Subject: Montana Free Port Tax Exemption Sample Letter: An Overview of the Available Types Dear [Recipient's Name], I hope this letter finds you in good health. I am reaching out to you today to provide a detailed description of what a Montana Free Port Tax Exemption entails. This exemption plays a significant role in promoting economic growth, international trade, and enhancing Montana's position as a thriving business hub. In this letter, I will outline the various types of Montana Sample Letters concerning Free Port Tax Exemption that are commonly used. 1. Montana Free Port Tax Exemption for Goods in Transit: One of the primary initiatives driven by the state is the Free Port Tax Exemption for goods in transit. This exemption aims to encourage businesses to utilize Montana as a strategic location for global trade and distribution activities. It allows businesses to store, process, and carry out intermediate manufacturing operations on goods within the state, without being subject to property taxes. 2. Montana Free Port Tax Exemption on Inventory Held for Resale: Another key type of Montana Free Port Tax Exemption is applied to inventory held for resale. This exemption benefits businesses by eliminating property taxes on goods and merchandise held within Montana solely for the purpose of resale. This tax incentive encourages businesses to maintain larger inventories within the state, facilitating more efficient distribution and availability of products. 3. Montana Free Port Tax Exemption for Qualified High-Tech Businesses: Montana recognizes the importance of fostering growth in the high-tech industry sector. Qualified High-Tech Businesses can benefit from a specific type of Free Port Tax Exemption that encompasses exemptions on property taxes related to high-tech equipment, machinery, and infrastructure. By providing this tax relief, Montana aims to attract and retain technology-driven companies. 4. Montana Free Port Tax Exemption for Renewable Energy Equipment: To promote the expansion of renewable energy sources, Montana offers a Free Port Tax Exemption on the equipment and infrastructure utilized in renewable energy projects. This exemption encourages investment in clean energy technologies, such as solar, wind, and biofuels. It covers property taxes related to renewable energy equipment, making the state an attractive destination for renewable energy businesses. These are the key types of Montana Sample Letters concerning Free Port Tax Exemption. However, it is important to note that each specific exemption might have unique requirements and qualifications. It is advisable for interested parties to consult with the Montana Department of Revenue or a tax professional to understand the eligibility criteria for each exemption and the process involved in seeking tax relief. By availing the various Free Port Tax Exemptions, businesses can enjoy substantial cost savings, enhanced global trade opportunities, and contribute to Montana's economic development. Please feel free to reach out for any further clarification or assistance in exploring these exemptions. Thank you for your attention to this matter. Sincerely, [Your Name] [Your Title/Position] [Company/Organization Name]

