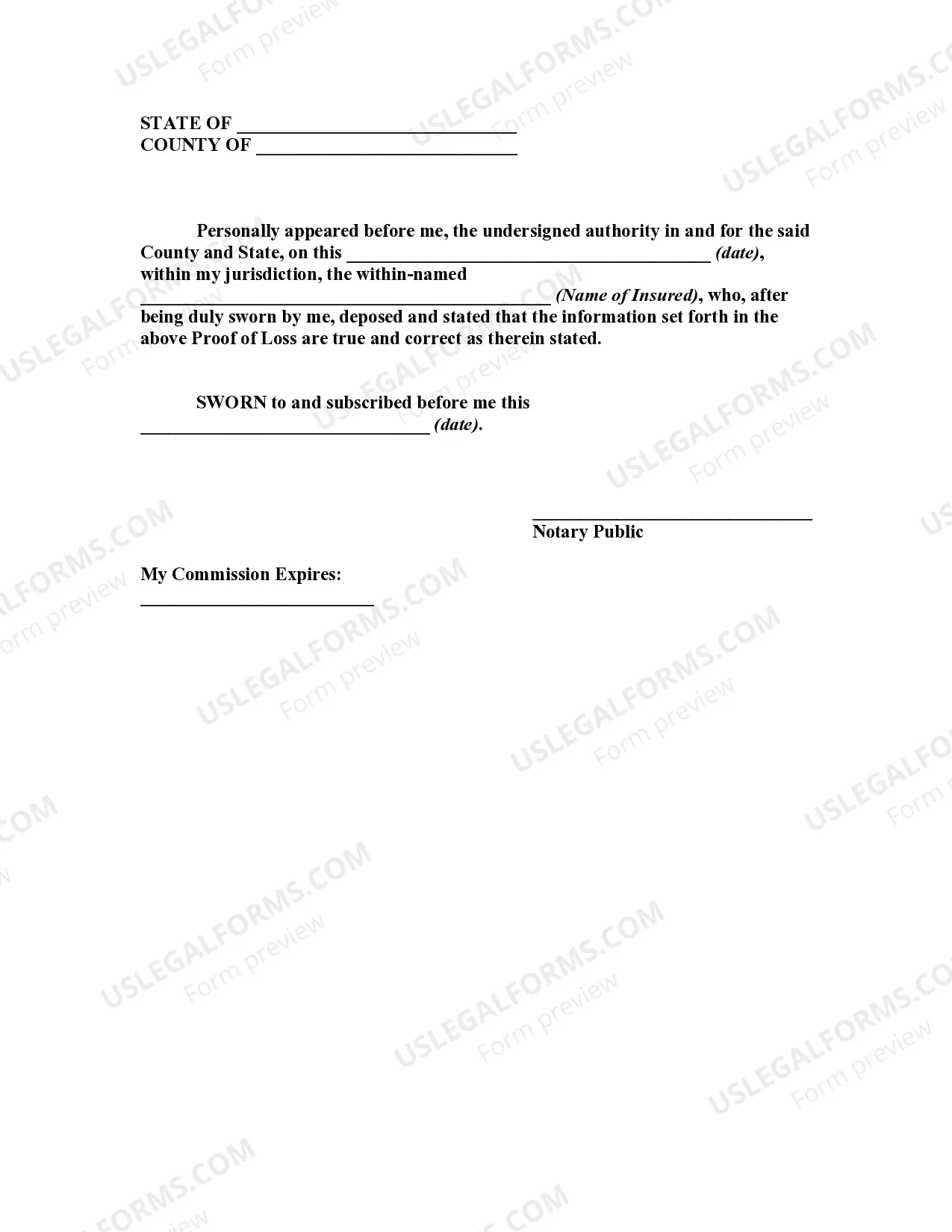

A Proof of Loss is a sworn statement that usually must be furnished by the insured to an insurer before any loss under a policy may be paid.

