This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Montana Agreement between Mortgage Brokers to Find Acceptable Lender for Client

Description

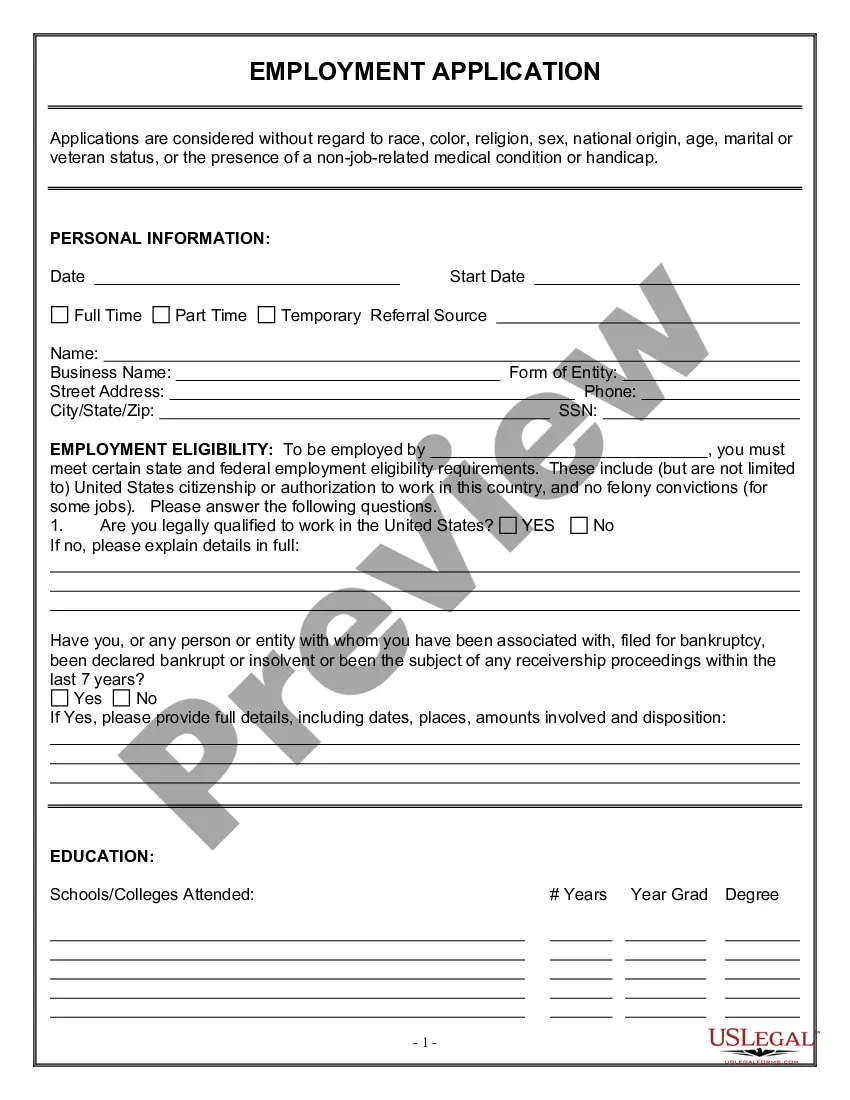

How to fill out Agreement Between Mortgage Brokers To Find Acceptable Lender For Client?

Choosing the right lawful papers web template could be a have difficulties. Naturally, there are plenty of layouts available online, but how will you get the lawful develop you will need? Make use of the US Legal Forms web site. The services gives 1000s of layouts, for example the Montana Agreement between Mortgage Brokers to Find Acceptable Lender for Client, which can be used for company and private requirements. All of the forms are examined by professionals and fulfill federal and state specifications.

Should you be previously registered, log in to your accounts and click on the Down load option to find the Montana Agreement between Mortgage Brokers to Find Acceptable Lender for Client. Make use of accounts to appear through the lawful forms you might have bought formerly. Go to the My Forms tab of your own accounts and acquire an additional version of the papers you will need.

Should you be a brand new end user of US Legal Forms, allow me to share straightforward directions so that you can stick to:

- Initial, ensure you have chosen the correct develop to your city/state. You can examine the shape while using Preview option and look at the shape description to ensure this is basically the best for you.

- When the develop is not going to fulfill your needs, use the Seach field to obtain the appropriate develop.

- When you are certain the shape is acceptable, select the Get now option to find the develop.

- Select the rates plan you want and enter the needed info. Create your accounts and pay for an order utilizing your PayPal accounts or credit card.

- Select the submit file format and download the lawful papers web template to your system.

- Comprehensive, change and print out and indication the attained Montana Agreement between Mortgage Brokers to Find Acceptable Lender for Client.

US Legal Forms will be the greatest library of lawful forms in which you can see a variety of papers layouts. Make use of the service to download skillfully-produced papers that stick to condition specifications.

Form popularity

FAQ

A lender is a financial institution that makes loans directly to you. A broker does not lend money. A broker finds a lender. A broker may work with many lenders.

Using a mortgage broker to take out a mortgage can be quicker and easier than comparing deals and applying for a mortgage directly with a mortgage lender. This is particularly true if your financial situation means you risk being turned down for a mortgage by certain lenders.

10 Lead Generation Strategies for Mortgage Brokers Network. Networking is an extremely important way of finding new leads. ... Buy leads. ... Utilise social media. ... Use MLS listings. ... Get published. ... Optimise your website. ... Ask for referrals. ... Create a Google my business page.

"A mortgage broker, essentially, is a conduit between the buyer and the bank. Instead of someone going straight to the bank to get a loan, they can go to a mortgage broker who will have access to a whole lot of different lenders - quite often a panel of up to 30 different lenders.

Using multiple brokers can be advantageous especially if you have already used a broker that isn't whole of market and they're struggling to provide you with a mortgage. But, in most cases it is best to vet your broker upfront and use a whole of market broker with an exemplary reputation.

You could switch brokers when you refinance, or even before your home loan application has been approved, though doing so could risk putting both the broker and yourself in a challenging situation, and setting you back a few steps on your home loan journey.

Can you have two mortgage brokers? Using multiple mortgage brokers can be possible, although it might not be a good idea, particularly if they're both submitting applications on your behalf.

A mortgage broker is a third party who will act on your behalf to arrange your home loan application. Instead of working directly with a bank or financial institution, a mortgage broker can work with various lenders to find the right home loan for you.

Conclusion. Using multiple brokers can be advantageous especially if you have already used a broker that isn't whole of market and they're struggling to provide you with a mortgage. But, in most cases it is best to vet your broker upfront and use a whole of market broker with an exemplary reputation.

?There will be a record of multiple credit inquiries if you do apply with multiple lenders, but there should be little to no impact on your credit score from those inquiries and it shouldn't discourage you from speaking with multiple lenders until you find the right fit,? Anastasio says.