Montana Credit Cardholder's Report of Lost or Stolen Credit Card is an important document that cardholders must fill out immediately if they notice their credit card missing or stolen. This report allows individuals to notify their credit card issuer about the potential fraud or unauthorized use of their card, ensuring prompt action to protect their account and financial security. Upon discovering the loss or theft of the credit card, it is essential to act quickly by contacting the credit card issuer's customer service helpline or utilizing their online portal, specifically designed to report such incidents. The Montana Credit Cardholder's Report of Lost or Stolen Credit Card form may also be available for download on the issuer's website, enabling cardholders to submit the required information efficiently. This report typically asks for essential details, including the cardholder's personal information, such as full name, address, phone number, and email address. Additionally, the form usually requires the credit card number, expiration date, and the three-digit CVV code located on the back of the card or the four-digit code on the front for American Express cards. It is crucial to provide accurate and complete information to expedite the cancellation or temporary freeze of the credit card. By doing so, the likelihood of unauthorized charges decreases significantly, preventing potential financial loss and identity theft. Montana Credit Cardholder's Report of Lost or Stolen Credit Card usually offers options for the cardholder to select the type of loss or theft they experienced. These options may include: 1. Lost Credit Card: This option applies when the cardholder is unsure about the exact circumstances of the disappearance of their credit card. It might be misplaced or unintentionally left behind. 2. Stolen Credit Card: If the cardholder believes their credit card was stolen due to theft or unlawful activity, this option should be chosen. It prompts additional security measures to be taken. 3. Suspected Fraudulent Activity: In cases where the cardholder notices fraudulent charges or suspicious activity on their credit card statement before realizing the loss or theft, they should select this option. Timely reporting helps the credit card company investigate and resolve the issue promptly. 4. Found Credit Card After Reporting Lost or Stolen: Occasionally, a cardholder may report their credit card as lost or stolen but later discovers it. In such instances, they should inform the credit card issuer immediately to avoid any inconvenience or unnecessary card replacement. Remember, reporting a Montana Credit Cardholder's Report of Lost or Stolen Credit Card promptly is crucial to protect yourself from financial liability and minimize potential fraud. By accurately filling out the form and providing all required information, you can assist the credit card issuer in resolving the matter efficiently and ensuring the security of your funds.

Montana Credit Cardholder's Report of Lost or Stolen Credit Card

Description

How to fill out Montana Credit Cardholder's Report Of Lost Or Stolen Credit Card?

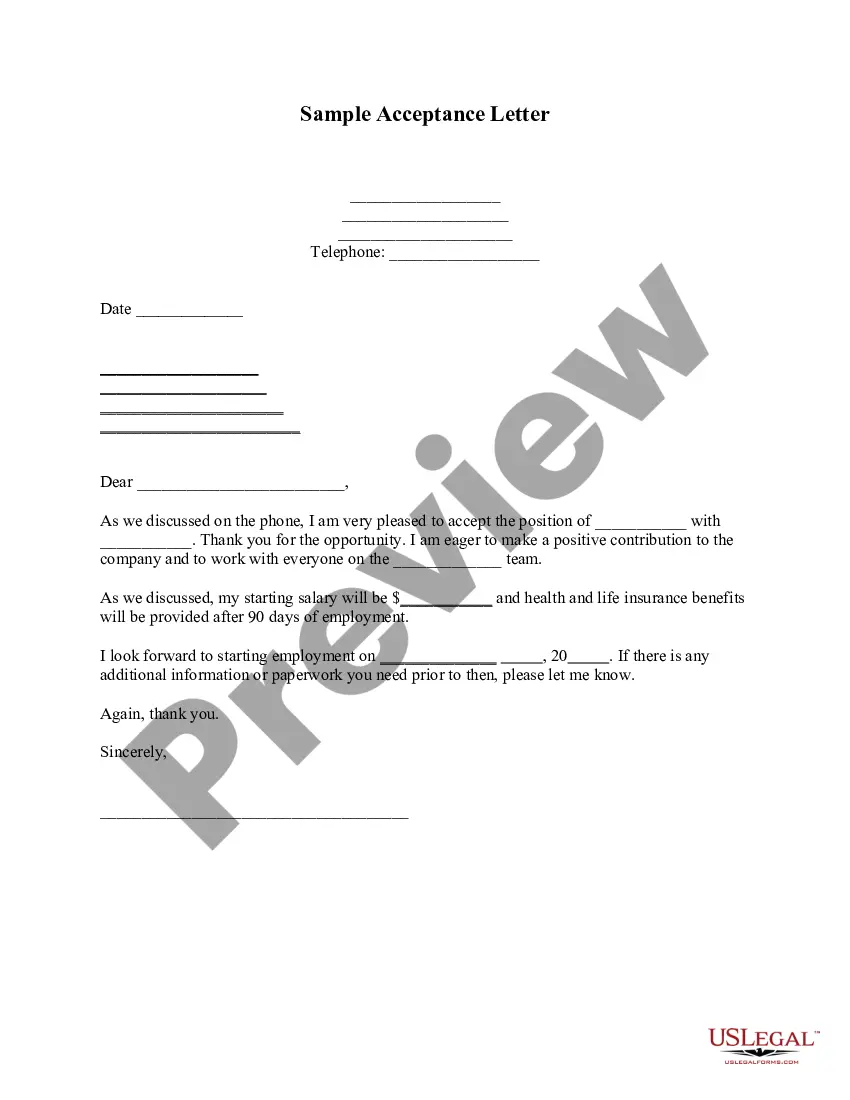

Choosing the right lawful document web template can be quite a struggle. Of course, there are a lot of web templates available on the Internet, but how would you find the lawful form you need? Use the US Legal Forms web site. The assistance provides a large number of web templates, such as the Montana Credit Cardholder's Report of Lost or Stolen Credit Card, that can be used for business and private needs. Every one of the forms are checked by experts and meet up with federal and state specifications.

If you are currently signed up, log in to your account and then click the Download button to get the Montana Credit Cardholder's Report of Lost or Stolen Credit Card. Utilize your account to look throughout the lawful forms you have acquired earlier. Proceed to the My Forms tab of your own account and obtain another backup in the document you need.

If you are a whole new consumer of US Legal Forms, allow me to share simple instructions that you should adhere to:

- Very first, make certain you have chosen the correct form to your metropolis/region. You are able to examine the shape making use of the Preview button and browse the shape outline to make sure this is the best for you.

- When the form does not meet up with your needs, take advantage of the Seach area to get the proper form.

- Once you are sure that the shape is suitable, click on the Buy now button to get the form.

- Pick the costs plan you would like and enter in the required information and facts. Build your account and buy the order using your PayPal account or bank card.

- Opt for the data file file format and download the lawful document web template to your device.

- Complete, modify and printing and signal the acquired Montana Credit Cardholder's Report of Lost or Stolen Credit Card.

US Legal Forms will be the most significant library of lawful forms that you can discover different document web templates. Use the service to download skillfully-made files that adhere to express specifications.