When you cannot make your monthly credit card payment, the worst thing you can do is to simply let the bill go unpaid. Your creditor can charge you a late fee, raise your interest rate, and report the late payment to the credit bureaus. If you cannot pay the minimum, consider writing your credit card company and explaining your situation to them. Many creditors will extend your due date, waive the late fee, and continue reporting a "current" payment status to credit bureaus.

Montana Letter to Credit Card Company Seeking to Lower Payments Due to Financial Difficulties

Description

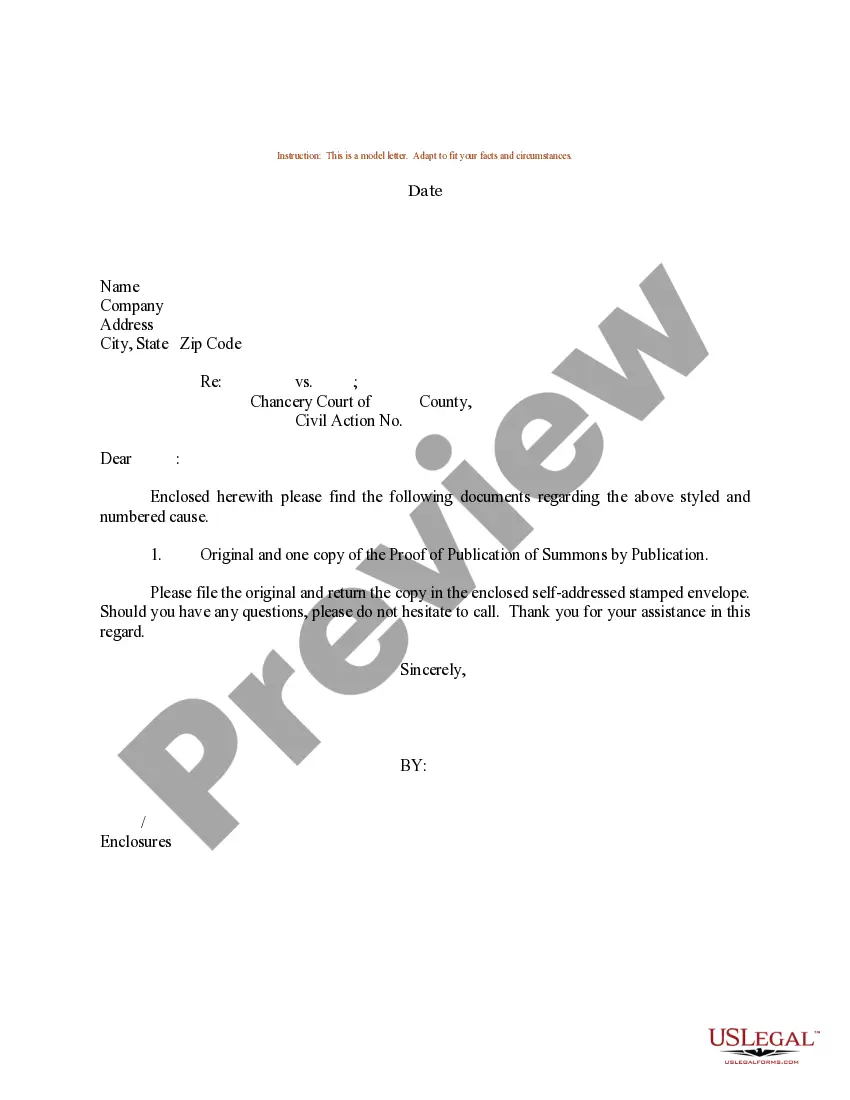

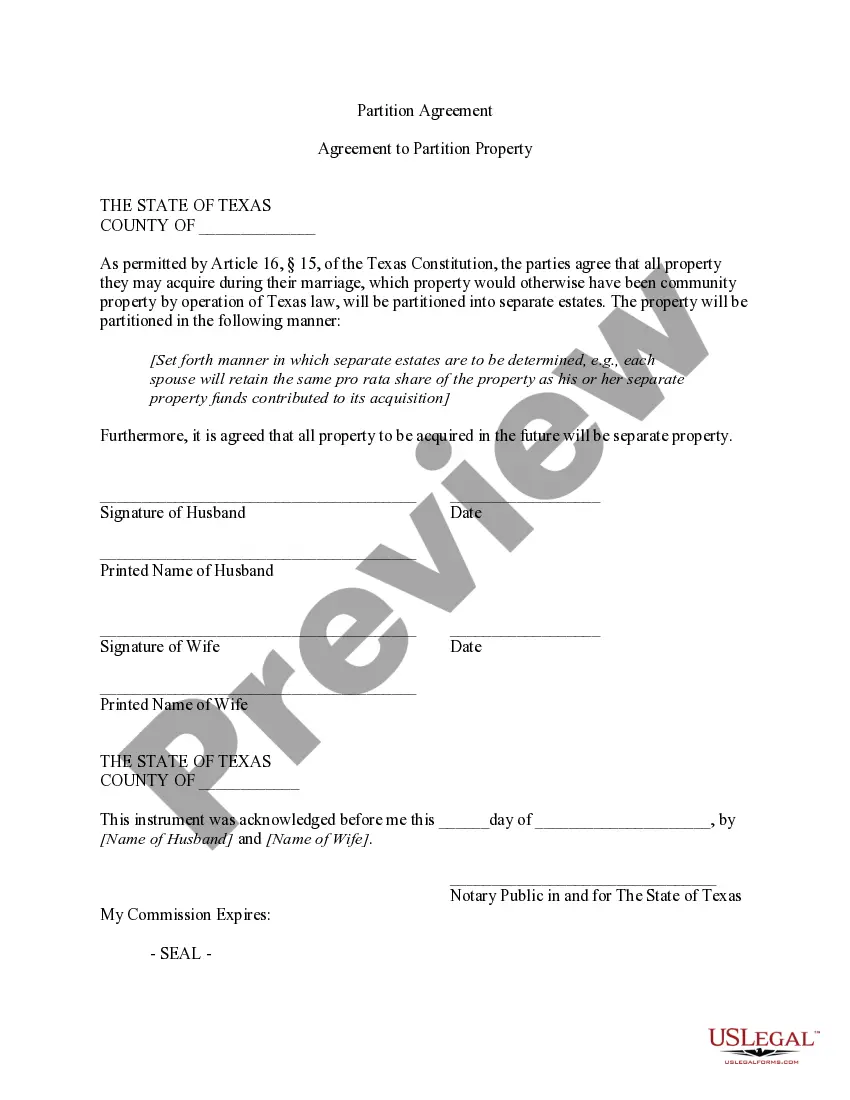

How to fill out Letter To Credit Card Company Seeking To Lower Payments Due To Financial Difficulties?

Are you currently in a situation where you require documents for occasional business or personal reasons each day? There are numerous legal document templates available online, but finding ones you can trust is not easy.

US Legal Forms offers a wide array of template forms, including the Montana Letter to Credit Card Company Requesting Reduced Payments Due to Financial Hardships, designed to comply with federal and state regulations.

If you are already familiar with the US Legal Forms website and have an account, simply Log In. After that, you can download the Montana Letter to Credit Card Company Requesting Reduced Payments Due to Financial Hardships template.

- Obtain the form you require and ensure it is appropriate for the correct city/state.

- Utilize the Review option to check the form.

- Read the description to ensure you have selected the correct form.

- If the form does not match your needs, use the Search field to find a form that fits your requirements and specifications.

- When you find the right form, click Purchase now.

- Select the pricing plan you prefer, fill in the necessary information to create your account, and complete your purchase using PayPal or a credit card.

- Choose a convenient document format and download your version.

Form popularity

FAQ

Negotiating lower payments with creditors involves communicating openly about your current financial situation. Begin by explaining your hardships and presenting evidence if necessary. Utilize templates, such as the Montana Letter to Credit Card Company Seeking to Lower Payments Due to Financial Difficulties, to structure your request effectively. Always be polite and patient, as this approach increases your chances of a favorable outcome.

Typically, credit card companies may settle debts for about 30% to 70% of the owed amount, depending on factors like your financial status and the age of the debt. Each case is unique, and creditors might be more open to negotiations if they see a genuine need for assistance. By using a Montana Letter to Credit Card Company Seeking to Lower Payments Due to Financial Difficulties, you express your willingness to engage and potentially expedite the negotiations. This approach increases your chances of achieving a favorable settlement.

