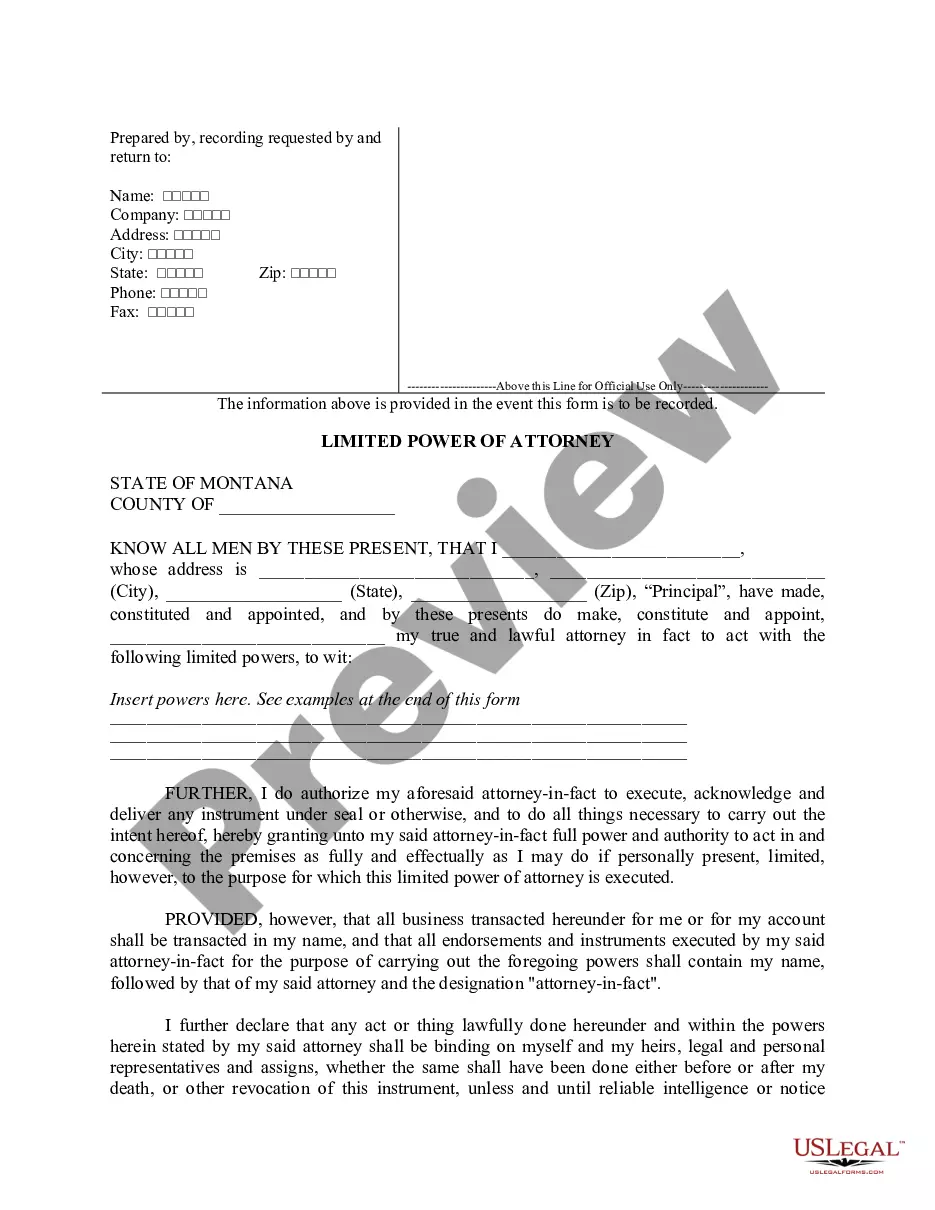

Montana Limited Power of Attorney where you Specify Powers with Sample Powers Included

Description

How to fill out Montana Limited Power Of Attorney Where You Specify Powers With Sample Powers Included?

Avoid pricey attorneys and find the Montana Limited Power of Attorney where you Specify Powers with Sample Powers Included you need at a affordable price on the US Legal Forms site. Use our simple groups functionality to look for and download legal and tax documents. Read their descriptions and preview them just before downloading. Moreover, US Legal Forms enables customers with step-by-step tips on how to download and complete each and every template.

US Legal Forms clients just need to log in and download the particular form they need to their My Forms tab. Those, who have not obtained a subscription yet need to stick to the tips listed below:

- Ensure the Montana Limited Power of Attorney where you Specify Powers with Sample Powers Included is eligible for use where you live.

- If available, read the description and make use of the Preview option before downloading the sample.

- If you’re confident the template is right for you, click on Buy Now.

- If the template is incorrect, use the search engine to get the right one.

- Next, create your account and choose a subscription plan.

- Pay by card or PayPal.

- Select download the document in PDF or DOCX.

- Just click Download and find your form in the My Forms tab. Feel free to save the template to your device or print it out.

After downloading, you are able to fill out the Montana Limited Power of Attorney where you Specify Powers with Sample Powers Included manually or an editing software. Print it out and reuse the template many times. Do more for less with US Legal Forms!

