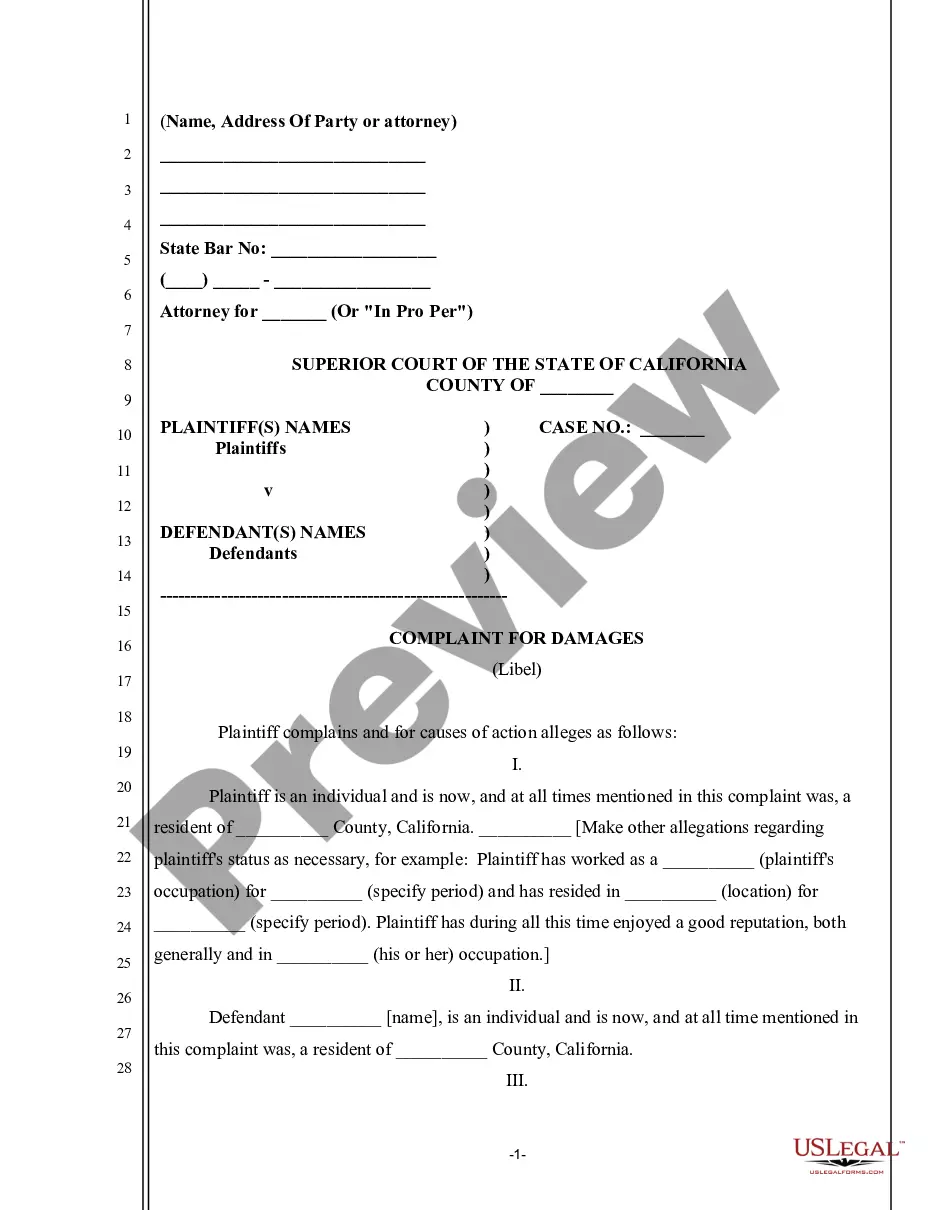

A Montana Receipt for Down Payment for Real Estate is a legally binding document used to acknowledge the receipt of a down payment made by a buyer in a real estate transaction taking place in the state of Montana. This receipt acts as proof of payment and establishes the terms and conditions of the down payment. Keywords: — Montana: Refers to the specific state in which the real estate transaction is taking place. — Receipt: Denotes a written acknowledgment of receiving something, in this case, a down payment. — Down Payment: The initial payment made by a buyer to the seller as a part of the total purchase price before closing the deal. — Real Estate: Refers to property or land, including buildings and natural resources, that can be bought, sold, or rented. Different types of Montana Receipt for Down Payment for Real Estate: 1. Cash Receipt for Down Payment: This type of receipt confirms the receipt of a down payment made in cash by the buyer. 2. Check Receipt for Down Payment: This receipt is used to acknowledge a down payment made through a check. 3. Wire Transfer Receipt for Down Payment: In cases where the down payment is made through a wire transfer, this receipt is issued to confirm the successful transmission of funds. 4. Electronic Payment Receipt for Down Payment: When a down payment is made using digital payment methods such as online banking or mobile payment apps, an electronic payment receipt is given. 5. Escrow Receipt for Down Payment: When the down payment is held by a third-party escrow agent until specified conditions are met, an escrow receipt is issued to acknowledge the receipt of the funds. In all cases, a Montana Receipt for Down Payment for Real Estate typically includes the following information: — Date: The date when the down payment is received. — Buyer and Seller Information: The names, addresses, and contact details of the buyer and seller. — Property Details: A description of the real estate property being purchased, including its address and legal description. — Amount: The total amount of the down payment, stated in both numeric and written forms. — Payment Method: Specifies how the down payment was made, such as cash, check, wire transfer, etc. — Witness and Notary: Signatures and contact details of any witnessed parties or notary public involved in the transaction. — Terms and Conditions: Any additional terms or conditions related to the down payment, such as refund ability, deadlines, or penalties. It is vital to ensure accuracy and completeness while preparing a Montana Receipt for Down Payment for Real Estate, as it protects both the buyer and seller and serves as proof of the transaction.