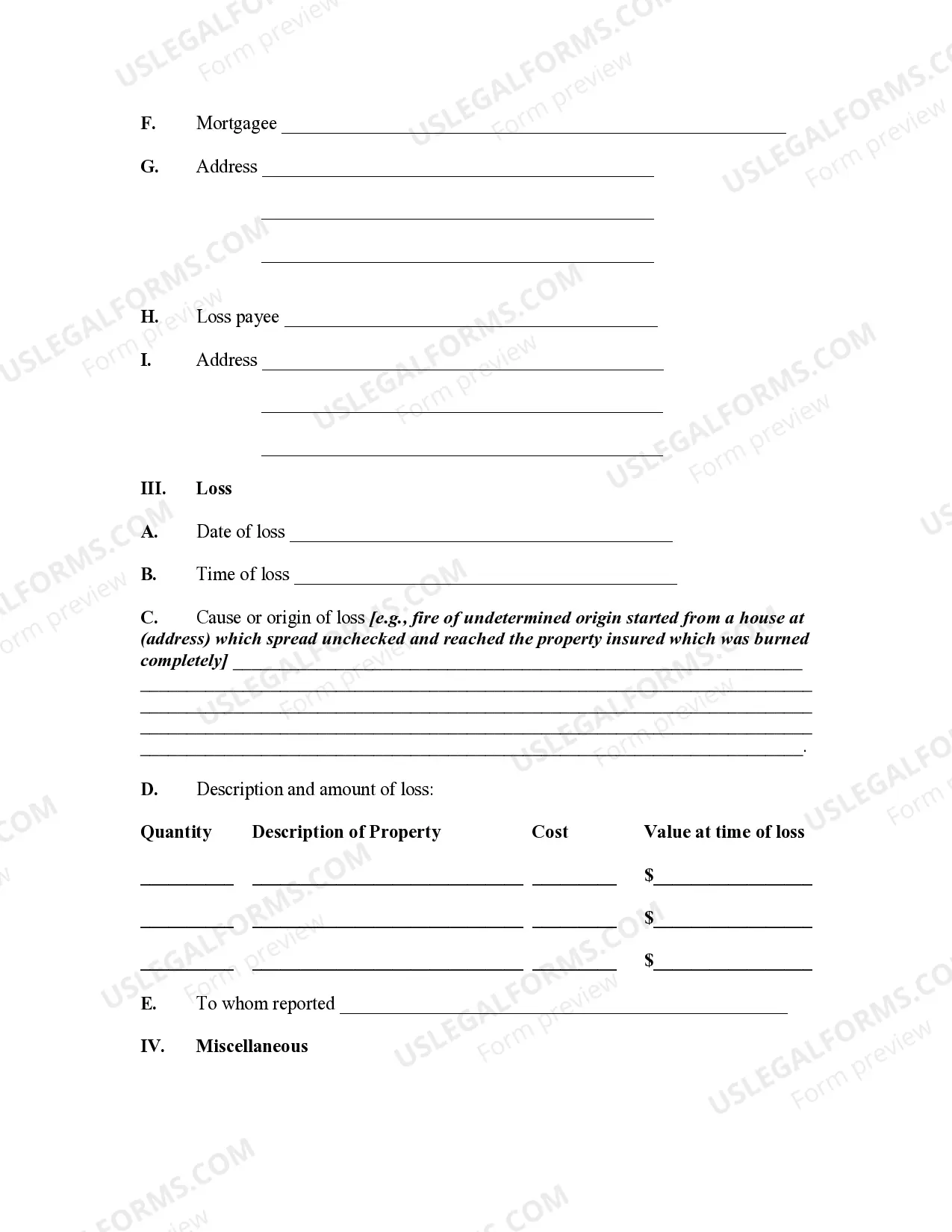

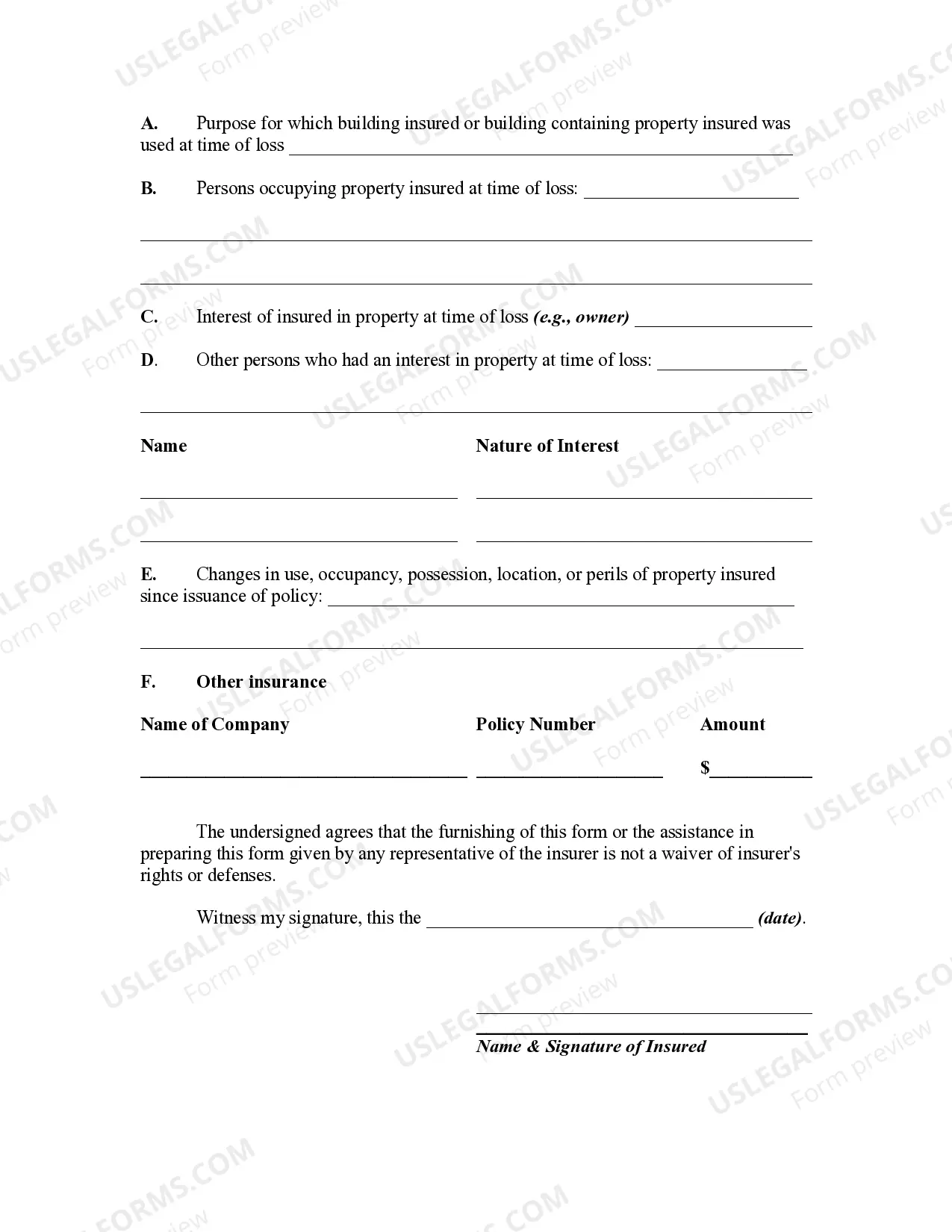

Montana Proof of Loss for Fire Insurance Claim is a crucial document required by insurers to substantiate fire damage claims in the state of Montana. This legal document outlines the details of the fire loss incurred by policyholders and serves as evidence of the claimed damages. When filing a fire insurance claim in Montana, policyholders must complete and submit a comprehensive Proof of Loss form, adhering to specific guidelines and providing all pertinent information. The Montana Proof of Loss for Fire Insurance Claim typically comprises the following key elements: 1. Policyholder information: The form necessitates policyholder details, including name, address, contact information, policy number, and insurance company information. 2. Description of property: Policyholders are required to describe the damaged property, such as residential or commercial structures, personal belongings, or other assets affected by the fire. It is crucial to provide accurate and detailed information regarding the type, size, and condition of the property involved. 3. Date of loss: The Proof of Loss form mandates specifying the exact date when the fire incident occurred, which is essential to determine policy coverage and validate the claim. 4. Cause of fire: It is vital to provide a clear explanation of the fire's cause, whether it was accidental, intentional, or due to external factors like natural disasters or faulty equipment. 5. Detailed inventory of damaged property: Policyholders must prepare an itemized list of all items damaged or destroyed by the fire, including furniture, electronics, personal belongings, and structural components. This inventory should include the estimated value, date of purchase, and photographs if available. 6. Receipts and proof of ownership: Supporting documentation such as receipts, invoices, warranties, and photographs should accompany the Proof of Loss form to validate ownership and value of the damaged or lost items. 