Montana Direct Deposit Form for IRS

Description

How to fill out Direct Deposit Form For IRS?

Are you presently in a role where you require documents for both business or personal activities nearly every day.

There is a plethora of valid document templates available online, but locating ones you can trust isn't easy.

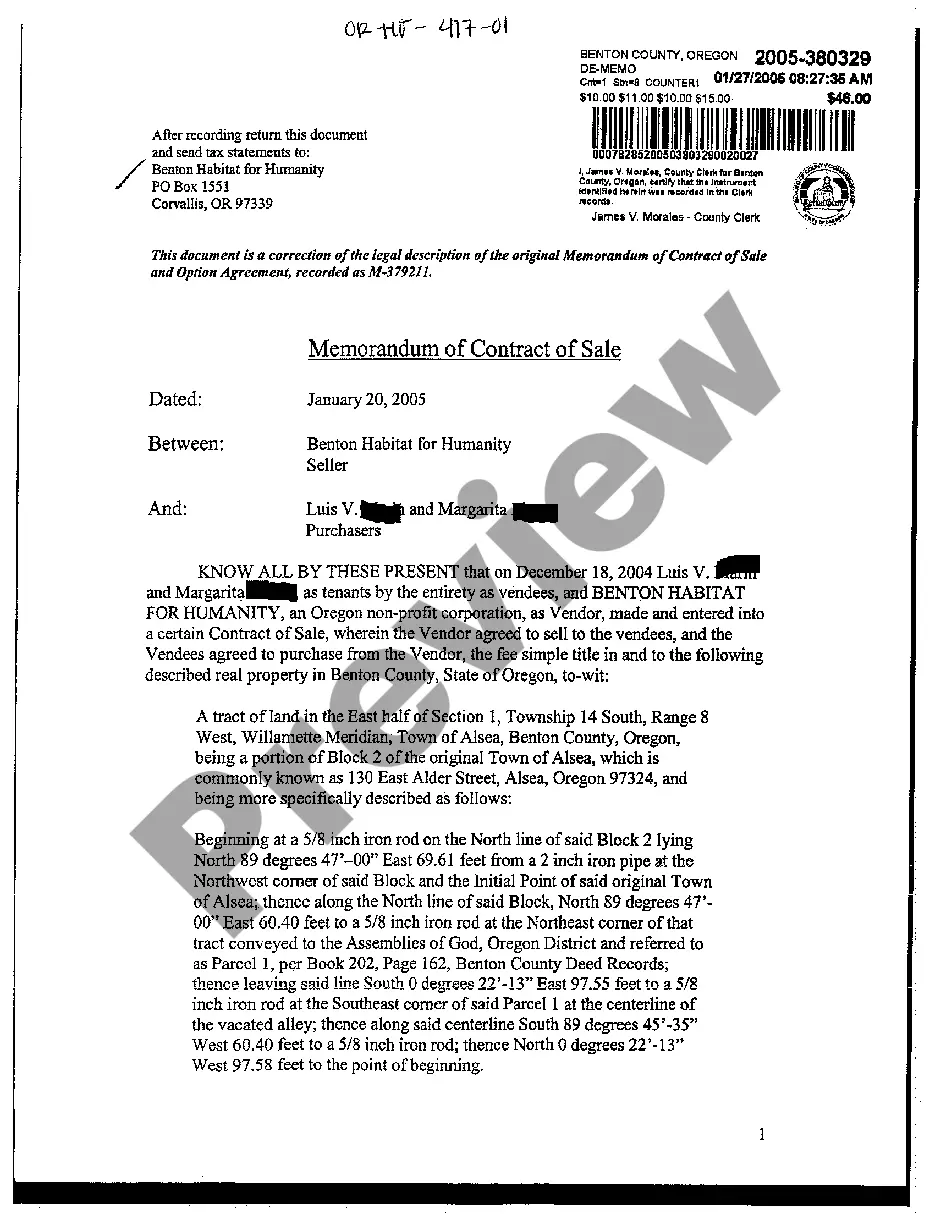

US Legal Forms offers thousands of form templates, such as the Montana Direct Deposit Form for IRS, that are crafted to fulfill state and federal standards.

Once you identify the correct form, click on Acquire now.

Select a convenient file format and download your copy.

- If you are already familiar with the US Legal Forms website and possess an account, simply Log In.

- After that, you can download the Montana Direct Deposit Form for IRS template.

- If you do not have an account and want to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct city/region.

- Use the Review button to examine the form.

- Check the description to verify that you have selected the appropriate form.

- If the form isn’t what you are looking for, utilize the Lookup field to find the form that suits your needs.

Form popularity

FAQ

It's possible to change or update your direct deposit information with the IRS for your tax refund; it's just a matter of if your return has been completely filed already. If you haven't filed your return, or if the IRS rejected your return, you can contact the IRS directly to update your bank account information.

To set up a direct deposit payment via the IRS Direct Pay system, log into your IRS account and go to the Account Home tab on your dashboard. Select the Go To Payment Options button. Scroll down the page and select Go To IRS Direct Pay under the Pay by Bank Account section.

You can use your tax software to do it electronically. Or, use IRS' Form 8888, Allocation of RefundPDF (including Savings Bond Purchases) if you file a paper return. Just follow the instructions on the form. If you want IRS to deposit your refund into just one account, use the direct deposit line on your tax form.

The bank account on file with the IRS is likely from your 2019 or 2020 tax returns, but that's only if you wanted your refund put directly into your account. Also, note the IRS said you can't contact them to change your bank account information.

No. You are not able to make changes to your bank account information on your tax return once it has been filed and accepted by the IRS. If you are referring to the stimulus check, at this time, there is no way to update or add direct deposit information.

If you want to change your bank account or routing number for a tax refund, call the IRS at 800-829-1040....If you haven't yet filed your return, or if the IRS rejected your return:Go to the File section of the H&R Block Online product.Choose how you want to file.Choose Direct Deposit.

Direct deposit is easy to use. Just select it as your refund method through your tax software and type in the account number and routing number. Or, tell your tax preparer you want direct deposit. You can even use direct deposit if you are one of the few people still filing by paper.

There's no way to change your bank information once the IRS has accepted your e-filed tax return. You can check the status of your refund by using the IRS's Where's My Refund? tool.

If you want to change your bank account or routing number for a tax refund, call the IRS at 800-829-1040....If you haven't yet filed your return, or if the IRS rejected your return:Go to the File section of the H&R Block Online product.Choose how you want to file.Choose Direct Deposit.

IRS Website Now Has Tools to Add or Change Direct Deposit Information, Track Coronavirus Stimulus Payments. Taxpayers who did not have direct deposit information on record with the IRS can now enter or change that info on the IRS website Get My Payment tool.