Montana Escrow Agreement for Residential Sale: A Comprehensive Description In the state of Montana, when it comes to residential real estate transactions, the use of an escrow agreement is of great importance. An escrow agreement acts as a safeguard for both the buyer and the seller, ensuring a smooth and secure transfer of property ownership. This detailed description aims to provide valuable insights into the Montana escrow agreement for residential sales, along with relevant keywords associated with this topic. The Montana Escrow Agreement for Residential Sale serves as a legally binding contract between the buyer, seller, and the neutral third party known as the escrow agent. The main purpose of this agreement is to hold the funds, legal documents, and other pertinent items related to the transaction until all terms and conditions are successfully met. Keywords: Montana escrow agreement, residential sale, escrow agent, buyer, seller, real estate transactions, property ownership, legally binding contract, funds, legal documents, terms and conditions. Different Types of Montana Escrow Agreement for Residential Sale: 1. Standard Montana Escrow Agreement: This is the most common type of escrow agreement used in residential real estate sales. It covers the essential elements required for a successful transaction, such as the purchase price, escrow timeline, conditions for release of funds, and conditions for property title transfer. 2. Contingency Escrow Agreement: This type of agreement includes specific contingencies that must be satisfied before the transaction can be completed. Contingencies may vary and can include conditions such as inspection reports, loan approval, or property repairs, among others. The release of funds and property transfer is contingent upon the satisfactory fulfillment of all agreed-upon contingencies. 3. Owner Financing Escrow Agreement: In certain cases, the seller may offer to finance a portion or the entirety of the purchase price. This type of escrow agreement outlines the terms and conditions related to the financing arrangement, including interest rates, repayment schedules, and default provisions. The escrow agent ensures the proper handling and disbursement of funds, along with monitoring the buyer's compliance with the financing terms. 4. Short Sale Escrow Agreement: When a property is listed for sale at a price lower than the outstanding mortgage balance, a short sale escrow agreement is used. This agreement outlines the necessary steps and conditions for the completion of the short sale transaction, including the approval of the lender. The escrow agent plays a crucial role in coordinating communication between the buyer, seller, and lender, ensuring a smooth process. Key Components of a Montana Escrow Agreement for Residential Sale: 1. Parties Involved: Identification of the buyer, seller, and escrow agent, including their contact details. 2. Property Description: Detailed information regarding the property being sold, including its address and legal description. 3. Purchase Price and Deposit: Stipulation of the agreed-upon purchase price and the amount of initial deposit to be held in escrow. 4. Escrow Timeline: Specific dates and deadlines for various stages of the escrow process, such as inspection periods, financing contingency removal, and the closing date. 5. Conditions for Release of Funds: Clearly defined conditions that must be met for the release of funds, including the buyer's satisfaction with property inspections, loan approvals, and any additional contingencies. 6. Title Transfer: Provisions related to the transfer of property title, including any necessary title searches, clearances, and insurance. 7. Default and Dispute Resolution: Outline of consequences in the event of a breach of contract, default, or dispute resolution mechanisms, such as mediation or arbitration. 8. Escrow Agent's Duties: Identification of the responsibilities and obligations of the escrow agent, including the safekeeping of funds, documents, and compliance with applicable laws and regulations. In conclusion, the Montana Escrow Agreement for Residential Sale provides a comprehensive framework for real estate transactions within the state. Its purpose is to protect the interests of both buyers and sellers, ensuring a secure and successful property transfer. Different types of escrow agreements cater to specific transaction circumstances, and each one serves to establish clear guidelines and responsibilities.

