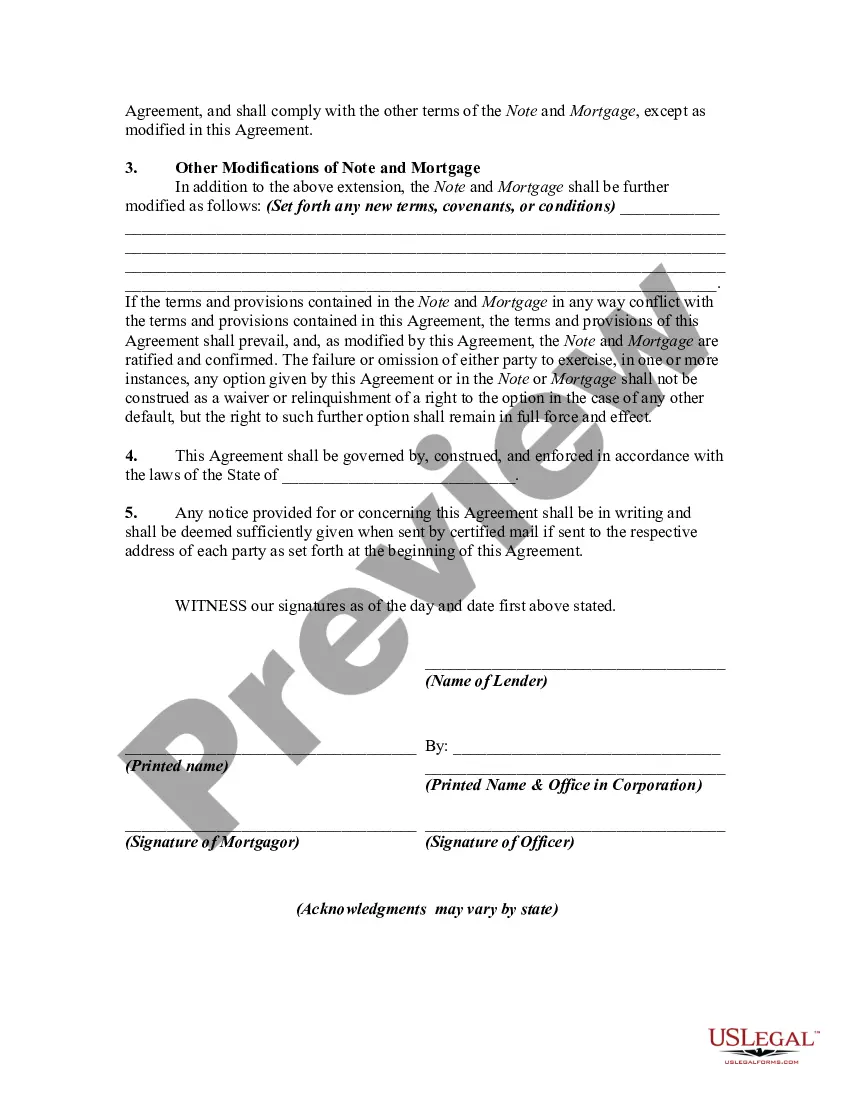

An agreement modifying a loan agreement and mortgage should be signed by both parties to the transaction and recorded in the office of the register of deeds and mortgages where the original mortgage was recorded. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Montana Agreement to Modify Promissory Note and Mortgage to Extend Maturity Date

Description

How to fill out Agreement To Modify Promissory Note And Mortgage To Extend Maturity Date?

You may invest hours online trying to find the lawful file format which fits the federal and state demands you want. US Legal Forms gives thousands of lawful varieties which are examined by professionals. You can actually down load or produce the Montana Agreement to Modify Promissory Note and Mortgage to Extend Maturity Date from our services.

If you already possess a US Legal Forms accounts, you are able to log in and click on the Acquire switch. After that, you are able to full, change, produce, or indication the Montana Agreement to Modify Promissory Note and Mortgage to Extend Maturity Date. Every single lawful file format you get is yours permanently. To obtain yet another duplicate of the obtained form, visit the My Forms tab and click on the corresponding switch.

If you use the US Legal Forms internet site for the first time, adhere to the basic guidelines listed below:

- Very first, make certain you have chosen the correct file format for that region/town that you pick. Browse the form outline to ensure you have chosen the right form. If readily available, use the Review switch to search throughout the file format at the same time.

- In order to find yet another edition in the form, use the Search field to discover the format that meets your needs and demands.

- Upon having found the format you want, just click Purchase now to move forward.

- Choose the costs plan you want, key in your credentials, and register for a merchant account on US Legal Forms.

- Total the financial transaction. You may use your charge card or PayPal accounts to cover the lawful form.

- Choose the file format in the file and down load it to your gadget.

- Make modifications to your file if required. You may full, change and indication and produce Montana Agreement to Modify Promissory Note and Mortgage to Extend Maturity Date.

Acquire and produce thousands of file web templates using the US Legal Forms site, that provides the greatest assortment of lawful varieties. Use skilled and express-specific web templates to handle your business or specific needs.

Form popularity

FAQ

A maturity date on a loan is the date it's scheduled to be paid in full. The loan and any accrued interest should ideally be paid off in full if you've made regular and timely payments. If you do have a remaining balance past your maturity date, you'll have to work with the lender to figure out how to pay it off.

Changing a loan's maturity date is possible in more than one way. Some lenders offer borrowers the option to modify their loan terms. In this case, a borrower could adjust their repayment term and in so doing change the date.

For example, if a borrower has problems paying back their loan, or if the lender is asking for less time to repay it, the borrower can request an extension of their promissory notes.

What is a Mortgage Modification Agreement? The mortgage modification agreement is a legal document between a lender and borrower to change an existing loan's terms. A typical modification may include reducing the interest rate, extending the repayment term, lowering monthly payments, or even forgiving part of the debt.

You end up with a collections notice on your credit report or, worse, your car may be repossessed. Because repossessions are costly and complicated, banks try to avoid them if possible. However, if you don't make an arrangement to repay your loan, you could end up with fees that drive your balance higher.

If you need extra time to make your final payment, one option is a short-term extension. Extensions are common for lines of credit and construction loans. Often a lender will write an automatic extension into the note if the construction project falls behind schedule to prevent maturity problems.

To extend the loan maturity and perfect the lender's lien on a matured loan, you must refinance the loan with a new loan account number and a new set of full loan documents. Be aware that renewing a loan after maturity may cause issues with title insurance.

If you lend money to someone and the borrower later wants more time to pay, or lower monthly payments, you can use this form to make changes to the original promissory note.