Credit card companies often settle for percentages that vary based on individual circumstances and the creditor’s policies. On average, you might expect settlements to occur around 40% to 60% of the outstanding balance. Utilizing a Montana Letter to Credit Card Company Seeking to Lower Payments Due to Financial Difficulties can enhance your negotiation strategy and clarify your intentions to the creditor. This letter helps convey your situation while advocating for a fair settlement percentage.

Yes, you can request your credit card company to lower your payment. It is crucial to explain your current financial difficulties clearly in your letter. By presenting the Montana Letter to Credit Card Company Seeking to Lower Payments Due to Financial Difficulties, you can formally express your request and provide a structured rationale for your appeal.

To write a letter explaining your financial situation, start with a brief introduction about your current economic circumstances. Provide specific examples that illustrate your hardships, such as medical bills or changes in employment. Finish by clarifying your aims, whether it's to lower payments or renegotiate terms.

Writing a letter explaining financial hardship involves being honest and clear about your situation. Include relevant details about lost income or increased expenses that have made it hard for you to keep up with payments. The Montana Letter to Credit Card Company Seeking to Lower Payments Due to Financial Difficulties is a great format to use for crafting your explanation.

To craft a settlement letter, begin by stating your account information and the amount owed. Explain your financial difficulties and propose a specific settlement amount you can afford. It is essential to frame your settlement proposal as an opportunity for the credit card company to recover a portion of what you owe.

When writing a hardship letter to a credit card company, start with your personal information and account details. Clearly state your hardship, provide any relevant documents, and specify what assistance you seek, such as reduced payments. Make your letter respectful and straightforward to increase the chances of a positive response.

A financial hardship letter typically outlines your circumstances and requests assistance from your credit card company. For example, you might mention a sudden illness or job loss affecting your finances. By using the Montana Letter to Credit Card Company Seeking to Lower Payments Due to Financial Difficulties, you can tailor your request to effectively convey your situation.

To explain your financial hardship, begin by clearly describing your current financial challenges. Share specific details, such as job loss, reduced income, or unexpected expenses. It helps to mention how these factors impacted your ability to meet your credit card payments, emphasizing that you are committed to resolving the situation.