7. Cost estimates: Policyholders must provide detailed cost estimates for repair or replacement of the damaged property. This involves obtaining quotes from contractors, repair specialists, or experts, validating the extent of the fire's impact. 8. Other relevant information: Supplemental information, like witness statements, fire department reports, police reports, or expert opinions, should be included to strengthen the fire claim process. Different types of Montana Proof of Loss for Fire Insurance Claims may exist based on the specific insurance policy or insurer requirements. For example, some insurers may have customized or additional forms that policyholders need to complete. It is essential to consult and communicate with the insurance company or the designated claims' adjuster to ensure compliance with their specific guidelines. In conclusion, the Montana Proof of Loss for Fire Insurance Claim is a crucial document enabling policyholders to seek compensation for fire damages. Compiling a detailed, accurate, and well-supported Proof of Loss form plays a decisive role in expediting the fire insurance claim process and maximizing the chance of a successful claim settlement.Montana Proof of Loss for Fire Insurance Claim is a crucial document required by insurers to substantiate fire damage claims in the state of Montana. This legal document outlines the details of the fire loss incurred by policyholders and serves as evidence of the claimed damages. When filing a fire insurance claim in Montana, policyholders must complete and submit a comprehensive Proof of Loss form, adhering to specific guidelines and providing all pertinent information. The Montana Proof of Loss for Fire Insurance Claim typically comprises the following key elements: 1. Policyholder information: The form necessitates policyholder details, including name, address, contact information, policy number, and insurance company information. 2. Description of property: Policyholders are required to describe the damaged property, such as residential or commercial structures, personal belongings, or other assets affected by the fire. It is crucial to provide accurate and detailed information regarding the type, size, and condition of the property involved. 