Form popularity

FAQ

Limited Power of Attorney (LPOA) is an authorization that permits a portfolio manager to perform specific functions on behalf of the account owner. In general, the LPOA allows the manager to execute an agreed-upon investment strategy and take care of routine related business without contacting the account holder.

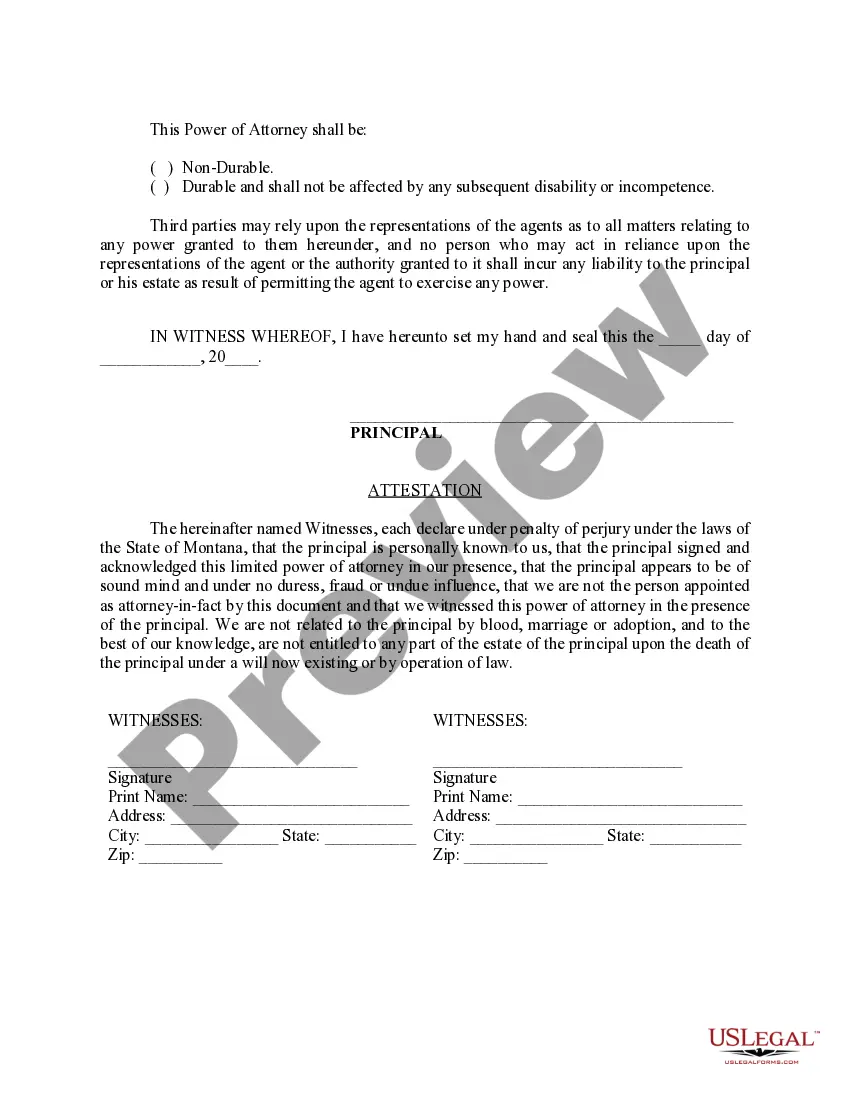

Choose the limited power of attorney made for your state. Input personal information about both the principal and the agent or attorney-in-fact. Explain the powers of the agent. Include the date the limited power of attorney expires or will be revoked.

A limited power of attorney grants the representative that you choose (the agent or attorney-in-fact) the power to act on your behalf under limited circumstances.Under a general power of attorney, the agent or attorney-in-fact can do anything that you can do.

A Power of Attorney might be used to allow another person to sign a contract for the Principal. It can be used to give another person the authority to make health care decisions, do financial transactions, or sign legal documents that the Principal cannot do for one reason or another.

1. Durable Power of Attorney. A durable power of attorney, or DPOA, is effective immediately after you sign it (unless stated otherwise), and allows your agent to continue acting on your behalf if you become incapacitated.

A general power of attorney is comprehensive and gives your attorney-in-fact all the powers and rights that you have yourself. For example, a general power of attorney may give your attorney-in-fact the right to sign documents for you, pay your bills, and conduct financial transactions on your behalf.

General Power of Attorney. Durable Power of Attorney. Special or Limited Power of Attorney. Springing Durable Power of Attorney.

Power of Attorney broadly refers to one's authority to act and make decisions on behalf of another person in all or specified financial or legal matters.Durable POA is a specific kind of power of attorney that remains in effect even after the represented party becomes mentally incapacitated.

Limited Power of Attorney (LPOA) is an authorization that permits a portfolio manager to perform specific functions on behalf of the account owner. In general, the LPOA allows the manager to execute an agreed-upon investment strategy and take care of routine related business without contacting the account holder.