Montana Letter to Creditors Notifying Them of Identity Theft for New Accounts

Description

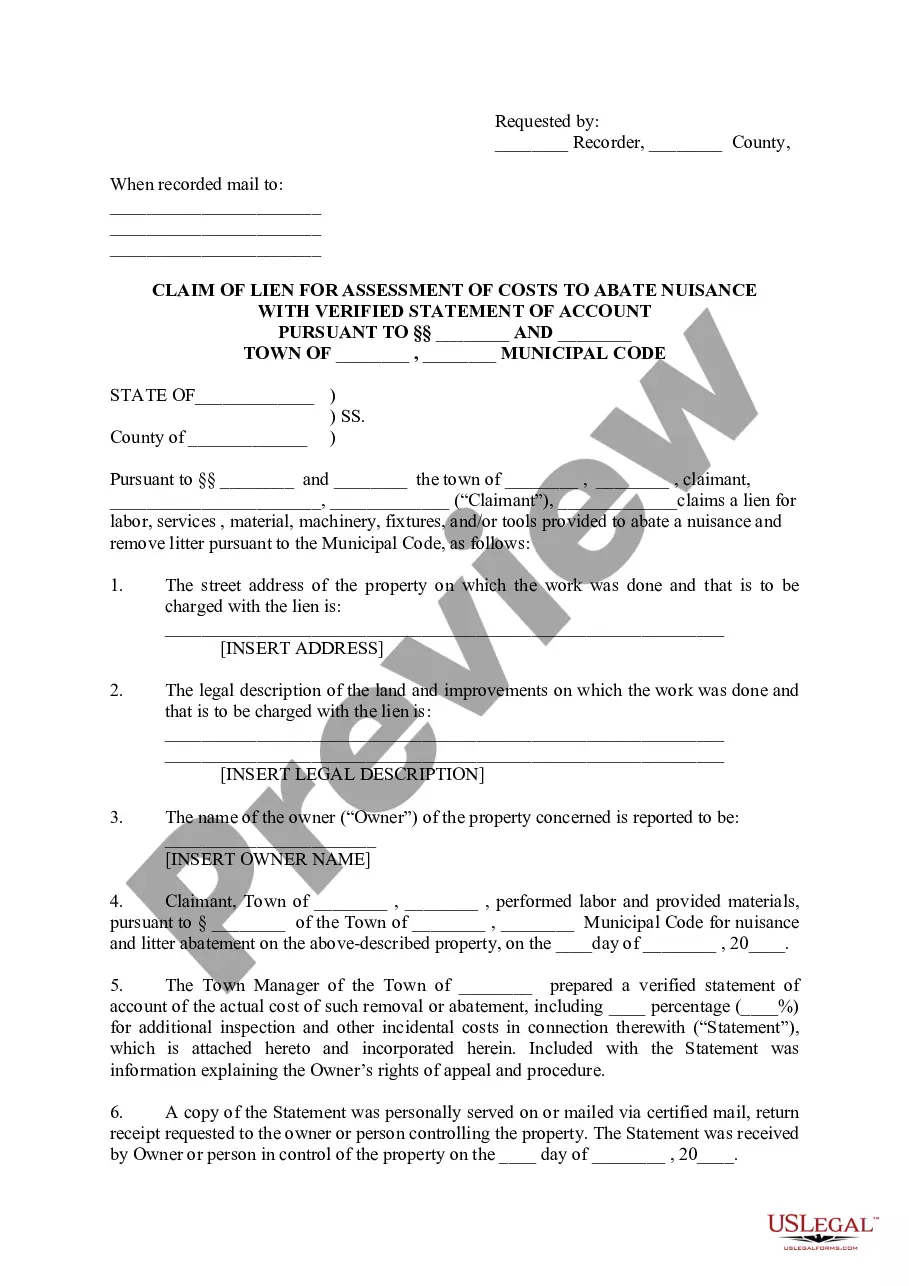

How to fill out Letter To Creditors Notifying Them Of Identity Theft For New Accounts?

If you want to comprehensive, download, or produce lawful document themes, use US Legal Forms, the greatest collection of lawful forms, which can be found on-line. Make use of the site`s simple and practical research to discover the paperwork you need. Different themes for company and personal reasons are sorted by classes and claims, or keywords. Use US Legal Forms to discover the Montana Letter to Creditors Notifying Them of Identity Theft for New Accounts in a couple of click throughs.

When you are already a US Legal Forms consumer, log in for your profile and click on the Download option to have the Montana Letter to Creditors Notifying Them of Identity Theft for New Accounts. You can also gain access to forms you formerly downloaded from the My Forms tab of your own profile.

If you use US Legal Forms initially, follow the instructions beneath:

- Step 1. Be sure you have chosen the form for your correct town/country.

- Step 2. Make use of the Review method to look over the form`s information. Never neglect to read the description.

- Step 3. When you are not satisfied together with the form, use the Search industry towards the top of the screen to locate other types of the lawful form format.

- Step 4. After you have identified the form you need, click the Purchase now option. Opt for the prices prepare you like and put your credentials to sign up for an profile.

- Step 5. Procedure the deal. You can utilize your credit card or PayPal profile to accomplish the deal.

- Step 6. Select the formatting of the lawful form and download it on your product.

- Step 7. Full, modify and produce or indication the Montana Letter to Creditors Notifying Them of Identity Theft for New Accounts.

Every single lawful document format you get is your own for a long time. You may have acces to each form you downloaded within your acccount. Click the My Forms section and decide on a form to produce or download again.

Be competitive and download, and produce the Montana Letter to Creditors Notifying Them of Identity Theft for New Accounts with US Legal Forms. There are many skilled and status-specific forms you can utilize for your company or personal demands.

Form popularity

FAQ

7 Steps to take after your personal data is compromised online Change your passwords. ... Sign up for two-factor authentication. ... Check for updates from the company. ... Watch your accounts, check your credit reports. ... Consider identity theft protection services. ... Freeze your credit. ... Go to IdentityTheft.gov.

First, contact the companies or banks where you know the fraudulent activity occurred. Stop any accounts that have been opened without your permission or tampered with. Then, file a report with the Federal Trade Commission (FTC).

What they want are account numbers, passwords, Social Security numbers, and other confidential information that they can use to loot your checking account or run up bills on your credit cards. Identity thieves can take out loans or obtain credit cards and even driver's licenses in your name.

I am a victim of identity theft, and I did not make [this/these] charge(s). I request that you remove the fraudulent charge(s) and any related finance charge and other charges from my account, send me an updated and accurate statement, and close the account (if applicable).

To report identity theft, contact: The Federal Trade Commission (FTC) online at IdentityTheft.gov or call 1-877-438-4338. The three major credit reporting agencies. Ask them to place fraud alerts and a credit freeze on your accounts.

File a police report about the identity theft, and get a copy of the police report or the report number. Bring your FTC Identity Theft Affidavit when you file a police report. Attach your FTC Identity Theft Affidavit to your police report to make an Identity Theft Report.

Dear Sir or Madam: I am a victim of identity theft. I recently learned that my personal information was used to open an account at your company. I did not open or authorize this account, and I therefore request that it be closed immediately.

To make certain that you do not become responsible for any debts incurred in your name by an identity thief, you must prove that you didn't create the debt. Taking action quickly is important, so don't delay. Create a personalized recovery plan at IdentityTheft.gov that walks you through each step of the process.