Montana Letter to Credit Reporting Company or Bureau Regarding Known Imposter Identity Theft: Identity theft is a serious issue that affects millions of individuals and can have detrimental effects on their financial well-being. If you have been a victim of known imposter identity theft in Montana, it is crucial to take immediate action to protect your credit and personal information. One effective step you can take is to send a letter to the credit reporting company or bureau outlining the details of the incident and requesting their assistance in resolving the matter. When writing a Montana Letter to Credit Reporting Company or Bureau Regarding Known Imposter Identity Theft, it is essential to include relevant keywords that highlight the specific nature of the incident and attract the appropriate attention. Some keywords that can be used include: 1. Imposter Identity Theft: Clearly state in the letter that the incident involves imposter identity theft to ensure the seriousness and accuracy of the issue. 2. Known Imposter: Emphasize that the imposter's identity is known to distinguish it from general identity theft cases where the perpetrator's identity may be unknown. 3. Montana Victim: Use the term "Montana" to specify the jurisdiction where the incident occurred, which ensures that the information is relevant to the appropriate entities in the state. 4. Credit Reporting Company or Bureau: Mention these terms to ensure that the letter reaches the appropriate entities responsible for maintaining credit information and investigating fraud-related matters. 5. Fraudulent Accounts: Specifically mention any fraudulent accounts that have been opened in your name without your consent or knowledge, as this demonstrates the impact of the imposter identity theft. 6. Personal Information: Highlight any personal information that has been compromised, such as Social Security numbers, driver's license numbers, or financial account details, as these details are critical in assessing the severity of the situation. Different types of Montana Letters to Credit Reporting Company or Bureau Regarding Known Imposter Identity Theft can include: 1. Initial Identity Theft Report: This type of letter is sent to report the incident of known imposter identity theft to the credit reporting company or bureau for immediate action, such as placing a fraud alert on your credit file. 2. Request for Fraudulent Account Closure: If you have identified specific fraudulent accounts, you can draft a letter requesting the credit reporting company or bureau to close those accounts and remove them from your credit report. 3. Dispute Letter: In case you have noticed inaccuracies in your credit report resulting from the imposter identity theft, you can send a letter to the credit reporting company or bureau disputing those inaccuracies and requesting their removal or correction. Remember to provide as much detail and supporting documentation as possible when submitting a Montana Letter to Credit Reporting Company or Bureau Regarding Known Imposter Identity Theft. Providing a clear timeline of events, copies of police reports (if applicable), and any other relevant evidence strengthens your case and enhances the chances of a swift resolution.

Montana Letter to Credit Reporting Company or Bureau Regarding Known Imposter Identity Theft

Description

How to fill out Montana Letter To Credit Reporting Company Or Bureau Regarding Known Imposter Identity Theft?

US Legal Forms - one of the most significant libraries of authorized types in the USA - offers a variety of authorized papers layouts it is possible to down load or printing. Using the website, you may get a huge number of types for business and person uses, sorted by groups, claims, or search phrases.You can get the latest variations of types just like the Montana Letter to Credit Reporting Company or Bureau Regarding Known Imposter Identity Theft within minutes.

If you already possess a registration, log in and down load Montana Letter to Credit Reporting Company or Bureau Regarding Known Imposter Identity Theft from your US Legal Forms catalogue. The Download key will appear on each and every form you perspective. You gain access to all formerly saved types in the My Forms tab of your respective accounts.

If you want to use US Legal Forms the first time, listed here are simple instructions to help you started off:

