This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Montana Affidavit or Proof of No Income - Unemployed - Assets and Liabilities

Description

How to fill out Affidavit Or Proof Of No Income - Unemployed - Assets And Liabilities?

US Legal Forms - one of the largest repositories of legal documents in the United States - offers a range of legal document templates that you can download or print.

By using the website, you can access thousands of templates for both business and personal uses, organized by categories, states, or keywords.

You can obtain the latest editions of templates like the Montana Affidavit or Proof of No Income - Unemployed - Assets and Liabilities in just minutes.

If the document doesn’t meet your needs, use the Search field at the top of the screen to find the one that does.

Once you are satisfied with the form, confirm your selection by clicking the Buy now button. Then choose your preferred payment plan and provide your information to register for an account.

- If you have a monthly subscription, Log In to download the Montana Affidavit or Proof of No Income - Unemployed - Assets and Liabilities from the US Legal Forms collection.

- The Download option will be visible on every document you view.

- You can access all previously downloaded documents from the My documents section of your account.

- To use US Legal Forms for the first time, here are some simple steps to get you started.

- Ensure you have selected the correct document for your city/county.

- Click the Review button to examine the content of the form.

Form popularity

FAQ

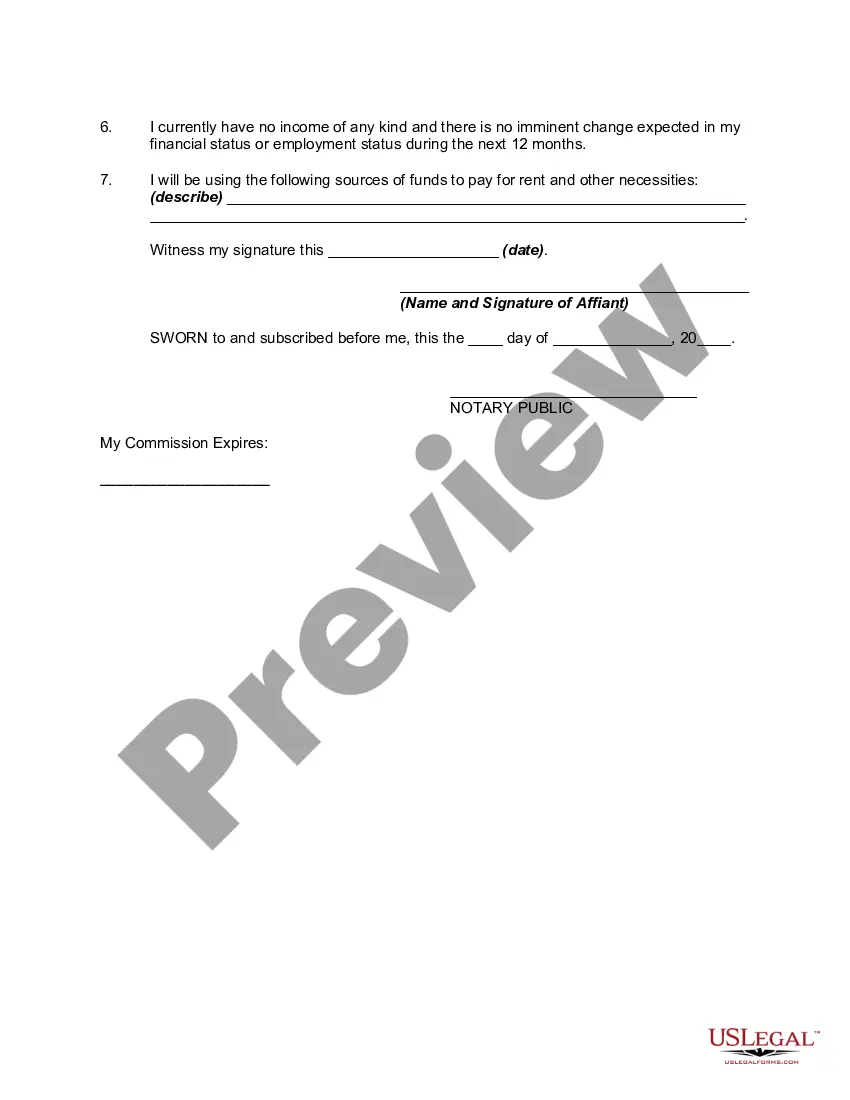

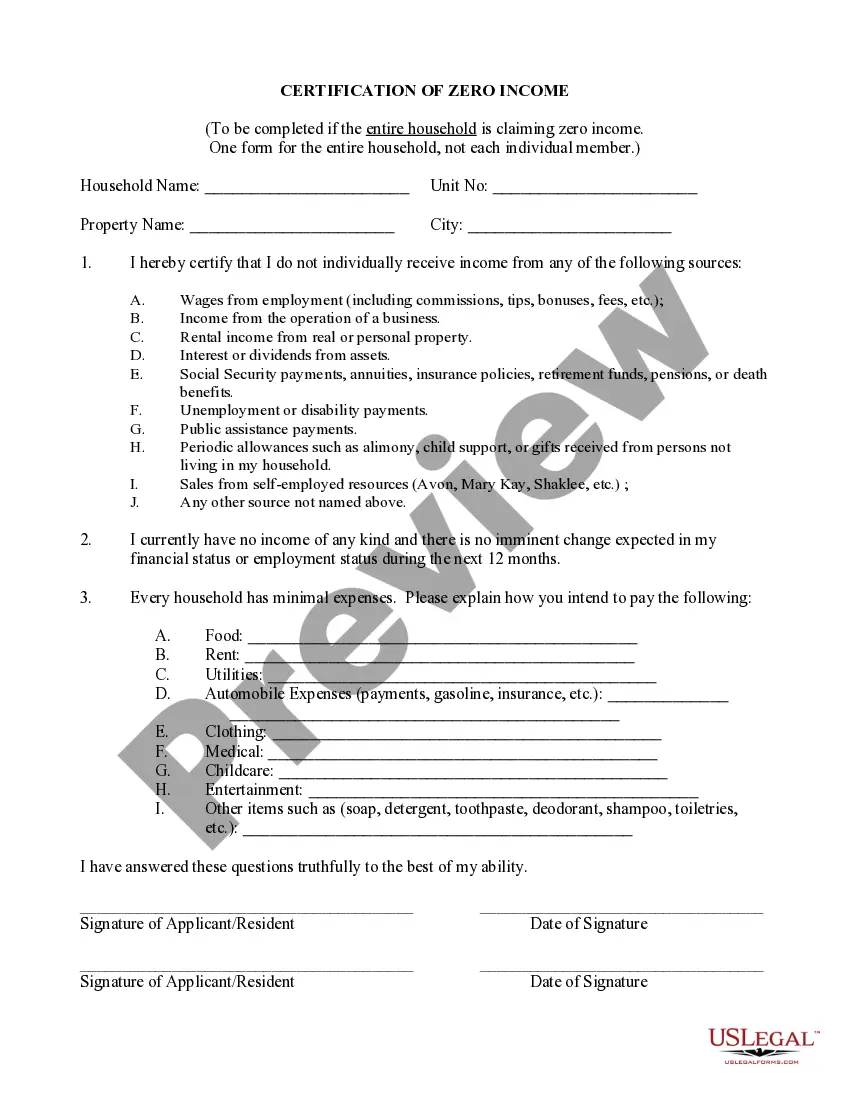

A proof of no income letter is a written statement verifying that an individual has not received any income within a certain period. This can be particularly useful for those applying for financial assistance or benefits. Using a Montana Affidavit or Proof of No Income - Unemployed - Assets and Liabilities, you can formalize your situation and ensure that your application is processed smoothly, reflecting your true financial status.

A proof of no income document is a formal declaration stating that an individual has not earned any income during a specified timeframe. This may be required for various applications, including rental agreements or government assistance programs. A Montana Affidavit or Proof of No Income - Unemployed - Assets and Liabilities serves as an official document that clearly outlines your financial circumstances, simplifying communication with landlords or financial institutions.

Montana taxes non-residents on income earned from Montana sources. This may include wages, business income, and capital gains. Non-residents must file a state income tax return for any Montana-sourced income. If you find yourself in a situation without income, a Montana Affidavit or Proof of No Income - Unemployed - Assets and Liabilities can help support your claims during tax season.

