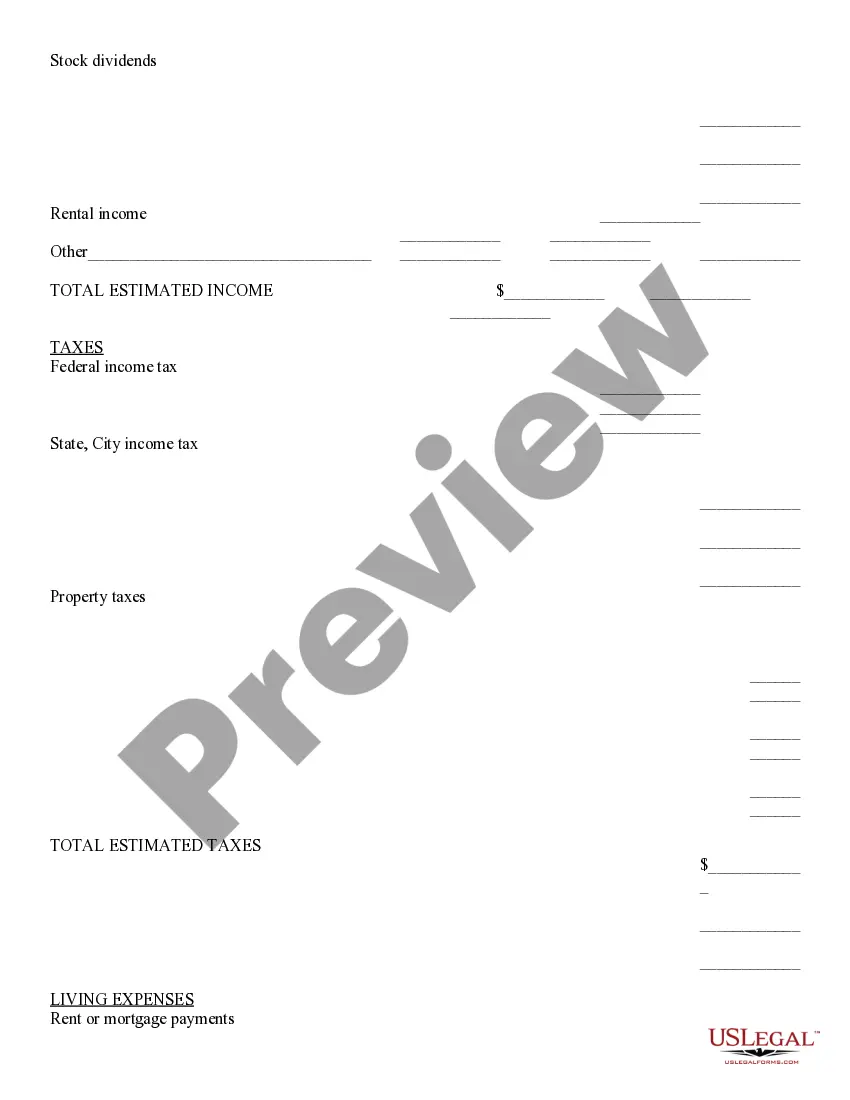

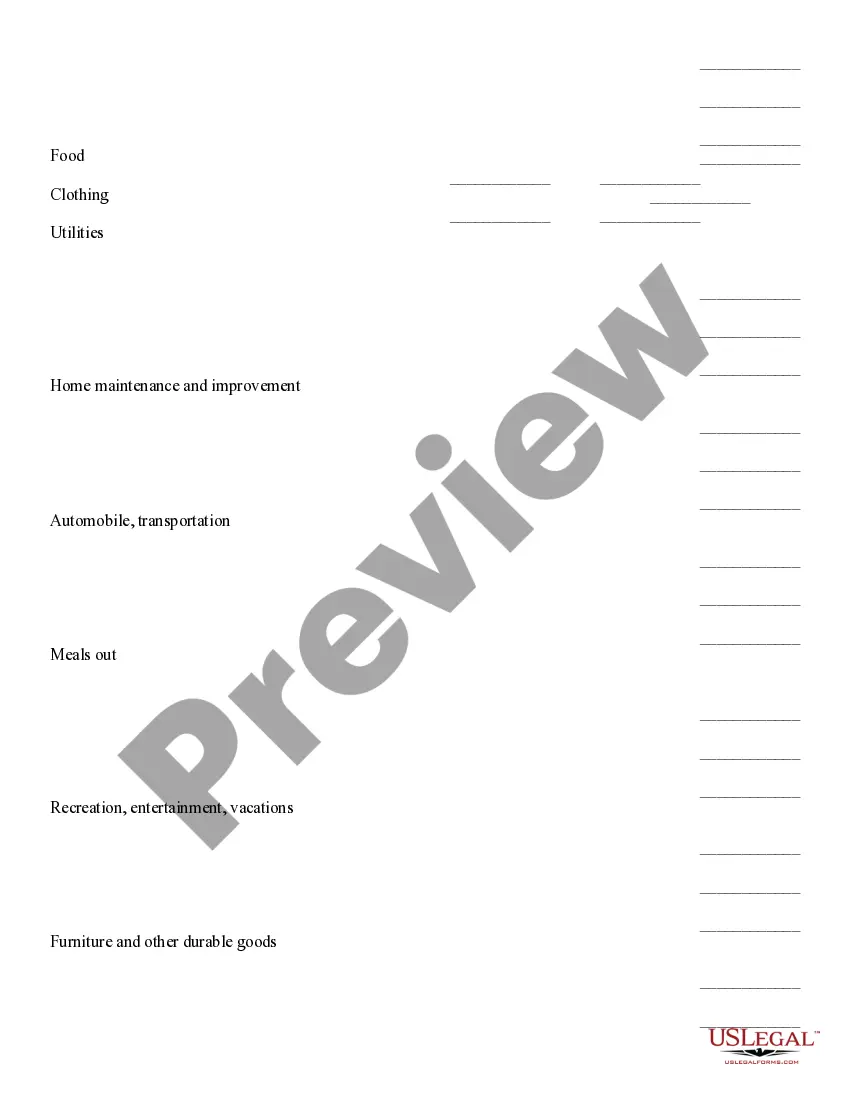

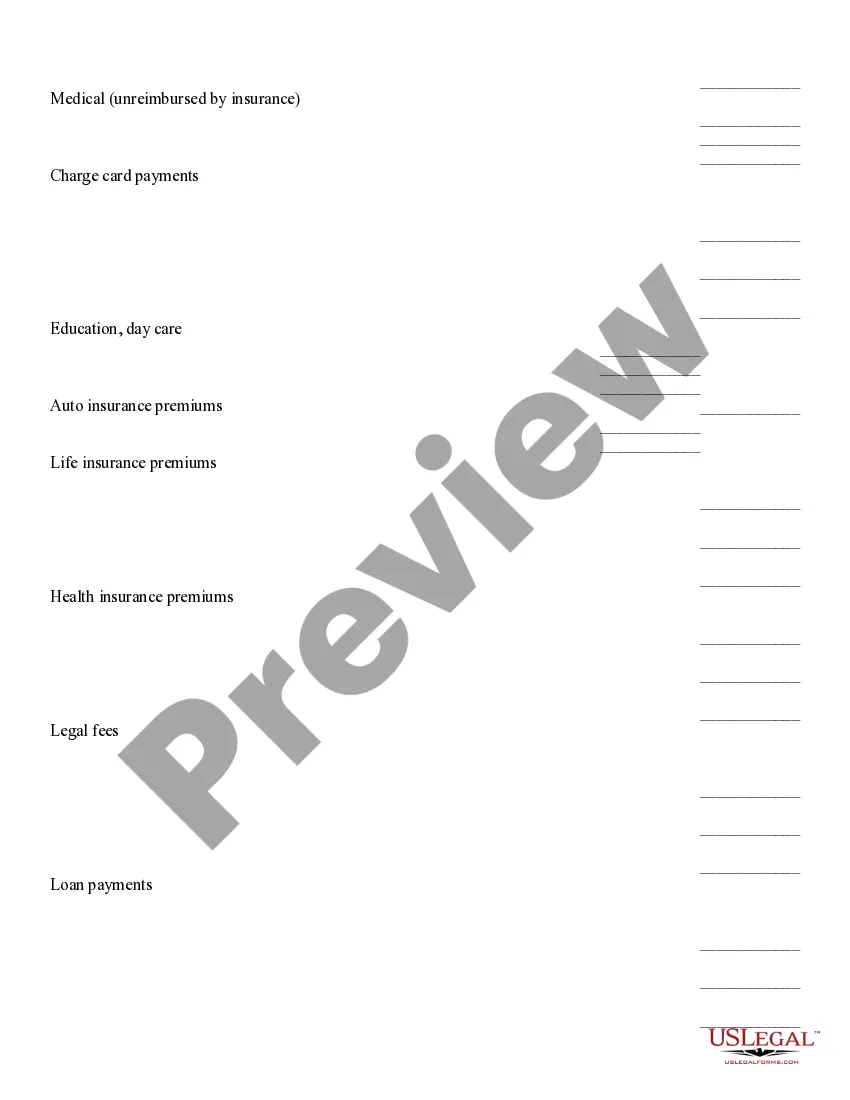

Montana Retirement Cash Flow

Description

How to fill out Retirement Cash Flow?

US Legal Forms - one of the largest collections of legal documents in the United States - offers a broad selection of legal form templates that you can download or print.

While using the website, you can locate numerous forms for business and personal needs, organized by categories, states, or keywords. You can find the latest forms such as the Montana Retirement Cash Flow in moments.

If you already have an account, Log In and download the Montana Retirement Cash Flow from your US Legal Forms library. The Download button will appear on every form you view. You can access all previously downloaded forms from the My documents section of your account.

Process the transaction. Use a credit card or PayPal account to complete the purchase.

Select the format and download the document to your device. Make modifications. Fill out, edit, and print and sign the downloaded Montana Retirement Cash Flow. Each template you add to your account has no expiration date and is yours indefinitely. Therefore, if you wish to download or print another copy, just go to the My documents section and click on the form you desire. Access the Montana Retirement Cash Flow with US Legal Forms, the largest collection of legal document templates. Utilize a wide variety of professional and state-specific templates that meet your business or personal needs and requirements.

