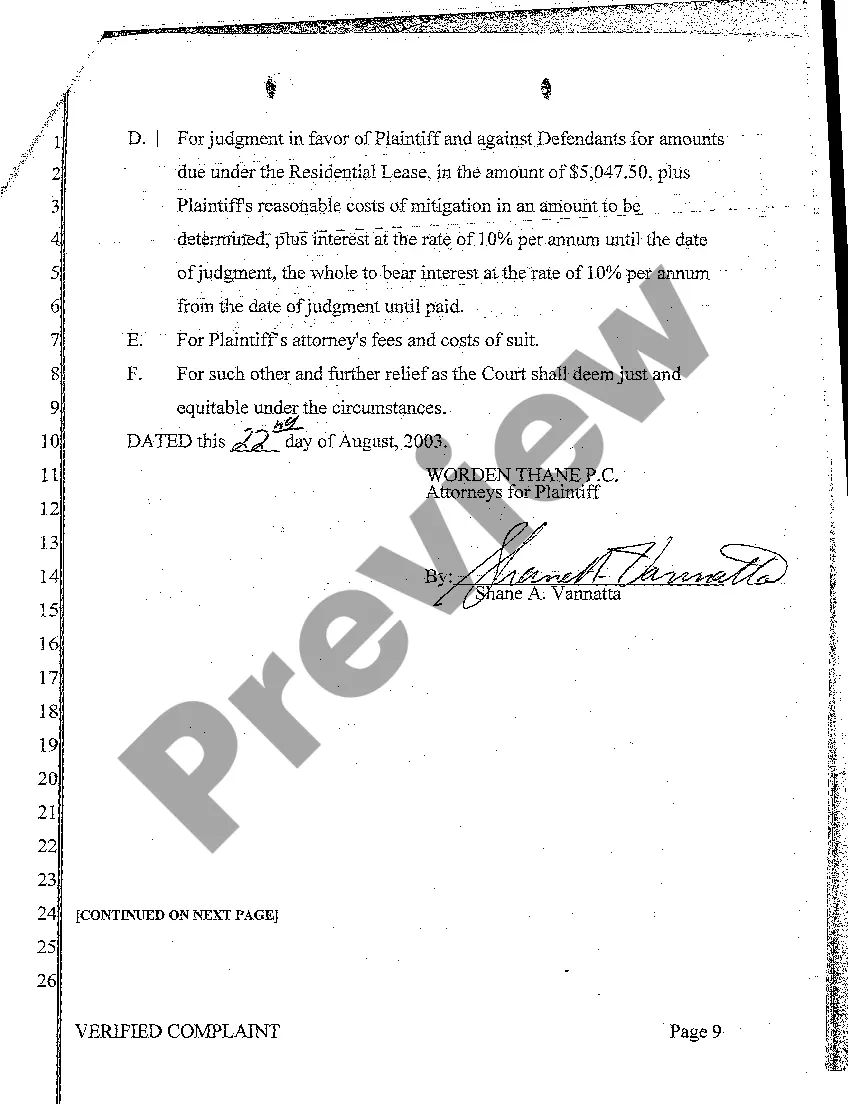

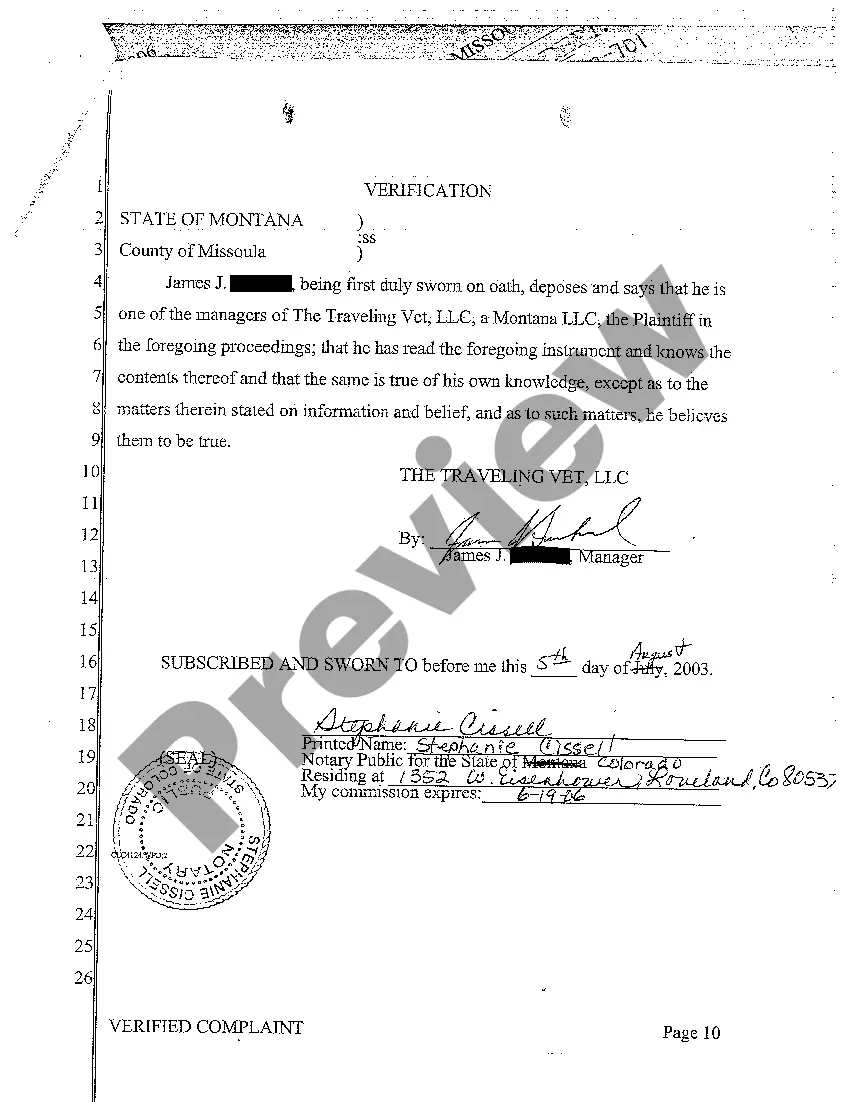

Montana Verified Complaint for Debt Collection

Description

How to fill out Montana Verified Complaint For Debt Collection?

Obtain a printable Montana Verified Complaint for Debt Collection within just several mouse clicks in the most comprehensive library of legal e-files. Find, download and print professionally drafted and certified samples on the US Legal Forms website. US Legal Forms continues to be the #1 provider of reasonably priced legal and tax templates for US citizens and residents online starting from 1997.

Customers who already have a subscription, need to log in in to their US Legal Forms account, get the Montana Verified Complaint for Debt Collection and find it stored in the My Forms tab. Customers who don’t have a subscription must follow the tips below:

- Ensure your form meets your state’s requirements.

- If provided, read the form’s description to find out more.

- If readily available, review the shape to see more content.

- As soon as you’re sure the form suits you, click on Buy Now.

- Create a personal account.

- Select a plan.

- via PayPal or visa or mastercard.

- Download the form in Word or PDF format.

As soon as you have downloaded your Montana Verified Complaint for Debt Collection, you may fill it out in any web-based editor or print it out and complete it manually. Use US Legal Forms to to access 85,000 professionally-drafted, state-specific documents.

Form popularity

FAQ

Never Give Them Your Personal Information. A call from a debt collection agency will include a series of questions. Never Admit That The Debt Is Yours. Even if the debt is yours, don't admit that to the debt collector. Never Provide Bank Account Information.

