The Montana Exchange Agreement for Real Estate is a legally binding contract specific to the state of Montana that governs the exchange of properties between parties. This agreement is designed to facilitate tax-deferred exchanges under Section 1031 of the Internal Revenue Code, wherein real estate investors can exchange one property for another of like-kind and defer paying capital gains taxes. The Montana Exchange Agreement for Real Estate outlines the terms and conditions under which the exchange will take place. It includes important details such as the identification of the properties involved in the exchange, the timeframe within which the exchange must be completed, and the roles and responsibilities of each party involved. There are various types of Montana Exchange Agreements for Real Estate, depending on the specific nature of the exchange. Some common types include simultaneous exchanges, delayed exchanges, construction exchanges, and reverse exchanges. Simultaneous exchanges occur when the properties are transferred simultaneously between the parties involved. This type of exchange may require the assistance of a qualified intermediary, who acts as a neutral third party to facilitate the exchange. Delayed exchanges allow for a time gap between the sale of the relinquished property and the acquisition of the replacement property. In this case, the proceeds from the sale are held by a qualified intermediary during the interim period, ensuring compliance with the 1031 tax-deferred exchange requirements. Construction exchanges pertain to situations where an investor wishes to use the proceeds from the sale of the relinquished property to construct or improve a replacement property. The Montana Exchange Agreement for Real Estate in this case would include specific provisions related to the construction process and the payment schedule. Reverse exchanges occur when an investor acquires the replacement property before selling the relinquished property. This type of exchange can be challenging and requires careful planning and compliance with IRS guidelines. The Montana Exchange Agreement for Real Estate for reverse exchanges would contain unique provisions to address the complexities of this transaction. In summary, the Montana Exchange Agreement for Real Estate is a contractual document that governs the exchange of properties in Montana, with the purpose of facilitating tax-deferred exchanges under Section 1031 of the Internal Revenue Code. There are different types of this agreement, including simultaneous exchanges, delayed exchanges, construction exchanges, and reverse exchanges, each with its own specific provisions.

