Montana Triple Net Commercial Lease Agreement - Real Estate Rental

Description

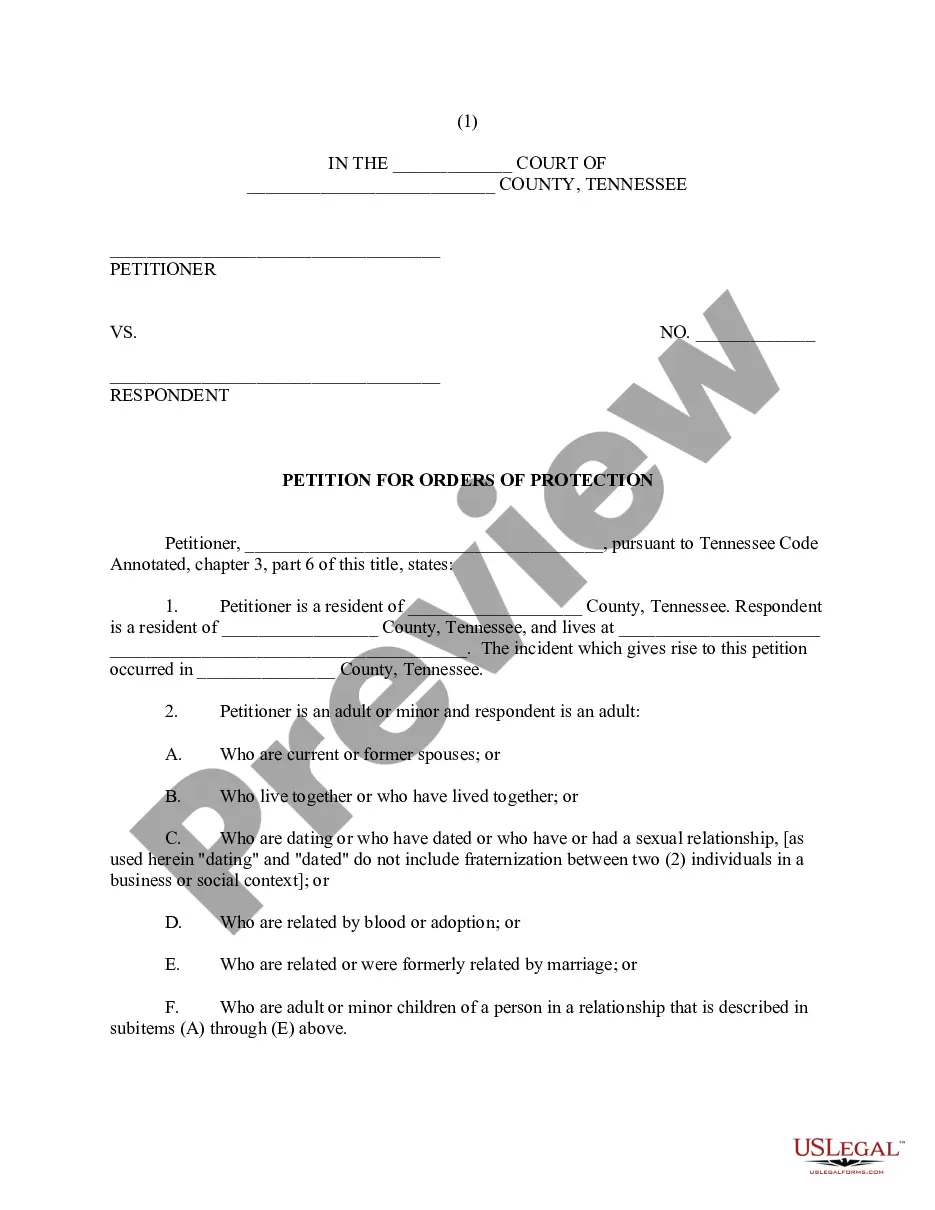

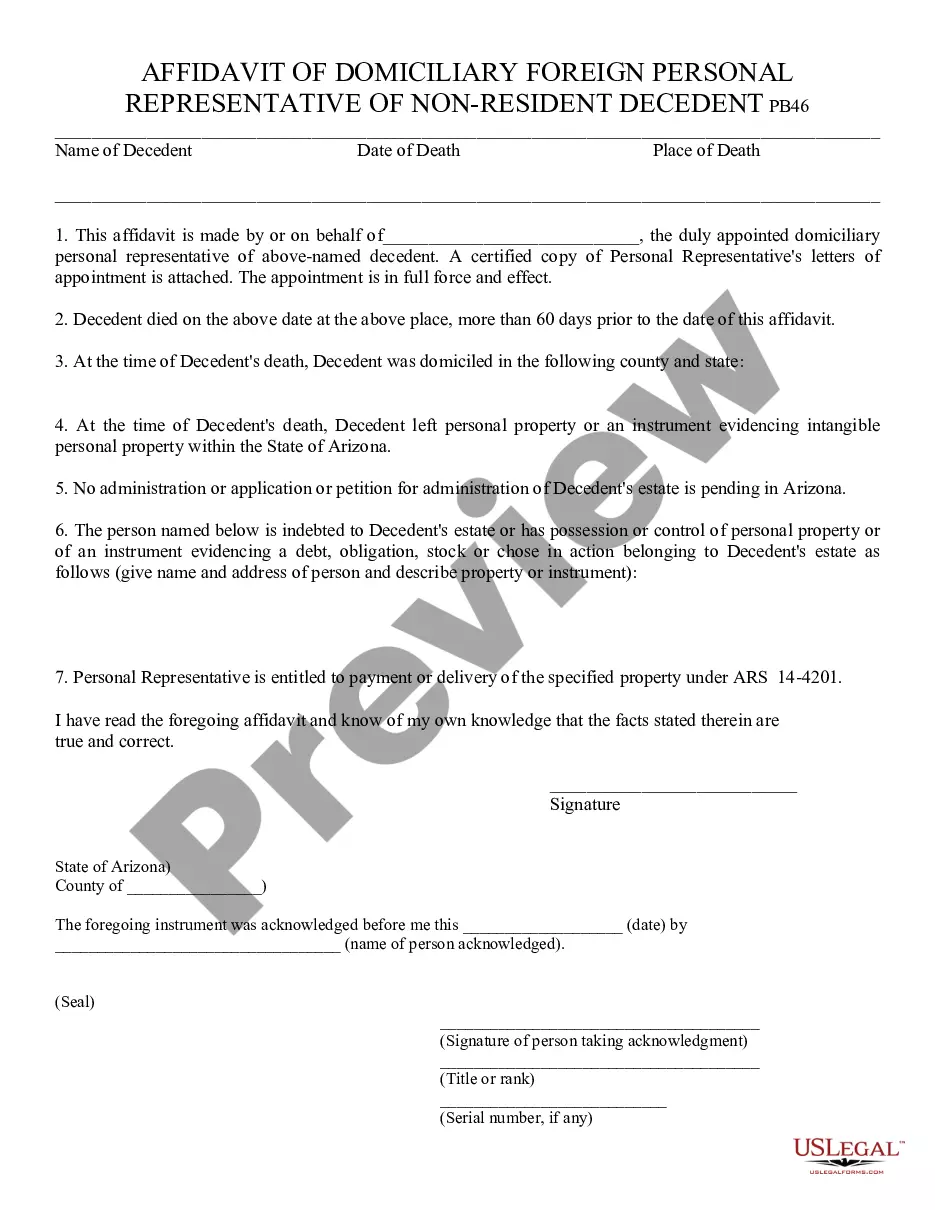

How to fill out Triple Net Commercial Lease Agreement - Real Estate Rental?

If you wish to accumulate, acquire, or print legal document templates, utilize US Legal Forms, the largest assortment of legal forms available online.

Take advantage of the site’s straightforward and user-friendly search to locate the documents you need.

Various templates for business and personal purposes are organized by categories and regions, or keywords.

Every legal document template you purchase is yours indefinitely. You have access to each form you downloaded with your account. Click the My documents section and choose a form to print or download again.

Stay competitive and obtain, and print the Montana Triple Net Commercial Lease Agreement - Real Estate Rental with US Legal Forms. There are millions of professional and state-specific forms you can use for your business or personal needs.

