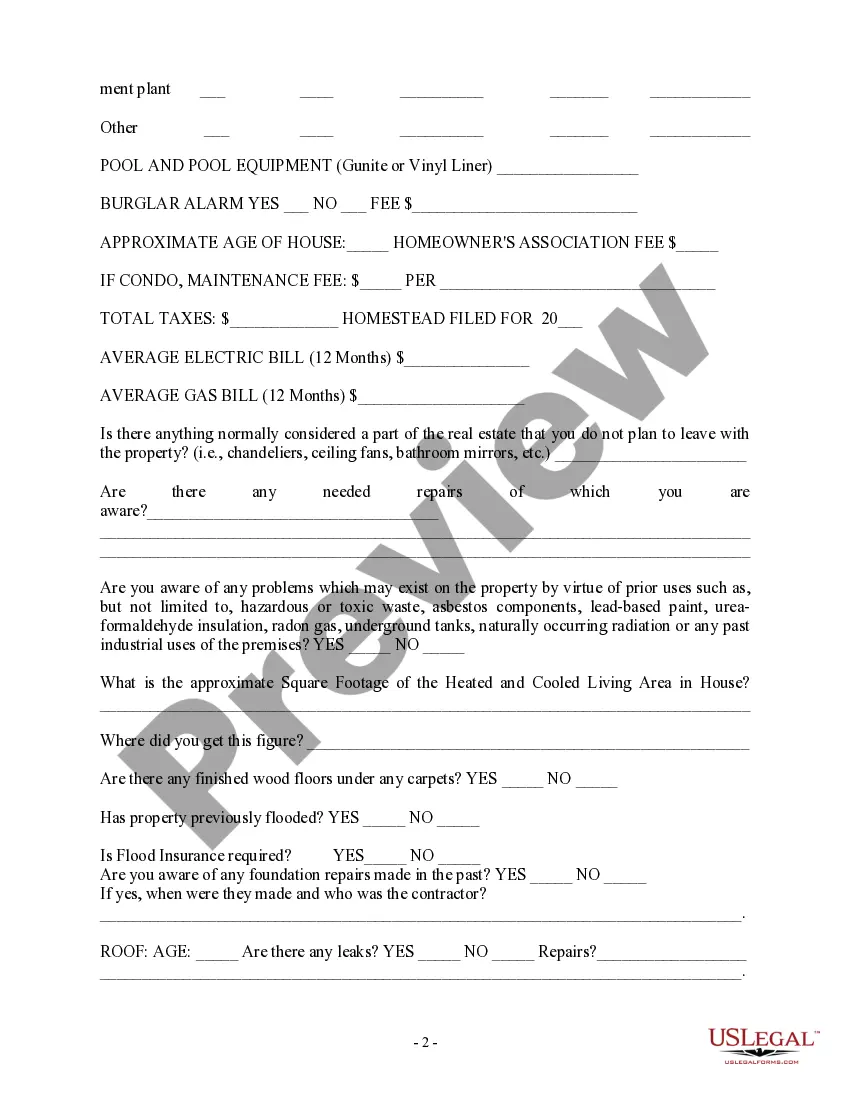

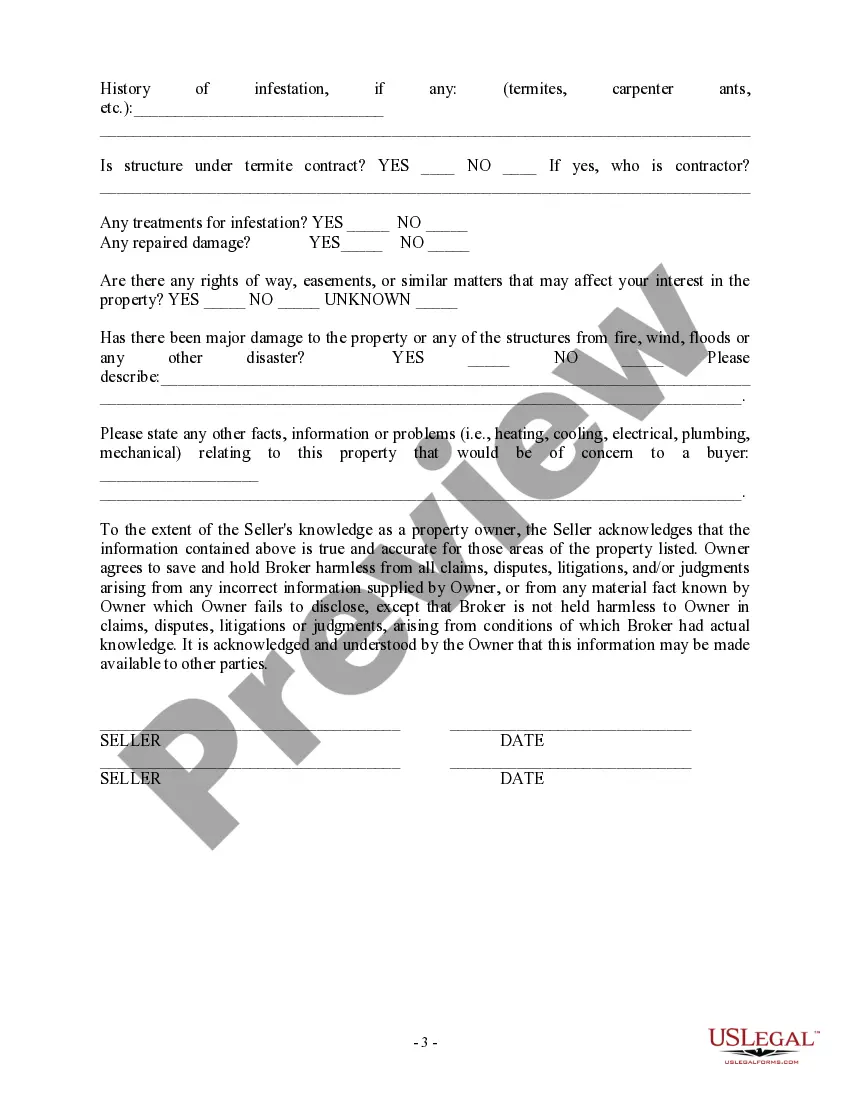

Montana Seller's Real Estate Disclosure Statement

Description

How to fill out Seller's Real Estate Disclosure Statement?

Have you ever been in a situation where you needed documents for either business or personal reasons almost all the time.

There is a multitude of legal document templates available online, but finding reliable ones can be challenging.

US Legal Forms offers thousands of document templates, such as the Montana Seller's Real Estate Disclosure Statement, designed to comply with federal and state regulations.

If you find the correct document, click Buy now.

Select the pricing plan you wish to use, provide the necessary information to create your account, and pay for the order using your PayPal or Visa or Mastercard.

- If you are already familiar with the US Legal Forms website and possess an account, simply Log In.

- Then, you will be able to download the Montana Seller's Real Estate Disclosure Statement template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Locate the document you require and ensure it is for the correct city/region.

- Use the Review button to review the form.

- Read the description to ensure you have selected the correct document.

- If the document is not what you are looking for, utilize the Search section to find the form that meets your needs.

Form popularity

FAQ

The seller and any broker(s)/agent(s) involved are to participate in the disclosures. If more than one broker/agent is involved, the broker/agent obtaining the offer is to deliver the disclosures to the prospective buyer unless the seller instructs otherwise.

Many years ago, the Montana legislature looked at this issue and passed laws preventing the taxing authorities from using the sales price of properties as the basis for establishing taxable values. As a result, Montana became one of the non-disclosure states in the U.S.

Here are eight common real estate seller disclosures to be aware of, whether you're on the buyer's side or the seller's side.Death in the Home.Neighborhood Nuisances.Hazards.Homeowners' Association Information.Repairs.Water Damage.Missing Items.Other Possible Disclosures.