Montana Exchange Agreement for Real Estate

Instant download

Description

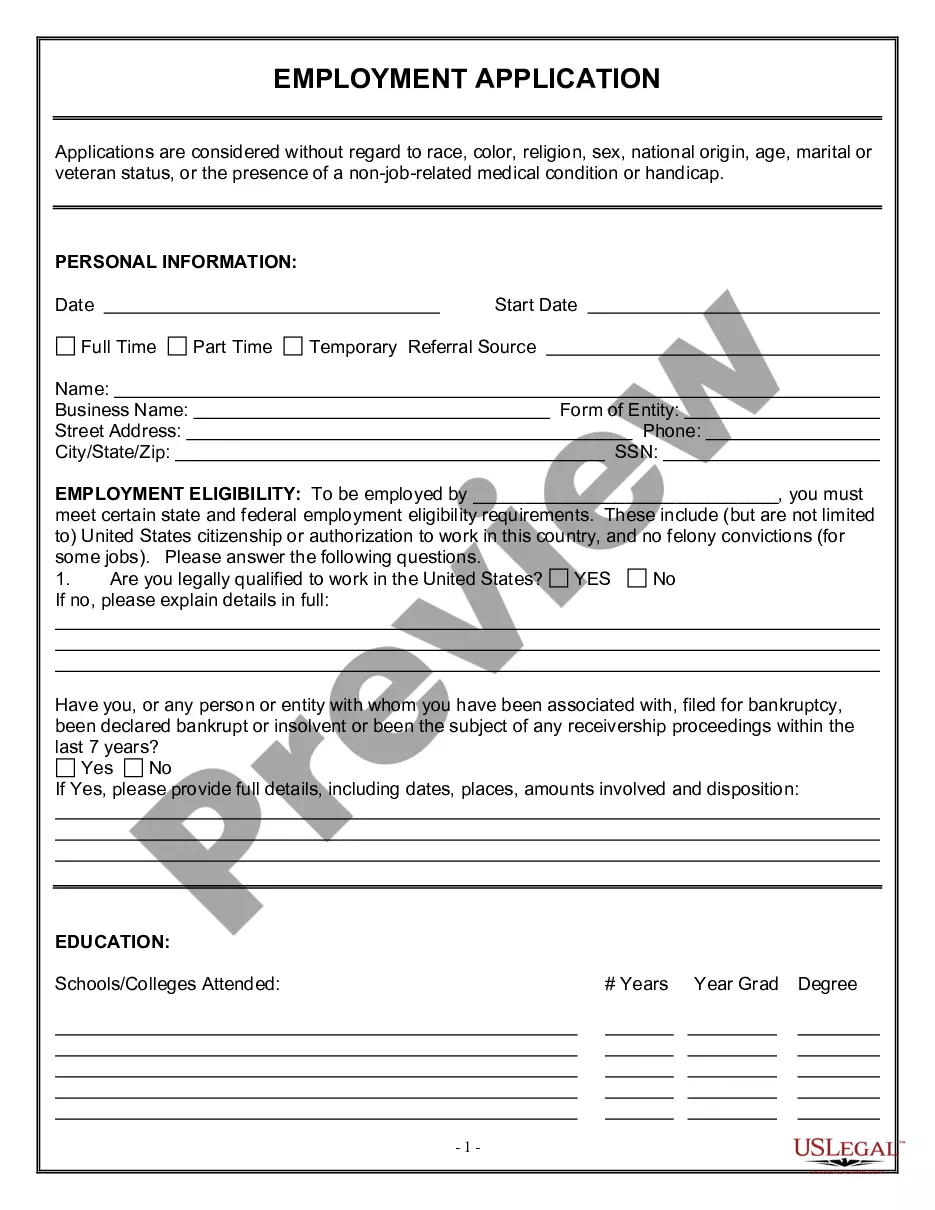

This form states that the owner of certain property desires to exchange the property for other real property of like kind and to qualify the exchange as a nonrecognition transaction. The agreement also discusses assignment of contract rights to transfer relinquished property, resolution of dispute, indemnification, and liability of exchangor.

The Montana Exchange Agreement for Real Estate is a legally binding contract specific to the state of Montana that governs the exchange of properties between parties. This agreement is designed to facilitate tax-deferred exchanges under Section 1031 of the Internal Revenue Code, wherein real estate investors can exchange one property for another of like-kind and defer paying capital gains taxes. The Montana Exchange Agreement for Real Estate outlines the terms and conditions under which the exchange will take place. It includes important details such as the identification of the properties involved in the exchange, the timeframe within which the exchange must be completed, and the roles and responsibilities of each party involved. There are various types of Montana Exchange Agreements for Real Estate, depending on the specific nature of the exchange. Some common types include simultaneous exchanges, delayed exchanges, construction exchanges, and reverse exchanges. Simultaneous exchanges occur when the properties are transferred simultaneously between the parties involved. This type of exchange may require the assistance of a qualified intermediary, who acts as a neutral third party to facilitate the exchange. Delayed exchanges allow for a time gap between the sale of the relinquished property and the acquisition of the replacement property. In this case, the proceeds from the sale are held by a qualified intermediary during the interim period, ensuring compliance with the 1031 tax-deferred exchange requirements. Construction exchanges pertain to situations where an investor wishes to use the proceeds from the sale of the relinquished property to construct or improve a replacement property. The Montana Exchange Agreement for Real Estate in this case would include specific provisions related to the construction process and the payment schedule. Reverse exchanges occur when an investor acquires the replacement property before selling the relinquished property. This type of exchange can be challenging and requires careful planning and compliance with IRS guidelines. The Montana Exchange Agreement for Real Estate for reverse exchanges would contain unique provisions to address the complexities of this transaction. In summary, the Montana Exchange Agreement for Real Estate is a contractual document that governs the exchange of properties in Montana, with the purpose of facilitating tax-deferred exchanges under Section 1031 of the Internal Revenue Code. There are different types of this agreement, including simultaneous exchanges, delayed exchanges, construction exchanges, and reverse exchanges, each with its own specific provisions.

Free preview

How to fill out Montana Exchange Agreement For Real Estate?

Have you ever been in a situation where you require documents for either professional or personal reasons nearly every single day.

There is a plethora of legal document templates accessible online, but finding ones you can rely on is not easy.

US Legal Forms offers thousands of form templates, including the Montana Exchange Agreement for Real Estate, designed to meet state and federal requirements.

Once you find the correct form, click Purchase now.

Select the pricing plan you wish, fill in the required information to create your account, and pay for the transaction using your PayPal or credit card.

- If you are already acquainted with the US Legal Forms website and have an account, simply Log In.

- After that, you can download the Montana Exchange Agreement for Real Estate template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Search for the form you need and ensure it is for your correct state/region.

- Utilize the Preview button to view the form.

- Read the description to confirm that you have selected the appropriate document.

- If the form is not what you're looking for, use the Search field to find the form that meets your needs and requirements.