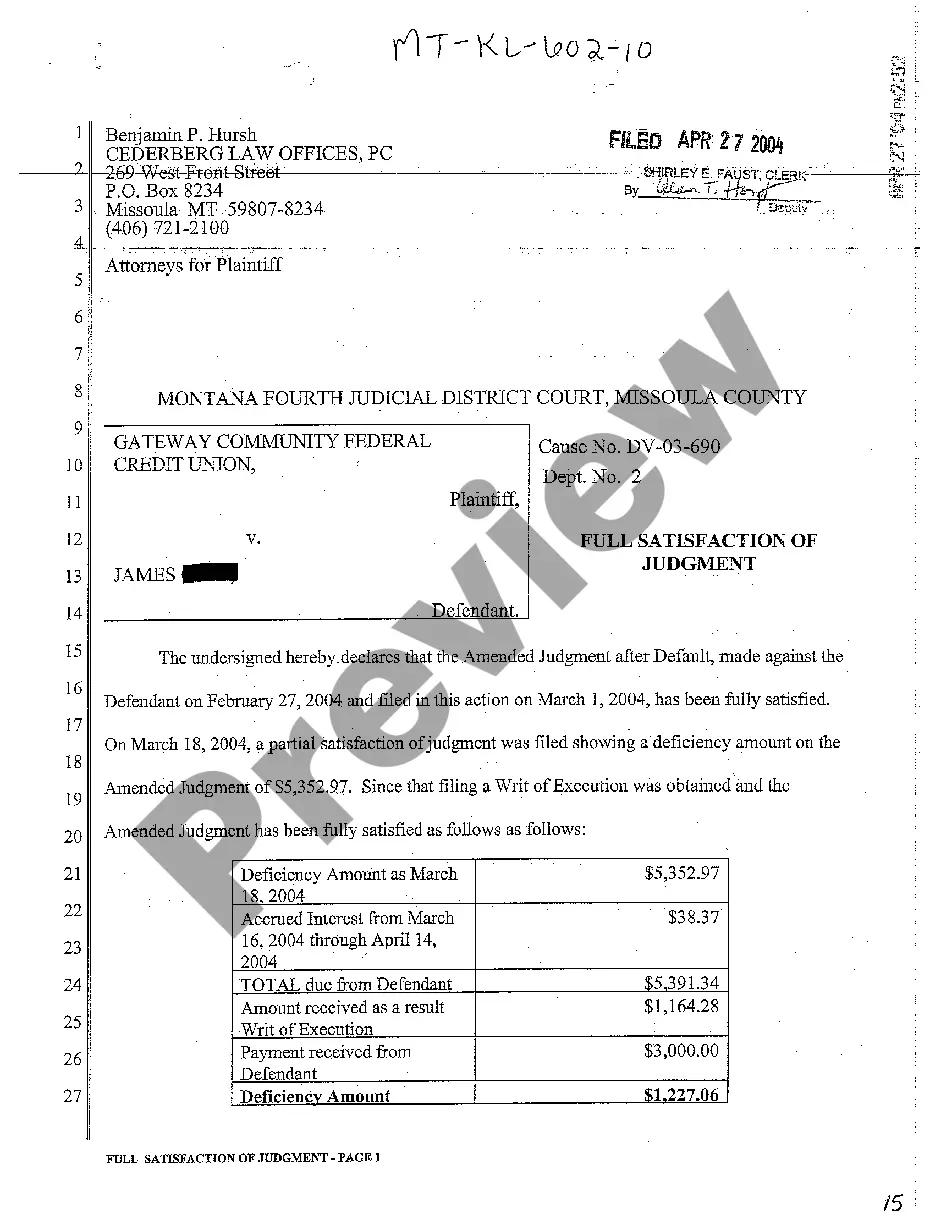

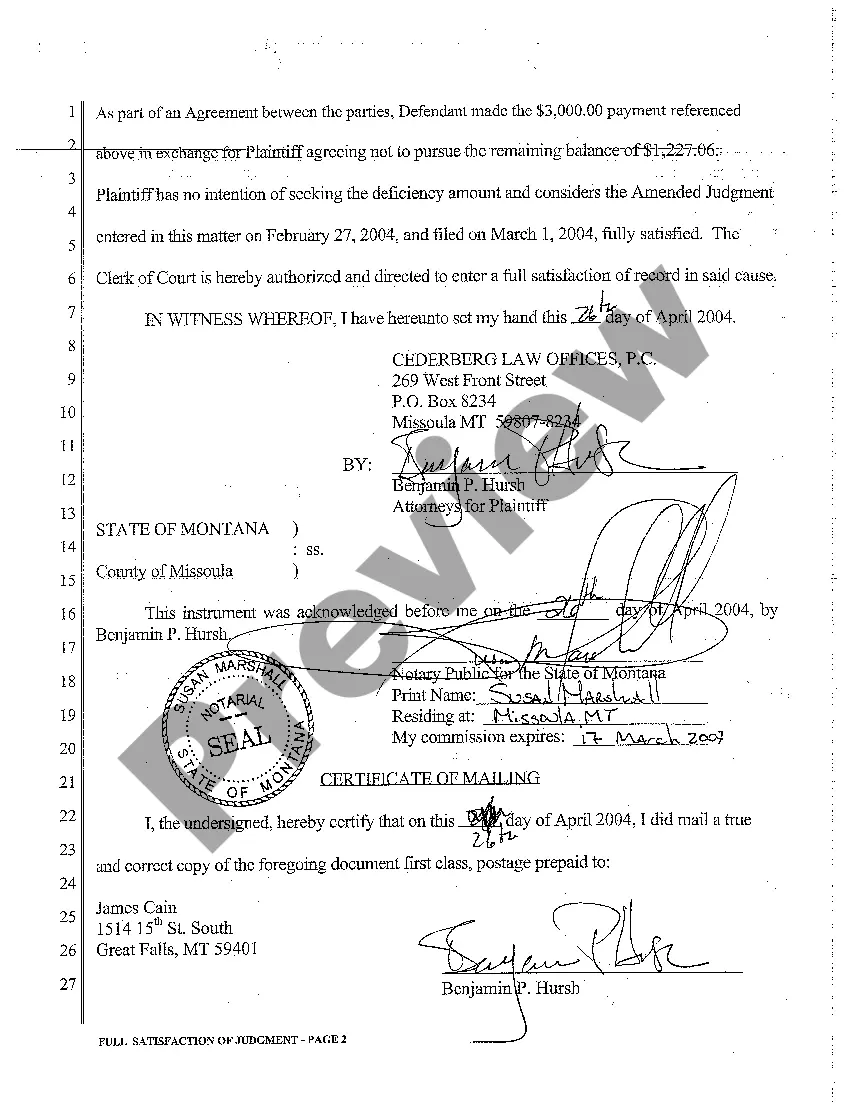

Montana Full Satisfaction of Judgment

Description

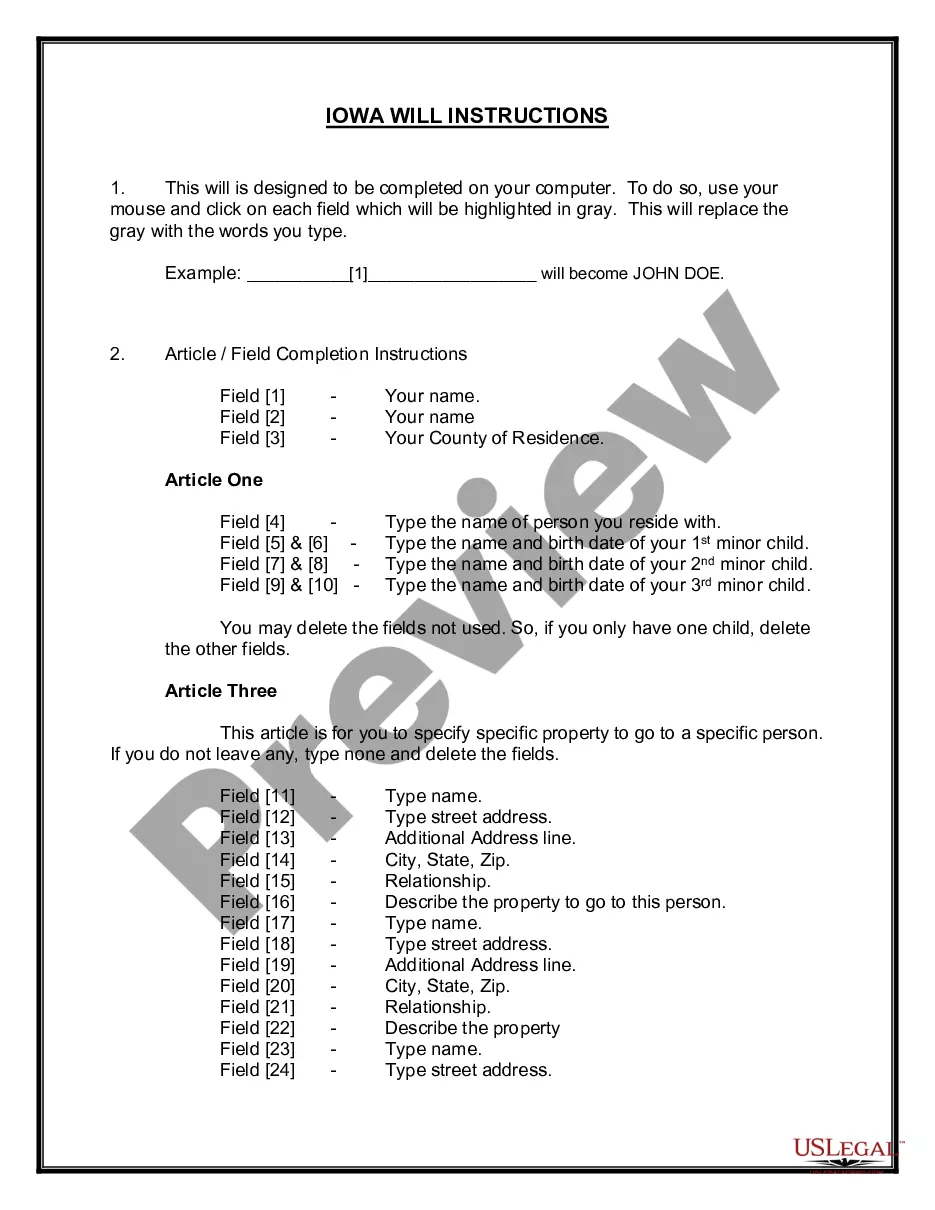

How to fill out Montana Full Satisfaction Of Judgment?

Obtain a printable Montana Full Satisfaction of Judgment in only several clicks from the most comprehensive library of legal e-forms. Find, download and print out professionally drafted and certified samples on the US Legal Forms website. US Legal Forms continues to be the Top provider of affordable legal and tax templates for US citizens and residents on-line since 1997.

Customers who have a subscription, need to log in into their US Legal Forms account, get the Montana Full Satisfaction of Judgment and find it saved in the My Forms tab. Customers who do not have a subscription are required to follow the steps listed below:

- Make certain your form meets your state’s requirements.

- If available, look through form’s description to find out more.

- If accessible, preview the shape to find out more content.

- When you are confident the form meets your requirements, click Buy Now.

- Create a personal account.

- Select a plan.

- Pay through PayPal or visa or mastercard.

- Download the form in Word or PDF format.

