Montana Agreement to Redeem Interest of a Single Member in an LLC

Description

How to fill out Agreement To Redeem Interest Of A Single Member In An LLC?

You can devote hours on-line looking for the authorized document web template that suits the federal and state needs you need. US Legal Forms provides a huge number of authorized varieties which are analyzed by pros. It is simple to download or produce the Montana Agreement to Redeem Interest of a Single Member in an LLC from your services.

If you already possess a US Legal Forms account, you may log in and then click the Obtain button. Following that, you may total, revise, produce, or indicator the Montana Agreement to Redeem Interest of a Single Member in an LLC. Each authorized document web template you purchase is the one you have for a long time. To have another duplicate of any purchased type, visit the My Forms tab and then click the related button.

If you are using the US Legal Forms website initially, follow the simple instructions below:

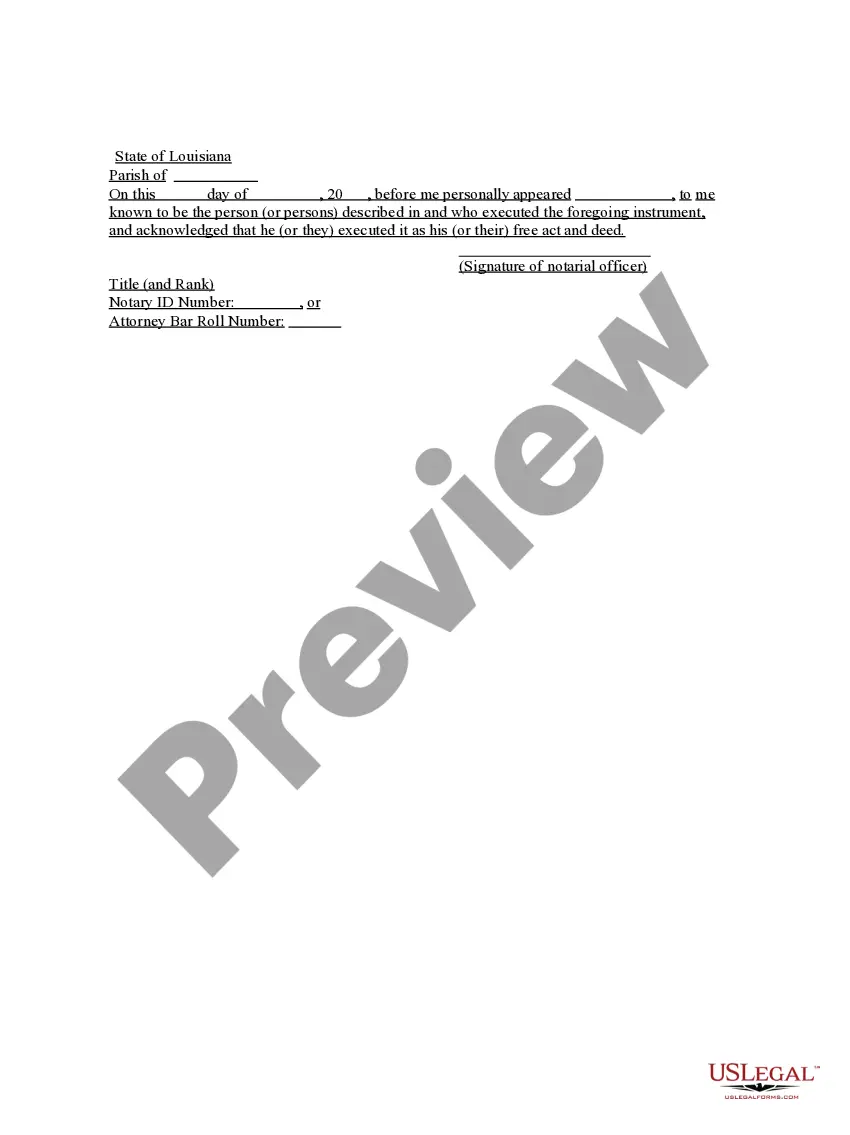

- Very first, make certain you have chosen the best document web template for your state/metropolis that you pick. Look at the type outline to ensure you have picked out the right type. If accessible, make use of the Review button to look from the document web template at the same time.

- If you want to find another version in the type, make use of the Look for industry to discover the web template that suits you and needs.

- Upon having identified the web template you want, just click Get now to move forward.

- Pick the pricing prepare you want, key in your credentials, and register for an account on US Legal Forms.

- Total the deal. You can utilize your charge card or PayPal account to purchase the authorized type.

- Pick the file format in the document and download it in your device.

- Make adjustments in your document if needed. You can total, revise and indicator and produce Montana Agreement to Redeem Interest of a Single Member in an LLC.

Obtain and produce a huge number of document themes while using US Legal Forms web site, that offers the biggest collection of authorized varieties. Use skilled and condition-distinct themes to tackle your company or specific demands.

Form popularity

FAQ

To start a Montana LLC, you must appoint a Montana registered agent service. The agent receives service of process (notice of a lawsuit), as well as other important business mail and legal notices, on behalf of the Montana LLC. All documents are received, signed for, and immediately forwarded to the client.

Delaware does NOT require an operating agreement. However, it is highly recommended to have a LLC operating agreement even if you are only a single member LLC. The state of Delaware recognizes operating agreements and governing documents.

Common pitfalls of a poorly drafted Operating Agreement include failing to: (i) specify what authority managers or members have; (ii) carve out key decisions that require a higher approval threshold (e.g., dissolution, sale of all or substantially all of the assets of the LLC, etc.); (iii) address how deadlocks in the ...

Wyoming Statutes § 17-29-110: Though Wyoming does not legally require an operating agreement for an LLC, having one is strongly recommended. This document includes provisions for the regulation of business affairs of the company and its members, as well as managers.

A redemption agreement is a legal contract between a corporation and its shareholders that specifies how the corporation can redeem or repurchase the shares of a shareholder who wants to exit the business or who passes away.

A REDEMPTION AGREEMENT ALLOWS A DEPARTING SHAREHOLDER, PARTNER OR LLC MEMBER TO SELL OUT THEIR INTEREST IN THE BUSINESS TO THE COMPANY INSTEAD OF THEIR CO-OWNER.

Montana does not require you to have an operating agreement when you form an LLC; however, even as the sole owner of the company, it's in your best interest to file an operating agreement when you create your LLC.