Montana Certificate of Trust for Successor Trustee

Description

How to fill out Certificate Of Trust For Successor Trustee?

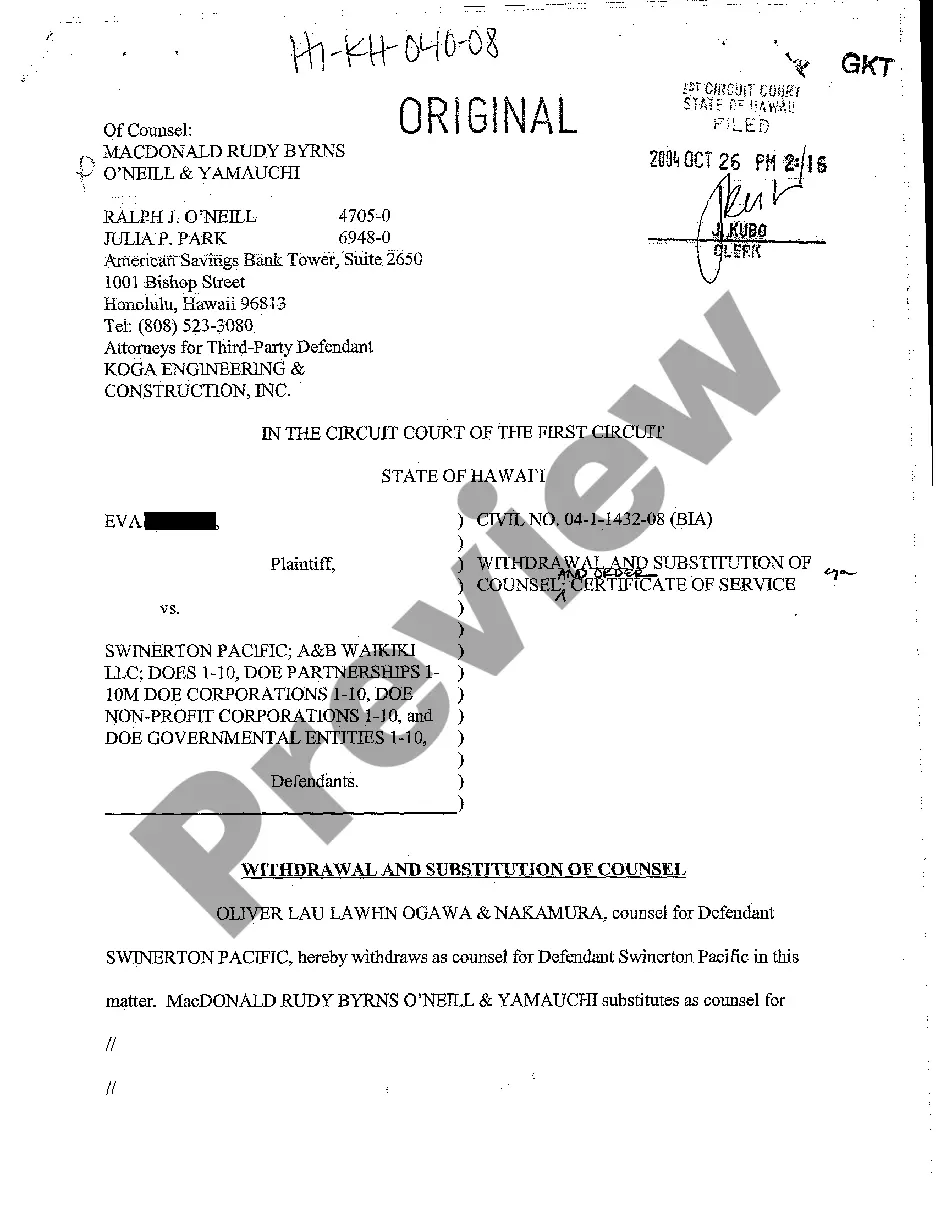

US Legal Forms - one of several largest libraries of authorized forms in the United States - delivers a wide range of authorized record themes you may acquire or produce. Utilizing the internet site, you will get a large number of forms for organization and personal purposes, categorized by types, says, or keywords and phrases.You can find the most up-to-date models of forms such as the Montana Certificate of Trust for Successor Trustee in seconds.

If you already possess a subscription, log in and acquire Montana Certificate of Trust for Successor Trustee in the US Legal Forms collection. The Download switch will show up on every form you view. You have accessibility to all earlier downloaded forms in the My Forms tab of the profile.

If you would like use US Legal Forms the first time, allow me to share simple directions to get you started:

- Be sure to have chosen the right form for the metropolis/state. Go through the Preview switch to examine the form`s content. Read the form outline to ensure that you have chosen the proper form.

- If the form does not match your requirements, make use of the Lookup industry towards the top of the display screen to find the the one that does.

- When you are happy with the shape, verify your option by clicking the Get now switch. Then, choose the pricing plan you favor and supply your credentials to register to have an profile.

- Method the financial transaction. Make use of credit card or PayPal profile to accomplish the financial transaction.

- Choose the formatting and acquire the shape on your gadget.

- Make adjustments. Load, edit and produce and signal the downloaded Montana Certificate of Trust for Successor Trustee.

Every format you included with your money does not have an expiration particular date which is your own forever. So, if you want to acquire or produce yet another backup, just go to the My Forms portion and click on in the form you will need.

Gain access to the Montana Certificate of Trust for Successor Trustee with US Legal Forms, by far the most comprehensive collection of authorized record themes. Use a large number of skilled and condition-distinct themes that meet your small business or personal requirements and requirements.

Form popularity

FAQ

States Using Deed of Trust In Alabama, Arizona, Arkansas, Illinois, Kentucky, Maryland, Michigan, Montana and South Dakota, the lender has the choice of either a mortgage or deed of trust. In any other state, you must have a mortgage.

A living trust can help you manage your property while you are alive, and when you pass away. Living trusts offer more protections than last wills in some cases, and can help your family avoid the expensive probate process.

So, now you know that the Trust Maker holds the most power before the Trust is established, but the Trustee holds the most power after the Trust is established.

What is a trustor vs trustee? In a deed of trust, a trustor is the borrower and the trustee is a third party that holds the property's title. The trustee is entrusted with the title and the right to sell the property if the trustor defaults on the loan.

A trustee is any person or organization that holds the legal title of an asset or group of assets for another person, called the grantor. A trustee is granted this legal title through a trust in which the they hold title to the assets held in trust for the benefit of others.

Generally, the trustee must be an attorney, title insurance company, trust company, bank, savings and loan, credit union, or other company specifically authorized by law to serve as a trustee. Other states have no limitations.

Generally, the trustee must be an attorney, title insurance company, trust company, bank, savings and loan, credit union, or other company specifically authorized by law to serve as a trustee.