Reach out to the company the collector says is the original creditor. They might help you figure out if the debt is legitimate and if this collector has the right to collect the debt. Also, get your free, annual credit report online or at 877-322-8228 and see if the debt shows up there. Dispute the debt in writing.

Debt validation is your federal right granted under the Fair Debt Collection Practices Act (FDCPA). To request debt validation, you must send a written request to the debt collector within 30 days of being contacted by the collection agency.

The amount of debt owed. The name of the creditor to whom the debt is owed. A statement of notice that the debt will be considered valid by the debt collector unless the consumer disputes it within 30 days of notice.

If you pay the collection agency directly, the debt is removed from your credit report in six years from the date of payment. If you don't pay, it purges six years from the last activity date, but you may be at risk for wage garnishment.

In general, if you want to escalate the issue with the debt collector, you should do so within 30 days of receiving the validation letter. This includes disputing that you owe the debt, requesting additional verification of the debt, or requesting the name and address of the original creditor.

Ask the caller for their name, company, street address, telephone number, and if your state licenses debt collectors, a professional license number.

Step 1: Keep detailed records of what the debt collector is doing. Step 2: Take action write to the debt collector, complain to an External Dispute Resolution scheme (Ombudsman Service) or VCAT. Step 3: Complain to a Regulator.

Your creditor also has to report your complaint to the Financial Conduct Authority (FCA), even if they respond within 3 business days. If you need help with this, you can phone our debt helpline on 0300 330 1313. We can usually help between 9am and 8pm, Monday to Friday.