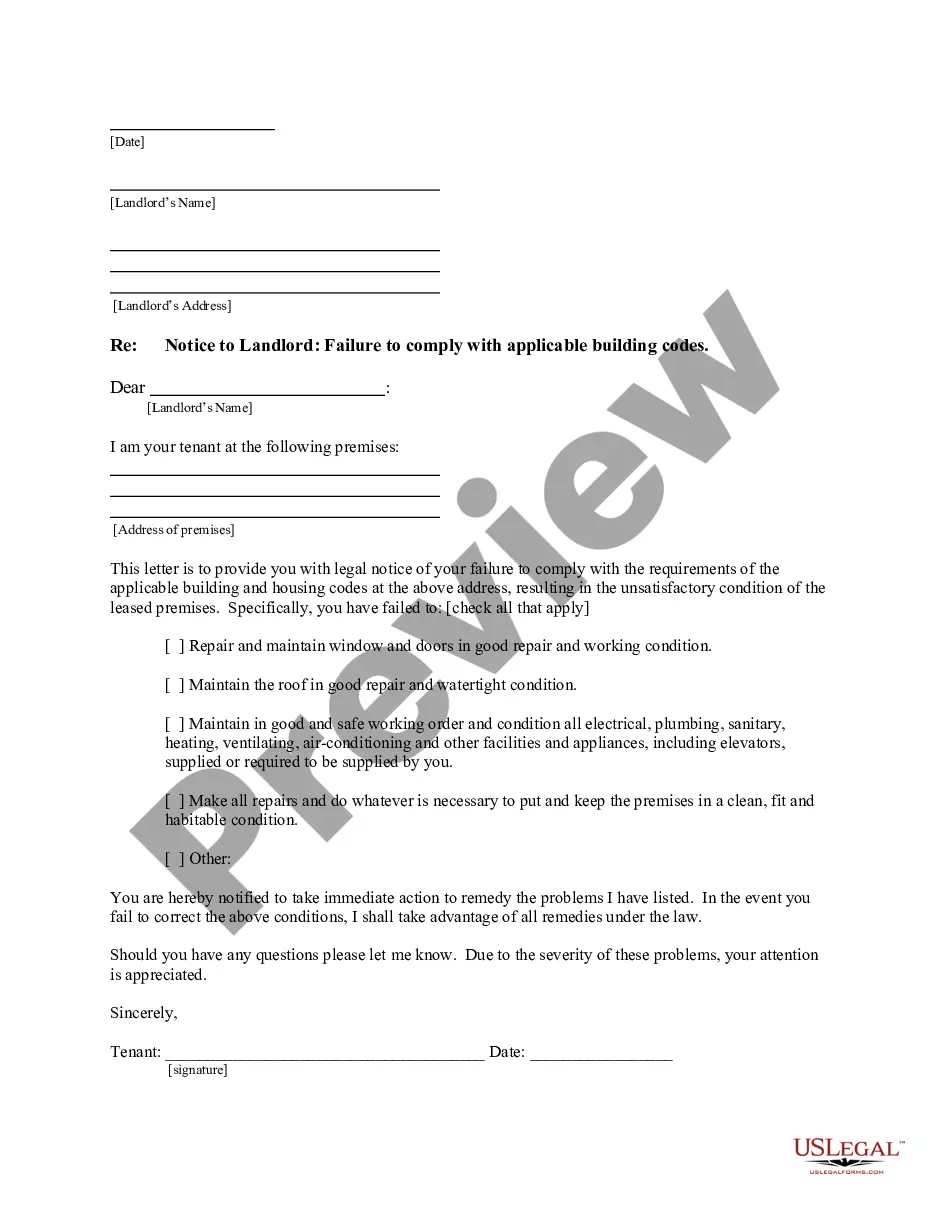

- Be sure to have picked the right form for your metropolis/state. Select the Preview key to analyze the form`s articles. Browse the form information to actually have selected the proper form.

- In case the form doesn`t suit your needs, use the Search industry near the top of the monitor to find the the one that does.

- In case you are happy with the shape, affirm your decision by simply clicking the Buy now key. Then, pick the costs prepare you favor and give your credentials to register for the accounts.

- Approach the purchase. Make use of bank card or PayPal accounts to accomplish the purchase.

- Select the file format and down load the shape on your own product.

- Make changes. Load, edit and printing and indication the saved Montana Letter to Credit Reporting Company or Bureau Regarding Known Imposter Identity Theft.

Each and every design you added to your account does not have an expiry day and it is yours permanently. So, in order to down load or printing yet another copy, just visit the My Forms segment and click in the form you need.

Gain access to the Montana Letter to Credit Reporting Company or Bureau Regarding Known Imposter Identity Theft with US Legal Forms, the most comprehensive catalogue of authorized papers layouts. Use a huge number of professional and status-distinct layouts that satisfy your organization or person demands and needs.

Form popularity

FAQ

To report identity theft, contact: The Federal Trade Commission (FTC) online at IdentityTheft.gov or call 1-877-438-4338. The three major credit reporting agencies. Ask them to place fraud alerts and a credit freeze on your accounts.

Dear Sir or Madam: I am a victim of identity theft. I recently learned that my personal information was used to open an account at your company. I did not open or authorize this account, and I therefore request that it be closed immediately.

First, contact the companies or banks where you know the fraudulent activity occurred. Stop any accounts that have been opened without your permission or tampered with. Then, file a report with the Federal Trade Commission (FTC).

I am a victim of identity theft, and did not make the charge(s). I am requesting that the item(s) be blocked to correct my credit report. Enclosed are copies of (describe any enclosed documents) supporting my position. Please investigate this (these) matter(s) and block the disputed item(s) as soon as possible.

Dear Sir or Madam: I am a victim of identity theft. I recently learned that my personal information was used to open an account at your company. I did not open or authorize this account, and I therefore request that it be closed immediately.

I am a victim of identity theft, and I did not make [this/these] charge(s). I request that you remove the fraudulent charge(s) and any related finance charge and other charges from my account, send me an updated and accurate statement, and close the account (if applicable).

Your letter should clearly identify each item in your report you dispute, state the facts, explain why you dispute the information, and request that it be removed or corrected. You may want to enclose a copy of your credit report with the items in question circled.