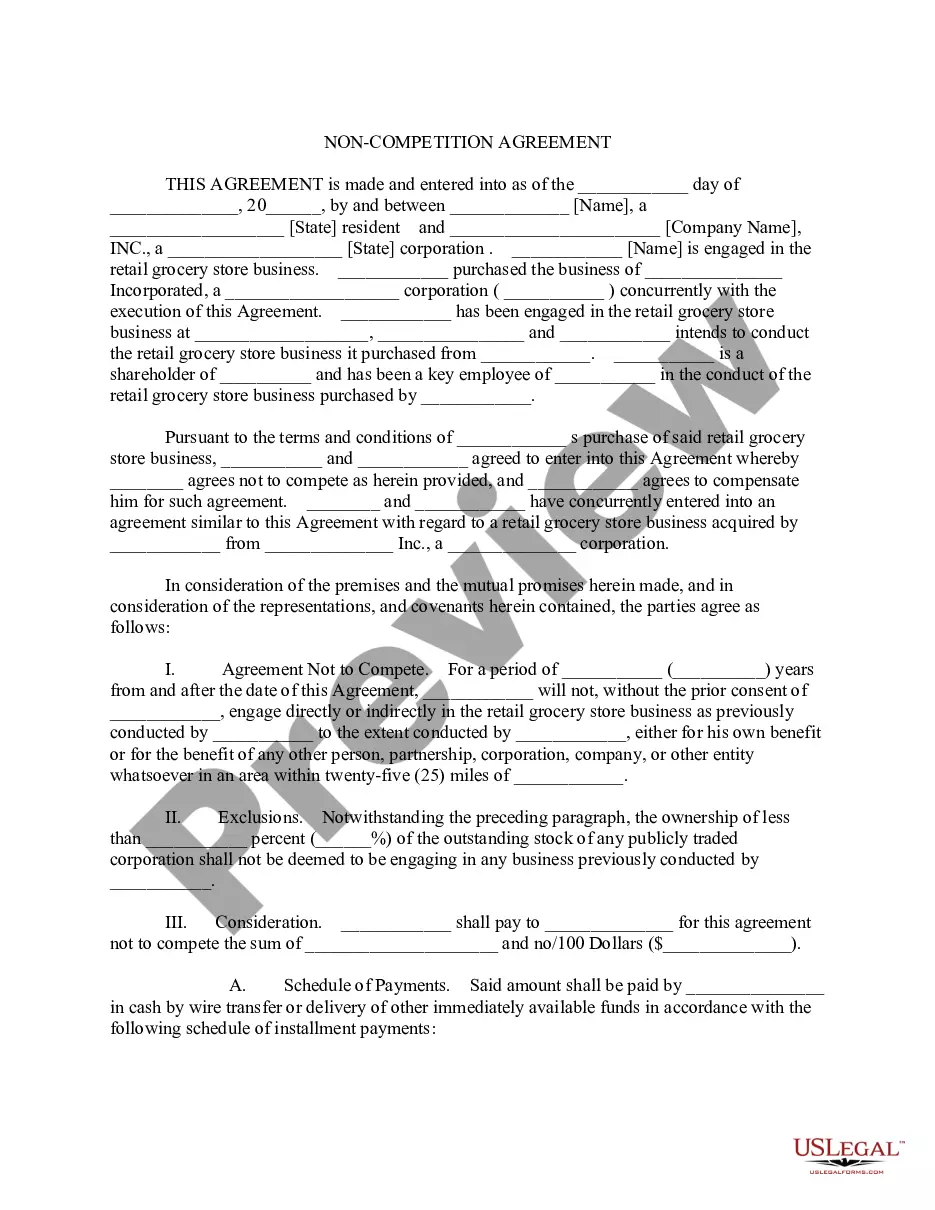

Montana Sale of Business - Noncompetition Agreement - Asset Purchase Transaction

Description

How to fill out Sale Of Business - Noncompetition Agreement - Asset Purchase Transaction?

You can spend hours online searching for the authentic document template that fulfills the state and federal requirements you need.

US Legal Forms offers thousands of legal forms that have been reviewed by experts.

You can easily download or print the Montana Sale of Business - Noncompetition Agreement - Asset Purchase Transaction from the service.

If available, utilize the Preview option to review the document template as well.

- If you already have a US Legal Forms account, you can Log In and then click the Get option.

- Then, you can complete, modify, print, or sign the Montana Sale of Business - Noncompetition Agreement - Asset Purchase Transaction.

- Every legal document template you acquire is yours permanently.

- To obtain another copy of any purchased form, visit the My documents tab and click the appropriate option.

- If you are using the US Legal Forms site for the first time, follow the simple instructions below.

- First, ensure that you have selected the correct document template for the county/town of your choice.

- Review the form description to confirm you have chosen the right template.

Form popularity

FAQ

A shareholders' agreement may impose various restrictions such as limits on share transfer, obligations to buy shares, or specific voting rights. These restrictions aim to protect the interests of the shareholders and ensure smooth operation of the business. During a Montana Sale of Business, it is vital to understand these limitations to avoid future conflicts. Seeking legal assistance helps you navigate these complexities and create a balanced agreement.

A shareholders' agreement can set specific terms and conditions that differ from the provisions of the Company Act. However, it cannot completely override statutory requirements established by the Act, such as confidentiality and fiduciary duties. In the context of a Montana Sale of Business, understanding the interplay between these agreements is crucial. Legal advice ensures that your shareholders' agreement aligns with the statutory framework while achieving your objectives.

While buyer's counsel typically prepares the first draft of an asset purchase agreement, there may be circumstances (such as an auction) when seller's counsel prepares the first draft.

An asset acquisition is the purchase of a company by buying its assets instead of its stock. An individual who owns stock in a company is called a shareholder and is eligible to claim part of the company's residual assets and earnings (should the company ever be dissolved).

Provisions of an APA may include payment of purchase price, monthly installments, liens and encumbrances on the assets, condition precedent for the closing, etc. An APA differs from a stock purchase agreement (SPA) under which company shares, title to assets, and title to liabilities are also sold.

Recording the purchase and its effects on your balance sheet can be done by:Creating an assets account and debiting it in your records according to the value of your assets.Creating another cash account and crediting it by how much cash you put towards the purchase of the assets.More items...

An asset purchase agreement is an agreement between a buyer and a seller to purchase property, like business assets or real property, either on their own or as part of a merger-acquisition.

An asset acquisition strategy is when one company buys another company through the process of buying its assets, as opposed to a traditional acquisition strategy, which involves the purchase of stock.

An asset purchase agreement is exactly what it sounds like: an agreement between a buyer and a seller to transfer ownership of an asset for a price. The difference between this type of contract and a merger-acquisition transaction is that the seller can decide which specific assets to sell and exclude.

An asset purchase agreement is exactly what it sounds like: an agreement between a buyer and a seller to transfer ownership of an asset for a price. The difference between this type of contract and a merger-acquisition transaction is that the seller can decide which specific assets to sell and exclude.