3. Date of loss: The Proof of Loss form mandates specifying the exact date when the fire incident occurred, which is essential to determine policy coverage and validate the claim. 4. Cause of fire: It is vital to provide a clear explanation of the fire's cause, whether it was accidental, intentional, or due to external factors like natural disasters or faulty equipment. 5. Detailed inventory of damaged property: Policyholders must prepare an itemized list of all items damaged or destroyed by the fire, including furniture, electronics, personal belongings, and structural components. This inventory should include the estimated value, date of purchase, and photographs if available. 6. Receipts and proof of ownership: Supporting documentation such as receipts, invoices, warranties, and photographs should accompany the Proof of Loss form to validate ownership and value of the damaged or lost items. 7. Cost estimates: Policyholders must provide detailed cost estimates for repair or replacement of the damaged property. This involves obtaining quotes from contractors, repair specialists, or experts, validating the extent of the fire's impact. 8. Other relevant information: Supplemental information, like witness statements, fire department reports, police reports, or expert opinions, should be included to strengthen the fire claim process. Different types of Montana Proof of Loss for Fire Insurance Claims may exist based on the specific insurance policy or insurer requirements. For example, some insurers may have customized or additional forms that policyholders need to complete. It is essential to consult and communicate with the insurance company or the designated claims' adjuster to ensure compliance with their specific guidelines. In conclusion, the Montana Proof of Loss for Fire Insurance Claim is a crucial document enabling policyholders to seek compensation for fire damages. Compiling a detailed, accurate, and well-supported Proof of Loss form plays a decisive role in expediting the fire insurance claim process and maximizing the chance of a successful claim settlement.