Montana Obtain S Corporation Status - Corporate Resolutions Forms

Description

How to fill out Obtain S Corporation Status - Corporate Resolutions Forms?

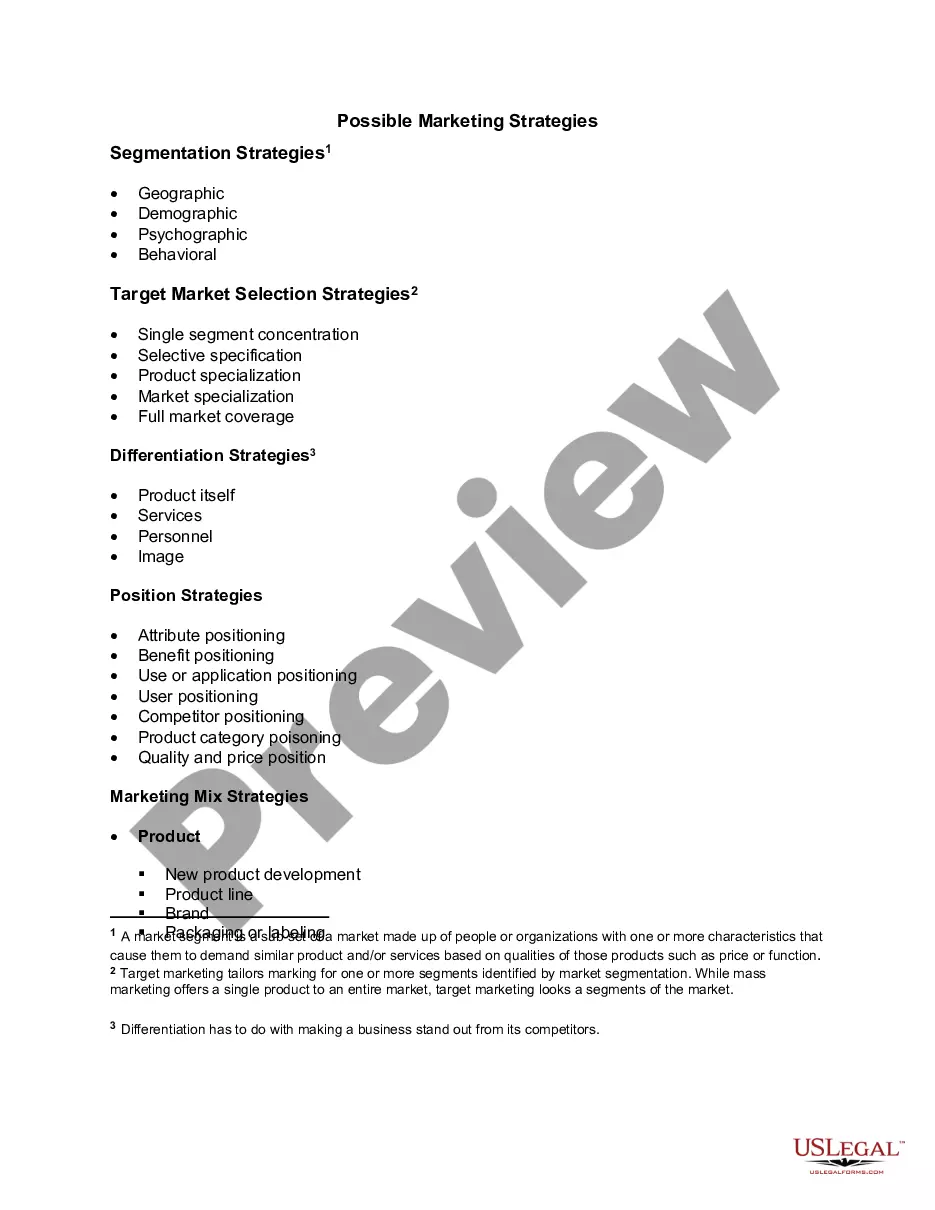

Selecting the appropriate legal document template can be challenging. Obviously, there are numerous templates accessible online, but how do you locate the legal form you need? Check out the US Legal Forms website.

The service provides a wide array of templates, such as the Montana Obtain S Corporation Status - Corporate Resolutions Forms, which can be utilized for both business and personal purposes. All documents are reviewed by experts and comply with state and federal requirements.

