This form set up what is known as present interest trusts, with the intention of meeting the requirements of Section 2503(c) of the Internal Revenue Code.

Montana Trust Agreement for Minors Qualifying for Annual Gift Tax Exclusion - Multiple Trusts for Children

Description

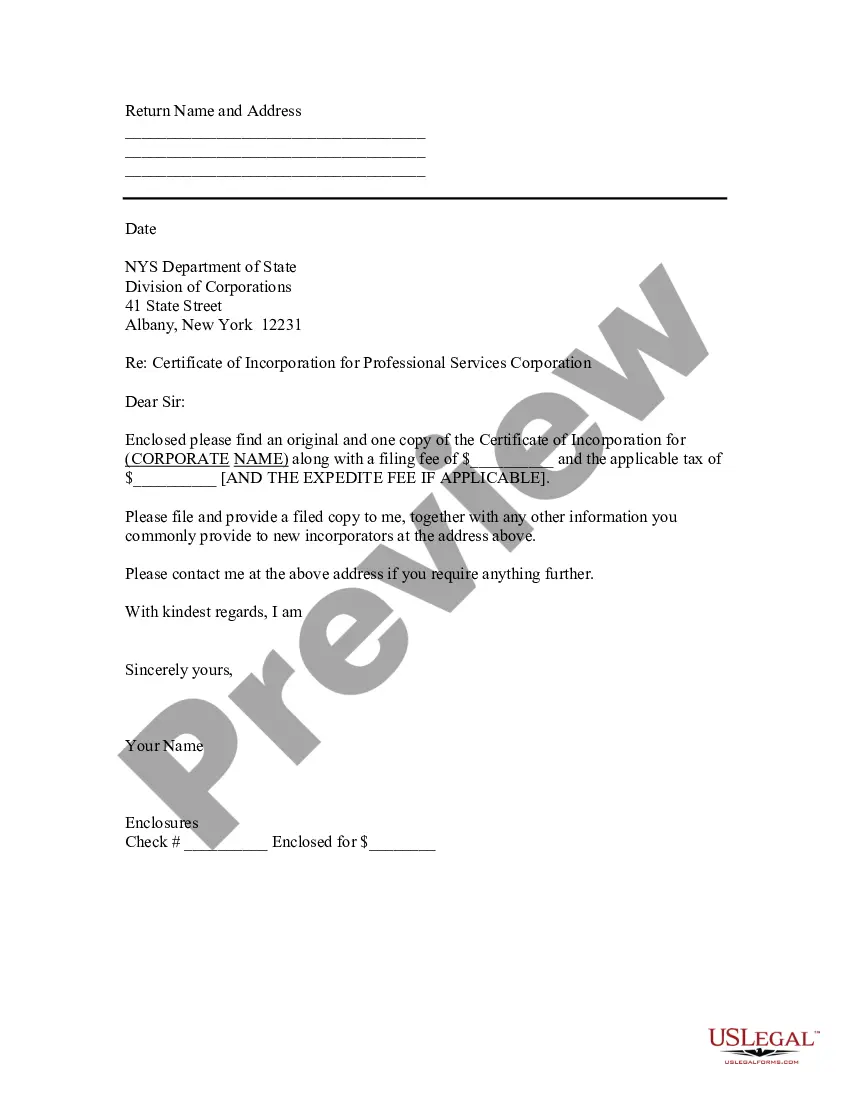

How to fill out Trust Agreement For Minors Qualifying For Annual Gift Tax Exclusion - Multiple Trusts For Children?

Are you currently in a situation where you require documents for occasional business or personal purposes almost every day.

There are numerous legal document templates accessible online, but locating those you can trust is not easy.

US Legal Forms offers thousands of form templates, including the Montana Trust Agreement for Minors Qualifying for Annual Gift Tax Exclusion - Multiple Trusts for Children, which can be tailored to meet state and federal requirements.

Select a suitable document format and download your copy.

You can find all the document templates you have purchased in the My documents section. You can obtain an additional copy of the Montana Trust Agreement for Minors Qualifying for Annual Gift Tax Exclusion - Multiple Trusts for Children at any time if needed. Click on the desired template to download or print the document.

