Montana Summary Instructions are a set of guidelines used to determine the eligibility of individuals for certain state programs. These instructions are used to provide an overview of the requirements and steps for applying for programs such as Montana Medicaid, Temporary Assistance for Needy Families (TANK), and the Supplemental Nutrition Assistance Program (SNAP). The instructions cover eligibility criteria; the forms and documents needed for application; and the application process. The instructions are available in both English and Spanish, making them accessible for individuals with limited English proficiency. There are two types of Montana Summary Instructions: Standard Instructions and Special Instructions. Standard Instructions are used to determine eligibility for all programs, and Special Instructions are specifically used to determine eligibility for SNAP and TANK.

Montana Summary Instructions

Description

How to fill out Montana Summary Instructions?

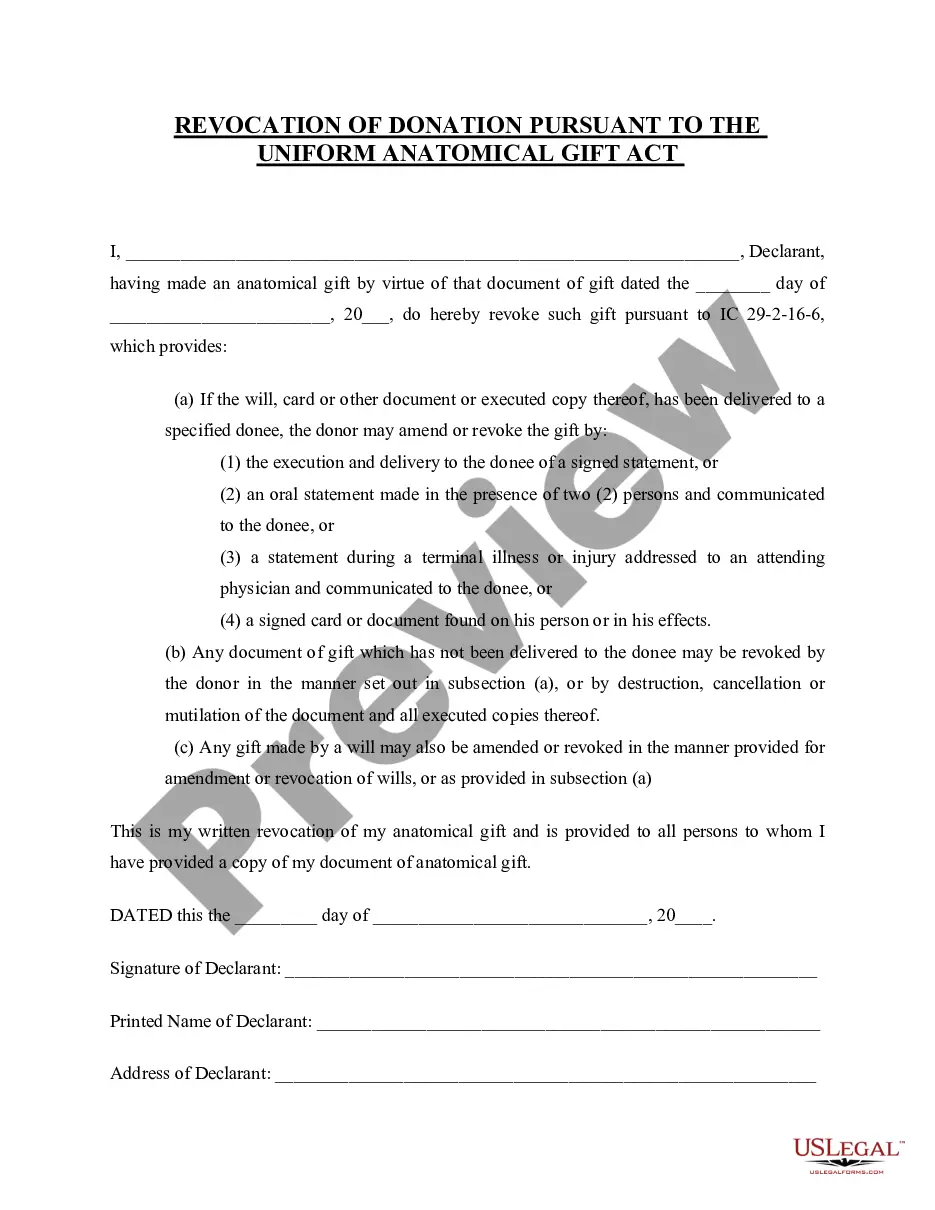

Dealing with official paperwork requires attention, accuracy, and using well-drafted blanks. US Legal Forms has been helping people countrywide do just that for 25 years, so when you pick your Montana Summary Instructions template from our library, you can be certain it complies with federal and state regulations.

Working with our service is straightforward and quick. To get the necessary document, all you’ll need is an account with a valid subscription. Here’s a quick guideline for you to find your Montana Summary Instructions within minutes:

- Make sure to carefully check the form content and its correspondence with general and legal requirements by previewing it or reading its description.

- Look for an alternative formal template if the previously opened one doesn’t match your situation or state regulations (the tab for that is on the top page corner).

- Log in to your account and download the Montana Summary Instructions in the format you need. If it’s your first time with our website, click Buy now to continue.

- Register for an account, choose your subscription plan, and pay with your credit card or PayPal account.

- Choose in what format you want to save your form and click Download. Print the blank or upload it to a professional PDF editor to submit it electronically.

All documents are created for multi-usage, like the Montana Summary Instructions you see on this page. If you need them one more time, you can fill them out without re-payment - simply open the My Forms tab in your profile and complete your document whenever you need it. Try US Legal Forms and prepare your business and personal paperwork quickly and in full legal compliance!

Form popularity

FAQ

Two weeks for e-filers. 18 weeks for paper filers.

If you're looking at your old tax filings, the department says the income tax number used for its rebate calculations is the number on line 20 of its 2021 Montana Individual Income Tax Return form.

Ing to Montana Instructions for Form 2, ?you must file a Montana Individual Income tax return if your federal gross income meets the threshold and you lived or earned income in Montana during the tax year."

Montana law allows a federal income tax deduction of up to $5,000 (or $10,000 for MFJ). Taxpayers itemizing on the federal return receive the deduction for state income taxes paid. Montana allows an itemized deduction for medical insurance premiums and long-term care insurance premiums.