An agreement modifying a loan agreement and mortgage should be signed by both parties to the transaction and recorded in the office of the register of deeds and mortgages where the original mortgage was recorded. Such a modification or extension is contractual in nature and must be supported by consideration. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Montana Mortgage Extension Agreement with Assumption of Debt by New Owner of Real Property Covered by the Mortgage and Increase of Interest

Description

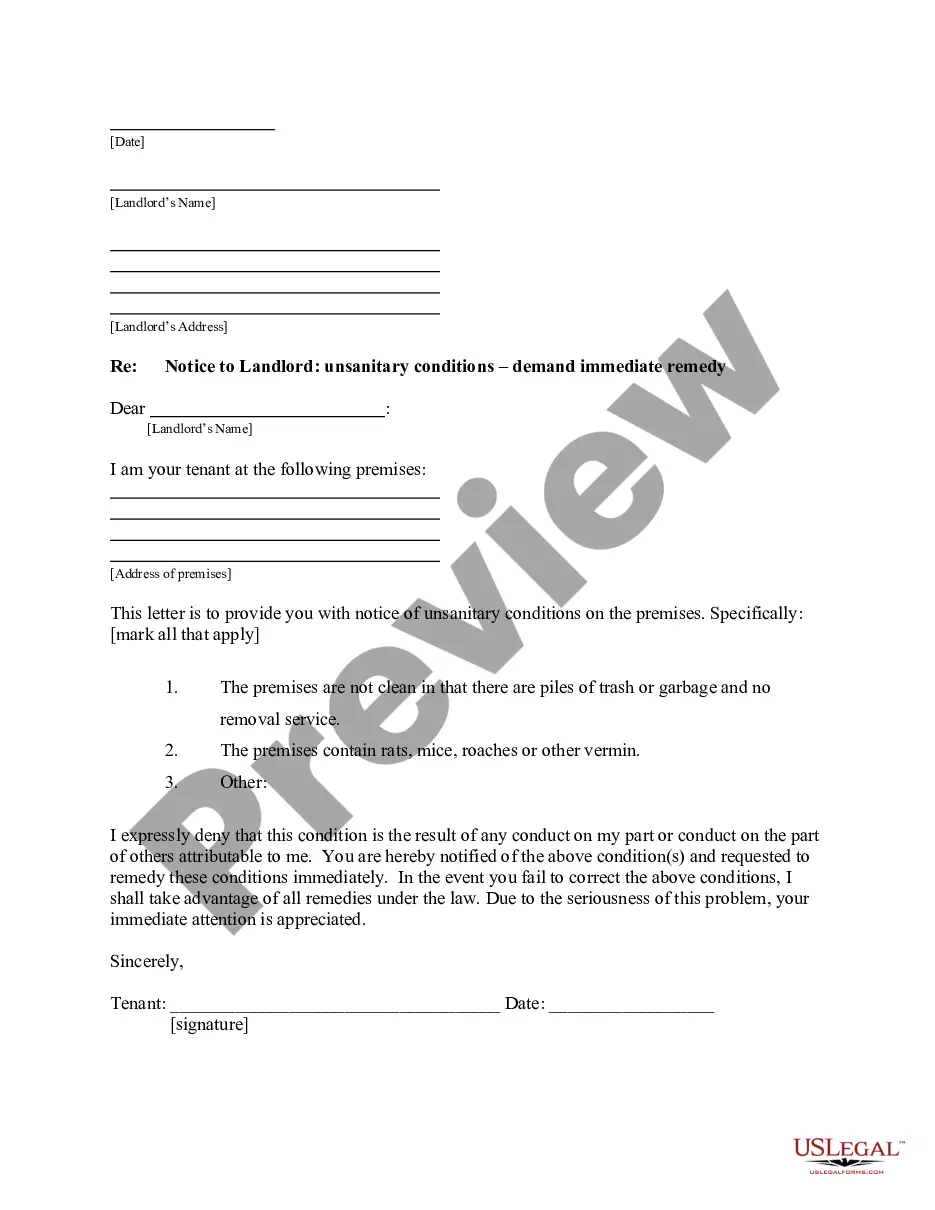

How to fill out Mortgage Extension Agreement With Assumption Of Debt By New Owner Of Real Property Covered By The Mortgage And Increase Of Interest?

