Montana Letter to Creditors Notifying Them of Identity Theft of Minor

Description

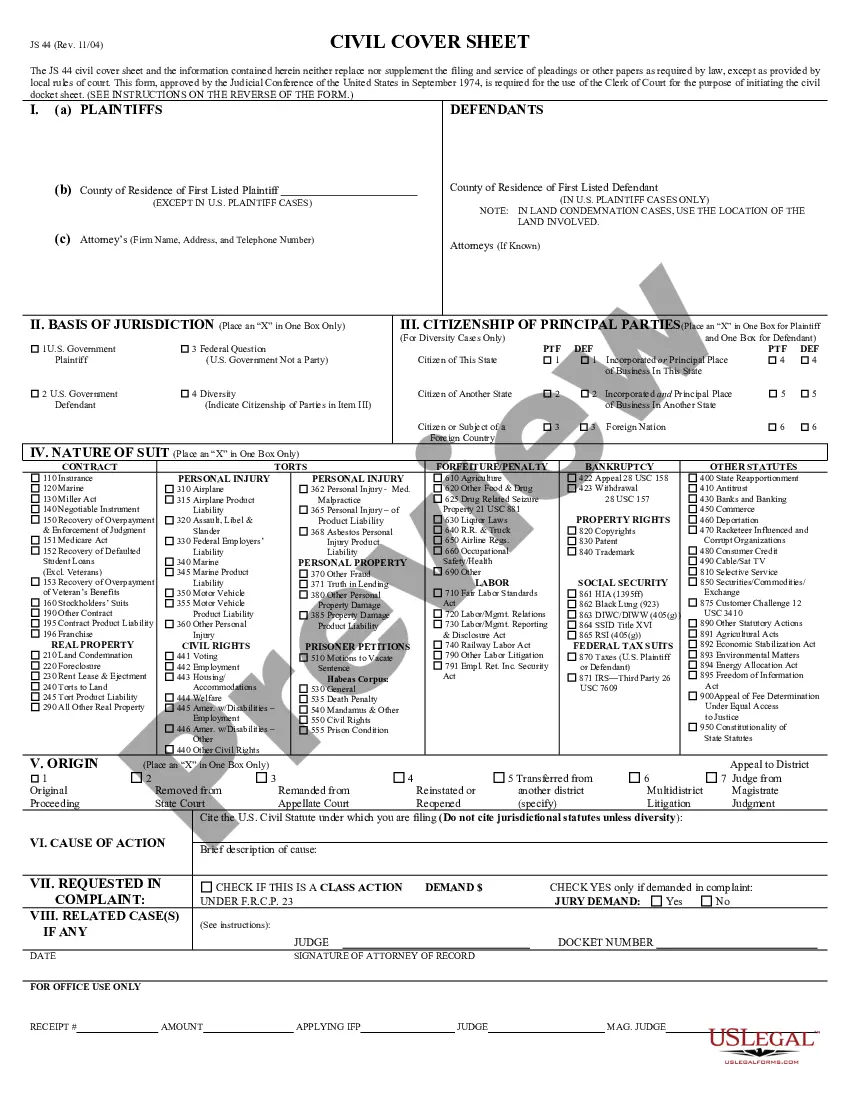

How to fill out Letter To Creditors Notifying Them Of Identity Theft Of Minor?

Are you presently inside a situation that you need to have papers for either business or individual uses just about every day time? There are tons of authorized record templates available on the net, but locating kinds you can rely isn`t simple. US Legal Forms provides thousands of develop templates, like the Montana Letter to Creditors Notifying Them of Identity Theft of Minor, which can be published to meet state and federal requirements.

When you are already familiar with US Legal Forms web site and possess your account, simply log in. Afterward, it is possible to down load the Montana Letter to Creditors Notifying Them of Identity Theft of Minor format.

Should you not have an profile and would like to start using US Legal Forms, abide by these steps:

- Discover the develop you require and make sure it is for the appropriate city/region.

- Use the Review switch to analyze the shape.

- Browse the explanation to ensure that you have selected the appropriate develop.

- If the develop isn`t what you are seeking, use the Look for area to obtain the develop that suits you and requirements.

- When you discover the appropriate develop, click Purchase now.

- Opt for the costs program you desire, complete the required information and facts to produce your account, and pay for the order utilizing your PayPal or credit card.

- Select a hassle-free paper formatting and down load your version.

Get each of the record templates you have bought in the My Forms food selection. You can get a extra version of Montana Letter to Creditors Notifying Them of Identity Theft of Minor whenever, if needed. Just click the needed develop to down load or printing the record format.

Use US Legal Forms, the most extensive collection of authorized varieties, in order to save efforts and steer clear of errors. The service provides expertly created authorized record templates that can be used for a variety of uses. Make your account on US Legal Forms and initiate generating your way of life easier.

Form popularity

FAQ

If you have been a victim of identity theft, the Identity Theft Statement helps you notify financial institutions, credit card issuers and other companies that the identity theft occurred, tell them that you did not create the debt or charges, and give them information they need to begin an investigation.

To report identity theft, contact: The Federal Trade Commission (FTC) online at IdentityTheft.gov or call 1-877-438-4338. The three major credit reporting agencies. Ask them to place fraud alerts and a credit freeze on your accounts.

I am a victim of identity theft, and did not make the charge(s). I am requesting that the item(s) be blocked to correct my credit report. Enclosed are copies of (describe any enclosed documents) supporting my position. Please investigate this (these) matter(s) and block the disputed item(s) as soon as possible.

You also may ask for proof of a claim of identity theft, such as an Identity Theft Report issued by the FTC or a police report. An FTC Identity Theft Report subjects the person filing the report to criminal penalties if the information is false, and businesses can treat it as they would a police report.

Dear Sir or Madam: I am a victim of identity theft. I recently learned that my personal information was used to open an account at your company. I did not open or authorize this account, and I therefore request that it be closed immediately.