Yes, Montana requires you to file a tax return if you have earned income above a certain threshold. This includes income from wages, investments, and other sources. If you are unemployed and have no income, you may not be required to submit a tax return, but it's beneficial to check with the Montana Department of Revenue. Utilizing a Montana Affidavit or Proof of No Income - Unemployed - Assets and Liabilities can assist in clarifying your financial situation.

Filling out an affidavit of financial information requires you to list all relevant details about your finances comprehensively. You should include your income sources, monthly expenses, assets, and liabilities in a clear format. Using platforms like USLegalForms can aid you in creating an effective Montana Affidavit or Proof of No Income, ensuring you meet all necessary requirements. Thorough documentation supports your claims and helps streamline the process.

To fill out a personal information affidavit, you should provide your full name, address, contact details, and relevant financial information. Make sure to follow all instructions on the form closely to avoid any mistakes. This affidavit helps communicate your financial circumstances clearly, especially when using documents like the Montana Affidavit or Proof of No Income for Unemployed individuals. Clarity and accuracy in this affidavit present a truthful financial picture.

To fill out an affidavit example, start by reviewing the form carefully to understand its format and requirements. Next, replicate the structure in your own affidavit, incorporating your personal financial information as well as any required supporting documents. It's essential to remain honest and precise; this builds trust in your affidavit's validity. The Montana Affidavit or Proof of No Income - Unemployed - Assets and Liabilities can serve as a reliable reference during this process.

In a financial affidavit, you should include a detailed summary of your income, expenses, assets, and liabilities. This includes itemizing any sources of income, as well as listing any debts you owe and your monthly bills. Additionally, make sure to present supporting documents that validate your financial status. A well-structured financial affidavit, such as the Montana Affidavit or Proof of No Income for Unemployed individuals, helps create a clear financial picture.

Filling out an affidavit of financial information involves gathering all necessary financial documents and accurately completing the form. You'll need to outline your assets, liabilities, income, and expenses in detail. Tools like USLegalForms can guide you through the specific requirements for your Montana Affidavit or Proof of No Income - Unemployed - Assets and Liabilities, ensuring you include everything accurately. Take your time to ensure each section is filled out correctly.

To prove someone has no income, you need documentation that clearly shows their current financial status. This could include a Montana Affidavit or Proof of No Income for Unemployed individuals, which lays out a verifiable record of your earnings and expenses. You may also need to provide recent bank statements and proof of any government assistance. This information helps build a comprehensive picture of your financial situation.