Title: Understanding Montana Letters Regarding Trust Money: A Comprehensive Overview Introduction: Montana Letters play a crucial role in the realm of trust funds, ensuring transparency, compliance, and accountability. This article aims to provide a detailed description of Montana Letters regarding trust money, shedding light on their significance, types, and key aspects. We will explore various variations of these letters, including Montana Letters of Release, Notification, and Approval, among others. 1. Montana Letters Regarding Trust Money: An Overview: — Trust Money Defined: Trust money refers to funds entrusted to a fiduciary, typically a trustee, for the benefit of beneficiaries, with specific instructions on its usage and allocation. — Importance of Montana Letters: Montana Letters serve as official documents that establish trust money's existence, authenticate fiduciary actions, and protect the rights of beneficiaries. 2. Montana Letters of Approval: — Purpose: These letters are granted when a trustee requires authorization to execute a particular financial transaction or investment using trust funds. — Scope: Montana Letters of Approval outline the details of the proposed transaction, ensuring compliance with trust terms, legal regulations, and fiduciary responsibilities. — Process: Trustee submits a comprehensive request detailing the transaction's purpose, beneficiary benefits, associated risks, and legal implications. Upon a thorough review, the approval letter is issued or denied. 3. Montana Letters of Release: — Significance: When beneficiaries receive their entitled portion of trust money or when the trust fund reaches its termination, Montana Letters of Release are issued. — Content: These letters confirm the completion of all distributions, discharge the trustee's liabilities, and signal the successful closure of the trust. Details may include final account summaries and instructions regarding any remaining assets or actions required. 4. Montana Letters of Notification: — Purpose: These letters are dispatched to beneficiaries, notifying them of changes in trust terms, administration, investment strategies, or critical updates impacting their interests. — Content: Montana Letters of Notification emphasize transparency, providing thorough explanations for the modifications, ensuring beneficiaries' complete understanding and informed decision-making. 5. Montana Letters of Accounting: — Essence: These letters focus on maintaining transparency and accountability by illustrating the financial transactions, distributions, and administrative actions performed by the trustee within a specified accounting period. — Contents: Montana Letters of Accounting encompass balance sheets, income statements, expense reports, beneficiary distributions, and necessary explanations or justifications for any discrepancies. Conclusion: Montana Letters regarding trust money fulfill vital roles in safeguarding the interests of beneficiaries, promoting trust administration best practices, and ensuring proper financial management. Understanding their implications, various types, and their respective purposes is essential for trustees and beneficiaries alike, creating a harmonious relationship built on trust and compliance.

