Montana Child Support Transmittal #2 - Subsequent Actions and Instructions

Description

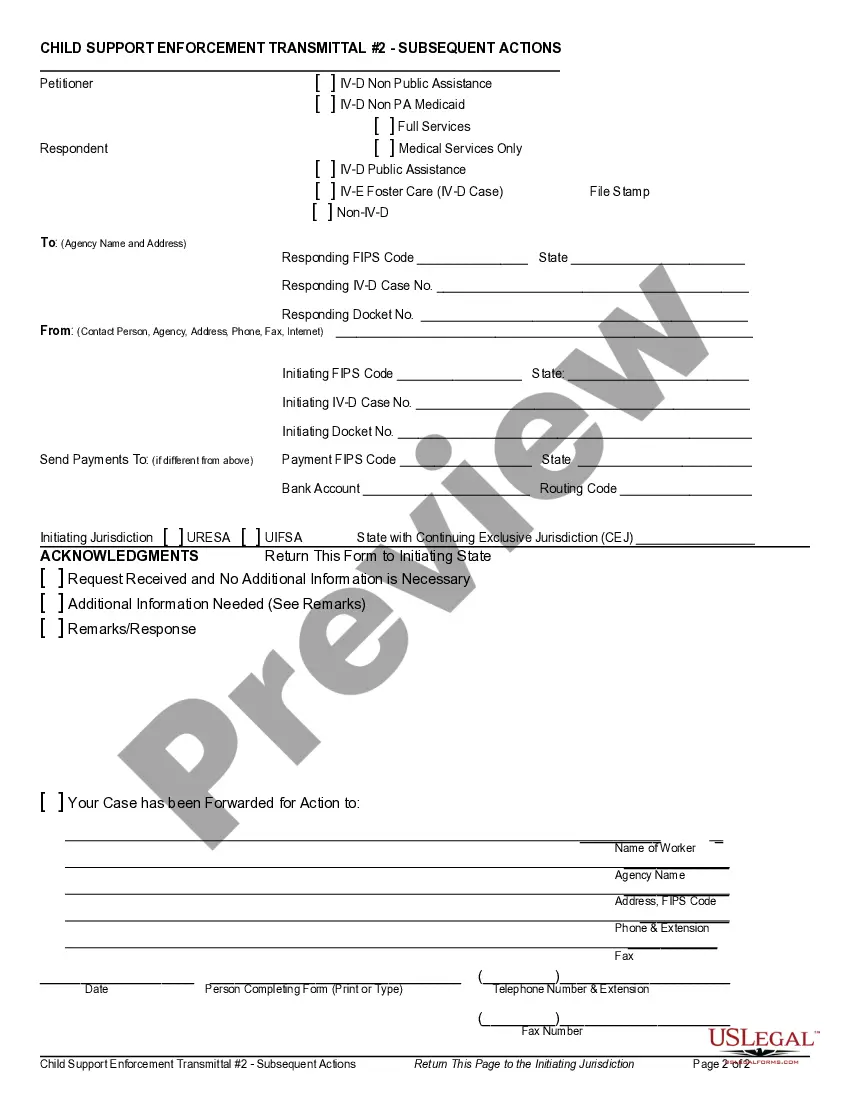

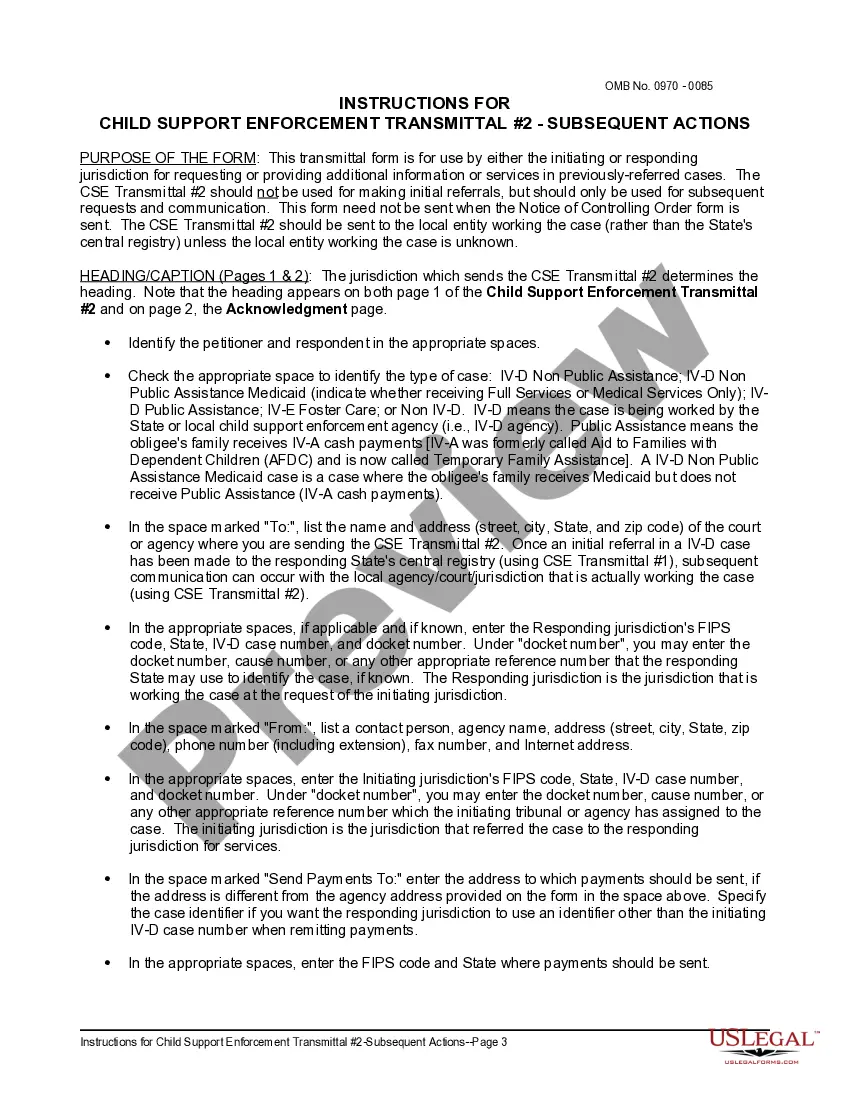

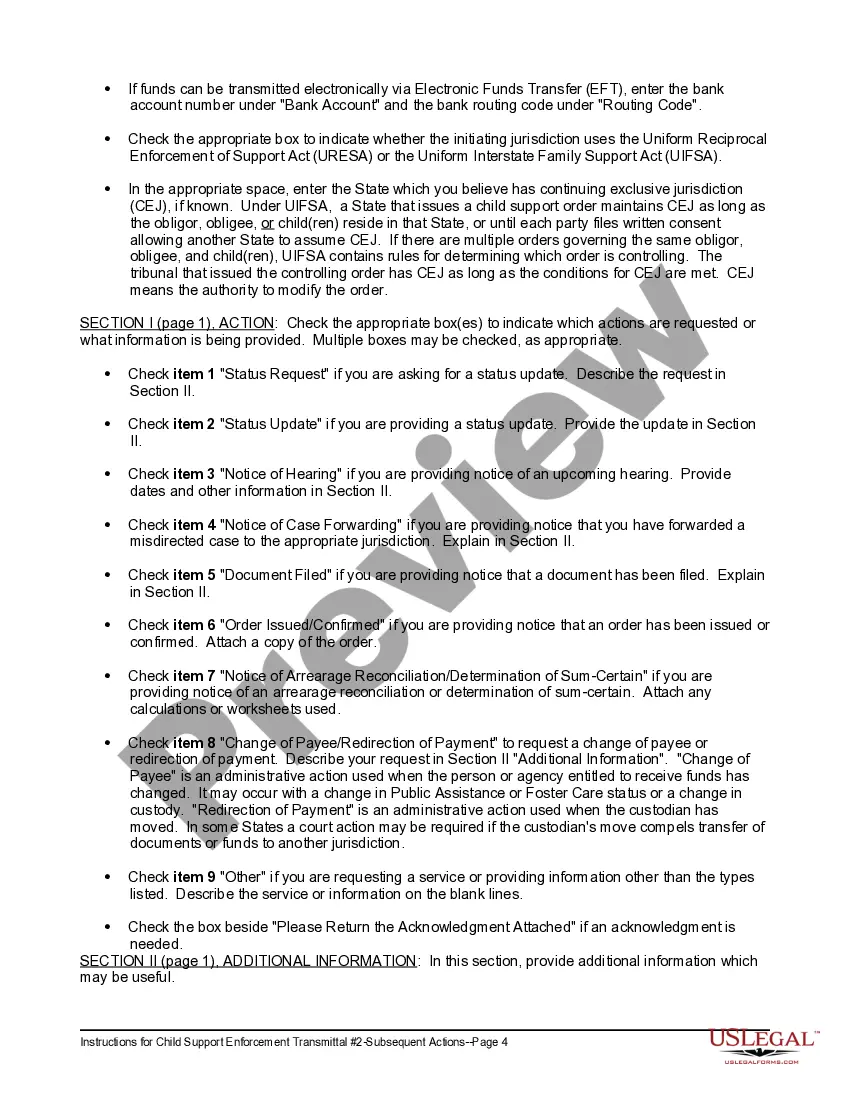

How to fill out Child Support Transmittal #2 - Subsequent Actions And Instructions?

If you require to aggregate, acquire, or produce authentic document templates, utilize US Legal Forms, the largest assortment of legal forms, available online.

Employ the site's straightforward and convenient search feature to locate the documents you need. Numerous templates for business and personal purposes are organized by categories and states, or keywords.

Utilize US Legal Forms to find the Montana Child Support Transmittal #2 - Subsequent Actions and Instructions with just a few clicks.

Every legal document template you purchase is yours permanently. You will have access to every form you acquired in your account. Navigate to the My documents section and select a form to print or download again.

Acquire and download, and print the Montana Child Support Transmittal #2 - Subsequent Actions and Instructions with US Legal Forms. There are millions of professional and state-specific forms you can utilize for your business or personal requirements.

- If you are an existing US Legal Forms user, sign in to your account and then click the Get button to obtain the Montana Child Support Transmittal #2 - Subsequent Actions and Instructions.