Utilize US Legal Forms, the most extensive collection of legal forms, to save time and avoid mistakes. The service provides professionally drafted legal document templates that can be used for various purposes. Create your account on US Legal Forms and start making your life a little easier.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Once logged in, you can download the Montana Trust Agreement for Minors Qualifying for Annual Gift Tax Exclusion - Multiple Trusts for Children template.

- If you do not have an account and wish to use US Legal Forms, follow these steps.

- Select the template you need and ensure it is for your specific city/state.

- Use the Review button to examine the form.

- Read through the description to confirm that you have chosen the correct template.

- If the form is not what you are looking for, use the Search feature to find a template that fits your needs.

- When you find the correct form, click Buy now.

- Choose the pricing plan you want, provide the necessary information to create your account, and pay for the order using your PayPal or credit card.

Form popularity

FAQ

Montana does not currently impose a state gift tax, allowing for greater flexibility in gifting to minors. This means you can make gifts under the federal annual exclusion limit without incurring additional taxes. Utilizing a Montana Trust Agreement for Minors Qualifying for Annual Gift Tax Exclusion - Multiple Trusts for Children allows you to strategically gift assets while maximizing your tax advantages.

Montana does not have an inheritance tax, making it more favorable for beneficiaries receiving assets. This lack of an inheritance tax means that when you establish a Montana Trust Agreement for Minors Qualifying for Annual Gift Tax Exclusion - Multiple Trusts for Children, your children will receive their inheritance without a tax penalty. This can significantly benefit their financial future.

Montana does impose a capital gains tax, which can affect the overall return on investments. However, there are certain exemptions and deductions available that can alleviate the tax burden. When considering a Montana Trust Agreement for Minors Qualifying for Annual Gift Tax Exclusion - Multiple Trusts for Children, understanding capital gains tax implications can be crucial for effective wealth management.

Yes, you can convert a UTMA account to a trust under certain circumstances. This conversion might be beneficial if you seek greater control over how the assets are managed and distributed. By establishing a Montana Trust Agreement for Minors Qualifying for Annual Gift Tax Exclusion - Multiple Trusts for Children, you can provide specific instructions that will enhance the protection of your children's assets.

The Uniform Transfers to Minors Act (UTMA) in Montana allows adults to transfer assets to minors without the need for a formal trust. This act facilitates the management of these assets until the minor reaches the age of majority. By using a UTMA, you can ensure that your minor children receive their inheritance while qualifying for the Montana Trust Agreement for Minors Qualifying for Annual Gift Tax Exclusion - Multiple Trusts for Children.

Since Montana does not have an inheritance tax, your focus should be more about strategic planning. Establishing a Montana Trust Agreement for Minors Qualifying for Annual Gift Tax Exclusion - Multiple Trusts for Children can help manage assets efficiently. This approach ensures beneficial wealth transfer to the next generation while minimizing other tax implications.

Montana does not impose an inheritance tax, allowing heirs to inherit without any additional tax burden. This policy makes it an excellent choice for families utilizing a Montana Trust Agreement for Minors Qualifying for Annual Gift Tax Exclusion - Multiple Trusts for Children. Such agreements help accumulate wealth without the worry of inheritance tax deducting from your estate.

In Montana, the gift tax rate aligns with federal regulations, varying from 18% to 40%, depending on the amount gifted. Utilizing a Montana Trust Agreement for Minors Qualifying for Annual Gift Tax Exclusion - Multiple Trusts for Children can help circumvent this tax. By gifting within the annual exclusion limit, you can ensure no gift tax applies to those contributions.

To avoid gift tax, consider using a Montana Trust Agreement for Minors Qualifying for Annual Gift Tax Exclusion - Multiple Trusts for Children. This strategy allows you to make annual gifts under the exclusion limit. By structuring your gifts through trusts, you can effectively manage how and when gifts are distributed, ensuring they qualify for the exemption.

The Uniform Transfers to Minors Act (UTMA) allows custodians to manage assets for minors until they reach the age specified by state law, which is typically 21 years old. However, some states permit distributions as early as 18, depending on local statutes. If you need guidance for the effective management of these assets, consider establishing a Montana Trust Agreement for Minors Qualifying for Annual Gift Tax Exclusion - Multiple Trusts for Children, ensuring the transition is smooth and in the child's best interest.