Montana Letter regarding trust money

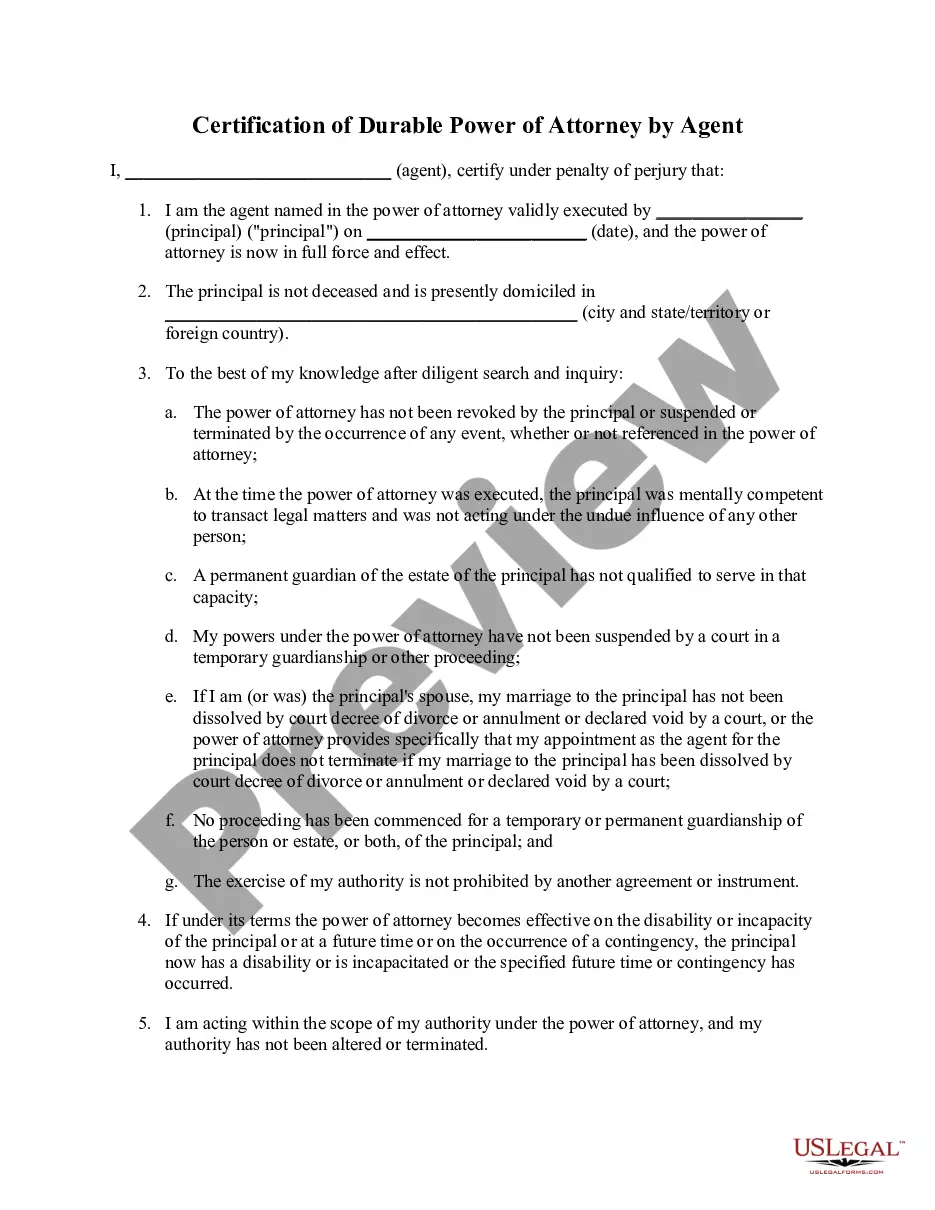

Description

How to fill out Montana Letter Regarding Trust Money?

It is possible to devote hours online searching for the legitimate record template that meets the state and federal needs you need. US Legal Forms gives thousands of legitimate kinds which are analyzed by professionals. You can actually obtain or produce the Montana Letter regarding trust money from your support.

If you currently have a US Legal Forms profile, you can log in and click on the Obtain key. After that, you can complete, change, produce, or indication the Montana Letter regarding trust money. Every single legitimate record template you get is your own eternally. To acquire an additional duplicate of the purchased type, check out the My Forms tab and click on the related key.

Should you use the US Legal Forms website the very first time, follow the basic guidelines under:

- Initially, make sure that you have chosen the right record template for your county/metropolis of your choosing. Look at the type information to ensure you have picked out the right type. If readily available, use the Review key to look with the record template too.

- If you wish to find an additional model from the type, use the Research area to discover the template that meets your needs and needs.

- When you have discovered the template you would like, click Acquire now to proceed.

- Pick the pricing plan you would like, key in your references, and register for an account on US Legal Forms.

- Total the purchase. You can use your credit card or PayPal profile to cover the legitimate type.

- Pick the structure from the record and obtain it to the gadget.

- Make adjustments to the record if needed. It is possible to complete, change and indication and produce Montana Letter regarding trust money.

Obtain and produce thousands of record templates making use of the US Legal Forms Internet site, that provides the most important assortment of legitimate kinds. Use expert and status-distinct templates to take on your business or personal requires.