Montana Escrow Agreement for Residential Sale

Description

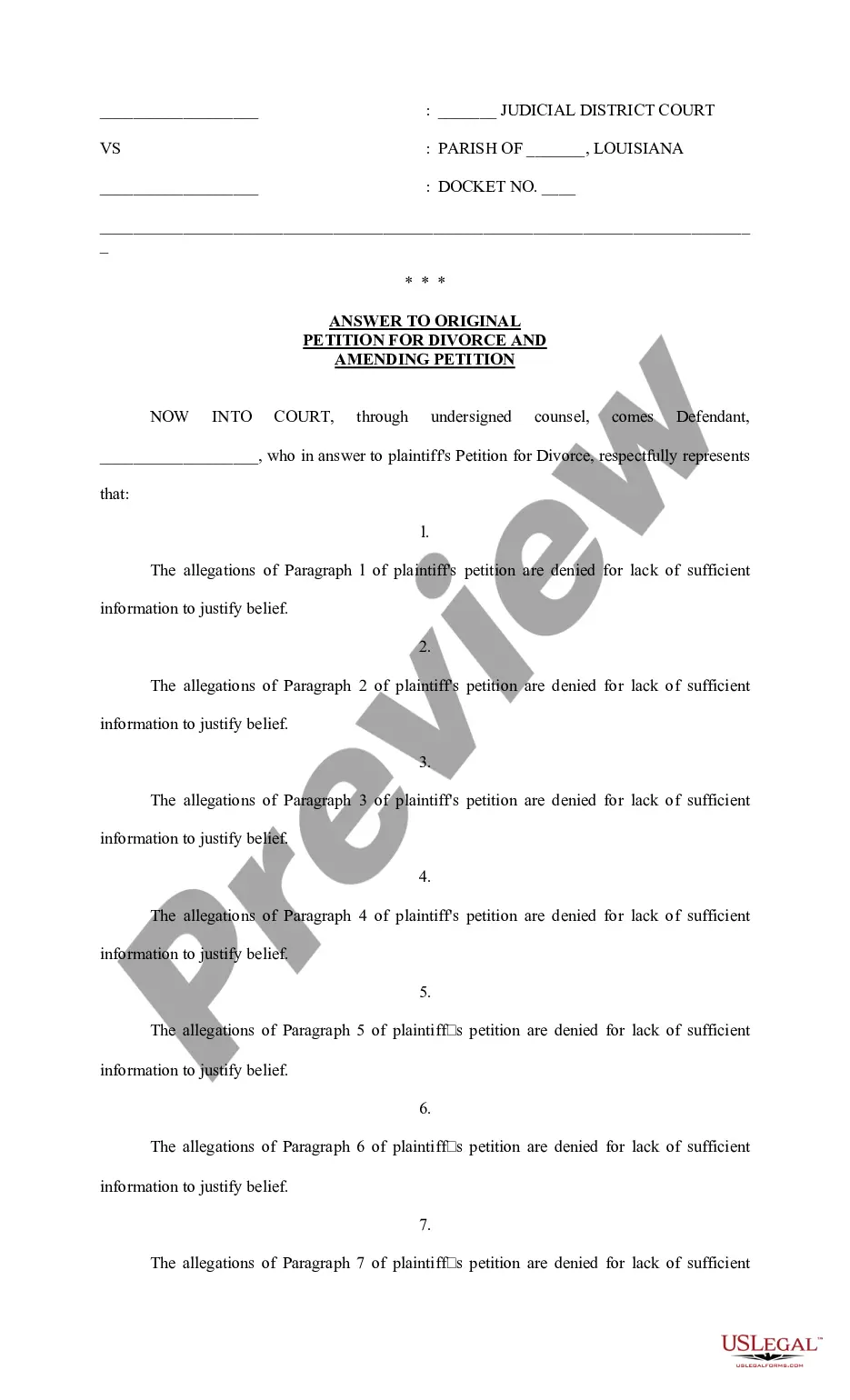

How to fill out Montana Escrow Agreement For Residential Sale?

Selecting the appropriate authentic document template can be challenging.

Clearly, there are numerous templates accessible online, but how can you locate the authentic document you require? Utilize the US Legal Forms website.

The service offers a vast array of templates, including the Montana Escrow Agreement for Residential Sale, which can be applied for both business and personal purposes.

You can preview the form using the Preview button and review the form details to confirm it meets your needs.

- All of the documents are reviewed by professionals and comply with state and federal regulations.

- If you are already registered, Log In to your account and click the Acquire button to access the Montana Escrow Agreement for Residential Sale.

- Use your account to browse the legal documents you have obtained previously.

- Navigate to the My documents section of your account to retrieve another copy of the document you require.

- If you are a new user of US Legal Forms, here are simple steps you can follow.

- First, ensure you have selected the correct form for your city/county.

Form popularity

FAQ

A valid escrow must have mutual consent between the parties, a specific designation of the assets held, and clear written instructions for the escrow agent. The Montana Escrow Agreement for Residential Sale typically addresses these criteria to prevent misunderstandings. When all conditions are met, the transaction proceeds smoothly, fostering trust and satisfaction among all involved.

The three requirements for a valid escrow include a clear agreement between parties, the possession of property or funds by the escrow agent, and a defined purpose for the escrow arrangement. Each of these elements is crucial in a Montana Escrow Agreement for Residential Sale to ensure both parties are protected throughout the process. Failing to meet these requirements could result in complications or disputes.

An escrow requirement is a condition that needs to be satisfied before funds or property can change hands in a real estate transaction. In Montana, this may involve a thorough inspection or the completion of repairs outlined in the Montana Escrow Agreement for Residential Sale. Meeting these requirements helps protect all parties, promoting a fair and secure transaction.

To create an escrow agreement, you must outline the transaction's specific terms in a written document. The Montana Escrow Agreement for Residential Sale typically involves both the buyer and seller, alongside a trusted escrow agent. Utilizing platforms like US Legal Forms can streamline the creation process, ensuring that all legal requirements are met efficiently.

Escrow includes the funds, documents, and instructions regarding the residential sale in Montana. First, the funds are deposited securely, preventing premature access until conditions are met. Secondly, all necessary documents, such as the property title and inspection reports, are placed in escrow as protection for buyers and sellers alike.

A standard escrow contract defines the terms and conditions under which assets are held by a third party during a residential sale in Montana. The Montana Escrow Agreement for Residential Sale specifies the obligations of all parties involved, ensuring a smooth transaction. This contract generally outlines when funds will be released and conditions that must be met before the closing can occur.

In your Montana Escrow Agreement for Residential Sale, ensure the agreement specifies the conditions under which funds will be released. Look for detailed information about how disputes will be handled, as this can prevent complications later on. It’s also beneficial to have an escrow agreement that includes a clear outline of fees and any other potential costs to avoid surprises.

An escrow account plays a crucial role in the Montana Escrow Agreement for Residential Sale. It holds funds securely while completing the property transaction, protecting both the buyer and seller. This account ensures that the buyer's deposit is safe until all conditions of the sale are met. By using an escrow account, you can have peace of mind knowing that the funds will only be released when the deal is completed successfully.

Typically, an escrow agreement is created by the real estate agents involved in the transaction or by an attorney. They draft the document to reflect the unique terms agreed upon by both the buyer and the seller. This process is essential to ensure that the Montana Escrow Agreement for Residential Sale meets legal standards and addresses the specific needs of both parties. To streamline this, uslegalforms offers templates that streamline the creation of escrow agreements.

Interesting Questions

More info

Available search Related Clauses Post Closing Date Closing Representations Warranties Multi User Features Governing Private Placement Closing Date Summary Closing Agreements Litigation Approval Representations Warranties Contract Type Your library Secure access storage.