No particular language is necessary for the return of an account as uncollectible so long as the notice or letter used clearly conveys the necessary information.

Montana Collection Agency's Return of Claim as Uncollectible

Description

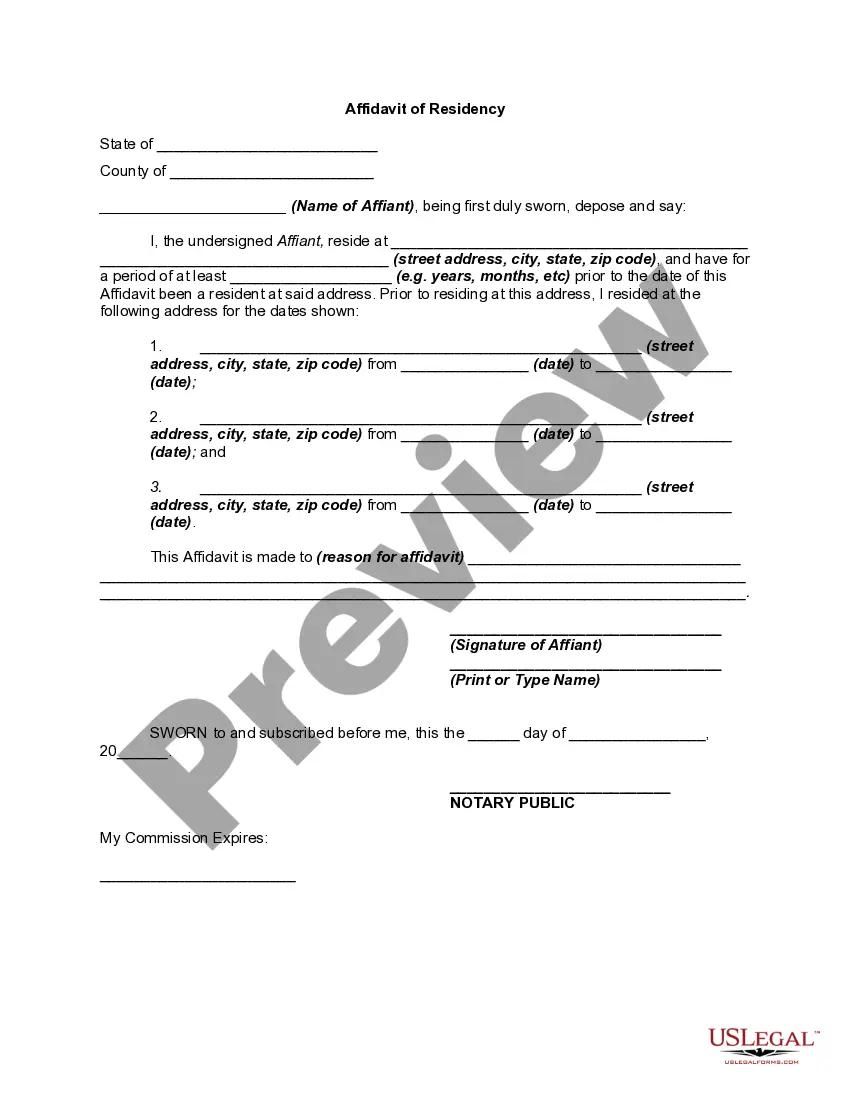

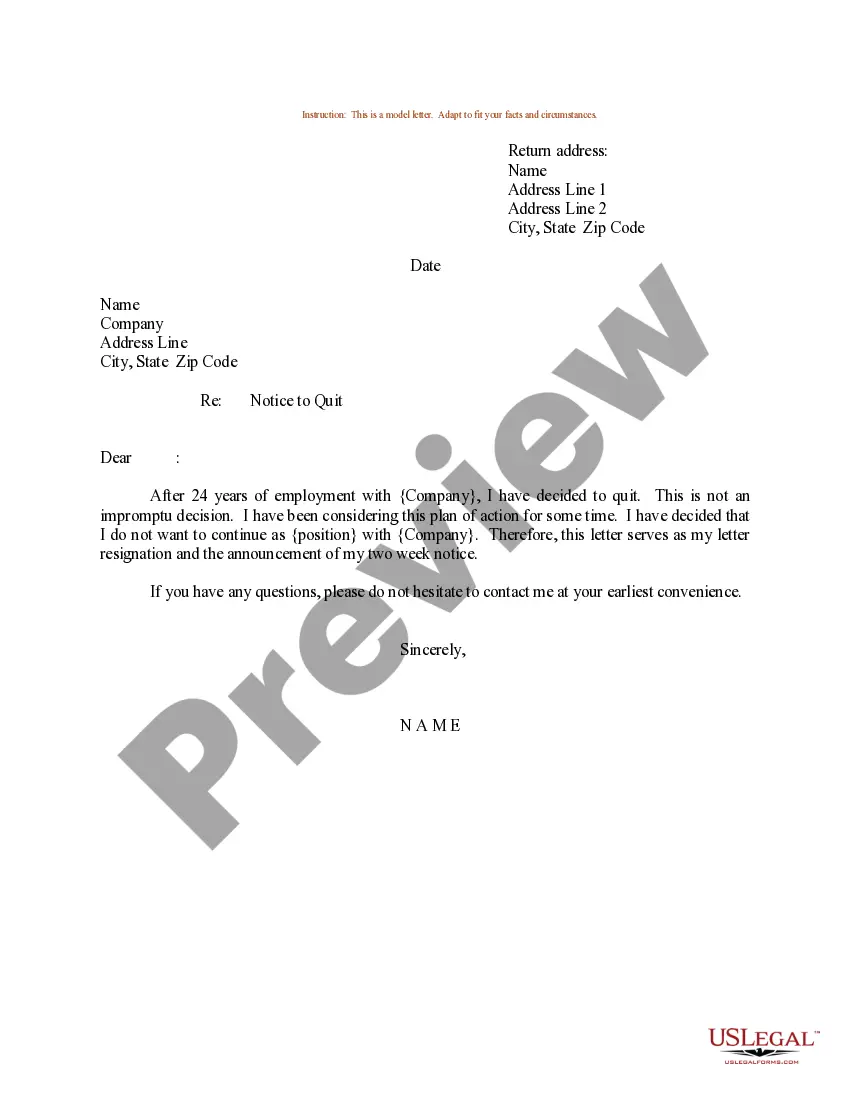

How to fill out Collection Agency's Return Of Claim As Uncollectible?

You have the capability to utilize online resources to search for the legal document template that satisfies the federal and state requirements you seek.

US Legal Forms offers thousands of legal forms that may be examined by experts.

It is easy to download or print the Montana Collection Agency's Return of Claim as Uncollectible from their service.

If available, utilize the Preview button to review the document template as well.

- If you possess a US Legal Forms account, you can Log In and click the Download button.

- Then, you can complete, modify, print, or sign the Montana Collection Agency's Return of Claim as Uncollectible.

- Every legal document template you acquire is yours indefinitely.

- To obtain an extra copy of a purchased form, go to the My documents tab and click the corresponding button.

- If you are using the US Legal Forms site for the first time, follow the straightforward instructions below.

- First, ensure you have selected the correct document template for your specific area or town.

- Review the form description to confirm that you have chosen the correct document.

Form popularity

FAQ

In most cases, the statute of limitations for a debt will have passed after 10 years. This means a debt collector may still attempt to pursue it (and you technically do still owe it), but they can't typically take legal action against you.

There are 3 ways you can remove collections from your credit report without paying. 1) sending a Goodwill letter asking for forgiveness 2) disputing the collections yourself 3) working with a credit repair company like Credit Glory that can dispute it for you.

