Montana Beneficiary Deed

Description

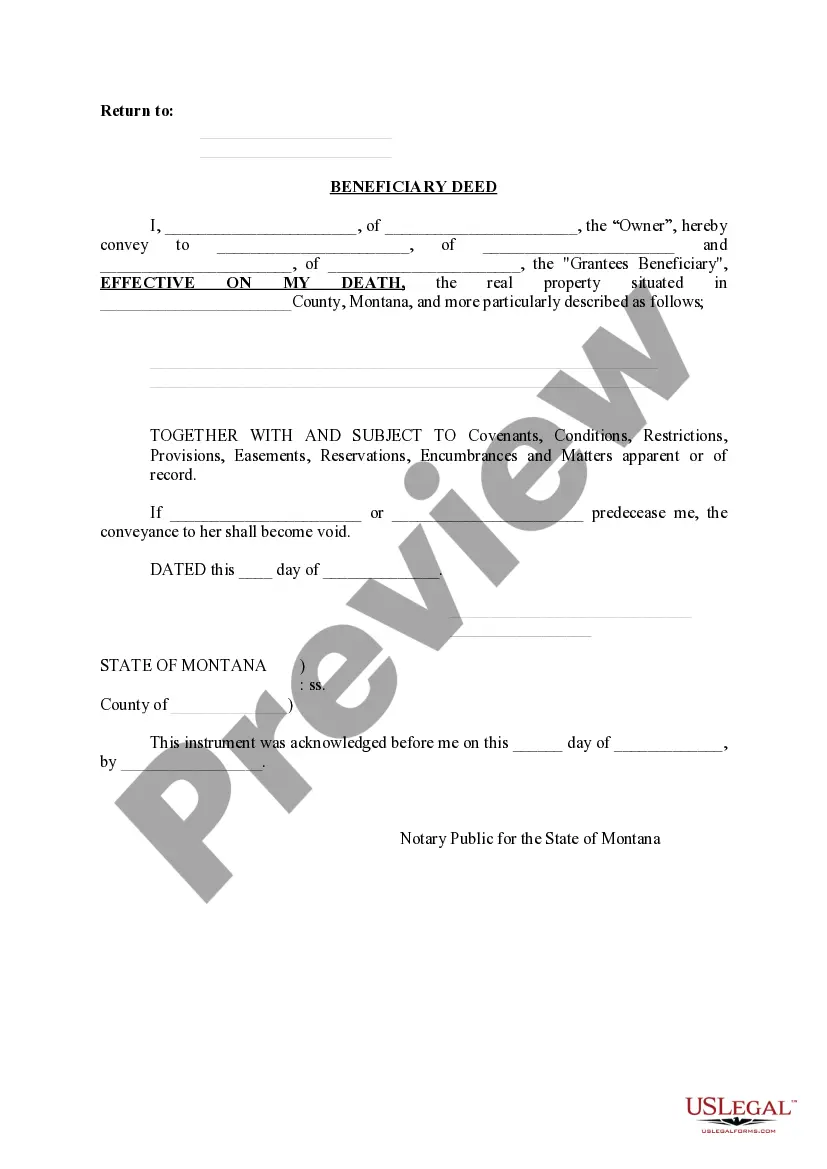

How to fill out Montana Beneficiary Deed?

Avoid expensive attorneys and find the Montana Beneficiary Deed you want at a reasonable price on the US Legal Forms website. Use our simple categories function to find and obtain legal and tax documents. Go through their descriptions and preview them well before downloading. In addition, US Legal Forms provides users with step-by-step tips on how to download and fill out every single template.

US Legal Forms clients basically must log in and obtain the specific form they need to their My Forms tab. Those, who haven’t got a subscription yet must stick to the tips below:

- Make sure the Montana Beneficiary Deed is eligible for use in your state.

- If available, read the description and make use of the Preview option just before downloading the templates.

- If you’re confident the document is right for you, click on Buy Now.

- In case the form is wrong, use the search engine to get the right one.

- Next, create your account and choose a subscription plan.

- Pay by credit card or PayPal.

- Choose to obtain the document in PDF or DOCX.

- Simply click Download and find your template in the My Forms tab. Feel free to save the form to your gadget or print it out.

After downloading, it is possible to fill out the Montana Beneficiary Deed by hand or by using an editing software. Print it out and reuse the template many times. Do more for less with US Legal Forms!

Form popularity

FAQ

As of September 2019, the District of Columbia and the following states allow some form of TOD deed: Alaska, Arizona, Arkansas, California, Colorado, Hawaii, Illinois, Indiana, Kansas, Maine, Minnesota, Missouri, Montana, Nebraska, Nevada, New Mexico, North Dakota, Oklahoma, Oregon, South Dakota, Texas, Utah, Virginia,

When a person dies, beneficiaries might learn that the decedent made a deed that conflicts with the specific wording in his will. Generally, a deed will override the will. However, which legal document prevails also depends on state property laws and whether the state has adopted the Uniform Probate Code.

States that allow TOD deeds are Alaska, Arizona, Arkansas, California, Colorado, District of Columbia, Hawaii, Illinois, Indiana, Kansas, Maine, Minnesota, Mississippi, Missouri, Montana, Nebraska, Nevada, New Mexico, North Dakota, Ohio, Oklahoma, Oregon, South Dakota, Texas, Utah, Virginia, Washington, West Virginia,

A beneficiary deed is one in which an owner conveys an interest in Montana real property to a grantee beneficiary effective upon the owner's death. In other words, real property is transferred from the deceased person to the person(s) listed on the deed.

If you'd like to avoid having your property going through the probate process, it's a good idea to look into a transfer on death deed. A transfer on death deed allows you to select a beneficiary who will receive your property, but only when you've passed away.

A beneficiary deed is generally used for avoidance of probate, although it may be used to remove a particular property from a probate estate.

The beneficiary deed does for real estate what the payable on death or POD designation does for a bank account. It allows the owner to designate a beneficiary for that asset and creates a method by which ownership of the asset will transfer directly to the beneficiary upon the owner's death.

Using a beneficiary deed may reduce or eliminate fees for probating the estate or managing a trust. Liens and loans. After a beneficiary deed is signed, grantors may still do what they want with the property, including selling it or mortgaging it.