In equity sharing both parties benefit from the relationship. Equity sharing, also known as housing equity partnership (HEP), gives a person the opportunity to purchase a home even if he cannot afford a mortgage on the whole of the current value. Often the remaining share is held by the house builder, property owner or a housing association. Both parties receive tax benefits. Another advantage is the return on investment for the investor, while for the occupier a home becomes readily available even when funds are insufficient.

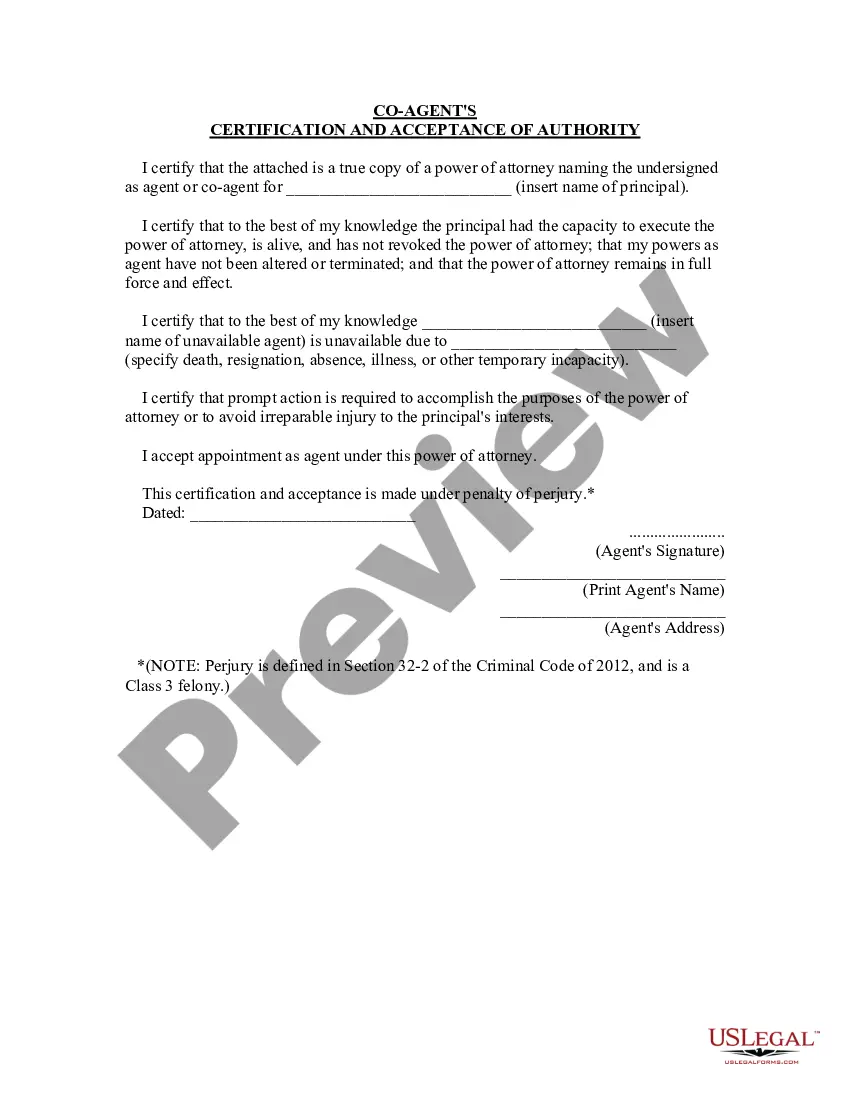

This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Montana Equity Share Agreement is a legal contract that outlines the terms and conditions of a partnership or investment agreement in the state of Montana. It is a collective agreement between parties who collaborate to invest in a venture, wherein each party contributes capital and shares in the profits, losses, and ownership of the venture. In a Montana Equity Share Agreement, the involved parties typically include investors or equity shareholders, the business or project seeking investment, and potentially a managing entity or individual responsible for overseeing the operations. This agreement facilitates the fair distribution of equity and financial interests amongst the investing parties. There are different types of Montana Equity Share Agreements that cater to specific investment scenarios. Some of these types include: 1. General Partnership: A Montana Equity Share Agreement that establishes a partnership where all parties share both profits and losses equally, and each partner has equal decision-making power. 2. Limited Partnership: In this type, the agreement differentiates between general partners and limited partners. General partners assume full responsibilities and liabilities, while limited partners have limited roles and are only liable up to their investment amount. 3. Joint Venture Agreement: This type of Montana Equity Share Agreement is designed for short-term projects or collaborations where two or more parties come together with the aim of achieving a common goal. Each participant contributes capital, knowledge, or resources and shares in the profits or losses based on their agreed-upon percentage. 4. Share Purchase Agreement: In this agreement, one party agrees to sell a portion or all of their shares to another party, allowing the buyer to become an equity shareholder in the respective business or project. 5. Convertible Equity Agreement: Montanan startup companies often make use of this agreement type, wherein investors contribute capital in exchange for equity shares that can be converted into a different class or type of shares in the future, such as preferred shares. These various types of Montana Equity Share Agreements cater to different investment structures and objectives, allowing investors and businesses to collaborate and allocate financial interests in a mutually beneficial manner. In conclusion, a Montana Equity Share Agreement is a legal contract that facilitates investment partnerships in the state of Montana. It ensures a fair distribution of equity, profits, and losses amongst the involved parties. Different types of agreements, including General Partnerships, Limited Partnerships, Joint Ventures, Share Purchase Agreements, and Convertible Equity Agreements, provide flexibility to suit varying investment scenarios.