Montana Sample Letter concerning Free Port Tax Exemption

Description

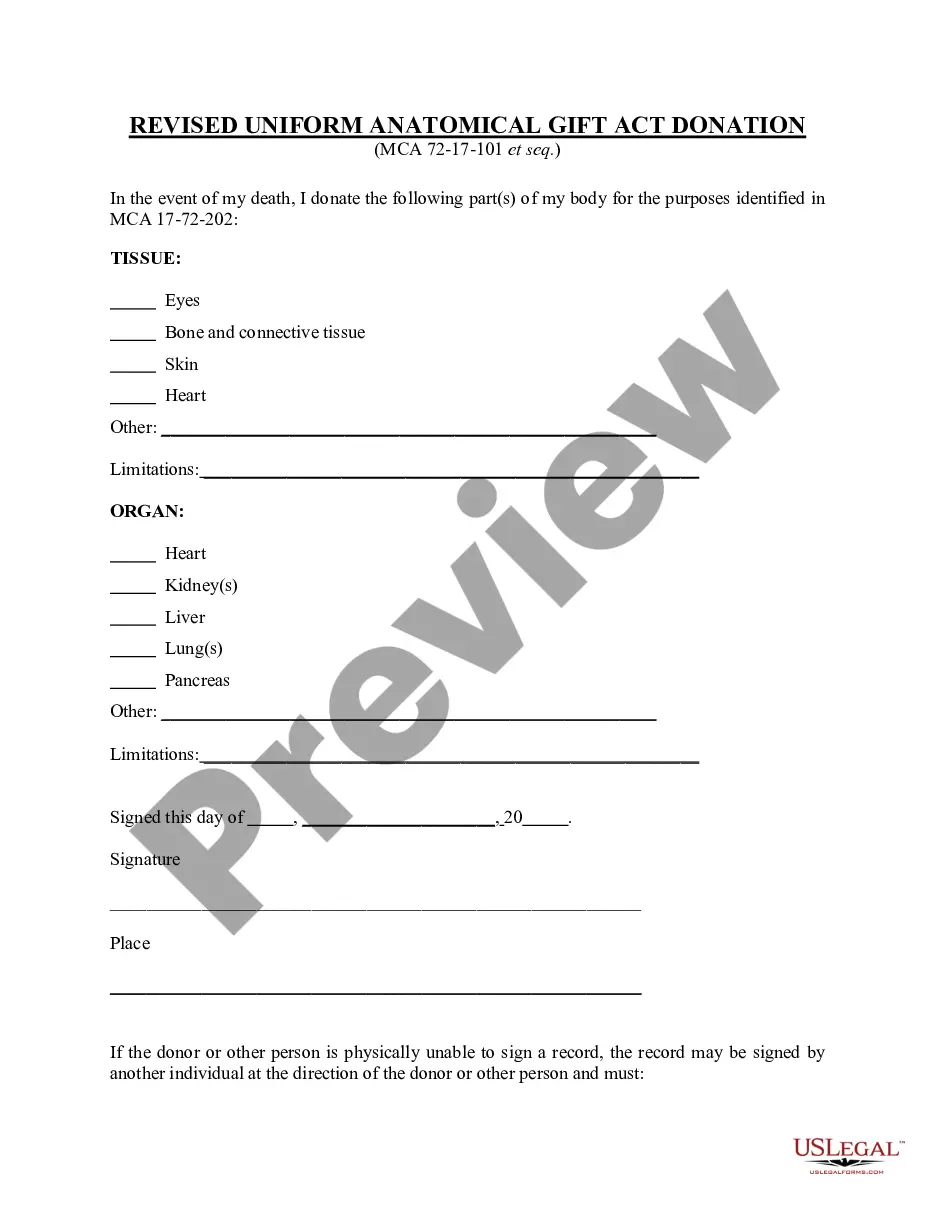

How to fill out Montana Sample Letter Concerning Free Port Tax Exemption?

You can commit hours on-line attempting to find the authorized papers template that fits the federal and state requirements you require. US Legal Forms gives thousands of authorized types that happen to be reviewed by specialists. It is simple to down load or print out the Montana Sample Letter concerning Free Port Tax Exemption from our services.

If you have a US Legal Forms profile, it is possible to log in and click on the Acquire switch. Following that, it is possible to complete, revise, print out, or indication the Montana Sample Letter concerning Free Port Tax Exemption. Each authorized papers template you acquire is your own property eternally. To have an additional copy of any purchased form, proceed to the My Forms tab and click on the corresponding switch.

If you work with the US Legal Forms website for the first time, keep to the easy instructions below:

- Initial, be sure that you have chosen the right papers template to the county/metropolis that you pick. Look at the form description to ensure you have chosen the appropriate form. If readily available, make use of the Preview switch to look through the papers template too.

- If you wish to discover an additional version of your form, make use of the Lookup area to discover the template that fits your needs and requirements.

- After you have identified the template you desire, click Purchase now to carry on.

- Choose the rates prepare you desire, type your credentials, and register for an account on US Legal Forms.

- Total the purchase. You can utilize your Visa or Mastercard or PayPal profile to pay for the authorized form.

- Choose the formatting of your papers and down load it in your system.

- Make modifications in your papers if necessary. You can complete, revise and indication and print out Montana Sample Letter concerning Free Port Tax Exemption.

Acquire and print out thousands of papers themes making use of the US Legal Forms website, which offers the largest assortment of authorized types. Use skilled and condition-specific themes to deal with your small business or person requirements.