The Montana Gift of Unregistered Securities pursuant to the Uniform Gifts to Minors Act offers a unique opportunity for individuals to pass on unregistered securities to minors while enjoying various benefits and flexibility. This gifting mechanism, established under Montana law, allows donors to transfer ownership of these securities to a minor beneficiary while maintaining control over the assets until the beneficiary reaches a certain age or predetermined event occurs. Unregistered securities encompass various types of financial instruments that are not traded on public exchanges or regulated by the Securities and Exchange Commission (SEC). These securities can include private company stock, limited partnership interests, promissory notes, and other similar investment vehicles. By utilizing the Montana Gift of Unregistered Securities, donors can make long-term investments more accessible to minors, potentially fostering financial literacy and wealth accumulation at an early age. One important aspect of this gifting mechanism is the Uniform Gifts to Minors Act (UGA), which provides a legal framework for the transfer of assets to minors in a custodial account. Montana has adopted its own version of the UGA, which allows donors to contribute unregistered securities to a custodian account set up for the benefit of the minor. The custodian, typically a trusted adult, manages the account and makes investment decisions on behalf of the minor until they reach the age of majority or another specified event occurs. It is worth noting that different types of Montana Gift of Unregistered Securities can exist within this framework, depending on the specific assets transferred. For instance, a donor may choose to gift private company stock to a minor beneficiary, enabling them to potentially benefit from future capital appreciation or dividends. Alternatively, another donor may decide to gift limited partnership interests in a real estate project, granting the minor the opportunity to earn income from rental properties or participate in the project's profits. The Montana Gift of Unregistered Securities pursuant to the Uniform Gifts to Minors Act provides several advantages for both donors and beneficiaries. Donors can transfer assets while minimizing gift and estate taxes, as well as potentially maximizing the impact of their gifts. By passing on unregistered securities, donors may also support local businesses or innovative ventures, contributing to economic growth within Montana and beyond. For beneficiaries, this gifting mechanism offers the potential for long-term wealth creation and financial education. As minors become involved in managing their custodial accounts, they can gain firsthand experience in investment decision-making, monitoring market trends, and understanding the risks and rewards associated with various types of unregistered securities. These skills and knowledge can prove invaluable as they grow into adulthood and navigate their financial futures. In conclusion, the Montana Gift of Unregistered Securities pursuant to the Uniform Gifts to Minors Act presents a beneficial tool for those wishing to pass on unregistered securities to minors. By taking advantage of this legal framework, donors can not only provide financial support but also empower the next generation to develop a keen understanding of investments and wealth accumulation. Whether it involves private company stock, limited partnership interests, or other unregistered securities, this gifting mechanism allows for customized, long-term planning while adhering to Montana's legal guidelines.

Montana Gift of Unregistered Securities pursuant to the Uniform Gifts to Minors Act

Description

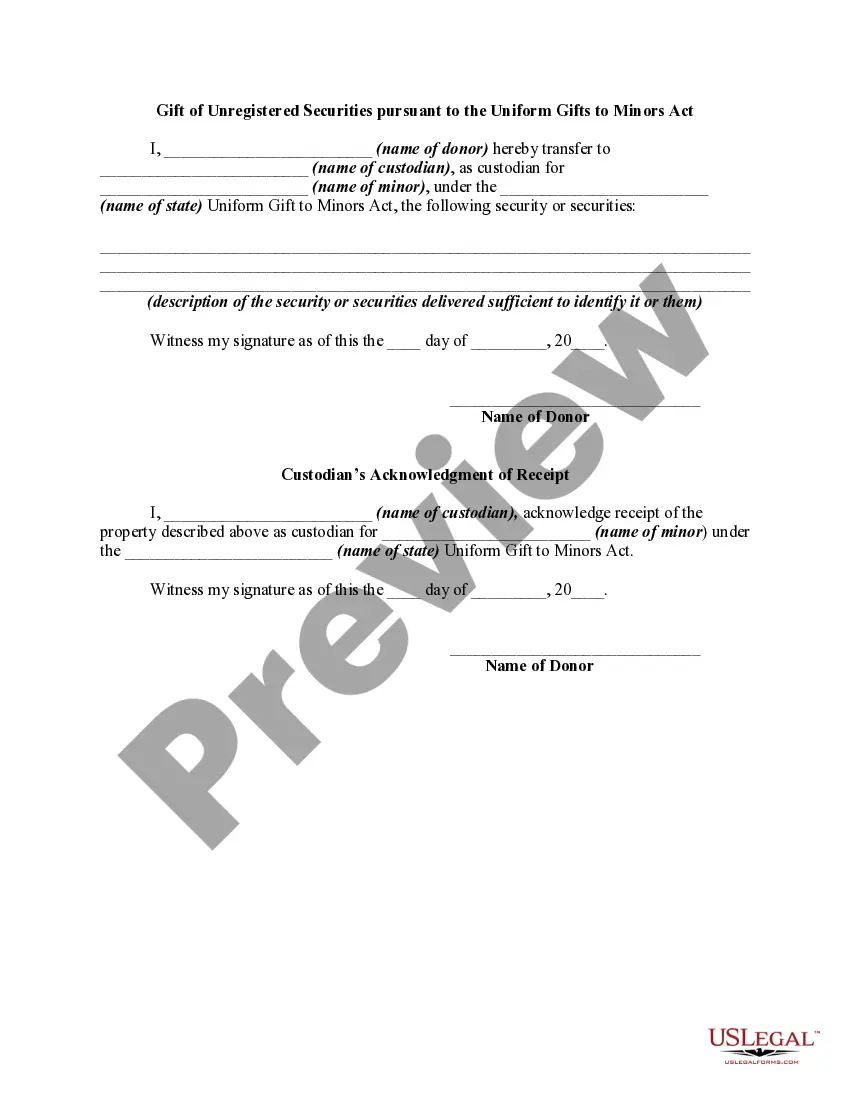

How to fill out Montana Gift Of Unregistered Securities Pursuant To The Uniform Gifts To Minors Act?

Finding the right legal document template can be quite a have a problem. Of course, there are tons of templates available on the net, but how can you obtain the legal kind you will need? Take advantage of the US Legal Forms web site. The service delivers thousands of templates, such as the Montana Gift of Unregistered Securities pursuant to the Uniform Gifts to Minors Act, that you can use for enterprise and personal requirements. All the varieties are checked by specialists and meet state and federal needs.

In case you are previously listed, log in to your accounts and click the Down load key to have the Montana Gift of Unregistered Securities pursuant to the Uniform Gifts to Minors Act. Use your accounts to appear with the legal varieties you possess bought earlier. Proceed to the My Forms tab of your accounts and have one more duplicate in the document you will need.

In case you are a brand new end user of US Legal Forms, allow me to share basic recommendations that you should adhere to:

- First, make certain you have selected the right kind for your personal metropolis/state. You are able to examine the shape using the Review key and read the shape explanation to guarantee it is the best for you.

- If the kind will not meet your expectations, make use of the Seach discipline to get the right kind.

- When you are positive that the shape is proper, click on the Get now key to have the kind.

- Opt for the pricing program you desire and enter in the needed info. Create your accounts and purchase your order making use of your PayPal accounts or charge card.

- Choose the file file format and download the legal document template to your system.

- Comprehensive, modify and print out and signal the acquired Montana Gift of Unregistered Securities pursuant to the Uniform Gifts to Minors Act.

US Legal Forms is the largest collection of legal varieties that you can discover a variety of document templates. Take advantage of the service to download professionally-produced papers that adhere to state needs.