US Legal Forms - one of several greatest libraries of legitimate forms in America - provides a wide array of legitimate file themes you are able to down load or print. Making use of the site, you may get thousands of forms for organization and personal functions, sorted by groups, states, or search phrases.You will discover the most up-to-date types of forms like the Montana Mortgage Extension Agreement with Assumption of Debt by New Owner of Real Property Covered by the Mortgage and Increase of Interest in seconds.

If you already possess a subscription, log in and down load Montana Mortgage Extension Agreement with Assumption of Debt by New Owner of Real Property Covered by the Mortgage and Increase of Interest in the US Legal Forms catalogue. The Acquire key will show up on each and every form you look at. You get access to all earlier acquired forms inside the My Forms tab of the profile.

If you want to use US Legal Forms for the first time, here are simple recommendations to help you get began:

- Be sure to have chosen the right form to your town/area. Go through the Review key to check the form`s information. Browse the form outline to ensure that you have selected the proper form.

- In case the form does not match your specifications, make use of the Look for discipline near the top of the monitor to obtain the one who does.

- Should you be content with the shape, validate your decision by visiting the Buy now key. Then, pick the costs program you prefer and provide your accreditations to sign up for the profile.

- Method the deal. Utilize your credit card or PayPal profile to complete the deal.

- Select the formatting and down load the shape on your gadget.

- Make modifications. Fill out, modify and print and indication the acquired Montana Mortgage Extension Agreement with Assumption of Debt by New Owner of Real Property Covered by the Mortgage and Increase of Interest.

Every single design you included with your account does not have an expiry time and is also yours permanently. So, if you would like down load or print yet another copy, just proceed to the My Forms portion and click about the form you will need.

Gain access to the Montana Mortgage Extension Agreement with Assumption of Debt by New Owner of Real Property Covered by the Mortgage and Increase of Interest with US Legal Forms, the most extensive catalogue of legitimate file themes. Use thousands of specialist and state-particular themes that meet up with your business or personal demands and specifications.

Form popularity

FAQ

Additionally, sellers who can offer loan assumption may have a leg up on others because they can provide the opportunity to lock in low interest rates. In some cases, they can even sell their home at a higher price because the lower interest rate offsets the higher principal amount.

The due-on-sale clause protects your lender by preventing prospective buyers from assuming your mortgage.

If you assume the mortgage, you'll need to compensate the seller for the equity they've built up in the home ? the amount of the mortgage they've paid off. While this is part of the overall purchase price, you have to pay it right away ? as part of your down payment, basically.

Cons On An Assumable Mortgage If you don't have that much cash, you'll have to take a second mortgage at current rate to cover the shortfall. You'll have to assume mortgage insurance payments: Most FHA and all USDA loans will include a monthly mortgage insurance payment in addition to the mortgage payment itself.

How Does An Assumable Mortgage Work? An assumable mortgage works much the same as a traditional home loan, except the buyer is limited to financing through the seller's lender. Lenders must typically approve an assumable mortgage.

VA loans and USDA don't require any down payment and you can get an FHA loan for as little as 3.5% down. But you'll need to make a much larger down payment ? at least 15 %, ing to Tozer ? when assuming one of these loans. The reason is, an assumable loan rarely covers the full purchase price of the house.

Most importantly, an alienation clause prevents a homebuyer from assuming the current mortgage on the property. Without this clause, the new owner could assume the existing mortgage and repay it at that interest rate, rather than obtaining a new loan at prevailing rates.

How do assumable mortgages work? When you assume a mortgage, the current borrower signs the balance of their loan over to you, and you become responsible for the remaining payments. That means the mortgage will have the same terms the previous homeowner had, including the same interest rate and monthly payments.