Montana Receipt for Down Payment for Real Estate

Description

How to fill out Montana Receipt For Down Payment For Real Estate?

You can spend hours online attempting to locate the valid document format that fulfills the federal and state requirements you need.

US Legal Forms provides thousands of valid templates that are examined by professionals.

It's easy to download or print the Montana Receipt for Down Payment for Real Estate from my services.

If you wish to find another version of your form, utilize the Research field to discover the format that fits you and your requirements.

- If you already have a US Legal Forms account, you may Log In and click the Obtain button.

- Then, you can complete, edit, print, or sign the Montana Receipt for Down Payment for Real Estate.

- Every valid document format you acquire is yours forever.

- To get another copy of the purchased form, visit the My documents tab and click the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the easy instructions below.

- First, ensure that you have selected the correct document format for your area/town of choice.

- Review the form description to verify that you have chosen the right one.

Form popularity

FAQ

Yes, the down payment is indeed applied towards the principal balance of the mortgage. This means that when you make a down payment, it reduces the amount you need to borrow, leading to lower monthly payments over time. Completing a Montana Receipt for Down Payment for Real Estate makes this process clear and ensures that your financial commitment is formally recognized.

Typically, the down payment is held in trust by the real estate broker or an escrow agent until the transaction closes. This arrangement protects both the buyer and seller by ensuring that funds remain secure during the purchasing process. By using the Montana Receipt for Down Payment for Real Estate, you can clearly delineate this responsibility and enhance trust in your transaction.

A deposit receipt is a formal document that records the receipt of a down payment from a buyer to a seller. It outlines the amount deposited, property details, and terms agreed upon by both buyer and seller. The Montana Receipt for Down Payment for Real Estate serves as a reliable form of this document, ensuring a smooth transaction.

Yes, Montana has a real estate tax system that assesses properties annually. Property owners must be aware of their tax responsibilities to avoid penalties. Understanding the real estate tax framework, as well as obtaining crucial documents like the Montana Receipt for Down Payment for Real Estate, will streamline your property transactions and ensure a smoother ownership experience.

While no state completely abolishes property tax, some states have very low rates. States like New Jersey and Illinois have high taxes, while others, like Hawaii and Alabama, offer comparatively low ones. As a resident or prospective buyer in Montana, you will want to factor in its property tax structure when making real estate decisions, especially regarding the Montana Receipt for Down Payment for Real Estate.

Yes, Montana offers several property tax exemptions that can benefit homeowners. These include exemptions for seniors, veterans, and certain agricultural properties. Knowing about these exemptions can enhance your financial planning as you navigate the process of real estate transactions, including receiving the Montana Receipt for Down Payment for Real Estate.

Montana does not impose an estate tax; however, it's wise to check for any potential federal estate taxes that may apply. Understanding the tax landscape will help in planning your estate effectively. If you require documentation related to real estate transactions, such as the Montana Receipt for Down Payment for Real Estate, consider utilizing our platform for comprehensive resources.

Lowering property taxes in Montana can involve applying for exemptions, appealing your property assessment, or seeking assistance from local tax professionals. Understanding the various exemptions available can help reduce your tax burden. By proactively managing your real estate finances, including securing the Montana Receipt for Down Payment for Real Estate, you position yourself better for favorable tax outcomes.

To apply for a Montana withholding account, you typically start by visiting the Montana Department of Revenue's website. There, you can find the necessary forms and guidelines to set up your account. Once you complete your application, submit it to the appropriate department. This process is critical if you plan to manage your real estate transactions, including obtaining the Montana Receipt for Down Payment for Real Estate.

Yes, Montana has a Homestead Act that provides property tax benefits to homeowners. This act allows qualifying homeowners to exempt a portion of their home’s value from property taxes. To take full advantage of these benefits, you may need to apply through your local county office. Having your Montana Receipt for Down Payment for Real Estate documented can be beneficial when applying for these exemptions.