California's Especially Stringent Disclosure Requirements In addition, California sellers must fill out a separate form that discloses potential hazards from floods, earthquakes, fires, environmental hazards, and other problems. (This is called a Natural Hazard Disclosure Statement.)

A Seller's Disclosure is a legal document that requires sellers to provide previously undisclosed details about the property's condition that prospective buyers may find unfavorable. This document is also known as a property disclosure, and it's important for both those buying a house and for those selling a house.

It includes the loan terms, your projected monthly payments, and how much you will pay in fees and other costs to get your mortgage (closing costs). The lender is required to give you the Closing Disclosure at least three business days before you close on the mortgage loan.

A Seller's Disclosure is a legal document that requires sellers to provide previously undisclosed details about the property's condition that prospective buyers may find unfavorable. This document is also known as a property disclosure, and it's important for both those buying a house and for those selling a house.

The State Transfer Disclosure is required for all home sales in California. The transfer disclosure statement (TDS) evaluates the condition of a property. Every residential seller must complete the TDS document. It will let the buyer know about major defects at the property.

The document provided by the seller that described the condition of the property is known as the Transfer Disclosure Statement. As a buyer, you should receive this document during the contract contingency period.

A disclosure statement is a financial document given to a participant in a transaction explaining key information in plain language. Disclosure statements for retirement plans must clearly spell out who contributes to the plan, contribution limits, penalties, and tax status.