Under the Fair Credit Reporting Act, debts can appear on your credit report generally for seven years and in a few cases, longer than that. Under state laws, if you are sued about a debt, and the debt is too old, you may have a defense to the lawsuit.

A goodwill deletion is the only way to remove a legitimate paid collection from a credit report. This strategy involves you writing a letter to your lender. In the letter, you need to explain your circumstances and why you would like the record of the paid collection to be removed from your credit report.

The time limit is sometimes called the limitation period. For most debts, the time limit is 6 years since you last wrote to them or made a payment. The time limit is longer for mortgage debts.

Once a creditor cancels or forgives a debt, the creditor is prohibited from trying to collect the debt. This is because the debt no longer exists, and the debtor therefore no longer has a legal responsibility to pay it.

Each state has an established statute of limitations on debt collection, which outlines the time frame during which a debt collector can pursue legal action against you. In Montana, creditors have between four and 10 years to sue you, depending on the type of debt.

A goodwill deletion is the only way to remove a legitimate paid collection from a credit report. This strategy involves you writing a letter to your lender. In the letter, you need to explain your circumstances and why you would like the record of the paid collection to be removed from your credit report.

After seven years, most collections accounts should fall off your credit reportso if you're closing in on seven years, just hang on. The impact on your credit score is probably already lessened. After the collection account disappears, your credit score might improve.

Criminal Statute of Limitations in Montana In Montana, all misdemeanors carry a one-year statute of limitations. Felonies are more varied, with a 10-year time limit for rape or 10 years after victim reaches 18 years of age. Most other felonies carry a five-year time limit.