- Make sure you have selected the correct form for your jurisdiction.

- Click the Preview button to review the content of the form.

- Examine the form details to confirm that you have chosen the right document.

- If the form does not meet your needs, utilize the Search bar at the top of the page to find one that does.

- If you are pleased with the form, confirm your choice by clicking the Get now button.

- Then, select your preferred payment plan and provide your information to sign up for an account.

Form popularity

FAQ

If you want your retirement to be calm and relaxing, Montana could be the place for you. This beautiful and safe Midwestern state has stunning scenery and thriving cities, perfect for active adults who enjoy wide-open spaces. The Treasure State is a haven for retirees.

Montana is moderately tax-friendly for retirees. Depending on your specific financial circumstances, you may find it very friendly or very unfriendly. For starters, the state has no sales tax, which lowers living costs for everyone. It also has relatively low property taxes.

Montana is moderately tax-friendly for retirees. Depending on your specific financial circumstances, you may find it very friendly or very unfriendly. For starters, the state has no sales tax, which lowers living costs for everyone. It also has relatively low property taxes.

Nine of those states that don't tax retirement plan income simply because distributions from retirement plans are considered income, and these nine states have no state income taxes at all: Alaska, Florida, Nevada, New Hampshire, South Dakota, Tennessee, Texas, Washington and Wyoming.

TAX-FRIENDLY RETIREMENT Not only does this state have an overall lower tax burden than the rest of the United States, but its income tax rates are also capped at 6.65 percent. Certain amounts of social security payments and pensions aren't taxed, and there is no sales tax in Montana at all.

Due in large part to a relatively low cost of living, retirement is relatively affordable in Montana. The average 65 year old in the state will spend an estimated $998,983 to retire comfortably, about $121,400 less than the typical 65 year old American. A relatively large share of Montana's population are 65 or older.

Hey, who's complaining? Regardless of where it came from, that $10,000 a month gives you plenty of options for where you can retire, including states with higher income tax rates like New York and California. Here, we outline our top five picks.

TAX-FRIENDLY RETIREMENT Not only does this state have an overall lower tax burden than the rest of the United States, but its income tax rates are also capped at 6.65 percent. Certain amounts of social security payments and pensions aren't taxed, and there is no sales tax in Montana at all.

One rule of thumb is that you'll need 70% of your pre-retirement yearly salary to live comfortably.

Although housing prices are on the rise, Montana is still pretty affordable, which makes it a great place to settle down.