12 USC 2605(e) creates a duty of a loan servicer to respond to the inquiries of borrowers regarding loans covered by RESPA. If the borrower believes there is an error in the mortgage account, he or she can make a "qualified written request" to the loan servicer. The request must be in writing, identify the borrower by name and account, and include a statement of reasons why the borrower believes the account is in error. The request should include the words "qualified written request". It cannot be written on the payment coupon, but must be on a separate piece of paper. The Department of Housing and Urban Development provides a sample letter.

The servicer must acknowledge receipt of the request within 20 days. The servicer then has 60 days (from the request) to take action on the request. The servicer has to either provide a written notification that the error has been corrected, or provide a written explanation as to why the servicer believes the account is correct. Either way, the servicer has to provide the name and telephone number of a person with whom the borrower can discuss the matter.

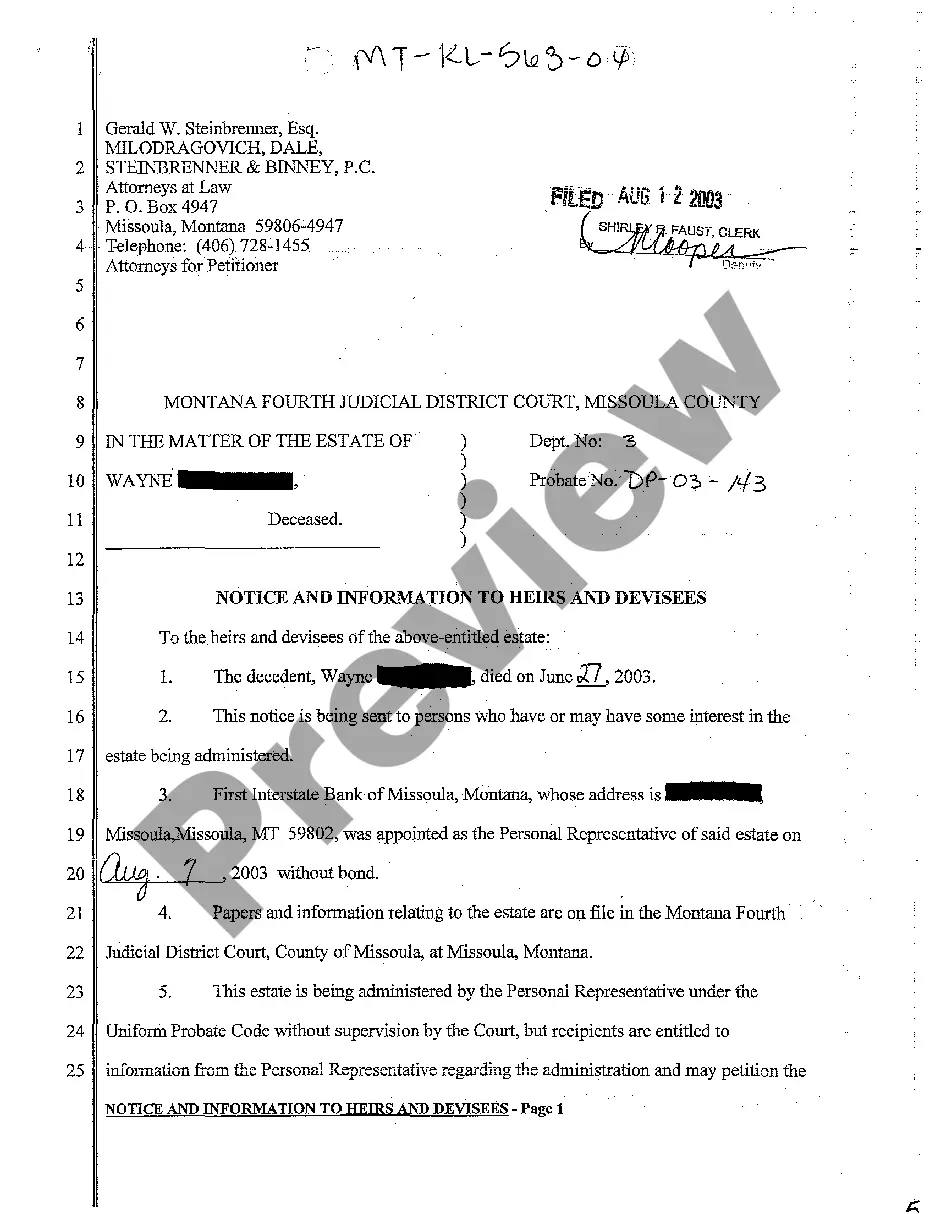

A Montana Qualified Written Request (BWR) is a formal letter sent to a mortgage service under Section 6 of the Real Estate Settlement Procedures Act (RESP). This request allows borrowers in Montana to obtain information about their mortgage loan and request a resolution for any errors or discrepancies they may have encountered. When drafting a Montana BWR, it is important to use relevant keywords to ensure effectiveness and accuracy. Here is a detailed description of what a Montana BWR entails and the different types associated with this regulatory provision: The Montana Qualified Written Request under Section 6 of RESP serves as a powerful tool for homeowners seeking clarity and resolution regarding their mortgage loans and the actions of their mortgage services. It enables borrowers to address concerns or disputes related to loan payments, escrow accounts, insurance coverage, or any other aspect of their mortgage service's practices. A Montana BWR must be submitted in writing, signed by the borrower, and address the specific issues or information requested. It should include the borrower's name, loan number, and property address. The letter should clearly state that it is a Qualified Written Request under Section 6 of RESP. By using this specific language, borrowers gain the legal protections and entitlements provided under this section of the law. The primary purpose of a Montana BWR is to request detailed information about the mortgage loan and its servicing history. This may include documentation on the loan's origination, any subsequent transfers or assignments, payment history, fees charged, and any applicable escrow account details. By obtaining this information, borrowers can assess the accuracy and legitimacy of their loan transactions. Furthermore, a Montana BWR can be utilized to highlight any errors or discrepancies identified during the examination of the loan documents. Borrowers may dispute inaccurate charges, unauthorized fees, or improper calculation of loan payments. This letter prompts the mortgage service to investigate the claims raised and provide a timely resolution. Although there are no specific types of Montana Was under Section 6 of RESP, the content and nature of the requests may vary based on the borrower's unique circumstances. Some common variations may involve