- You can also access forms you previously obtained in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Make sure you have selected the form for the appropriate city/state.

- Step 2. Use the Preview option to review the form’s content. Be sure to check the summary.

- Step 3. If you are dissatisfied with the document, use the Search field at the top of the screen to find alternative versions of the legal form template.

- Step 4. Once you have found the form you need, click on the Purchase now button. Choose your preferred payment plan and enter your information to register for an account.

- Step 5. Complete the payment process. You can use your credit card or PayPal account to finalize the transaction.

- Step 6. Select the format of the legal form and download it to your device.

- Step 7. Complete, edit, and print or sign the Montana Child Support Transmittal #2 - Subsequent Actions and Instructions.

Form popularity

FAQ

The three basic principles of the Melson formula are 1) parents are entitled to sufficient income to meet their basic needs; 2) parents shouldn't be permitted to retain more income than required to meet their basic needs; and 3) the child(ren) are entitled to share in any additional income and benefit from a ...

(c) A person convicted of aggravated nonsupport shall be fined an amount not to exceed $50,000 or be imprisoned in the state prison for a term not to exceed 10 years, or both.

Most child support in Montana is collected via income withholding from a parent's wages. When income withholding is not available the CSSD does have other enforcement actions available.

CSED can suspend the paying parent's driver's license, recreational hunting license, and professional or occupational licenses if the parent has arrearages totaling six months or more. CSED can intercept the paying parent's state tax returns and apply them to any arrearages.

In split or joint custody situations, a judge may order both parents to pay support or may not order child support at all. Ultimately, any child support award must serve a child's best interests.

Montana's Statute of Limitations on Back Child Support Payments (Arrears) The Montana statute of limitations on enforcement of child support is 10 years from the date of payment due for debt accrued prior to 10/1/1993; 10 years after termination of obligation for payments due after 10/1/1993.

The Montana statute of limitations on enforcement of child support is 10 years from the date of payment due for debt accrued prior to 10/1/1993; 10 years after termination of obligation for payments due after 10/1/1993.

Child support ends upon the 18th birthday or at graduation from high school, whichever is later, but no later than age 19.