- Step 1: Ensure you have selected the form for the correct area/state.

- Step 2: Use the Review option to examine the form's content. Remember to read the description.

- Step 3: If you are unsatisfied with the form, utilize the Search field at the top of the screen to find alternative versions in the legal document category.

- Step 4: Once you’ve found the form you need, click on the Purchase now button. Choose your preferred pricing plan and enter your details to register for an account.

- Step 5: Process the transaction. You can use your Visa or MasterCard or PayPal account to complete the transaction.

- Step 6: Select the format of the legal document and download it to your device.

- Step 7: Complete, edit, and print or sign the Montana Triple Net Commercial Lease Agreement - Real Estate Rental.

Form popularity

FAQ

To calculate a net lease, you take the base rent and add the estimated costs for taxes, insurance, and maintenance expenses. This total gives you a clearer picture of the financial obligations for both the landlord and tenant. By leveraging a Montana Triple Net Commercial Lease Agreement - Real Estate Rental, you can ensure that all necessary calculations are addressed correctly.

A net lease REIT (Real Estate Investment Trust) specializes in properties leased on net lease agreements. These REITs earn income by leasing out commercial real estate where tenants are responsible for property expenses. If you're interested in investing in commercial real estate, a Montana Triple Net Commercial Lease Agreement - Real Estate Rental can offer opportunities through such net lease REITs.

net lease obligates the tenant to cover two main expenses in addition to the base rent, typically property taxes and insurance. This type of lease provides a middle ground between a gross lease and a triple net lease. If you are looking at options for a Montana Triple Net Commercial Lease Agreement Real Estate Rental, understanding netnet leases can provide insight into diverse leasing structures.

The difference between NN (Net Lease) and NNN (Triple Net Lease) primarily lies in the responsibilities assigned to the tenant. In a net lease, the tenant typically pays base rent plus some property expenses, while in a triple net lease, the tenant is responsible for paying base rent along with all property expenses including taxes, insurance, and maintenance. If you are considering a Montana Triple Net Commercial Lease Agreement - Real Estate Rental, understanding these distinctions can help you make informed decisions.

The most common lease in commercial real estate is the net lease, particularly the triple net lease. This type of lease structure, such as the Montana Triple Net Commercial Lease Agreement - Real Estate Rental, requires tenants to cover property expenses in addition to their rental payments. This format benefits both parties, as it clarifies financial obligations and reduces the landlord's burden. For those interested in this type of lease, our platform provides user-friendly tools to help create a customized agreement.

The most common type of leasehold in commercial real estate is the leasehold estate. This type of agreement allows tenants to use and occupy a property for a specific period while paying rent according to the terms. The Montana Triple Net Commercial Lease Agreement - Real Estate Rental is an example of a leasehold that delineates responsibilities between tenant and landlord effectively. If you want to secure a leasehold, our platform offers resources to assist you in drafting legally sound agreements.

The most common type of commercial lease is the triple net lease, which includes the Montana Triple Net Commercial Lease Agreement - Real Estate Rental. In this agreement, tenants are responsible for paying base rent as well as property taxes, insurance, and maintenance costs. This arrangement provides landlords with a stable income while offering tenants a clear understanding of their financial responsibilities. If you’re considering this type of lease, our platform can help you create a tailored agreement.

up lease is a rental agreement that features predetermined rent increases at specified intervals. This type of lease can benefit both landlords and tenants by providing predictable revenue growth for property owners and budgeting plans for tenants. If you are exploring a Montana Triple Net Commercial Lease Agreement Real Estate Rental, consider how a stepup lease might align with your financial goals.

Breaking a rental lease in Montana can be complicated, but it is possible under specific legal circumstances. If you face hardship, such as a job relocation or domestic violence, you may be protected under Montana's landlord-tenant laws. Always review the terms of your Montana Triple Net Commercial Lease Agreement - Real Estate Rental and consult professionals when in doubt.

The opposite of a triple net lease is a gross lease. In a gross lease, landlords typically cover all property expenses, including maintenance, taxes, and insurance, simplifying the tenant's responsibilities. When engaging in a Montana Triple Net Commercial Lease Agreement - Real Estate Rental, it's crucial to understand these distinctions.