Once you have downloaded your Montana Full Satisfaction of Judgment, it is possible to fill it out in any online editor or print it out and complete it by hand. Use US Legal Forms to to access 85,000 professionally-drafted, state-specific files.

Form popularity

FAQ

In order to vacate a judgment in California, You must file a motion with the court asking the judge to vacate or set aside the judgment. Among other things, you must tell the judge why you did not respond to the lawsuit (this can be done by written declaration).

How long does a judgment lien last in Montana? A judgment lien in Montana will remain attached to the debtor's property (even if the property changes hands) for ten years.

In many situations, one of the best ways to collect a judgment after winning a case is to put a lien on the debtor's property. This gives you a claim to the property and, in some cases, the property will be sold at public auction in order to satisfy the debt that is owed.

Even after you win a lawsuit, you still have to collect the money awarded in the judgmentthe court won't do it for you. Financially sound individuals or businesses will routinely pay a judgment entered against them. However, not everyone will be as willing. If necessary, legal ways to force payment exist.

You have 30 days after entry of the original judgment before you have to pay the creditor. During this time, you can: Pay the judgment voluntarily;Fill out and send the creditor a Judgment Debtor's Statement of Assets (Form SC-133).

Charging Order. A Charging Order is a means of securing the debt against property owned by either the individual or the company in debt to you. Attachment of Earnings Order. Winding Up Proceedings. Bankruptcy Petition. Warrant of Execution.

Keep in mind that if you do NOT pay the judgment: The amount you owe will increase daily, since the judgment accumulates interest at the rate of 10% per year. The creditor can get an order telling you to reimburse him or her for any reasonable and necessary costs of collection.

Do not use illegal ways to collect your money. The debtor may be protected from abusive or unfair ways to collect the debt. Encourage the debtor to pay you voluntarily. Be organized. Ask a lawyer or collection agency for help. Make sure you renew your judgment. Ask the court for help.

The third and easiest way to collect is wage garnishment. If the debtor has a job, you can collect up to 25% of his or her wages until the judgment is paid. Give your sheriff or other local official (known as a levying officer) information about the judgment and where the debtor works.