If you are already a registered user, Log In to your account and press the Download button to access the Montana Obtain S Corporation Status - Corporate Resolutions Forms. Use your account to search through the legal documents you have previously purchased. Visit the My documents section of your account to obtain another copy of the document you need.

US Legal Forms is the largest collection of legal documents where you can explore various document templates. Use the service to acquire professionally crafted files that adhere to state regulations.

- First, ensure you have chosen the correct form for your city/county. You can browse the document using the Preview button and review the document summary to confirm it is suitable for you.

- If the document does not meet your criteria, utilize the Search field to find the appropriate form.

- Once you are sure the document is correct, click the Buy now button to obtain the form.

- Select the pricing plan you require and fill in the necessary information. Create your account and complete the purchase using your PayPal account or credit card.

- Choose the file format and download the legal document template for your records.

- Complete, modify, and print the acquired Montana Obtain S Corporation Status - Corporate Resolutions Forms.

Form popularity

FAQ

Yes, Montana does have a Pass-Through Entity Tax (PTET), which affects businesses looking to obtain S Corporation status. This tax allows S Corporations to pass income to their shareholders, who then report it on their personal tax returns. By understanding how PTET interacts with your business structure, you can effectively manage your tax obligations. To streamline the process, consider using our platform, US Legal Forms, which offers resources and Corporate Resolutions Forms for Montana to help you obtain S Corporation status.

To obtain your S-Corp status, you need to complete and submit Form 2553 to the IRS after you've incorporated your business. Ensure you meet all eligibility requirements and adhere to the filing deadlines for your state. With the right approach, you will successfully secure your Montana Obtain S Corporation Status - Corporate Resolutions Forms and enjoy the benefits that come with it.

An S Corp can be beneficial once your business's profit reaches a certain level, often estimated around $40,000 to $50,000 a year. This structure can help you reduce self-employment taxes, making it a smart choice for many entrepreneurs. Evaluating your specific financial situation can guide you towards making the best decision regarding your Montana Obtain S Corporation Status - Corporate Resolutions Forms.

Filing for an S-Corp in Montana requires you to submit the necessary forms to both the federal and state authorities. Start with completing the Articles of Incorporation and filing it with the Secretary of State. Additionally, to obtain your S Corp status, you must fill out Form 2553 for the IRS. This process is crucial for achieving your Montana Obtain S Corporation Status - Corporate Resolutions Forms.

To start your own S Corp, begin by choosing a unique name for your business. After that, you will need to file your Articles of Incorporation with the appropriate state agency. Don't forget to file Form 2553 to obtain your S Corp status, and you will be on your way to managing your Montana Obtain S Corporation Status - Corporate Resolutions Forms efficiently.

Starting an S Corp in Montana involves several steps, beginning with selecting a business name that meets state requirements. Next, you must file Articles of Incorporation with the Secretary of State and apply for your federal S Corp election using Form 2553. With the right guidance, you can successfully achieve your Montana Obtain S Corporation Status - Corporate Resolutions Forms.

Yes, you can file for an S Corp yourself, but it requires careful attention to detail. You will need to complete and submit Form 2553 to the IRS, along with any state-specific documents. It's essential to follow the correct procedures to secure your Montana Obtain S Corporation Status - Corporate Resolutions Forms effectively.

An S-Corp must file several key forms to maintain its status. The IRS requires Form 1120S, which is the U.S. Income Tax Return for an S Corporation. Additionally, depending on your business activities, you may need to file various state forms as well, all of which are essential for ensuring your Montana Obtain S Corporation Status - Corporate Resolutions Forms remains in good standing.

Yes, Montana does accept federal extensions for S corporations. When you file for a federal extension, it allows you additional time to file your state tax return as well. Ensure you understand the specific deadlines, as this can help you stay compliant with Montana's tax laws while you work towards your Montana Obtain S Corporation Status - Corporate Resolutions Forms.

To fill out a W-9 for your small business, start by providing your business name and the appropriate federal tax classification. If your business is an S Corporation, indicate this as your structure. Don't forget to include your EIN and the business address, ensuring all details are accurate. Accessing US Legal Forms can provide helpful templates to ease your W-9 completion as you work to Montana Obtain S Corporation Status - Corporate Resolutions Forms.