requesting copies of all loan documents, including the promissory note and mortgage, seeking clarification on fee assessments, disputing force-placed insurance charges, or requesting loan modification options. In conclusion, a Montana Qualified Written Request under Section 6 of RESP empowers borrowers to address concerns, seek resolution, and obtain information about their mortgage loans. By using keywords that reflect the purpose and scope of this letter, borrowers can effectively communicate their requirements to mortgage services and assert their rights under the law.

A Montana Qualified Written Request (BWR) is a formal letter sent to a mortgage service under Section 6 of the Real Estate Settlement Procedures Act (RESP). This request allows borrowers in Montana to obtain information about their mortgage loan and request a resolution for any errors or discrepancies they may have encountered. When drafting a Montana BWR, it is important to use relevant keywords to ensure effectiveness and accuracy. Here is a detailed description of what a Montana BWR entails and the different types associated with this regulatory provision: The Montana Qualified Written Request under Section 6 of RESP serves as a powerful tool for homeowners seeking clarity and resolution regarding their mortgage loans and the actions of their mortgage services. It enables borrowers to address concerns or disputes related to loan payments, escrow accounts, insurance coverage, or any other aspect of their mortgage service's practices. A Montana BWR must be submitted in writing, signed by the borrower, and address the specific issues or information requested. It should include the borrower's name, loan number, and property address. The letter should clearly state that it is a Qualified Written Request under Section 6 of RESP. By using this specific language, borrowers gain the legal protections and entitlements provided under this section of the law. The primary purpose of a Montana BWR is to request detailed information about the mortgage loan and its servicing history. This may include documentation on the loan's origination, any subsequent transfers or assignments, payment history, fees charged, and any applicable escrow account details. By obtaining this information, borrowers can assess the accuracy and legitimacy of their loan transactions. Furthermore, a Montana BWR can be utilized to highlight any errors or discrepancies identified during the examination of the loan documents. Borrowers may dispute inaccurate charges, unauthorized fees, or improper calculation of loan payments. This letter prompts the mortgage service to investigate the claims raised and provide a timely resolution. Although there are no specific types of Montana Was under Section 6 of RESP, the content and nature of the requests may vary based on the borrower's unique circumstances. Some common variations may involve requesting copies of all loan documents, including the promissory note and mortgage, seeking clarification on fee assessments, disputing force-placed insurance charges, or requesting loan modification options. In conclusion, a Montana Qualified Written Request under Section 6 of RESP empowers borrowers to address concerns, seek resolution, and obtain information about their mortgage loans. By using keywords that reflect the purpose and scope of this letter, borrowers can effectively communicate their requirements to mortgage services and assert their rights under the law.